It was a seesaw week for the Phisix. The local benchmark fumbled at the start but rallied strongly to close marginally lower (.25%). Year to date the Phisix remains on a positive ground up 1.75%.

The pressure encountered by the Philippine market appears to have been mainly influenced by the activities in the global equity markets where, except for Latin America, most of the major world indices posted losses for the week.

Though the markets have been biased towards the profit takers, the balance has not been lopsided.

Market breadth as shown by the advance decline spread reveals of a consolidation phase.

This means that the market sentiment, while slightly tilted towards decliners, has been mostly mixed.

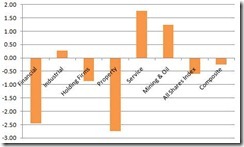

The varied performances can even be seen from the sectoral performance perspective which continues to manifest signs of rotation.

Except for the mines which have been on ablaze for the NINETH consecutive week, the only sector that outclassed the mines had been the service industry, led by PLDT and Globe Telecoms.

Meanwhile the industrial sector piggybacked on the advances of URC and Meralco to squeeze out marginal gains.

On the other hand, the property, financial (last week’s outperformer) and holding firms accounted for most of the losses.

The mixed market performance also indicates that the balance of prices, in terms technicals (particularly overbought or oversold conditions) as a function of profit-taking activities, appear as being resolved on a specific issue basis that are likewise being reflected on the sectoral indices.

The Phisix appears to be waiting for a second wind or the right moment to flex her muscles.

Finally the actions in the oil sector appears to validate my projections.

No comments:

Post a Comment