If you look at the typical stock on the New York Stock Exchange, its high will be, perhaps, for the last 12 months will be 150 percent of its low so they’re bobbing all over the place. All you have to do is sit there and wait until something is really attractive that you understand. And you can forget about everything else. That is a wonderful game to play in. There’s almost nothing where the game is stacked in your favor like the stock market. What happens is people start listening to everybody talk on television or whatever it may be or read the paper, and they take what is a fundamental advantage and turn it into a disadvantage. There’s no easier game than stocks. You have to be sure you don’t play it too often. You need the discipline to say no. –Warren Buffett

In this issue:

Rationalizing the Record Phisix 7,700

-False Investment Flows and Blind Confidence

-Marking the Close as Confidence Booster?

-Record Phisix 7,700 Equals Overtrading!

-Phisix 7,700: BSP Chief Express Concerns Over External Forces

-China’s PBOC and Danish Central Bank Panics!

Rationalizing the Record Phisix 7,700

This week Phisix broke through the 7,700 levels. Record after record.

False Investment Flows and Blind Confidence?

The PSE’s press release on the ninth record streak (bold mine): Year-to-date, the PSEi has broken through new record highs 9 times. It has also posted a 6.9 percent gain since the start of the year. "We are pleased with the market's movement in the last five weeks. The record numbers registered by the index highlights the level of investor confidence in our market. We hope that our initiatives to raise awareness about investing at the PSE to fund managers here and abroad will see more investment inflows into our market," PSE President and CEO Hans B. Sicat said.

First of all, the fact is that there is NO such thing as investment flows. For every buyer of a security there is a matching seller, the matching is expressed via peso (buy) per peso (sell) trades. What changes is the composition of the stock market ownership. For instance if foreign funds are buying, then the sellers would be local entities and vice versa.

This is not meant to nitpick on the PSE but to show how real exchanges work.

What record prices have been indicating instead has been the degree of aggressiveness of buyers to bid up prices relative to sellers.

It’s not about flows.

Over the past 5 weeks, there has been an “improvement” in foreign participation, but this has mostly been from special block sales of FGEN (January 21), JGS (January 22) and GTCAP (February 3)

Yet the PSE has not clearly stated why record after record stock levels should highlight as foreign investment attraction.

The year to date performance accompanied by the PER ratio of the entire Phisix basket demonstrates how the Phisix has reached the current levels. The arrangement in the chart has been ranked according to market weightings as of February 6 close.

The green rounded rectangle on the left reveals of the quality and quantitative aspects of 7,700

There have been 12 stocks (with 6% and above) that have buoyed the Phisix while the rest has been underperforming the bellwether. Remember the Phisix has posted 6.9% returns year to date.

The above implies that the pump and push has not only been in the most popular trades but on the biggest market caps! In short, these stocks have been mostly responsible for Phisix 7,700. The concentration of pump on the biggest market caps, which has been a continuation of the trend from 2014, has led to nose bleed PERs (see right boxes).

Basically the top 15 issues have PERs at celestial levels, ranging from 18 to 50!

Let me cite an example. Consumer stock URC declared that for 2014, profit growth came at 15.2%. In 2014, URC’s stock price generated 73.3%. This means that markets paid a shocking premium of 4.82% for every 1% earnings growth. Such pump has led to URC’s PER to 40+ (45.87 as of February 5 based on PSE data)!

As a side note, the reason I chose URC is because I just came across their first quarter performance (last quarter 2014) 12.6% performance.

Let us do some back of the envelop calculations and grant the past will project into the future where 2014 will repeat in toto this year.

At the end of year, URC’s stock price will be at 340 (196 * 73.3%) while EPS will jump from (Thursday’s close 204/ PER 45.87) 4.45 to 5.13 or 15.2% earnings growth. This implies PE at 66.28!

Such level of valuations will become an attraction for foreign investors? Perhaps for Wall Street high rollers or momentum traders financed by carry trades, but not serious fund managers.

