Over time, markets will do extraordinary, even bizarre, things. A single, big mistake could wipe out a long string of successes. We therefore need someone genetically programmed to recognize and avoid serious risks, including those never before encountered. Certain perils that lurk in investment strategies cannot be spotted by use of the models commonly employed today by financial institutions. Warren Buffett- 2006 Letter to Shareholders.

In this issue:

Phisix: Will the Global Black Swan Be Triggered by Economic Sanctions?

-OFWs in Libya Exposes on the Quality of the so-called Economic Boom

-The Toxicity of Overconfidence

-Another BSP Communications ‘Bait and Switch’?

-Credit Expansion as the Source of Inflation

-Stagflation Prediction Partly Met, IMF’s Straddle the Fence and the Peso Disconnect

-The BIR Assails Domestic Financial Community

-Global Black Swan: Nuclear War or Economic Sanctions or Both?

Phisix: Will the Global Black Swan Be Triggered by Economic Sanctions?

OFWs in Libya Exposes on the Quality of the so-called Economic Boom

OFWs caught in the crossfire in war ravaged Libya caught national attention to hug the headlines during the week. Unknown to most, the news carried with it an incisive latent perspective about the state of the Philippine economy.

The Philippine government ordered a mandatory evacuation of OFWs in Libya. Surprisingly to populist politics, only a few of the OFWs submitted to the government edict.

This striking commentary from a Philippine authority on the sentiment of Libyan based OFWs[1]: (bold mine)

Despite the danger, many Filipinos in Libya have ignored the government’s order for mandatory evacuation, DFA spokesman Charles Jose told reporters on Monday.

“The usual reason we hear from them is that they would rather take the chance. They think they have greater chances of surviving the war [there] than of surviving uncertainty [without jobs] here,” Jose said.

Why striking? Because the OFWs are simply saying that they have little or no choice but to keep their livelihood or suffer in hunger if they return home. This reverberates, if not reinforces, with self-rated poverty surveys where the average resident presently has considered themselves as becoming “poorer”. Such sentiment seems to signify grassroots account of real economic conditions.

Yet look at the difference between what OFWs and self-rated poverty surveys reveal compared to what experts, politicians and media say.

One example is from the IMF’s recent assessment of the Philippines (bold mine)[2]: Strong GDP growth in recent years has translated into improved social conditions. Growth has become less employment intensive, but still reduced the elevated under- and unemployment rates. Poverty incidence, although declining, remains high, and a large share of the population remains vulnerable to falling into poverty as a result of natural disasters and other shocks

As a side note, despite their army of experts, the IMF has a pathetic track record in forecasting, not only have they botched on their predictions on Greece, lately they even gave Bulgarian banking system a clean bill of health two weeks before two massive bank runs[3] that forced the EU to a rescue. I wouldn’t put my money on what the IMF says.

So why has the choice of OFWs been reduced to either “surviving the war” or “surviving uncertainty”, if indeed social conditions have improved from the 7% statistical GDP in 2013?

Have OFWs not heard of the magical “boom” here, which ironically has been well advertised both domestically and internationally? Why the ocean of variance in the sentiment, the claims of the government relative to surveys, as well as, patent disparities in the statistics[4]—between government poverty and self-diagnosed poverty? In short, why the stunning disconnect?

This marks a fundamental example of the evolving divergence between the top-down viewpoint vis-à-vis bottom-up conditions. One previous example I have shown has been how experts and the public defines inflation[5].

Another important dimension from the news is that the lifeblood of the Libyan healthcare system has been on OFWs (mostly from Philippines). So aside from pay and career, OFWs appears to have found some other psychological profits from their work; perhaps through Maslow’s hierarchy—a sense of belonging, self-esteem or even self-actualization. In other words, the human factor has prompted for the OFW’s defiance of the government where their choice can be read as ‘die as heroes or die as starved yet forgotten pawns of politics’[6]. And by disregarding populist politics, the OFWs have asserted their individual sovereignty.

