Prohibition in terms of market transactions or via short selling fails.

From Wall Street Journal’s Real Time Economics Blog

New research supports the notion that instituting temporary short-selling bans during stock market downturns doesn’t do any good.

This might not seem like shocking news to those who believe you have to let market forces play themselves out, even in volatile times, and to those who distinguish between the impact of short selling, the borrowing of shares with the expectation of buying them later at a lower price, and flat-out selling.

Nonetheless, the regulatory bans go on. Just last month, temporary short-selling bans of sorts were put in place in Italy and Spain.

In this latest look at short-selling bans, Federal Reserve Bank of New York economist Hamid Mehran teamed with Robert Battalio and Paul Schultz, both of whom are finance professors at the University of Notre Dame.

Harkening back to the dark days of the financial crisis in the U.S., they studied the two-week ban on short selling of financial stocks that was imposed in 2008 in a futile attempt to stop the massive sector bleeding.

“The 2008 ban on short sales failed to slow the decline in the price of financial stocks; in fact, prices fell markedly…and stabilized once it [the ban] was lifted,” the economists wrote in the latest issue of the New York Fed’s Current Issues in Economics and Finance.

And lest you think this tilting at windmills by banning short sales is a harmless sort of regulatory exercise by perplexed officials in the midst of a crisis, the trio begs to differ.

“If anything, the bans seem to have unwanted effects of raising trading costs, lowering market liquidity and preventing short sellers from rooting out cases of fraud and earnings manipulation,” the economists write.

The real goal of the trading bans is to establish price controls.

Regulators pass the proverbial hot potato (shift the blame) of policy failures or has been scapegoating the markets.

Regulators want to project of “do something” actions, no matter how these would only make the matters worse through “unwanted effects”.

“The regulatory bans go on”, is an example where in the world of politics, doing the same thing over and over and expecting different results has been the convention. That’s because political agents don’t get sanctioned for their decision mistakes which has widespread longer term implications.

On the contrary, regulators use market’s volatility as excuses to curb on people’s property rights, and importantly, to expand their control over the marketplace. This is why the idea that crises may have been premeditated cannot be discounted because political agents see these as “opportunity to do things you think you could not do before”

Political authorities also fantasize about using edicts to banish the natural laws of demand and supply to oblivion. Theories, history and or experience seem to have no relevance in the world of politics.

Importantly the tactical “do something” operations have barely been about the “public goods” but about saving their skins and of their cronies.

Of course, price controls can also come in indirect forms like central bank’s zero bound rates, quantitative easing and the operation twist (manipulation of the yield curve) and or other forms of interventionism (e.g. changing of the rules).

Even the classic Pavlovian mind conditioning communication strategies (signaling channel) employed by political institutions have had distortive effects on the marketplace.

The popular attribution of today’s recovery in the US equity markets looks like a nice example.

From Bloomberg,

The Standard & Poor’s 500 Index (SPX) rose for a sixth day, the longest rally since 2010, amid speculation the Federal Reserve will pursue more stimulus measures. Treasuries rose and commodities fell as Chinese and French data added to signs the global economy is slowing…

“The weaker the data, the higher the likelihood of stimulus from central banks,” said Alan Gayle, a senior strategist at RidgeWorth Capital Management in Richmond, Virginia, which oversees about $47 billion. “The weakness in China is likely to prompt a move there,” he said. “While the Fed has been clear it will do anything to support growth, some people tend to think it’s inevitable.”…

“Whilst markets have recently been rallying on bad news -- in the expectation that it will lead to further stimulus from the central banks -- the deterioration in the fundamentals is becoming a bit harder to ignore,” said Jonathan Sudaria, a trader at Capital Spreads in London. “Traders may be disappointed if their thirst for stimulus isn’t satiated as soon as they expect.”

See bad news is once again good news.

The public’s mindset has continually been impressed upon or manipulated to expect of salvation from political actions.

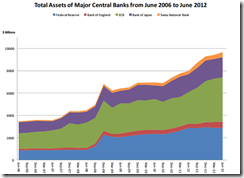

Central banks of major economies have more than doubled the size of their balance sheets (chart from cumber.com) yet the global debt crisis has not only lingered but has been worsening.

Interventionism through price controls have basically reduced the financial markets into a grand casino, which has tilted to benefit cronies while at the same time has vastly reduced or narrowed people's time orientation.

All these merely validates what the great professor Ludwig von Mises warned, (italics original)

Economics does not say that isolated government interference with the prices of only one commodity or a few commodities is unfair, bad, or unfeasible. It says that such interference produces results contrary to its purpose, that it makes conditions worse, not better, from the point of view of the government and those backing its interference.

At the end of the day, economic reality will expose on the quackery of interventionism.