As shown in the above, all these have nothing to do G-R-O-W-T-H, but about speculative orgies founded on the catchphrase of G-R-O-W-T-H. Domestic punters have become like Pavlov’s dogs, conditioned to pump and push at every citation of G-R-O-W-T-H. But instead of dogs drooling in the sound of ringing of the bells, when media, politicians and experts utter G-R-O-W-T-H, punters go into a blind hysteric bidding spree! Risk and valuations have been thrown under the bus!

Yet how much of these bidding orgies have been financed by debt?

Marking the Close as Confidence Booster?

Third, it doesn’t seem that 7,700 Phisix has been all about the “level of investor confidence”.

Record 7,700 Phisix as noted above has been about concentration of pumps on popular and biggest market cap stocks. The Phisix year to date performance can be squared with the “marking the close” activities or attempts at managing the index.

“Marking the close” is supposed to be a violation of the Philippine Securities Code but yet such practice has become rampant.

Record 7,700 Phisix has now been seen as a ONE way street. Corrections are simply not tolerated. Last week’s major marking the close has been used during corrections.

Last Monday February 2 (see left pane), the Phisix fell by as much 99 points or by 1.3% but the index managers ensured that losses will have to be mitigated. So the last minute pump resulted to the Phisix down by only 59.2 point or by .77% or .53% of the losses evaporated from a manic buying spree at the last minute. (charts above from technistock and colfinancial)

The same has been applied to the session on February 5, where marking the close reduced losses to just .54% (see middle). A minor “marking the close” became part of 7,700.

The serial “Marking the closes” has created a false perception of level of confidence. What it has really done has been to contribute to the ludicrous mangling of the pricing discovery system that has spawned outrageous mispricing of domestic securities.

As I have been saying the higher the Phisix, the greater the risks. This means that instead of sound market dynamics, Phisix 7,700 signifies a symptom of progressing financial instability.

Yet I am not sure that foreigners will see attractiveness in markets that have been gamed.

Record Phisix 7,700 Equals Overtrading!

The “I belong to the mainstream” crowd claims that the peso volume has been “heavy”. The claim is meant to justify the pump by appealing to the majority. Yet “heavy” really depends on data or reference points of comparison.

On an absolute level this has hardly been true or PSE data suggests the contrary. While peso volume (averaged on a daily basis) has been rising, peso volume remains off from the May 2013 levels. So far, current levels have reached the taper tantrum selloff volumes. And a significant chunk of current volume has been helped by huge special block sales.

What has really been a standout has been the number of daily trades. Trade churning has bloated by an astounding 50% from 2013 highs. The swelling of trade churning perhaps has likely been less about the growth of retail trades but more about, as I suspect, the managing of the index.

Historically, overtrading has been symptoms of a market top or market inflection points. Historian Charles Kindleberger sees overtrading as a symptom of a progressing “mania” where he noted[1],

The result of the continuation of the process is what Adam Smith and his contemporaries called ‘overtrading.’ This term is less than precise and includes speculation about increases in the prices of assets or commodities, an overestimate of prospective returns, or ‘excessive leverage.’ Speculation involves buying commodities for the capital gain from anticipated increases in their prices rather than for their use. Similarly speculation involves buying securities for resale rather than for investment income attached to these commodities. The euphoria leads to an increase in the optimism about the rate of economic growth and about the rate of increase in corporate profits and affects firms engaged in production and distribution

And how asset inflation tends to camouflage imbalances…

Even though bank loans are increasing, the leverage—the ratio of debt to capital or to equity—of many of their borrowers may decline because the increase in the prices of the real estate or securities means that the net worth of the borrowers may be increasing at a rapid rate.