And by failing to account for such human ‘individual’ factor, populist “feel good, noble intention and vote generating” politics thrust to “bring-the-OFWs-home” has utterly failed.

Why is this important? Because, in a nutshell, the Libyan OFW episode brings to light the quality of the so-called economic boom. This accentuates signs of the deepening misperception by the cheery consensus that has backed the prevailing conviction supporting today’s one way trade in the financial markets.

When reality begins to shatter such forceful expectations, then trouble lies ahead especially for those blinded by overconfidence.

The Toxicity of Overconfidence

Overconfidence breeds misconceptions and delusions. As professor of finance and author John Nofsinger writes[7]

People can be overconfident. Psychologists have determined that overconfidence causes people to overestimate their knowledge, underestimate risks, and exaggerate their ability to control events. Does overconfidence occur in investment decision making? Security selection is a difficult task. It is precisely this type of task in which people exhibit the greatest degree of overconfidence.

This means overconfidence can be fatal.

Could the lamentable fate of former Brazil Billionaire Eike Batista whose fortune $30+ billion in 2012, who then has been the Forbes seventh wealthiest in the world two years ago, to become negative net worth today been mainly through overconfidence[8]? Imagine $30 billion down the drain in just two years? Most have been oriented to think that wealth can only be accumulated, but Mr. Batista’s crash has been nothing more than horrific.

Warren Buffett once said “risks comes from not knowing what you are doing”. I would rather say every crisis reveals that a great scad of smart people have opted to “not know” for many reasons such as dogmatism, dedication to math models, preference for instant gratification, social pressure or groupthink, selective perception due to personal biases, sublime attachment to interest group/s benefiting from current policies and more, but overconfidence could be more of a compelling factor.

This means that in investing while there are times where one should go with the crowd, there are times required to go against the crowd. From a historical perspective, the crowd is ALWAYS wrong during MAJOR inflection points. The reason inflection point exists is exactly because of the extreme nature of sentiment. Of course, sentiment is never a standalone force. It is a necessary but insufficient factor. The path to overconfidence has always been established by fundamental forces.

For instance when boom times lead to an overconfident crowd, overborrowing in support of excessive speculation or overspending or both, builds up risks on the balance sheets of levered entities. So when economic reality upends the overconfidence that has been founded on popular superstitions, such fragilities simply unravels.

My favorite iconoclast Nassim Nicholas Taleb and partner Mark Spitznagel explains how debt hides fragility[9] (bold mine):

Debt has a nasty property: it is highly treacherous. A loan hides volatility as it does not vary outside of default, while an equity investment has volatility but its risks are visible. Yet both have similar risks. Thus debt is the province of both the overconfident borrower who underestimates large deviations, and of the investor who wants to be deluded by hiding risks. Then there are products such as complex derivatives, which in the name of “modern finance” make the system even more fragile.

So when financial markets exhibit intensifying signs of excessive buildup in sentiment in a single direction buttressed by developments in fundamental factors, then it is time to take a distance from crowd. As legendary investor John Templeton duly advised: Bull-markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.

As a lowly money manager, who survives from the markets also from my direct exposure, which means I have embedded ‘skin in the game’, I write not only to inform but to educate and share the conduct of my investing affairs discreetly through this outlook.

I also do not write with the intent of entertaining or to bloviate in order get populist plaudits or to confirm on the biases of the speculating crowd or community. I contravene or ethically oppose the Keynesian ‘sound banker’ approach of hiding under the skirt of crowd when the mess surfaces which means that I write with my conscience.

I keep to my heart the most precious legacy of investing wisdom from the great value investor Benjamin Graham:

Have the courage of your knowledge and experience. If you have formed a conclusion from the facts and if you know your judgment is sound, act on it - even though others may hesitate or differ. You are neither right nor wrong because the crowd disagrees with you. You are right because your data and reasoning are right

And unlike most of my contemporaries, I practice what I preach.

