For the mainstream, price inflation has been seen as inexistent because the CPI indices tells them so. Government data for them is seen as inviolable or sacrosanct even when real world experience suggest otherwise.

They ignore the fact that money flows into the economy have been in a relative manner: different stages, different industries at distinct levels, speed and degree, such that the consequence of monetary policies has been a relative price inflation (chart courtesy of Doug Short).

Never mind too that record high stock markets and surging property prices have been emblematic of price inflation on the asset markets.

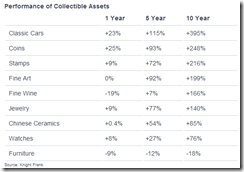

And that money flowing into asset markets have likewise led to bubbles in art and to other collectible markets.

Well add to this collection of bubbles, the thoroughbred racehorses. From CNBC

The market for racehorses took a big spill during the recession and didn't look ready for a comeback anytime soon. But suddenly, Thoroughbred prices are charging ahead.The Keeneland September Yearling Sale—the nation's premiere Thoroughbred auction—is just winding down, and the numbers resemble those from precrisis boom times.Keeneland said 18 yearlings sold for $1 million or more. That's the highest total since 2008 and more than twice last year's total. The most expensive sale was $2.5 million. Though that's below the top-horse price in 2006, which topped $11 million, it's more than double last year's.Sales this year total over $264 million, up 23 percent from last year and the highest since 2008. The average price of $130,780 is up 31 percent from 2012.

The ballooning prices of "toys for the big boys", amidst tepid economic growth (chart from Zero Hedge) are signs of the inequitable distribution of wealth—a subsidy to rich at the expense of society—brought about by central bank’s current zero bound rates and QE policies.