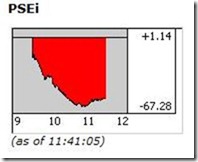

As of this writing the Phisix is down by over 1% and has followed Asia and ASEAN region and global equity markets in deep red.

Chart from technistock

Concerns have been raised that falling global equity markets have been about the risks of US downgrades.

I don’t think so.

One, the passage of the US debt bill temporarily eased US default risks as measured by CDS. That risk has not gone away but will accrue overtime (years).

Two, US credit rating agencies Fitch and Moody’s has affirmed the US credit standings, but has warned of future downgrades if deficits will not be reduced.

Three, the US yield curve has not exhibited signs of US downgrade risks but of fear of recession

Fear of downgrade implies HIGHER interest rates. US interest rates have been tumbling across the curve.

Fourth, if there is an example of the effects of downgrade risks then we should look at Europe

Chart from Bespoke invest.

This is an example of how a downgrade would look like. CDS of France and Italy have spiked.

This means that while everyone’s attention is in the US, they may be missing out that today’s market’s volatility could be a dynamic emanating from Europe

Europe's tanking equity markets (STOX50e, CAC, DAX) appears to have led the US (SPX) and not the other way around.

Lastly, while one day doesn't a trend make, these are seemingly strong signs where when faced with fear from another recession-crisis, the decoupling dynamic vanishes.