For me, identifying profitable opportunities comes with the imperative of evaluation of the risk environment, this applies to whether one positions for the long term (‘value investors’) or medium term mostly trend-following (growth) investors or even for scalping/momentum traders/punters. Again another gem from Ben Graham[10]: The essence of investment management is the management of risk, not the management of returns

Transitioning market phases implies that there will be time for aggressive or moderate or defensive positioning. Conditions today suggest of the latter. Remember, time is the investor’s real best friend.

Lastly, I neither subscribe nor attempt to share with my clients or audiences snake oil trading (or pseudo hedging) techniques, sought after by people who think with their eyes or who are after instant gratification.

Another BSP Communications ‘Bait and Switch’?

The unfolding predicament in Libya by OFWs and self-assessed poverty will even become more pronounced.

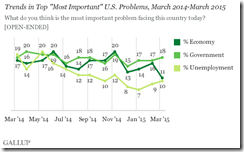

Last July Statistical consumer inflation swelled to 4.9%. The Bangko Sentral ng Pilipinas once again deviously blames this on weather.

From the BSP[11]: The higher July headline inflation rate was driven mainly by the higher prices of food. Food inflation accelerated as most food items particularly rice, vegetables, meat, fish, milk, fruits, sugar, oils, and corn posted higher prices due to tight domestic supply conditions triggered by recent weather-related production disruptions. Meanwhile, non-food inflation held steady as the increases in electricity rates, tuition fees, jeepney fares, and hospital services were counterbalanced by the slower price increases in domestic petroleum products (i.e., gasoline, diesel, kerosene, and LPG).

The Philippine consumer price inflation chart (right window) doesn’t match with the BSP’s statement. Philippine CPI began its ascent in September 2013 two months prior to Typhoon (Haiyan) Yolanda which devastated mostly Region 8 in November 8, 2013. Philippine CPI has now reached 2011 highs. Besides the only direct connection between Typhoon Yolanda and the economy has been the coconut industry[12].

In addition, if tight supply has been the problem, then the solution would be to allow imports to offset any supply imbalance. Yet given that statistical price inflation continues to move upwards during the last 10 months, which has intensified since the advent of 2014, it is quite obvious that either the government didn’t permit imports to cover the deficits which has mostly been in food but has become widespread even from statistics derived from a heavily regulated environment or that supply shocks have only been aggravating circumstances or symptoms from an undisclosed disease.

Next why did the BSP raise interest rates last week which they immediately implemented[13], if such has only been a supply side problem? What has raising interest rates got to do with bringing in supplies into the market? Or will increasing interest rates induce more imports? How? And why the BSP’s seemingly desperate attempts to curtail inflation via 5 successive policies—2 reserve requirements, SDA rates, bank stress test and lately official rates—in 5 months? The BSP leadership leaves the public groping in the dark

So whether it is about facts or about policy actions, the BSP’s communications appear to become more abstruse, increasingly inconsistent and non-transparent. This is hardly positive, as this should raise suspicions.

As reminder, in order to promote domestic demand, the BSP in 2009 made a grand pirouette in line with most of central banks around the world to shield their respective economies from a contagion from a financial meltdown via zero bound rates. Does the BSP think that frontloading expenditures through the creation of money from thin air via bank credit expansion or in the words of the BSP chief “counter-cyclical support to aggregate demand in the form of expansionary fiscal and monetary policies”[14] will not impact prices? Is the BSP blind to demand and supply curves? Does the BSP believe in free lunches?

As one can see Philippine statistical price inflation reared its ugly head when the BSP unleashed the inflation Godzilla via a 30++% month money supply growth rates in July 2013 (left window). Because monetary inflation has lagging effects, the CPI response came later. I would further deduce that the 30+% money growth has been a manifestation of the accumulation of inflation pressures from the earlier phase of credit expansion combined with the SDA policy of 2013. In short, the SDA policy of 2013 became the outlet valve for the simmering inflation pressures that has amassed overtime.

Let me add to the BSP chief’s words then “Maintaining an expansionary monetary policy stance to the extent that the inflation outlook allows, could support market confidence and assure households and businesses that risks to macro-stability are being addressed decisively”. Well can blowing bubbles be seen and interpreted as “risks to macro-stability are being addressed decisively”? Or is macro-stability risk being ignored decisively due to unstated or undeclared political objectives?

