If major ASEAN markets have been resilient (except for the past 2 days). Vietnam’s benchmark has been cratering.

Chart from Bloomberg

The Financial Times Blog notes

Stock markets rarely move in straight lines but nervous Vietnamese investors have done their best to buck that trend of late, with shares falling for nine sessions in a row amid worries about the economic outlook.

The benchmark VN Index closed down 3.6 per cent at 402.59 points on Tuesday.

Shares on the 11-year-old Ho Chi Minh Stock Exchange have now lost 16.7 per cent since May 11, as falls have precipitated a series of margin calls

Traders said investors were worried about inflation, which accelerated to 19.8 per cent year-on-year in May according to figures released on Tuesday, and the possible impact on businesses of high interest rates, part of the government’s plan to stabilise the fast-growing but shaky Vietnamese economy.

While media says that the likely cause has been about inflation, I think it is the opposite: a prospective tightening.

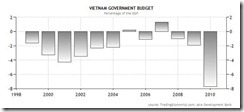

Given the way Vietnam’s government has been overspending…

Ballooning Budget deficit

surging Money supply

One can see why inflation has been surging.

Charts above from tradingeconomics.com (money supply, budget deficit and inflation)

And because the Vietnamese government wants to slough inflation, it has been raising rates and putting credit growth caps on the banking system especially on foreign banks.

From the Bloomberg,

The State Bank of Vietnam on May 17 boosted the repurchase rate to 15 percent from 14 percent, the second increase this month and its sixth this year to curb inflation, which is at 28- month high. The central bank has more than doubled the rate since early November as a widening trade deficit forced four currency devaluations in 15 months and threatened growth.

As a side note: The link between the Vietnam’s interest rates and currency devaluations isn’t from likely from trade deficits, but from government spending and expansionary credit.

And the ceiling on Vietnam’s government credit growth.

Reports the thanhniennews.com

The State Bank of Vietnam has banned foreign bank branches from setting credit growth targets of higher than 20 percent, persisting with a tight monetary policy to fight inflation.

According to a statement dated Friday, the central bank said most foreign branches in Vietnam have planned to keep credit growth below 20 percent and tried to cut back on lending to non-production sector. Some banks, however, have not moved to reduce their lending operations.

As a result, the central bank has ordered all foreign bank branches to control their lending, especially for real estate and stock market transactions. “The State Bank of Vietnam will not accept any plans by foreign financial institutions and bank branches to have credit expand by more than 20 percent this year,” the statement said.

Vietnam’s dramatic flattening of the yield curve doesn’t seem to manifest concerns of inflation (asianbondsonline.org), instead the yield curve could be signaling a slowdown in economic growth as consequence to policy based tightening.

Bottom line: stock markets are remarkably sensitive to the inflationary dynamics more than the conventional notion of ‘micro fundamentals’.

No comments:

Post a Comment