This is the problem with taxation. Major public corporations can move their tax domicile offshore to avoid taxes legally. The average person cannot move his labor offshore to lower his taxes, which is a disadvantage we must address with tax reform. VAT is far worse than a sales tax. Every person in the chain must collect and file paperwork. It must require three times the number of people to administer such a system compared to a point of sales tax collection.But that issue aside, there should be ABSOLUTELY NO income taxes whatsoever. That not only eliminates government having to track everything, but it also eliminates the whole movement of capital solely for tax purposes. This is unfair, for the average person cannot send their labor offshore to avoid taxation without moving. Even then, that would only get an American the first $100,000 tax-free; after that, it would be subjected to U.S. income tax.The Founding Fathers of the United States revolted over taxation without representation. We are back to that now, for we are being taxed to pay interest to service debts from the last two generations. We had no right to vote on that spending, which took place before we were born. This is not a democratic process.There should be ONLY a retail sales tax EXCLUSIVELY for local government. Federal government should be prohibited from imposing ANY tax and it should be barred from borrowing money. The local tax will naturally be checked by the free market, for if they keep raising taxes, businesses will move to the next town and there goes the jobs. This will help to restrain government on a more practical level.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Thursday, October 22, 2015

Quote of the Day: Slash Taxes to Restrain Government

Thursday, February 26, 2015

For Many Greeks, Taxes have been seen as Theft…

Of all the challenges Greece has faced in recent years, prodding its citizens to pay their taxes has been one of the most difficult.At the end of 2014, Greeks owed their government about €76 billion ($86 billion) in unpaid taxes accrued over decades, though mostly since 2009. The government says most of that has been lost to insolvency and only €9 billion can be recovered.Billions more in taxes are owed on never-reported revenue from Greece’s vast underground economy, which was estimated before the crisis to equal more than a quarter of the country’s gross domestic product.The International Monetary Fund and Greece’s other creditors have argued for years that the country’s debt crisis could be largely resolved if the government just cracked down on tax evasion. Tax debts in Greece equal about 90% of annual tax revenue, the highest shortfall among industrialized nations, according to the Organization for Economic Cooperation and Development.Greece’s new government, scrambling to secure more short-term funding, agreed on Tuesday to make tax collection a top priority on a long list of measures. Yet previous governments have made similar promises, only to fall short.Tax rates in Greece are broadly in line with those elsewhere in Europe. But Greeks have a widespread aversion to paying what they owe the state, an attitude often blamed on cultural and historical forces.During the country’s centuries long occupation by the Ottomans, avoiding taxes was a sign of patriotism. Today, that distrust is focused on the government, which many Greeks see as corrupt, inefficient and unreliable.“Greeks consider taxes as theft,” said Aristides Hatzis, an associate professor of law and economics at the University of Athens. “Normally taxes are considered the price you have to pay for a just state, but this is not accepted by the Greek mentality.”

The reason isn’t just political, but economic. The country’s depression has already pushed many small businesses to the brink of collapse. Forcing them to pay more in taxes would put even more out of business—and more Greeks out of work.“The Greek economy would collapse if the government were to force these people to pay taxes,” one senior government official said.

Take, for example, the institution of taxation, which statists have claimed is in some sense really “voluntary.” Anyone who truly believes in the “voluntary” nature of taxation is invited to refuse to pay taxes and to see what then happens to him. If we analyze taxation, we find that, among all the persons and institutions in society, only the government acquires its revenues through coercive violence. Everyone else in society acquires income either through voluntary gift (lodge, charitable society, chess club) or through the sale of goods or services voluntarily purchased by consumers. If anyone but the government proceeded to “tax,” this would clearly be considered coercion and thinly disguised banditry. Yet the mystical trappings of “sovereignty” have so veiled the process that only libertarians are prepared to call taxation what it is: legalized and organized theft on a grand scale.

The first lesson of economics is scarcity: There is never enough of anything to satisfy all those who want it. The first lesson of politics is to disregard the first lesson of economics.