Credit Expansion as the Source of Inflation

Central bank induced credit expansion means injecting fresh spending power into the economic stream. If the supply side fails to anticipate the surge in spending stream, then a supply shock will happen. This is what we are seeing today and this is what the BSP has been publicly attributing as factors responsible for inflation.

Yet additional demand unmet by supply growth will mean imbalances expressed through higher prices. So the government will need to address the growth in demand with more imports. But additional imports will extrapolate to strains on the trade balance which will impact the currency, through a weaker peso.

So the problem generated by credit expansion can only multiply. And the solution will be to reverse it.

But credit expansion also means that producers reallocating resources to capital intensive (high order) industries.

Since the Philippines has been seen as a consumption story, the direction of investments gravitated on these areas, particularly to the property sector mostly catering to the highly touted consumer, the shopping malls, residential condos or housing projects, hotel and restaurants, casinos.

Moreover since massive flows of funds and resources had been diverted to these popular bubble areas, which implies of overconsumption of resources, at the expense of the other industries, like agriculture, the dearth of investments and consumption of resources in the latter has contributed to supply side constrains which have now been expressed as consumer price inflation.

As for the former which has imbibed on most of the resources, the eventual outcome will be an oversupply. Signs of oversupply may have already emerged. As noted last week, the latest report from Global Property Guide indicated that Manila has ‘ghost cities’ or really more of ghost condos rather than the hyperbole of ‘cities’. Such are examples of how distortions of the pricing mechanism by inflationism engender malinvestments.

Yet most of these have been financed by debt. And debt from the supply side has growth disturbingly faster than real demand or even statistical economic growth. So massive misallocation of resources combined with rapid growth in debt relative to demand or economic growth makes the entire aggregate demand growth template unsustainable. This has been the cornerstone of the Philippine economic boom; a boom that has been revealing signs of reversal.

Rising price inflation means that resources or savings have been insufficient to finance projects established as profitable only at low price inflation levels and at low interest rates. For instance, for the supply side, rising price inflation will translate to project cost overruns and increasing overheads in the face of reduced demand from both consumers and producers.

In addition, for entities with access to credit in the formal banking sector, whom has sharply increased the level of debt absorption over the years, implies greater balance sheet risks when interest rates move higher.

The current increase in official rates still means negative real rates environment. When real rates move to positive, real debt levels will also increase, thereby increasing the burden of debt servicing.

For an economy whose statistical growth has become debt dependent, reduced debt levels will first temper down profitability and growth, and eventually expose on the degree of resource misallocations through the markets.

As you can see, aggregate demand quasi-boom policies bring about price disruptions, economic discoordination and malinvestments.

Stagflation Prediction Partly Met, IMF’s Straddle the Fence and the Peso Disconnect

Well the BSP’s current inflation predicament I have predicted years ago.

While I was still in the bullish camp as the effects of negative real rates remain benign I wrote[15]: Also, given the combination of the currentopwhich remains far above the interest rate, coupled with the negative real interest rate outlook, suggests that the Philippines continues to operate on a loose monetary inflation stoking environment.

By late 2012 I became concerned over the far aggressive rate of credit expansion, I wrote[16]:

Once price inflation accelerates through food and energy channels, which is likely to be accentuated by current easy money policies, and where stagflation becomes a clear and present threat, statistical economic growth, like a bubble, will simply pop. Then, the BSP will be in a state of panic. The public will discover that the emperor has no clothes

Oops.

By imposing 5 policies in 5 months, the BSP seem to have already shown incipient signs of desperation if not panic, even when statistical price inflation has been supposedly at the upper range of their target at 4.9% last July. Why? Because real inflation figures have been alot higher than statistical numbers say? Because some influential pressure groups, perhaps outside the Bank of International Settlement’s warnings[17], may have been cognizant of dangers or if not imperiled by effects of the BSP’s policies?

