…and thus massive tax avoidance and the huge informal economy.

The Wall Street Journal explains: (bold mine)

Of all the challenges Greece has faced in recent years, prodding its citizens to pay their taxes has been one of the most difficult.

At the end of 2014, Greeks owed their government about €76 billion ($86 billion) in unpaid taxes accrued over decades, though mostly since 2009. The government says most of that has been lost to insolvency and only €9 billion can be recovered.

Billions more in taxes are owed on never-reported revenue from Greece’s vast underground economy, which was estimated before the crisis to equal more than a quarter of the country’s gross domestic product.

The International Monetary Fund and Greece’s other creditors have argued for years that the country’s debt crisis could be largely resolved if the government just cracked down on tax evasion. Tax debts in Greece equal about 90% of annual tax revenue, the highest shortfall among industrialized nations, according to the Organization for Economic Cooperation and Development.

Greece’s new government, scrambling to secure more short-term funding, agreed on Tuesday to make tax collection a top priority on a long list of measures. Yet previous governments have made similar promises, only to fall short.

Tax rates in Greece are broadly in line with those elsewhere in Europe. But Greeks have a widespread aversion to paying what they owe the state, an attitude often blamed on cultural and historical forces.

During the country’s centuries long occupation by the Ottomans, avoiding taxes was a sign of patriotism. Today, that distrust is focused on the government, which many Greeks see as corrupt, inefficient and unreliable.

“Greeks consider taxes as theft,” said Aristides Hatzis, an associate professor of law and economics at the University of Athens. “Normally taxes are considered the price you have to pay for a just state, but this is not accepted by the Greek mentality.”

The above article manifests of rich political economic insights.

One, the typical approach by political agents in addressing economic disorders has mainly been to focus on superficiality or the immediacy—in particular “could be largely resolved if the government just cracked down on tax evasion”.

Political solutions that fail to understand the incentives guiding the average Greeks has been the reason why tax policies continue to falter.

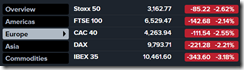

Two, just to be sure that non-payment of taxes hasn’t been the reason why Greeks have been struggling…

As one can see in the above, the controversial “austerity” exists only in the mindset of the statist occult. The Greek government continues to spend at a rate more than the statistical economy and thus the ballooning debt which consequently translates to heightened economic burden on the Greek society.

Three, Greece’s (and the Eurozone’s) boom bust cycle have only exposed on the chink in the armor of Greece’s big government.

The dilemma facing Greece today exemplifies the paragon of radical changes in fiscal conditions when the bust phase of the boom cycle emerges.

This can be seen from the article: (bold mine)

The reason isn’t just political, but economic. The country’s depression has already pushed many small businesses to the brink of collapse. Forcing them to pay more in taxes would put even more out of business—and more Greeks out of work.

“The Greek economy would collapse if the government were to force these people to pay taxes,” one senior government official said.

So the above data shows why many Greeks see their government as “corrupt, inefficient and unreliable” for them to “consider taxes as theft”

It doesn’t require a libertarian of the Rothbardian persuasion to see how taxes are theft.

All it takes is for one to see with two eyes the real nature of how governments operates. This has been best described in the article as “corrupt, inefficient and unreliable”.

Take, for example, the institution of taxation, which statists have claimed is in some sense really “voluntary.” Anyone who truly believes in the “voluntary” nature of taxation is invited to refuse to pay taxes and to see what then happens to him. If we analyze taxation, we find that, among all the persons and institutions in society, only the government acquires its revenues through coercive violence. Everyone else in society acquires income either through voluntary gift (lodge, charitable society, chess club) or through the sale of goods or services voluntarily purchased by consumers. If anyone but the government proceeded to “tax,” this would clearly be considered coercion and thinly disguised banditry. Yet the mystical trappings of “sovereignty” have so veiled the process that only libertarians are prepared to call taxation what it is: legalized and organized theft on a grand scale.

For the Greeks, the logical solution would seem as to dramatically pare down government spending and taxes or real austerity. These should ease tax burdens on the entrepreneurs or the productive agents that would allow them to channel resources to productive means. This should entail real economic growth.

In doing so, the informal economy should flourish and grow for the latter to integrate with the formal economy voluntarily.

But it’s not just taxes, there is the exigency to incentivize entrepreneurial activities via liberalization from excessive politicization of economic activities, specifically regulations, mandates, controls and all other politically erected anti-competition obstacles favoring entrenched interests.

Importantly, the Greeks should embrace sound money by preventing the government from tinkering with interest rates, and the currency via the central bank and allow real competition in both the currency and the banking system.

Of course, given the size of the debt burden, debt that had benefited politicians and cronies of the past, such debt has to be defaulted on. Creditors who took the risk in financing the previous government excesses should pay their dues.

But of course, parasites would not want to end their privileges so this will hardly be the route taken.

Politicians will continue to sell free lunch politics in order to get elected and stay the course.

But since Greek’s problem has been about economics, the solution will always be about economics. Yet political solutions that fails to address the real (and not statistical) economic issues will have inevitable economic consequences.

I am reminded by this gem from author and professor Thomas Sowell:

The first lesson of economics is scarcity: There is never enough of anything to satisfy all those who want it. The first lesson of politics is to disregard the first lesson of economics.

Yet my ideal solution is the Rothbard solution; end organized theft.