And how asset inflation incites a bandwagon effect applied to social status and the credit system…

A follow-the-leader process develops as firms and households see that others are profiting from speculative purchases. ‘There is nothing as disturbing to one’s well-being and judgment as to see a friend get rich.’ Unless it is to see a nonfriend get rich. Similarly banks may increase their loans to various groups of borrowers because they are reluctant to lose market share to other lenders which are increasing their loans at a more rapid rate. More and more firms and households that previously had been aloof from these speculative ventures begin to participate in the scramble for high rates of return. Making money never seemed easier. Speculation for capital gains leads away from normal, rational behavior to what has been described as a ‘mania’ or a ‘bubble.’

Phisix 7,700: BSP Chief Express Concerns Over External Forces

And yet while officials of the PSE have been patting their backs on the record after record levels, the Bangko Sentral ng Pilipinas honcho, Amando Tetangco Jr., continues to raise the prospects of risks from the external environment.

In a recent speech he said[2]: (bold mine)

The steep decline in oil prices has complicated the market appreciation of the outlook for monetary policy in 2015. Some analysts say, the Fed would be hard-pressed to hike rates by any significant measure (as in June this year) if oil prices continue to drop because inflation in the US will be soft.

In addition, low oil prices increase the risk of deflation in the EU and Japan, raising the likelihood that more easing measures would be put in place.

In other words, ladies and gentlemen, whereas markets used to have the confidence in the trend of monetary policies, this new uncertainty from oil price movements is now seen to heighten volatility in financial markets by unsettling investor risk appetite and unseating inflation expectations.

Further, a continued decline in oil price could also change the balance of global growth prospects. There will be winners and losers if low oil prices persist. While the decline in oil is a dampener to inflation and could raise purchasing power for oil importers, it could also result in a loss of revenues for oil producers and lead to weak aggregate demand. With overall global growth still fragile, the significant drop and the weak prospects in oil prices have gotten more analysts discussing the risk of deflation in recent weeks.

Nonetheless while the BSP chief sanitizes and downplays the risks to the Philippine economy due to the alleged “strong environment”, he sees a potential reemergence of market volatility.

Also the BSP chief seems to signal the possibility for them to lower interest rates.

Our initial projections using lower oil prices show that inflation would still be within the target range for 2015, which is now lower at 2-4 percent compared to the previous year’s target of 3-5 percent. Indications of easing inflationary pressures owing in part to the decline in international oil prices as well as signs of robust domestic economic growth allow the BSP some room to maintain its current monetary policy stance. Even so, we do not pre-commit to a set course of action. As I have always said, the stance of monetary policy will remain data-dependent.

One thing we keep in the back of our minds is that prices can reverse and often very quickly. If you have been in this market long enough – as I believe some in the audience have – you know that markets tend to get ahead of themselves. So, we continue to watch developments in the oil market carefully and how these affect inflation and growth dynamics, to see if there is any need to make adjustments in the stance of policy.

Remember what I wrote last week on the 4Q 6.9% GDP[3]?

if the BSP, suddenly cuts rate for one reason or another, say below inflation target, or external based alibis, then this proves that 4Q 6.9% GDP 2014 has all been a Potemkin Village.

In the same speech, the BSP chief denies the risks of deflation, supposedly due to the “ramping up of government spending”, yet this outlook overlooks Japan’s experience.

Going back to the BSP, statistics isn’t economics.

Debt represents the intertemporal distribution of spending activities. Borrowing money to spend simply means the frontloading of spending. The cost of debt financed spending today is spending in the future. Debt will have to be repaid at the expense of future spending. Of course there are productive and non-productive debts. But policies of financial repression via zero bound rates tend to promote non-productive ‘speculative’ and consumption debts.

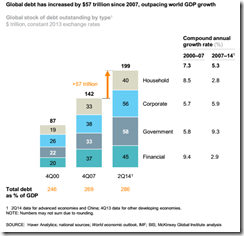

The BSP fails to understand that having too much debt, which constrains balance sheets, will undermine real economic growth. The transmission mechanism from balance sheet problems will affect prices and subsequently the economic coordination process. The mainstream sees this as lack of aggregate demand when they are in fact balance sheet imbalances. Debt is not a free lunch, not even government debt. McKinsey Quarterly estimates that global debt grew by $57 trillion since 2007 where debt to GDP has reached 286%! Why do you think the negative interest rate policies adapted by many central banks?

