``There is only one thing which causes man to look for and to organize a tool which is an instrument of compulsion and prohibition. That thing is fear. Men look to government to protect them because they fear. And virtually without exception, everything that human beings fear becomes a project for government." Robert LeFevre The Nature of Man and His Government

The Swine Flu could have been a Black Swan. And perhaps yet it could.

The Black Swan theory as proposed by my favorite iconoclast Nassim Nicholas Taleb comprises three traits:

One, it “lies outside the realm of regular expectations”,

Two, it “carries an extreme impact” and

Finally it makes people “concoct explanations for its occurrence after the fact, making it explainable and predictable”.

Since the swine flu struck, it had practically caught everyone by surprise. Next, many have been unnerved or nations have been in a state of panic; the World Health Organization (WHO), the health agency of the multilateral organization the United Nations, have raised the pandemic alarm level to 5 out of the maximum 6, which implies pandemic levels or the risks of the global spread of disease as “imminent”. (Reuters). Lastly, there have been many theories circulating in traditional media or in the cyberspace as to why and how such ailment came to be.

So this episode contains elements fitting of a Black Swan. But what seems arguable is the degree of impact.

Since the Swine Flu surfaced in the news, markets have initially been devastated, albeit not equally. Realizing the sensitivity of today’s fragile environment, I had also been tempted to undertake “crash” or defensive positions.

However, it dawned upon me that panics are always triggered by our brain’s Amygdala, which had been hardwired into our fight-or-flight responses by our primitive progenitors, who were faced with survivalship against the adverse forces of nature. Panics are actually exacerbated by the lack of information.

Hence, considering the uneven nature of the market’s responses, the underlying market trend, the most recent experiences of the world to deal with epidemics (SARS, Avian Flu) and the rapidly advancing state of our technology, I decided that it would be best to defer fear and possibly deal with this from the reverse.

A great example would be the Severe Acute Respiratory Syndrome (SARS) episode, as shown in Figure 1.

From the benefit of hindsight, the SARS was a short term dislocation or a blip or another account of Posttraumatic Stress Disorder (PTSD) for the tourism industries of key East Asian economies. From the market perspective, it served as a window of opportunity to profit from fear.

Since global markets have rallied furiously following the initial shock from the Swine Flu this implies that the pandemic risks have been digested and discounted in contrast to the headlines and the actuations of governments.

Sensationalism-Survivorship Bias: Markets versus Media and Politics

So why the flagrant disparity between the market and news headlines or from political authorities?

Because it is primarily about perspective.

In Mexico, the epicenter of the disease, the present death toll from the Swine flu has been reduced from 176 to 101 (Guardian) and now to 75 (BBC)! But even at 176, this number represents as an infinitesimal fraction relative to Mexico’s population of 110 million (CIA).

Moreover, the expanded global reach is said to cover 18 countries which had reported accounts of infections, as The Independent reported, ``The World Health Organisation said that 18 countries have now reported 766 infections. The confirmed cases include 443 in Mexico, 184 in the US, 85 in Canada, 15 in Spain, 15 in Britain, six in Germany, and smaller numbers in 12 other countries. Italy reported its first known case yesterday, a man in the Tuscany region who returned from Mexico on 24 April. He has since recovered. Almost all infections outside Mexico have been mild. In Britain, where two new cases were confirmed – one being the husband of a woman who was confirmed the day before – some 632 possibles are under investigation”.

The accounted fatalities, as of this writing, have been 17 globally, according to the same article.

To compare, the US Centers for Disease Control and Prevention (CDC) reports of 36,000 influenza associated deaths and 200,000 hospitalizations annually. This translates to 98 deaths per day and 548 people hospitalized per day from seasonal influenza in the US alone.

In addition, 115 people die from car accidents a day in the US (car-accidents.com), 38,500 People die each week around the world from the Aids virus and 1,288 is the number of British people who die from strokes in an average week (The Independent).

