``There is a tendency for things to right themselves." - Ralph Waldo Emerson

Similar to the previous weeks, Philippine assets have been on a roll!

Local sovereign bonds continued with its upward march, which brought down yields, as the Bangko Sentral ng Pilipinas (BSP) restructured its lending rates, notes Clarissa Batino of Bloomberg, ``The central bank yesterday introduced three rate levels for bank deposits, maintaining a 7.5 percent payment on amounts of up to 5 billion pesos. Interest on deposits of up to 10 billion pesos was cut to 5.5 percent, while sums in excess of 10 billion pesos will get a 3.5 percent rate.”

In the meantime, the Phisix was equally in a bedazzling motion to post another exceptional week up 2.39%. However, despite its outstanding performance, the Phisix landed only fourth in the region, following the phenomenal advances of China’s Shanghai composite (+3.27%), Indonesia’s JKSE (+2.55%) and Hong Kong’s Hang Seng (+2.47%).

And in contrast to country-specific vainglories attributed by our local “experts”, our position has been that these unfolding developments has been a global phenomenon with the Philippines benefiting from the flux of excessive creation and intermediation of money and credit on an international scale, as shown in Figure1.

Figure 1: stockcharts.com: Dow Jones Asia Ex-Japan (candle), and Dow Jones World (black line)

Like our Phisix, global markets have been on a tear. Albeit, the Dow Jones World Index appears to phase in an incipient correction mode as US markets take a breather. Notice too that like our Phisix, at the lower pane, technical indicators as the Relative Strength Index (RSI) have been drifting in the highly overbought zone.

Of course, we do not discount local developments as possible variables that could HELP influence present market psychology or sentiment, as the recent upgrade of the international rating agency, Moody’s Investors Services, on our credit rating outlook. Although, my view that is that the Moody’s upgrade has been simply a consequence to the gains of Philippine assets or that they have positively reacted to the snowballing trend of portfolio money flooding into Philippine and emerging market assets, which prompted such upgrade. Just consider, over the past three weeks, the Phisix recorded an accrued gain of 8.2%, which means even without the latest Moody’s edict issued last Thursday, the Phisix has been on a winning streak.

Naturally, the tidal wave of foreign money flows into Philippine assets reflects on our local currency, the Peso (up 6.4% year-to-date), as shown in Figure 2.

Figure 2: Rising Peso Correlates to an Ascending Phisix

In the previous rising stockmarket cycle during 1986-1997, I do not recall (sorry, no data on this, although I’ll try to work this one out with the BSP/PSE) the Peso as having been a significant factor in buttressing its past ascent. This makes the recent developments of rising currencies in the region a structural factor which should further boost the region’s financial markets over the LONG RUN. According to Denise Kee and Wes Goodman of Bloomberg (emphasis mine), ``The Asian bond market outside Japan will grow 10 percent to 15 percent a year to $10 trillion by 2015, said Heng Swee Keat, managing director of the Monetary Authority of Singapore. The market has grown to $2.7 trillion this year, making up 45 percent of Asia’s gross domestic product excluding Japan…That’s up from $600 billion in 1997, when the bond market made up 20 percent of GDP, he said.” If such projection materializes for the bond markets you can likewise expect the region’s stockmarket to likewise flourish. Since markets are mainly about expectations, I’d like to reemphasize the phrase, OVER THE LONG RUN, as to clear myself.

Over the short-term, I have made my case on the Phisix last week, having said that the GIST of the GAINS have had already been made, or to put bluntly, the Phisix nears its interim zenith. Yes, all these DEPEND on the external activities or conditions thereof which are centered mainly in the US.

I do not dispute that the Philippine benchmark may be headed for 3,000, if the momentum continues, despite its strenuously overbought conditions. Because markets are mainly psychological based, emotional rapt may bring market levels to the extremes, which may be described as parabolic movements. There could be short-term pullbacks though, as we have seen in the Dow Jones World Index led by the US over the week, which could also inspire a related retreat in the domestic arena, but what concerns your analyst is the major one, one that could see the Phisix drop by as much as 10-15% as discussed last week.

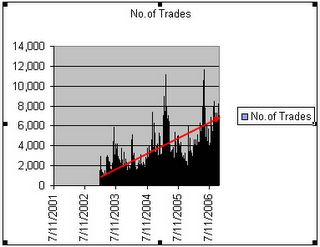

Figure 3: Number of Trades per Day

For the moment, we can expect the Phisix even amidst any minor correction to be engaged in sector rotational plays. While the locals have been as bullish as overseas investors, as measured in the number of trades, we have yet to attain the height of overconfidence similar to early May of this year, where the number of trades hit 9,000 to 11,000 per day, as shown in Figure 3 to signify a TOP! The momentum appears to be building for another spike ~of investor overconfidence (see red arrow and take note of the twin spikes).