And one only needs to look at the growth conditions of loan and statistical GDP to see how disproportionalities have been mounting in the Philippines.

From end of the year 2008 to end of the year 2014, or in 6 years, production or supply side banking loans has inflated 125% (CAGR 14.51%) whereas gdp (at current prices) has only amassed 70.2% (CAGR 9.3%). The bigger buildup of debt relative to gdp means slower real economic growth ahead. This is regardless whether debt based spending has been due to government or private sector. The government can pump statistical economy but not the real economy.

And since consumer spending accounts for about 70% of the expenditure GDP, HFCE has grown by about a similar rate to statistical gdp of 73.43% (CAGR 9.61%) over the same period.

Yet from the same timeframe, supply side GDP has swelled by outlandish rates as follows: construction 135.1%, trade 105.71%, finance 142.94% and real estate 273.38%. This has been financed mostly by bank credit growth with incredulous growth rates for the said industries at 200.85%, 176.92%, 194.68% and 178.77% respectively.

So even if Real Estate GDP has ballooned more than the rate of credit growth, the huge disparity between consumer growth and industry growth means severe accumulation of excess capacity in motion. And this will become evident when credit growth slows.

Oh by the way, as possible symptom of excess capacity combined with a slump in retail 4Q GDP—have you seen the dramatic surge in store vacancies in many of the major malls at the metropolis? The vacancy rates of a high end mall have recently soared and appear to have already exceeded 10% of their total retail space! 6.9% 4Q GDP in the face of soaring vacancies in shopping malls! Duh!

And I’m not sure if the BSP chief has merely been just parroting what the central bank of central banks, the Bank for International Settlement has been saying, or if he is just underwriting an escape clause to exonerate (him and the BSP) when risks transforms into reality, nevertheless, the concerns of the BSP chief (or by the BSP) seem at material odds with the heady outlook of PSE officials.

Statistics isn’t economics. What seems as may not be what’s real. Notice how “strong” statistics have often been masked by an inflation boom as indicated by historian Charles Kindleberger? Warren Buffett’s alternative axiom has been: Only when the tide goes out do you discover whose swimming naked.

Two recent examples of “swimming naked” exposed.

Remember Brazilian tycoon Eike Batista whose worth was once quoted as anywhere from $25 to $35 billion in 2012 and was named as the 8th richest man in the world by Forbes Magazine in 2011? Well he is now a “negative” billionaire. Now, Mr. Batista reportedly owes $1.2 billion. Thus authorities have been seizing his assets, which includes white Lamborghini and $32,490 in cash, computers, and watches — as well as any real estate, six other cars, his boat and his airplanes, according to the Businessinsider.com

Worst, compounding his financial woes, the erstwhile mining and oil tycoon has now been faced with charges of insider trading and stock market manipulation.

Mr. Batista’s financial crash took only less than two years to happen. Who would have thought that billions worth of wealth (paper) can vaporize so fast? And yet when revulsion and discredit sets in, the blaming part begins.

At the turn of the business cycle, I believe that there will many miniature Eike Batistas, here and abroad.

For the domestic setting, I predict that “when the tide goes out”, the serial “marking the closes” will likely become a future legal issue.

Next, another account of what seems as, may not really be: Brazil’s state firm Petrobas

From Bloomberg: (bold mine) When Brazil emerged from the global financial crisis as one of the world’s great rising powers, Petrobras was the symbol of that growing economic might. The state-run oil giant was embarking on a $220 billion investment plan to develop the largest offshore crude discovery in the Western hemisphere since 1976 and was, in the words of then-President Luiz Inacio Lula da Silva, the face of “the new Brazil.” Today the company epitomizes everything that is wrong with a Brazilian economy that has been sputtering for the better part of four years: It’s mired in a corruption scandal that cost the CEO her job this week; it has failed to meet growth targets year after year; and it’s saddling investors with spectacular losses. Once worth $310 billion at its peak in 2008, a valuation that made it the world’s fifth-largest company, Petroleo Brasileiro SA is today worth just $48 billion.