Thursday, September 25, 2014

Simon Black: Some of the dumbest taxes throughout history

In the days of ancient Rome, it was tradition for the upper class to liberate their slaves after a set number of years.The Roman government, however, looked at this as an opportunity to generate revenue, and they taxed the newly freed slave on his freedom.I can’t imagine anything more repulsive than paying tax on freedom. But they gave it a pretty good try–In 1696, the English government under William III (William of Orange) passed a new law requiring subjects to pay a tax based on the number of windows in their homes.Not willing to pay such a ridiculous tax on something as basic as sunlight, many Englishmen simply reduced the number of windows in their homes.There was less light… and less ventilation… which ultimately became a public health problem.To follow that up, England introduced a tax on candles in 1789. Making your own candles was outlawed unless you first obtained a license and paid tax on your own homemade candles.As you could imagine, most people just did without.Coupled with the window tax, this was a very dark time for England. And it took until the mid 19th century for the government to realize its stupidity and repeal the taxes.But if that sounds excessive, consider the Johnstown Flood Tax.In 1936, the town of Johnstown, Pennsylvania was devastated by nasty flood, and in its efforts to ‘do something,’ the state assembly imposed an emergency, ‘temporary’ tax of 10% on all alcohol sold in the state.This ‘temporary’ tax remained in place for nearly three decades, at which point it was raised to 15% in 1963, and again to 18% in 1968.The ‘temporary’ tax still exists today, proving once again that there’s nothing more permanent than a temporary government measure.

Saturday, August 23, 2014

Quote of the Day: The police don’t work for us

The police don’t work for us, if by “us” we mean you, me, and at least 95 percent of the rest of the population. On the contrary: we work for them, literally; we work to earn money and acquire wealth that they take forcibly from us for their own support, either by taxation or by outright confiscation (civil forfeiture). The cops don’t work for us; they never worked for us. They work now, as they have always worked, for the government, which is to say, for the small part of the population that has any nonnegligible control over the government at any level — federal, state, or local. Certainly no more than 5 percent of the population has any such control. More likely the percentage is 1 percent or less of the population.

Wednesday, October 02, 2013

Shinzo Abe Increases Sales Tax as Japan’s Industrial Output Slumps

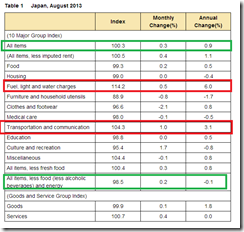

In a sign that Prime Minister Shinzo Abe’s aggressive economic stimulus has only produced mixed results at best so far, industrial production dropped a larger-than-expected 0.7% in August from the previous month, according to the Ministry of Economy, Trade and Industry on Monday. Economists were looking for a more modest 0.4% fall…By category, output for consumer durables, such as passenger cars, refrigerators, TV sets and notebook computers, fell an average 2.5%.“Recent data show that a larger portion of household income needs to be spent to pay for basic necessities, leaving much less money for discretionary items,” said the ministry official briefing reporters.The prices of daily necessities, such as energy, have been on the rise recently as businesses started passing on the higher costs of imported goods to consumers amid a sharply weaker yen.Output was also down in the important export sector. Production of capital goods, which are largely for export, fell 1.7%, despite the recent weakness of the yen, which should make Japanese exports more competitive. “Exporters are using a weaker yen to rebuild profit margins rather than cutting prices and boosting exports. We are waiting for them to start cutting prices and boosting output,” the briefer said.The only good news for Mr. Abe in the figures was itself something of a mixed blessing. There was strong demand for cement and other bridge construction materials, on demand from expressway operators. Output was up 1.3% for the fabricated metals category, and up 1.0% for the ceramics and stone category

The main unemployment reading came in at a surprisingly high 4.1% in August, the government said Tuesday, the first rise in six months and an apparent dark cloud on a day of otherwise bright economic data. It was also higher than the 3.8% predicted by economists surveyed by The Wall Street Journal.

However, logic tell us that when businesses dithers on investing, so will this be reflected on employment....unless the government goes on a hiring binge.

Prime Minister Shinzo Abe took a long-awaited decision to raise Japan's sales tax by 3 percentage points, placing the need to cut the nation's towering debt ahead of any risk to recent economic growth, as he now focuses on crafting a broader package of measures to address both problems further.Mr. Abe on Tuesday promised more stimulus to cushion the impact of the sales-tax rise on the economy, stressing the nation needs both fiscal consolidation and economic growth to end 15 years of debilitating deflation.The stimulus measures total around ¥5 trillion ($51 billion), including cash-handouts to low-income families, Mr. Abe said. On top of that, there will be tax breaks valued at ¥1 trillion for companies making capital investments and wage increases.