And to remind you that markets operate under mean reverting tendencies, such that any further outperformance by the PHISIX, which is up 32% year-to-date on its 4th year of consecutive advances, enlarges our risk factor of having a negative annual return for the Phisix in either 2007/2008.

On the other hand, a bullish trend of the local currency or peso may yet underpin the persistent vim in the Phisix if one would consider the outlook of Morgan Stanley’s chief currency analyst Stephen Jen (emphasis mine), ``In recent weeks the CNY (China’s Yuan), the SGD (Singapore Dollar), the THB (Thai Baht), the KRW (Korean Won) and the INR have outperformed the IDR (Indonesia’s Rupiah), the MYR (Malaysian Ringgit), the PHP and the TWD (Taiwan Dollar). I expect the latter four to gradually catch up: There is no reason why the still high-yielding IDR should not benefit from the normalizing risk pattern, and the MYR should rise with the SGD.” What Mr. Jen suggests as driver to the prospects of the firming four currencies is of the underlying currency’s yield premium/spread, or interest rates on the respective local currencies relative to the US Dollar or to the other ascribed pairs.

Of course, Mr. Jen’s forecast are predicated on the following conditions: US having a soft-landing, ``benign rotation of growth away from the US to the rest of the world” or essentially a decoupling, continued net equity inflows to the region, USD/CNY steady but orderly decline, continued retention of the Hong Kong Dollar’s peg and lastly, due to saturated levels of US dollar reserves, Asia ex-Japan Central Bank’s lesser degree of intervention.

While I am acquiescent with most of the conditions, the US soft-landing side is a continuing concern where because of the past occurrences, probabilities makes a soft landing a very unlikely scenario, in my view, in contrast to the consensus. In the invaluable words of Bond Guru Pimco’s William Gross (emphasis mine), ``Financial innovation, central bank transparency, and even globalization’s great moderation of economic volatility are powerful arguments suggesting the old days of copious Alpha and Beta are over because 5% GDP growth and compressed risk spreads are not likely to permanently return to historic levels. Yet we have a collective sense that risk spreads will not remain so low over the next 12-24 months, and that instability – whether it be sparked by U.S. housing, global overinvestment, or geopolitical events – will one day temporarily resurface.” Mr. Gross’ 12-24 months probability of a volatility spike resonates with my risk factor of a negative annual return for the Phisix in 2007/2008.

Figure 4: Chartoftheday.com: Breakdown by US Single-Family Home Prices

As we have previously noted, loose money and credit conditions still overwhelm any weaknesses seen in the US real estate sector that has prompted significant “rotational” activities such as a boom in US equities, corporate M&As, commercial real estate, etc. The full impact of an economic slowdown brought about by the retreat of the US real estate industry, which is already in a recession, has yet to be felt (with the consensus largely dismissing the prospects of a recession). Figure 4, courtesy of chartoftheday.com shows of the breakdown of the US Single-home prices.

Figure 5: stockcharts.com: Bottoming out of Treasury yields?

Yet, if expectations for a continued loose credit and money conditions or Fed rate cuts have been the impetus for the recent explosion in equities, then Friday’s activities in the bond markets as signified by 10 US Treasury year yields could possibly be ominous or the proverbial “taking away of the party’s punchbowl” as shown in Figure 5, where US T-yields (red candle) have declined (red arrow) in conjunction with the a Dow Jones Industrial Averages (black line; blue arrow). The yield spike was mainly a reaction to the declining unemployment rate.

While of course, we know that one day does not a trend make, what is notable in the chart is that the benchmark yields appears to form a double bottom pattern which could mark an important inflection point, if the succeeding price actions will affirm such behavior.

Notice too that the recent bottom has also coincided with the peak in the main Dow Jones equities bellwether.

This leads us to assess and/or project that a breakout of the Treasury yield at 48.5 (resistance level) would imply a confirmed reversal of the bond rally, heightened inflation expectations, an increased possibility of the US Federal Reserve to take additional action or increase its short-term rates and increased pressure on equities. Until then, I think, the Dow’s recent decline has been mainly due to technical factors.

No comments:

Post a Comment