Today, BoE governor Mark Carney warns of UK’s housing market approaching “warp speed”.

From the Bloomberg: (bold mine)

Bank of England Governor Mark Carney may be struggling to prevent Britain’s housing market from reaching what he calls “warp speed.”

About two-thirds of 27 economists in a Bloomberg News survey said property in the U.K. is at risk of overheating. The survey, published today, also showed that the outlook for the economy has improved, with forecasts for growth this quarter raised to 0.7 percent from 0.6 percent last month.

Carney has already taken a first tilt at the market, ending some incentives on mortgage lending in a program the central bank started last year to boost credit. House prices rose to a record in November, Acadametrics said today, while home-loan approvals and sales are increasing, bolstered by a strengthening economy, government incentives and record-low interest rates…

Carney has justified his decision to revamp the Funding for Lending Scheme by saying that taking small steps now will curtail the need for bigger measures later on.

“There’s a history of things shifting in the U.K. and the housing market moving from stall speed to warp speed and underwriting standards slipping,” he said in New York on Dec. 9. Developments “merit vigilance but not panic,” he said.

Acadametrics and LSL Property Services said today house prices rose 0.6 percent last month as transactions exceeded 77,000, the most for a November since 2007.

U.K. house prices rose to a record in November as strengthening demand pushed values higher in all regions of England and Wales, Acadametrics said.

Values increased 0.6 percent from October to an average 238,839 pounds ($390,900), the real-estate researcher and LSL Property Services Plc (LSL) said in a report today. Prices reached an all-time high in London and parts of the southeast as average values climbed 4.9 percent from a year ago. In London, prices surged an annual 9.2 percent in the quarter through November.

The source of funding for UK’s corporate sector comes mainly from bond issuance and banking loans…

The above distribution closely resembles bank loan distribution in the Philippines.

Meanwhile residential mortgages have likewise turned around…

…as consumers go on a borrowing spree.

And its not just in housing.

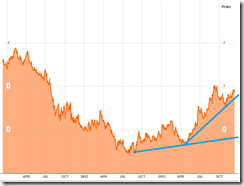

…this coincided with the bullmarket in UK’s equity bellwether, the FTSE 100.

What would likely put a halt on a housing and stock market approaching “warp speed”? Again aside from bubbles collapsing from its own weight, the likely answer will be higher interest rates.

Yields of UK’s 10 year sovereign bonds appear to have gotten a ‘second wind’ and seems headed higher.

Again the bond vigilantes lurks behind the shadows and remains a key threat to ubiquitous bubbles in the global financial markets, including those in the UK.