Since the US Federal Reserve went into an expansionary mode in order to supposedly "reflate" the US economy following the dot.com bust, the collectible markets seems to have been one of the major beneficiaries of such policies

According to CNBC’s Robert Frank

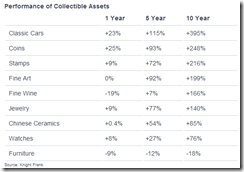

According Knight Frank's Wealth Report, an index of the nine main collectibles markets grew by 175 percent over the past 10 years – a far better record than U.S. stocks. All nine categories tracked by Knight Frank increased in value except collectible furniture.

Over a ten year period, classic cars, coins, stamps and fine arts returned about 200% and above.

However, popular themes lagged. Again from the CNBC,

As Knight Frank says, however, "performance doesn't go hand in hand with popularity." Sometimes the most beloved collectibles are dogs as investments.

Art remains far and away the most widely collected collectible among the world's wealthy and affluent. The world's millionaires plan to increase their spending by 13 percent on art this year.The second most popular collectible is watches – led by Asian collectors. That was followed by fine wine, jewelry and then cars.

Bottom line: The impact of central bank policies on asset prices are different. Also, popular themes may not be the best choice.

No comments:

Post a Comment