Yet the BSP’s reaction comes along with, as noted earlier[18] “the more than doubling of the growth rates of the real estate consumer NPLs in the 1Q 2014 vis-à-vis the average of the last three quarters of 2013 can be juxtaposed to the breathtaking 8.95% 1Q 2014 spike in the prices of 3 bedroom condominium units in Makati the cresting of money supply growth rates also in Q1 2014, the intensifying official inflation rates and the below consensus expectations of 5.7% 1Q 2014 GDP growth rates.”

Has anyone from the mainstream seen this outbreak of inflation? Most experts or talking heads see inflation like a pet in a cage.

Oh by the way, remember the sanguine quote above by the IMF on the Philippines in their press release? Well the IMF actually has straddled the fence to ensure that they can’t be lambasted for being blind.

First the IMF notes of the external risk[19]: This favorable outlook could be buffeted by external and domestic events. Abrupt exit from exceptionally loose monetary policies abroad, a sharp slowdown in China or other emerging markets, or a major geopolitical incident could impact global or regional trade and capital flows and adversely affect the Philippine economy.

Now the punchline (bold mine): On the domestic front, rapid credit growth or a disproportionate flow of resources to the property sector could boost short-term growth but heighten volatility thereafter, impacting overleveraged households and corporates.

I don’t know how the IMF defines “rapid credit growth or a disproportionate flow of resources” but for me, such seeming fence sitter’s word of caution has been descriptive of what has already been transpiring, specifically “boost short-term growth but heighten volatility thereafter”. Let me break it down: 2013’s 7% growth represents “boost short-term growth” while rising property NPLs, record growth in condo prices, ghost condos, price inflation and blatant overvaluations of asset prices levels can be read as “heighten volatility thereafter”, although ‘thereafter’ is today!

The point is the IMF, like many other global political or mainstream institutions or establishments, CANNOT deny the existence of bubbles anymore. So their recourse has been to either downplay on the risks or put an escape clause to exonerate them when risks transforms into reality which is the IMF position.

As for inflation outlook, unlike the IMF which sees inflation from a neo-Keynesian output gap version of the Phillips curve, with hardly inflation in the context of Milton Friedman’s “always and everywhere a monetary phenomenon”, for me for as long as bank credit expansion is sustained from which these will circulate in the economy as artificial demand and which will revealed in money supply growth, then price inflation will continue to rise even beyond the BSP’s moving goalpost.

However, as in the case today, money supply growth appears to be plateauing, this comes as the rate of growth in bank credit expansion seems to have also decelerated. This may be because much of the credit expansion could be used to pay off existing debt instead of capital expansion programs. And this is even before the increase in official rates at the end of July. If such trend is sustained then inflationary pressures down the road will ease but statistical economy growth will also vastly underperform. And slower growth amidst high debt levels will give rise to credit burdens of leveraged institutions and or individuals, or in the words of the IMF, “impacting overleveraged households and corporates”.

The Peso vis-à-vis the US dollar fell by .82% this week. However the Peso remains up for the year, which curiously comes in the face of rising price inflation. This is another sign of a fantastic detachment between financial markets and the real economy.

The government may for the meantime succeed at the massaging of prices at the financial markets, resort to statistical masquerade or publicity gimmicks. But eventually economic forces will ventilate on the accreted imbalances from all these manipulation of the markets and the economy. It’s just a matter of a not so distant time.

Yet the BSP’s recent actions have begun to reflect on all these.

With 2Q GDP growth due to be announced possibly in the last week of August, it is a wonder how the BSP will respond to data.

The BIR Assails Domestic Financial Community

Last week, the domestic financial community, which reportedly includes 9 of the most influential business groups, as well as, the banking and capital market, supposedly protested a new tax ruling which requires “the submission of an alphabetical list (alphalist) of payees of income payments subject to withholding taxes”[20]. The community said that the new rule may result to capital flight. The new ruling would affect dividends which, if not compliant with BIR directives, will be taxed at 30% instead of 10%.

