NEW YORK: The cost of borrowing gold surged on Tuesday to the highest level since January 2009, reflecting dwindling supplies from bullion banks after heavy liquidation and resilient demand for physical gold products.

The rates for lending out physical gold - mostly offered by bullion banks and central banks to institutional investors and manufacturers - have been near historically low levels over the past four years due to plentiful supplies.

Investors have lent out their big stockpiles of metal as prices have soared.

But that came to an abrupt end when supplies started tightening as institutional and speculative investors have unwound those long positions since the mid-April historic sell-off that has seen spot prices plunge 26 percent so far this year.

The implied one-month gold lease rate rose to 0.3 percent on Tuesday, their highest since January 2009 when investors scrambled for physical metal, seen as a safe haven investment, after Lehman Brothers collapsed.

That is up sharply from the 0.1 percent early last week. Rates have increased steadily from a negative 0.2 percent since September last year, but the gains have accelerated since April.

Even so, they are far off record highs of close to 10 percent seen in 1999 after European central banks agreed to curb gold sales and are still near historically low levels.

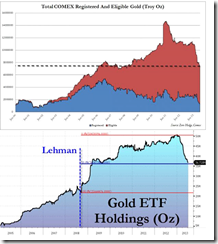

The recent collapse of gold prices came amidst a substantial decline in the inventories of the COMEX and gold ETFs (chart from Zero Hedge).

But in sharp contrast to Wall Street, demand for physical gold continues to be robust: Chinese imports of gold posted the second highest on record last May where gold spot premiums rose almost to "unprecedented levels", according to Mineweb.com. And even as official data on India’s imports may slow to reflect on recently imposed draconian gold trading curbs, gold smuggling has picked up according Mineweb.com. Emerging market central banks continue to substantially amass gold in April and May according to ETFTrends.com

There is another very important related development. Gold prices are reportedly in accelerating backwardation—where future prices are trading below spot prices.

As the Wikipedia.org notes

A backwardation starts when the difference between the forward price and the spot price is less than the cost of carry, or when there can be no delivery arbitrage because the asset is not currently available for purchase

something happened that has not happened since the Lehman collapse: the 1 Month Gold Forward Offered (GOFO) rate turned negative, from 0.015% to -0.065%, for the first time in nearly 5 years, or technically since just after the Lehman bankruptcy precipitated AIG bailout in November 2011. And if one looks at the 3 Month GOFO, which also turned shockingly negative overnight from 0.05% to -0.03%, one has to go back all the way to the 1999 Washington Agreement on gold, to find the last time that particular GOFO rate was negative.

Before we get into the implications of this rather historic inversion, let's review the basics:

What is GOFO (Gold Forward Offered Rates)?

GOFO stands for Gold Forward Offered Rate. These are rates at which contributors are prepared to lend gold on a swap against US dollars. Quotes are made for 1-, 2-, 3-, 6- and 12-month periods.

Who provides the rates?

The contributors are the Market Making Members of the LBMA: The Bank of Nova Scotia–ScotiaMocatta, Barclays Bank Plc, Deutsche Bank AG, HSBC Bank USA London Branch, Goldman Sachs, JP Morgan Chase Bank, Société Générale and UBS AG.

When are the rates quoted?

The means are set at 11 am London time. These are the rates shown on the LBMA website. To show derived gold lease rates, the GOFO means are subtracted from the corresponding values of the LIBOR (London Interbank Offered Rates) US dollar means. These rates are also available on the LBMA website.

How are the GOFO means established?

At 10.30 am London time, the Reuters page is cleared of all rates. Contributors then enter their rates for all time periods. A minimum of six contributors must enter rates in order for the means to be calculated. At 11.00 am, the mean is established for each maturity by discarding the highest and lowest quotations in each period and averaging the remaining rates.

What are some uses for GOFO means in the market?

They provide a basis for some finance and loan agreements as well as for the settlement of gold Interest Rate Swaps.

- An ETF-induced repricing of paper and physical gold

- Ongoing deliverable concerns and/or shortages involving one (JPM) or more Comex gold members.

- Liquidations in the paper gold market

- A shortage of physical gold for a non-bullion bank market participant

- A major fund unwinding a futures pair trade involving at least one gold leasing leg

- An ongoing bullion bank failure with or without an associated allocated gold bank "run"

- All of the above

The answer for now is unknown. What is known is that something very abnormal, and even historic, is afoot at the nexus of the gold fractional reserve lending market.

The payback time for the gold bulls nears.