Back to the debt ceiling bill, foreigners as the BRICs represent as pivotal forces, whom could function as bond vigilantes (bond market investors who protests monetary or fiscal policies they consider inflationary by selling bonds, thus increasing yields) and who could substantially sway US sovereign bond prices or the direction of interest rates.

Some of these significant bond holders have reportedly criticized the debt bill.

From Bloomberg,

China, the largest foreign investor in U.S. government securities, joined Russia in criticizing American policy makers for failing to ensure borrowing is reined in after a stopgap deal to raise the nation’s debt limit.

People’s Bank of China Governor Zhou Xiaochuan said China’s central bank will monitor U.S. efforts to tackle its debt, and state-run Xinhua News Agency blasted what it called the “madcap” brinksmanship of American lawmakers. Russian Prime Minister Vladimir Putin said two days ago that the U.S. is in a way “leeching on the world economy.”

The comments reflect concern that the U.S. may lose its AAA sovereign rating after President Barack Obama and Congress put off decisions on spending cuts and tax increases to assure enactment of a boost in borrowing authority. China and Russia, holding a total $1.28 trillion of Treasuries, have lost nothing so far in the wake of a rally in the securities this year.

“It’s probably frustration more than anything else for China,” said Brian Jackson, a senior strategist at Royal Bank of Canada in Hong Kong. While the nation has concerns, “they realize there’s not a lot of options for them out there and so they need to keep buying Treasuries.”

China held $1.16 trillion of Treasuries as of May, U.S. Treasury Department data show. The nation has accumulated the holdings as a by-product of holding down the value of its currency, a policy U.S. officials have said gives China an unfair advantage in trade.

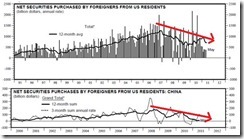

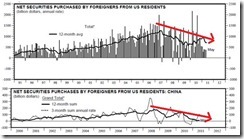

Apparently these have not just been political talk but appear to have been accompanied by action

Charts from yardeni.com

Foreign appetite for US bonds has been on a decline, with China accounting for the gist.

As earlier discussed, the local savers through private banks have been shackled by various regulations particularly the Basel Accords, which compels the banking industry to divert these savings to finance government expenditures. This has been called as Financial Repression by some experts. Once the bond market unravels, many of the private sector money tied due to such regulations will get burned.

Yet with the debt ceiling bill currently lifted to $16.5 trillion, and where the US Federal Reserve has taken over the bulk of the financing of the ballooning US deficits via the QE 2.0 from declining interests from foreigners, the $64 gazillion question is ‘will the US government allow interest rates to go up which increases the risks of popping the banking system’s ultra fragile balance sheets?’

Graphic above from PIMCO’s Bill Gross

I don’t think so.

And it has been part of the central banking dogma or quasi operating manual to inflate the system when some form of distress emerges.

This can be exemplified by the actions of the SNB on the Swiss Franc and the BoJ on the Yen during the past 24 hours. And that’s why, given the mounting risks of a bond auction failure, sluggish asset markets and the desire to keep interest rates at current levels or ‘Zero bound’, we should expect the next round of asset purchases by the US Fed to happen soon.

And this is also why fissures on the US dollar system continue to widen.

From another Bloomberg article

The committee of bond dealers and investors that advises the U.S. Treasury said the dollar’s status as the world’s reserve currency “appears to be slipping” in quarterly feedback presented to the government.

The Treasury Borrowing Advisory Committee, which includes representatives from firms ranging from Goldman Sachs Group Inc. to Pacific Investment Management Co., said the outperformance of haven currencies and those from emerging nations has aided in the debasement of the dollar’s reserve status, according to comments included in discussion charts presented ahead of the quarterly refunding. The Treasury published the documents today.

“The idea of a reserve currency is that it is built on strength, not typically that it is ‘best among poor choices’,” page 35 of the presentation made by one committee member said. “The fact that there are not currently viable alternatives to the U.S. dollar is a hollow victory and perhaps portends a deteriorating fate.”

What is unsustainable won’t last. The bond vigilantes are lurking around the corner and substantially higher interest rates will be the future. That’s what record gold prices have been admonishing us.

For now, profit from political folly.

(hat tip Dr. Antony Mueller)