I am with the financial community on this. Such senseless arbitrary new ruling will not only cause capital flight but put a barrier on business creation and investments, thereby adversely influencing economic growth and increasing poverty levels. If such program gets implemented and would result to economic deprivation will these bureaucrats be held responsible and prosecuted for policy failures? The answer is NO, so they go about tossing more and more fatal totalitarian decrees at the expense of everyone.

Yet as one could observe, the BIR has been relentlessly tightening the dragnet on the economy with aim of shanghaiing more resources from the productive sector.

Bizarrely, the financial community hardly appears to have seen this coming. The public lynching of doctors, the assault on the informal economy and many more has long served as the proverbial writings on the wall. Yet facetiously too, the financial industry remains sanguine over the financial markets and the economy. And as even more sign of oxymoron, at the day this article was published the Phisix zoomed by over 100 points or by about 1.5% mostly on local buying!

Think of it, threats of capital flight in the face of rampaging stocks would seem like a bait-and-switch, how do you think this will be effective in persuading the BIR commissioner??? Here is a guess; a full-fledged bear market will force the BIR chief to stand down. Yet this bear market will come with or without a change in the BIR ruling.

And secondarily, this eccentric pushing up of stocks in the face of government assault on the industry is one splendid example of blindness from overconfidence. How do you square the growing risk from a capital flight due to a repressive tax edict with frenetic bidding up of stocks? More confiscation by the government of investor’s resources equals more earnings growth? How fabulous!

And alongside this news, the BIR commissioner reportedly wants to remove or exempt the tax agency from standardization of salary levels[21]. The BIR chief wants to change the organization’s structure from rule based to arbitrary based. Doing so, allows even more internal politicization of the tax agency and the appointments of favored officers.

It’s sad to see how productive capital has already been wasted from current feel good programs, but it is even direr to see the suffocation of the domestic economy just to appease the whims of these self-righteous political agents.

It’s no crisis time, yet the government has been drooling for more funds and attempting to extract these by harassing more and more of the private sector.

What happens when the economic version of Typhoon Yolanda makes a landfall?

India’s Central Bank’s Rajan Warns of 1930s Collapse, US Treasury’s TBAC Warns of De-Risking

I have been saying that current environment has been prompting officials and the establishment to admit to the existence of bubbles. Except for the Bank of International Settlements, much of the warnings have functioned as an escape hatch perhaps intended to relieve authorities of the responsibility in the prospects of a financial-economic meltdown.

Well last week when I referred to China, I said ‘epic bubble will lead to epic collapse’.

Here is one central banker, India’s Central Bank Governor Raghuram Rajan, a Chicago School alumnus and formerly the chief economist of the IMF, who recently elevated the prospects of the risks of an ‘epic collapse’ by referring to the GREAT DEPRESSION.

Governor Rajan decries the beggar-thy-neighbor policies being implemented by global monetary authorities which translates to a lack of coordination, that for him, elevates the risks a 1930 scenario

From the Wall Street Journal Real Times Economics Blog (bold mine)[22]: We are taking a greater chance of having another crash at a time when the world is less capable of bearing the cost,” said Mr. Rajan in an interview with the Central Banking Journal. A sudden shift in asset prices could happen in a variety of ways, Mr. Rajan said. The most obvious route would be as a result of investors chasing higher yields at a time when they believe central bank policies will protect them against a fall in prices. They put the trades on even though they know what will happen as everyone attempt to exit positions at the same time – there will be major market volatility,” said Mr. Rajan. A clear symptom of the major imbalances crippling the world’s financial market is the over valuation of the euro, Mr. Rajan said.

Just a reminder; these quotes should not be interpreted as an ‘appeal to authority’, the economic theory of business cycles have been enough to prove the case of bubbles.

However, my citations of public authorities have been meant to point out how bubbles have not only been in the radar screens of authorities, but seem to have reached a state of clear and present danger for some like the BIS or RBI’s Governor Rajan. The difference is that public authorities appear to be directionless on how to approach or deal with them. So outside the BIS or RBI’s Rajan, the rest treat them as an escape hatchet. Again my analogy for this is “Yes I recognize the problem of addiction but a withdrawal syndrome would even be more cataclysmic”.