In other words, the actual collateral damage has hardly surpassed the average annual losses from its seasonal strain counterpart or from other common causes of deaths even based on US figures alone. Yet because the disease has reached 18 countries with 766 infections and 17 deaths, the WHO has triggered global alarm bells and international hysteria by placing the pandemic alarm level to 5!

So opposite to the survivorship bias, which usually fixates on winners, global authorities today have been entranced with sensationalism and has virtually used fears to respond on an overkill basis.

Notwithstanding, the ensuing consternation has led to divergent definitions of the disease; the Swine Flu has been reported as little to do with the Swine itself (Poor Pig- serves not only as human’s dish but as fall “guy” animal!) where according to the Reuters ``The WHO has said it would call the new virus strain Influenza A (H1N1), not "swine flu," since there is no evidence that pigs have the virus or can transmit it to humans. Pork producers had said consumers were shunning their product.”

Bizarrely too, even some US Farmers have raised concerns that their herd of pigs might be contaminated by infected humans!!!

This paradox as reported by another Reuter’s article, ``There is no evidence of this new strain being in our pig populations in the United States. And our concern very much is we don't want a sick human to come into our barns and transmit this new virus to our pigs," said National Pork Producers chief veterinarian Jennifer Greiner. If humans give it to pigs, we don't have things like Tamiflu for pigs. We don't have antivirals. We have no treatment other than to give them aspirin," said Greiner.” (bold highlight mine).

Yet many have alluded to the Spanish Flu as its origins, but the effects have been so far way way way off.

The Spanish Flu as described by wikipedia.org, ``The pandemic lasted from March 1918 to June 1920, spreading even to the Arctic and remote Pacific islands. It is estimated that anywhere from 25 to 80 million people were killed worldwide, or the approximate equivalent of one third of the population of Europe, more than double the number killed in World War I. This extraordinary toll resulted from the extremely high illness rate of up to 50% and the extreme severity of the symptoms, suspected to be caused by cytokine storms. The pandemic is estimated to have affected up to one billion people: more than half the world's population at the time.”

Perhaps lacking the expected casualty impact in the scale of the Spanish Flu pandemic, authorities have presently been downplaying its association, this from the Associated Press, ``Scientists looking closely at the H1N1 virus itself have found some encouraging news, said Nancy Cox, flu chief at the federal Centers for Disease Control and Prevention. Its genetic makeup doesn't show specific traits that showed up in the 1918 pandemic virus, which killed about 40 million to 50 million people worldwide.

``"However, we know that there is a great deal that we do not understand about the virulence of the 1918 virus or other influenza viruses" that caused serious illnesses, Cox said. "So we are continuing to learn." (all bold emphasis mine)

The irony is, if the said expert does not understand much about the virulence of the 1918 virus, how can she conclude that the genetic make up of today’s strain doesn’t resemble the specific killer traits of 1918 virus? Isn’t this a case of rationalization?

So like in the markets, we seem to be witnessing evidences of reflexivity behavior being applied to the Swine Flu incident-where the present outcome (diminished degree of impact and rising markets) seems to be influencing the public’s thinking as reflected by news accounts and backed by shifting views or sentiments of officials as cited by mainstream media.

Yet the frenzied policy responses have resulted to some unintended consequences. For instance, Egypt’s arbitrary decision to slaughter its entire pig population has spawned a religious schism between majority Muslims and Christians.

Another, Mexico’s decision to shut down stores and companies or its economy has prompted some agitation among the citizenry. According to the Reuters, ``The Labor Ministry said it would fine or forcibly close companies that stay open Monday and Tuesday as a major factory association and many small businesses say they plan to.

``"As far as I know we're coming to work next week. Unless someone comes from the government to tell us to close," said Victor Barracas, a bookstore employee in central Mexico City.”

It appears that the Mexican government prefers its population to suffer or perish out of starvation than from an overblown epidemic!

Talk about governments knowing the interest of their people.

Conspiracy Theories

Nevertheless, the compulsiveness over the Swine Flu won’t be complete without “conspiracy” theories.