The reason for these outcomes is that people respond predictably to incentives – in this case, to incentives created by higher taxes. Obliged, for example, by such a tax to pay a higher price for apples, consumers will not buy as many apples as they bought before the tax hike. Similarly, obliged – because of the tax – to accept a lower take-home price on each pound of apples sold, sellers aren’t willing to sell as many pounds of apples with the tax as they were before the tax was raised.

Raising sales tax or whatever taxes will only accelerate the downside spiral of Japan’s economy. Japanese investors have already been reluctant to invest, how would higher taxes encourage investments and more economic output?

Tuesday, June 11, 2013

Quote of the Day: Only the IRS (taxman)

Only the IRS can attach 100% of a tax debtor's wages and/or property.Only the IRS can invade the privacy of a citizen without court process of any kind.Only the IRS can seize property without a court order.Only the IRS can force a citizen to try his case in a special court governed by the IRS.Only the IRS can compel the production of documents, records, and other materials without a court case being in existence.Only the IRS can with impunity publish the details of a citizens debt.Only the IRS can legally, without a court order, subject citizens to electronic surveillance.Only the IRS can force waiver of statute of limitations and other citizen's rights through the threat of Arbitrary assesment.Only the IRS uses extralegal coercion. Threats to witnesses to examine their taxes regularly produces whatever evidence the IRS dictates.Only the IRS is free to violate a written agreement with a citizen.Only the IRS uses reprisals against citizen and public officials alike.Only the IRS can take property on the basis of conjecture.Only the IRS is free to maintain lists of citizen guilty of no crime for the purpose of harassing and monitoring them.Only the IRS envelops all citizens.Only the IRS publicly admits that it's purpose is to instill fear in the citizenry as a technique of performing it's function.

The confiscatory power of the taxman applies everywhere.

Saturday, May 25, 2013

The Economist: Why Americans Love the IRS

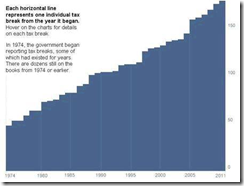

WHEN Barack Obama fired the acting head of the Internal Revenue Service (IRS) earlier this month, he doubtless hoped to quell the hullabaloo about its seemingly partial treatment of applications for tax-exempt status from conservative groups. The IRS selected for extra scrutiny groups whose names included conservative buzzwords, such as “tea party”, “9/12” and “patriot”. Republicans accuse the taxmen of persecuting anti-tax groups. The IRS’s defenders insist that a few low-level functionaries simply made a clumsy attempt at an administrative short-cut. But the main reason why Americans dislike dealing with the IRS is not, however, the bureaucrats’ fault. Congress keeps making the tax code more complex. It is now 4m words long, and has been changed over 4,000 times since 2001. Americans spend 6.1 billion hours a year complying with it—enough work to keep over 3m people employed full-time without producing anything. Nearly 90% of filers pay for help with their returns. The cost of all this is equivalent to 15% of the tax raised says the Taxpayer Advocate, an ombudsman. Yet change may be a long time coming. Politicians usually balk at taking on the myriad vested interests which all ferociously defend their favourite tax breaks, says Bill Gale of the Brookings Institution, a think-tank. For that reason, he argues, “tax reform is always the bridesmaid and never the bride”

- It has thieving employees.

- It has incompetent employees.

- It has thuggish employees.

- It has brainless employees.

- It has protectionist employees.

- It has wasteful employees.

- And it has victimizing employees.

The power to tax is the power to destroy.