Yet the buck doesn’t stop here.

A member of the US treasury Treasury Borrowing Advisory Committee (TBAC) composed of US banks and investors in a recent presentation warned of the risks of a massive de-risking due to Fed policies that has generated severe complacency in the marketplace, forced pension to extract yields to fulfill of return requirements and yield chasing based on orthodox risk models.

From the Financial Times[23] (bold mine): “Against [an] environment of low vol[atility] and low returns, the only way to achieve the same return targets is to take on more risk,” TBAC said in its presentation. Assets invested into hedge funds, which typically undertake riskier strategies, have ballooned to $2.8tn in the second quarter of this year, up from about $1.75tn just before the financial crisis, TBAC said. Meanwhile conservative investors such as pension funds are still trying to reach an average return target of a little less than 8 per cent, at a time when yields on benchmark US Treasuries are at 2.45 per cent. Because banks and investors incorporate volatility into their internal risk management models, there is a chance that suppressed markets are creating a feedback loop that amplifies further risk-taking, TBAC noted. The “value-at-risk” models used by most large Wall Street banks and investors typically incorporate volatility data to try to calculate how much a trading portfolio might be expected to lose in a given day with a given probability. With volatility drifting lower and lower in recent years, these models are spitting out extremely small chances of investors sustaining large losses, allowing Wall Street to assume additional risk without violating its own internal risk management standards. “VaR-based analysis leads to self-reinforcing loops as low volatility causes models to recommend scaling up risk,” TBAC said in its presentation. “An unexpected increase in volatility might come from broad-based selling of assets wanting to de-risk in front of a turn of policy.”

Again these are mainstream articles excerpting speeches or presentations of authorities from political institutions or the establishment. It’s pretty clear that we are seeing a convergence of worries.

Denial of bubbles wouldn’t remove its risks.

As English writer Aldous Leonard Huxley once penned, “Facts do not cease to exist because it is ignored.” I call such bubble denials as the Aldous Huxley syndrome.

Global Black Swan: Nuclear War or Economic Sanctions or Both?

Unless one has been hiding under the stone, it’s been quite clear that there has been a flare up in the accounts of wars around the globe.

Aside from the civil war in Libya, which has jeopardize domestic OFWs, and also the ongoing civil war in Syria, other wars include the US financed invasion by the Israel government of the Palestine held Gaza[24], the Northern Iraq offensive by the Jihadist Sunni led ISIS, supposedly financed by American ally Saudi Arabia and Qatar where the US has paradoxically joined foe Iran in defending the besieged Iraq government via air strikes which began last Friday[25]. The renewed skirmishes between two former Soviet Union Republics, Armenia and Azerbaijan over a contested mountainous territory[26] where the latter’s president threatened a full scale war with the former over Twitter[27] and a conflict which Russian President Vladmir Putin as of this writing has been trying to broker a peace deal[28].

While there may other ongoing wars, none has captured the world’s attention than the civil war in Ukraine which threatens to escalate into a war between US-NATO and Russia.

Economic sanctions are equivalent to protectionism that risks retaliation and further escalation. I recently wrote[29],

One thing may lead to another. If the brinkmanship escalation worsens, then sanctions are likely to expand to eventually cover trade and finance and more. This paves way for more heated confrontation which may open the door to a military conflict in today’s nuclear age. We just pray that cooler heads will prevail.

In other words, economic sanctions are equivalent to economic warfare. The great Proto-Austrian economist, the French classical liberal Claude Frederic Bastiat once said that “if goods don’t cross borders, armies will”

Historian Eric Margolis echoes Bastiat and provides a precedent[30]:

Economic embargos such as those launched by the US against Russia may seem relatively harmless. They are not. Trade sanctions are a form of strategic warfare that is sometimes followed by bullets and shells.

Think, for good example, of the 1940 US embargo against Japan that led Tokyo’s fateful decision to go to war rather than face slow,economic strangulation. How many Americans know that President Roosevelt closed the Panama Canal to Japanese shipping to enforce demands that Tokyo get out of Manchuria and China?