The face of “New Brazil”—another slogan highlighting euphoric “this time is different” demolished!

Rings a bell?

China’s PBOC and Danish Central Bank Panics!

Two central banks seem as in a panic mode.

China’s PBoC seems to have panicked too. The PBoC suddenly cut reserve requirements in the wake of a slower than expected bank lending, an unexpected contraction of factory activities and a slowdown in the service industry.

Government economists as quoted by media say that the cut, which injects $96 billion to the economy, has been aimed at curtailing the yuan’s slide as a result of accelerating capital outflows. Capital flight hit a record $91.2 billion in the fourth quarter according to a report from Bloomberg. The said report also noted that PBoC injected $31 billion over the past three weeks.

If cutting reserves had been intended to defend the yuan then this will hardly work.

First some data. Chinese credit to GDP has been reported by McKinsey Quarterly at 282% as of 2Q 2014. Corporate debt has been estimated by McKinsey at 125% of GDP the highest level in the world! In addition, Chinese debt has been concentrated to the real estate sector, along with a massive growth in Shadow Banking and in local government debt.

Given the sustained downturn in housing prices, which continues to put pressure on the economy and on credit conditions, capital flight would be a natural response for investors and currency holders anticipating a far worse outcome.

Cutting reserve requirements would free up resources for banks to lend but this will hardly attract credit activities if the balance sheets of Chinese residents and companies have been hocked to the eyeballs with debt.

Given the above statistics, what happens instead will be more access to credit in order to pay off existing loans (debt rollover) rather than for investment. The end result of the ‘extend and pretend’ strategy will be to increase debt levels as GDP cascades.

The Chinese government seems in a bind to desperately defer the inevitable distressing adjustments.

Interestingly, Hong Kong’s tourism seems as suffering from a facelift. Chinese tourists have become dominated by ‘Day Trippers’ which now accounts for a record 60%of Chinese tourists. According to a report from Bloomberg, Day-trippers spent an average of around HK$2,700 ($350) per capita in Hong Kong in 2013, compared with about HK$8,800 by overnight tourists, according to government data.

Wow, that’s a 69% collapse in spending budget by tourists! And this has resulted to a slump in luxury brand sales but a surge in medicine and cosmetic sales! What the report suggests has been that China’s economic slowdown and the government’s anti-corruption drive (political persecution) have changed the character of Hong Kong based Chinese tourists.

Well if the trend continues, then this will radically shake up the Hong Kong economy!

Now the report also says that the wealthy have been shifting visits to Japan, South Korea and Taiwan, but they didn’t give the numbers.

Anyway, Hong Kong’s dilemma seems to have been shared by the miseries of Macau as expressed by the crashing share prices and earnings of casinos.

And applied to the Philippines, if those wealthy Chinese high rollers don’t come streaming into the Philippine casinos soon, excess capacity will lead to losses and subsequently credit troubles.

The effects of the looming shortage of Chinese gamblers will not be isolated to casinos but will extend to creditors, suppliers and workers of the industry. The chain reaction will spread to the economy. If you add other risks areas like shopping mall or other property related industries the direct and indirect effects will be magnified.

In addition, a radical makeover of the Hong Kong’s economy may jeopardize domestic OFWs working there.

But then, according to the record Phisix 7,700 risks and valuations have all been expunged out of existence! Stocks and economic conditions are a one way street! So for the mainstream, we should not only buy, buy, buy!...but also borrow borrow borrow to buy, buy, buy! Money’s free!

.png)

.png)

.png)

.bmp)