News reports say that Federal Reserve Chairman Ben Bernanke is considering the next round of quantitative easing.

From the Bloomberg,

Federal Reserve Chairman Ben S. Bernanke said the economy is barely expanding at a sustainable pace and that it’s possible the Fed may expand bond purchases beyond the $600 billion announced last month to spur growth.

This is really no news for us.

Nevertheless the following looks like the kicker…

From the same article, (bold emphasis mine)

The Fed’s policy of purchasing Treasury securities shouldn’t be considered simply printing money, Bernanke said.

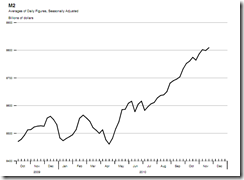

“The amount of currency in circulation is not changing,” he said. “The money supply is not changing in any significant way. What we’re doing is lowering interest rates by buying Treasury securities.”

Given the above graphs, the question that intuitively pops into my mind is how does Mr. Bernanke quantify change?

Like this?

That’s “change” in terms of the exponential growth in currency during the Germany’s Weimar Hyperinflation (chart from nowandfutures.com).

For bureaucrats, change seems like an abstraction. (this applies to politicians as well).

1 comment:

One thing is clear.. you can never talk a cult follower out of the cult! all you can do is get the he\\ out of they way of their actions....And in the case of the FED and criminal government that serves them is destroy it....It cant be saved its far too diseased. it must be cut out! We want to run this world with some humanity and truth?

Post a Comment