We are seeing some signs of these.

Recently, the US has imposed sanctions “directly targeting Russia’s banking, defence and energy sectors”[31], Russia has responded by “imposing a "full embargo" on food imports from the EU, US and some other Western countries”, which includes “fruit, vegetables, meat, fish, milk and dairy imports”[32] aside from “banning Ukrainian airlines from transit across its territory”. Russia also considers expanding retaliatory sanctions to include a ban on transit flights for EU and US airlines from Siberian airspace.

Professor Michael Rozeff gives 17 reasons why the US sanctions against Russia are crazy

Yet instead of sanctions leading to de-escalation, US sanctions on Russia appears to provoke more reciprocal adversarial response. Russia has recently re-amassed troops over the Ukraine border[33], and importantly, listen up, the US government has admitted that the Russian air force flew 16 forays over or near US air space at Alaska and at Northern Canada over the last 10 days[34]!

Historian Margolis says that because of the limited number of troops on both sides to conduct a full scale conventional war, such limitations are temptations to use tactical nuclear weapons.

It’s really silly for both governments to put the risks of a global Armageddon on the table just to please the egos of these politicians.

Even if we are to discount the occurrence of a nuclear war, these economic sanctions could lead to a 1930s equivalent of Smoot Hawley act or essentially de-globalization via protectionism.

But instead of a Smoot Hawley in response to a stock market-banking sector collapse, in today’s environment the causation may work in the opposite.

Economic sanctions can be the trigger for a global economic and financial black swan.

Economic sanctions can be interpreted as equivalent to monetary tightening. Investopedia.com’s defines credit crunch[35] as “an economic condition in which investment capital is difficult to obtain. Banks and investors become wary of lending funds to corporations, which drives up the price of debt products for borrowers.”

This means that despite zero bound rates or further QE by central banks, by imposing restrictions on capital flows and credit, banks and investors will become wary of lending funds to financial and nonfinancial corporations affected by the sanctions. And one can’t just look at the numbers because the financial system has been vastly interconnected if not tightly interdependent.

As I earlier noted, one thing can lead to another. Economic sanctions can spread to include allies (say China). Or the impact of sanctions can be transmitted via network effects.

Also sanctions are self-destructive. Take a look at Russia’s food counter sanctions against West.

One should first ask why does a country import? A country imports because the products may not be produced in the domestic economy, or they may be inefficiently or inadequately produced (or produced more expensively based on the law of comparative advantage) or offer more choice to the consumers (via product variation or quality, again law of comparative advantage).

To clarify: importations are conducted usually by enterprises than by the government. So I used ‘country’ to simplify the explanation

So by cutting off or prohibiting supply means to punish domestic consumers more than the overseas suppliers. Domestic consumers will have reduced supply at higher prices, if not at reduced quality. Meanwhile overseas suppliers suffer from a loss of business. The losses will be transmitted to suppliers to labor or even to taxes.

This applies whether to food or other items. The end result is that both parties lose, which further means that all these sanctions are like shooting oneself on the foot.

Also, take for example US-Russian trade which has recently collapsed. Media says sanctions have worked. Media doesn’t see the losses incurred by US producers as well as the potential impact of those losses to the economy. This applies as well to Russia.

Media has been fascinated by the numbers. What media doesn’t see is that of the human factor matters more than the numbers. If both sides will escalate further, then more and more parts of the global economy will be affected. We will end up with epic collapse given the epic bubble. But instead of finance, we may have a collapse triggered by a geopolitical fiasco.

Another problem with media is that sanctions applied by the US before may not have fomented war because these have been imposed against much smaller countries, say Iran, Cuba and North Korea.

Politically, economic depression from sanctions will be used by politicians to fuel nationalistic fervor that will incite popular clamor for war. These impassioned responses may provoke a real war.

At the end of the day all these sanctions will go back to Bastiat “if goods don’t cross borders, armies will”.

Unfortunately instead of armies, what may cross today’s borders may be nuclear bombs.

Have a nice day.