Monday, April 15, 2013

Murray Rothbard on Tax Day

April 15, that dread Income Tax day, is around again, and gives us a chance to ruminate on the nature of taxes and of the government itself.The first great lesson to learn about taxation is that taxation is simply robbery. No more and no less. For what is "robbery"? Robbery is the taking of a man’s property by the use of violence or the threat thereof, and therefore without the victim’s consent. And yet what else is taxation?Those who claim that taxation is, in some mystical sense, really "voluntary" should then have no qualms about getting rid of that vital feature of the law which says that failure to pay one’s taxes is criminal and subject to appropriate penalty. But does anyone seriously believe that if the payment of taxation were really made voluntary, say in the sense of contributing to the American Cancer Society, that any appreciable revenue would find itself into the coffers of government? Then why don’t we try it as an experiment for a few years, or a few decades, and find out?But if taxation is robbery, then it follows as the night the day that those people who engage in, and live off, robbery are a gang of thieves. Hence the government is a group of thieves, and deserves, morally, aesthetically, and philosophically, to be treated exactly as a group of less socially respectable ruffians would be treated.This issue of The Libertarian is dedicated to that growing legion of Americans who are engaging in various forms of that one weapon, that one act of the public which our rulers fear the most: tax rebellion, the cutting off the funds by which the host public is sapped to maintain the parasitic ruling classes. Here is a burning issue which could appeal to everyone, young and old, poor and wealthy, "working class" and middle class, regardless of race, color, or creed. Here is an issue which everyone understands, only too well. Taxation.

Saturday, April 13, 2013

Quote of the Day: Income Tax: Its unpopularity will grow with its life

POPULARITY OF THE INCOME TAX.The Chamber of Commerce has directed an inquiry into the administrative feature of the income tax after a debate in which it was said that the tax would not affect 99 per cent. of the citizenship. It was suggested that this deprived the bill of general interest, and that it was sure to be unpopular on account of the narrowness of its application.[...]The case is worse than this. It will tax the honest and allow the dishonest to escape. The administrative features which the Chamber is to investigate are so complicated that those who understand them will make their taxes light at the cost of those less well informed about the law. The income tax law may be considered good nevertheless by some, but even those who approve the tax despite its faults cannot contend that the same sums could not have been raised more certainly, more equitably, and with less trouble to both payers and collectors by a stamp tax.The experience with the tariff shows how hard it is to reduce or remove a tax once laid. It always seems better and easier to devise ways to spend the money than to repeal the tax. This fact will be better appreciated as the years pass, and particularly when the time shall come when this extraordinary tax–as it ought to be–shall be needed for an emergency. Then it will appear that this resource has been utilized and that the tax must be doubled instead of imposed initially. The tax was most popular before it was laid. Its unpopularity will grow with its life.

Friday, April 12, 2013

Chart of the Day: How Americans Feel About Paying Income Taxes

As April 15 approaches, a majority of Americans (56%) have a negative reaction to doing their income taxes, with 26% saying they hate doing them. However, about a third (34%) say they either like (29%) or love (5%) doing their taxes.

I don't like the income tax. Every time we talk about these taxes we get around to the idea of 'from each according to his capacity and to each according to his needs'. That's socialism. It's written into the Communist Manifesto. Maybe we ought to see that every person who gets a tax return receives a copy of the Communist Manifesto with it so he can see what's happening to him.

Tuesday, February 12, 2013

Curse of the Laffer Curve: Why Manny Pacquiao Prefers His Next Fight Outside the US

Manny Pacquiao's chief adviser insisted Monday that the Filipino superstar's preference is for his next bout – a fifth fight against Juan Manuel Marquez – to take place away from Las Vegas, with the off-shore Chinese gambling resort of Macau emerging as the "favorite."Michael Koncz told Yahoo! Sports that the 39.6 percent tax rate Pacquiao would face if he were to fight again in the U.S. makes a fall bout in Las Vegas "a no go."Promoter Bob Arum is hopeful of arranging a fifth match between Pacquiao and Marquez in the fall, potentially on Sept. 14. Arum's preference is for the fight to be at the MGM Grand in Las Vegas, which is his company's home base.But Arum and Koncz say Pacquiao is balking at the additional money he'd lose to the government if the fight were held in Las Vegas. Arum said Pacquiao would not have to pay taxes if the fight takes place in casinos in either Singapore or Macau."Manny can go back to Las Vegas and make $25 million, but how much of it will he end up with – $15 million?" Arum said. "If he goes to Macau, perhaps his purse will only be $20 million, but he will get to keep it all, so he will be better off."

Thursday, November 29, 2012

Statist Tax Fantasies Unmasked: Two-Third of UK Millionaires Vanish

Once again, reality has made an abject spectacle of popular statist’s fantasies about “class warfare” or “soak the rich” tax policies where tax rates are seen as having linear effects on tax revenues.