Since the current strain of Swine Flu combines genetic material not only from pigs but from birds and humans, where “it has bird flu from North America, swine flu from Europe, and swine flu from Asia. Humans do not have natural immunity to this strain”, (qualityhealth.com) some have suggested that this has been a “human engineered pathogen” meant as a biological weapon for biowarfare.

Many possible scenarios have been floated; it could have been an experiment gone awry or accidentally leaked into the population, or a deliberate covert test by some government entities for political purposes (deflect attention from the economic crisis?), or from a rogue insider who could have stolen from the government’s biolabs in order to advance an unspecified cause, similar to the Anthrax tainted letters mailed to the US Congress from which an employee, Bruce Edwards Irvins, a microbiologist, vaccinologist, and senior biodefense researcher of the US Army Medical Research Institute of Infectious Diseases (USAMRIID) in Fort Detrick, Maryland was held responsible (Global Research).

Or it could also have possibly been perpetrated by vested interests aimed at creating at an atmosphere of pandemic for economic or financial interests, or worst, perhaps in cahoots with the government.

And this isn’t new, according to qualityhealth.com, ``in 2006 investigators discovered that a major pharmaceutical company knowingly dumped HIV-tainted drugs for hemophiliacs onto European, Asian and Latin American markets.”

Anyway, such plot may run across the similar lines as with the movie Mission Impossible II.

Stock Market and Pandemics-Then and Today

True enough a full blown pandemic at the scale of the Spanish Flu will result to economic mayhem.

Economic activities in heavily impacted areas will suffer most while deglobalization in trade, tourism, migration or investments will probably worsen, given today’s recessionary environment.

But we learned that such devastating pandemic don’t necessarily translate to stock market collapses.

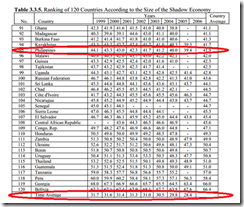

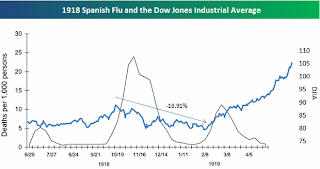

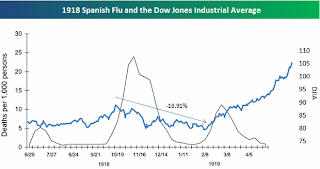

Since the public has been obsessed with the Spanish Flu, Bespoke Invest gives a good account of how the US stock market reacted to its outbreak in 1918 see figure 2.

Figure 2: Bespoke Invest: Spanish Flu and Dow Jones Industrials

Figure 2: Bespoke Invest: Spanish Flu and Dow Jones Industrials

We quote Bespoke Invest, ``There were three pandemic waves from 1918-1919, with the worst coming from October to December of 1918. While fear of the flu was widespread, the market really didn't react too badly. Following the first pandemic wave, the market sold off a little bit, but then rallied during the summer months before topping out prior to the second wave. The market trended downward during the worst wave of the flu outbreak, but it only went down 10.9% from peak to trough, and then it rallied significantly during and following the third wave. World War I was also coming to an end in late 1918, so the end of the pandemic and the war probably contributed to the subsequent rally in stocks.”

Let me emphasize that despite the huge losses of human lives and massive economic disruption brought about by both World War I and the Spanish Flu, the Dow Jones lost only 11% from the Spanish Flu plague.

However, it won’t do justice to say that the Spanish Flu was the biggest driver of the markets then, as with the culmination of World War I, because there could be other possible unseen variables which may have contributed to the market action, although we also don’t deny that both factors could have provided for significant inputs.

Unfortunately, history, for the mainstream, is always seen from a single observation that had taken place.

But the point is; initial fear from a shock usually dominates the markets, which is then followed by gradual recognition of the problem and its eventual resolution-the recovery.

Today we seem to share a similar impact but at very compressed or short circuited cycle see figure 3.