The axiom “if you tax something, you get less of it” seems to have been proven valid anew.

In Britain, 2/3 of millionaires swiftly vanished (or in just a year!) in the face of 50% tax rate increase.

Almost two-thirds of the country’s million-pound earners disappeared from Britain after the introduction of the 50p top rate of tax, figures have disclosed.

In the 2009-10 tax year, more than 16,000 people declared an annual income of more than £1 million to HM Revenue and Customs.

This number fell to just 6,000 after Gordon Brown introduced the new 50p top rate of income tax shortly before the last general election.The figures have been seized upon by the Conservatives to claim that increasing the highest rate of tax actually led to a loss in revenues for the Government.It is believed that rich Britons moved abroad or took steps to avoid paying the new levy by reducing their taxable incomes…Far from raising funds, it actually cost the UK £7 billion in lost tax revenue.

Monday, November 19, 2012

Into the Eyes of the Gorgon: IMF’s Endorsement of the Philippines

Humanitarian arguments are always used to justify government mandates related to the economy, monetary policy, foreign policy, and personal liberty. This is on purpose to make it more difficult to challenge. But, initiating violence for humanitarian reasons is still violence. Good intentions are no excuse and are just as harmful as when people use force with bad intentions. The results are always negative.

Thursday, August 18, 2011

How Tax Policies Affect Investments

From Steven M. Davidoff at the New York Times (bold emphasis mine)

Apple has a cash problem. It’s not just that Apple has too much cash, $76 billion as of June 30. It’s rather that the bulk of that pile, estimated at $41 billion, is held abroad.

Apple does not want to bring it back to the United States for several reasons, primarily because of the tax consequences, but also because of its own growing foreign presence. Apple is not alone — this problem is an increasing one in corporate America. And the answer may not be more big, all-cash acquisitions, like Google’s $12.5 billion offer for Motorola Mobility.

In an analyst report in May, JPMorgan Chase estimated that 519 American multinational corporations had $1.375 trillion outside the United States. The problem is particularly acute among technology companies, which historically tend to hoard cash because of the cyclical nature of their business.

A recent Moody’s report noted that Microsoft held $42 billion abroad, or more than 80 percent of its cash. Cisco Systems has $38.8 billion, or almost 90 percent of its cash. Google — at least before Monday’s deal — had nearly $40 billion in cash, with more than 43 percent of it held abroad

Tax policy is driving much of this trend. For multinational corporations, cash earned abroad cannot easily be remitted to the United States. If it is paid back to the United States, it is subject to a dividend tax that can rise to as much as 35 percent. Companies are loath to pay this tax because while they can offset it with taxes paid abroad, the companies still end up paying a relatively high tax rate.

Again, tax policies are seen as one of the major forces in prompting for distortions of investment decisions. This greatly affects the allocations of resources or the economy.

In the case above, money which should have been used for more investments or for paying off shareholders in the US has been hoarded overseas.

On the other hand, globalization is an issue too. (bold emphasis mine)

Yet it is not just a tax issue. Many United States companies want to keep cash abroad to focus on high-growth regions for investments and acquisitions.

A recent Standard & Poor’s study found that 50 percent of sales by companies in the S.&P. 500-stock index are outside the United States. Interestingly, the report also found that these companies paid more in foreign taxes than to the United States government. For Apple, 60 percent of its sales are abroad, and like these other companies, its foreign sales are expected to only go higher.

So, for those who expect that a change in tax policy would prompt Apple and other companies to put their cash piles to use in the United States, don’t be so sure. Even if there were no dividend tax, a large portion of this cash would stay abroad as these companies focus on higher growth overseas for investment.

Of course there many other domestic factors involved too which contributes to investment or resource allocation dynamics, this comes in the substance of monetary policies, regulatory climate, growing heft of political distribution of resources (seen via deficits) and etc.

The above evinces that world is complex, with variable interloping factors at work and simply can’t be ‘modeled’.

Point is: political actions affect the economy, most of them negative.

As a caveat, this not only applies to the US but everywhere including the Philippines. Thus, we have to be vigilant with politicos calling for more regulations or taxes or other interventionist measures.