Figure 3: Stockcharts.com: Swine Flu: Aborted Black Swan

Figure 3: Stockcharts.com: Swine Flu: Aborted Black Swan

Major global stock market benchmarks as seen by the Dow Jones World (DJW), Emerging Markets (EEM), Europe’s Stoxx 50 (STOX 50) and Asia (DJP1) seems to have simultaneously suffered a “blip” (circle) from the pseudo Swine Flu scare which eventually was more than recovered by most global bourses at the close of the week’s session.

Another way to look at it is that collective governments push to inflation has far larger influence than fear generated from the pandemic menace. Besides, by stoking fear governments implied action is to spur inflation by spending more for protection.

In addition, today’s environment is very much different than that of 1918. The world has been more globalized or integrated. Moreover, technological diffusion has been increasingly deepening this integration whereas monetary standards that drive the risk taking environment have been distinct.

As to how this has altered the pandemic risk environment we suggest some based on news accounts;

-the lessons from SARs and the Avian Flu have fostered stronger collaborations among global governments in dealing with potential pandemic risk by agreeing on “a sensible set of protocols for pandemic preparedness, sharing of genetic samples and other ways of coordinating a global response.” (Economist)

-technology impelled advancement in incubation and manufacturing techniques. Again from the Economist, ``It is possible, though, that new technology will come to the rescue. Gregory Poland of the Mayo Clinic, an American hospital chain, argues that thanks to SARS, bird flu and fears about bioterrorism, work has been undertaken on a range of new incubation and manufacturing techniques.

``One example is DNA-based vaccines, which are made in cell cultures, not incubated slowly in eggs. Vocal, an American biotechnology firm, has shown in early tests that its DNA vaccine for potentially pandemic influenzas, such as strains of H5N1, is safe and effective, and it claims the technology can be scaled up easily.”

-technology enabled information sharing via the cyberspace which has cultivated mass collaboration, networking and openness in the medical and science industry that may lead to faster vaccine discovery and production.

From the Reuters, ``Scientists in Mexico, the United States and New Zealand have since posted full sequences of its DNA taken from 34 virus samples in an online public library. And the list is growing.

``What this means is scientists everywhere can now use these descriptions to create new tools to fight the virus, such as rapid diagnostic test kits and vaccines.

``While the fastest conventional tests take up to two days, scientists are designing highly specific ones that can pick up this swine H1N1 flu virus in four to six hours…

``The genetic sequences have just been made available ... many laboratories are rushing to find the best test, it will take one to two weeks (for us to design one), but we need a lot of validation, we need hundreds of specimen to do that," said microbiologist Yuen Kwok-yung at the University of Hong Kong.”

Conclusion

So while the risks of pandemics will always be present in a rapidly evolving global environment, whether due to natural or lab-induced viral mutations, the world’s capability to address such risks based on global collaboration and technological adoption appears to be more enhanced than the yesteryears. Hence, conditions from the Spanish Flu, the SARS, Avian Flu or the pseudo Swine Flu have been different.

But this doesn’t guarantee immunity from other prospective tail risks.

Nevertheless, the recent Swine Flu which had the elements of surprise and rationalizations from the public almost seemed to have morphed into a full blown Black Swan risk except that the degree of impact was apparently muted in terms of collateral damage or as viewed from the financial market’s response.

The only profound impact from the present episode based on last week’s drama had been government sensationalism and its attendant overreaching political response which had been greatly amplified or inflamed by media.

Fear, as we know it, is a conventional tool of control used by governments to subvert civil liberties by coercion. Thus, considering today’s socialization trends of important segments of the global economy, it can’t be dismissed that this could be another part of the tactical socialization thrust to impose more government on our lives.

Nonetheless, the market reflecting on its inherent discounting mechanism has shattered this prism of state instituted fear and by virtue of reflexivity behavior has equally diminished its justification. The likelihood is that the threats of the pseudo pandemic will evaporate overtime.

Over the interim, global stock markets and the commodity markets will most likely continue to manifest on the concerted inflationary measures adapted by global governments.