Every crisis requires a trigger, a causa proxima or events or “incidences which saps the confidence in the system” as historian Charles Kindleberger wrote in his classic book; Manias, panics and Crashes.

Could high yield debt from US Shale industry be the modern day equivalent of the US housing subprime mortgages of 2007-8?

I explored on this last weekend: Yet it’s a wonder how the oil and energy industry (also the material industry) will respond to still collapsing prices or how they will affect economic activities. So far, new oil and energy permits have plummeted 40% (!), and so with Shale permits down 15% for across all major oil formations last month. Shale oil at the Bakken oil field at North Dakota has seen prices even plunge to $49.69 last November 28 (!), according to a Bloomberg report. That’s way (24%) below the $65.63 WTIC oil quoted last Friday. Yet from 2007-2012, about 16% of job growth came from the oil gas industry which outperformed the other sectors, according to the EIA. If the oil industry retrenches this will impact jobs as well as other sectors attached to them.

Analyst David Stockman splendidly expounds on this (excerpted from Mr. Stockman’s Contra Corner)

The US housing mania… [bold original, italics mine]

At bottom, the leading edge of the housing mania was the implicit price of land. That’s what always get bid up to irrational heights when the central bank fiddles with free market pricing of capital and debt.

Even as land prices were being driven to irrational heights you didn’t need to spend night and day in arcane data dumps to document it. All you had to do was look at the stock price of the homebuilders.

As I documented in The Great Deformation, the combined market cap of the big six national homebuilders including DH Horton, Lennar, Hovnanian, Pulte, Toll Brothers and KBH Homes soared from $6.5 billion in 2000 to $65 billion by the 2005-2006 peak. Yet you only needed peruse the financial statements and disclosures of any of these high-flyers and one thing was screamingly evident. They weren’t homebuilders at all; they were land banks that did not own a single hammer or saw or employ a single carpenter or electrician.

Stated differently, the homebuilders’ soaring profits were nothing more than speculative gain on their land banks—gains driven by the cheap mortgage mania that had been unleashed by Greenspan when he slashed the so-called policy rate from 6% to 1% in hardly 30 months of foot-to-the-floor monetary acceleration between 2001 and 2004.

Indeed, that cluelessness amounted to willful negligence. DH Horton was the monster of the homebuilder midway—–a giant bucket shop that never built a single home, but did accumulate land and sell finished turnkey units by the tens of thousands each period. Did it not therefore occur to the monetary politburo that DH Horton had possibly not really generated a 11X gain in sustainable economic profits in hardly 5 years?

The Shale oil mania…

So now we come to the current screaming evidence of bubble finance—–the fact that upwards of $500 billion of junk bonds ($200B) and leveraged loans ($300 B) have surged into the US energy sector over the past decades—–and much of it into the shale oil and gas patch.

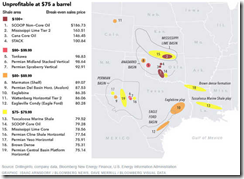

Folks, you don’t have to know whether the breakeven for wells drilled in the Eagleville Condy portion of the great Eagle Ford shale play is $80.28 per barrel, as one recent analysis documents, or $55 if you don’t count all the so-called “sunk costs” such as acreage leases and oilfield infrastructure. The point is, an honest free market would have never delivered up even $50 billion of leveraged capital—let alone $500 billion— at less than 400bps over risk-free treasuries to wildly speculative ventures like shale oil extraction.

The fact is, few North American shale oil fields make money below $55/barrel WTI on a full cycle basis (lease cost, taxes, overhead, transport, lifting cost etc.). As shown below, that actually amounts to up to $10 less on a netback to the wellhead basis—–the calculation that drives return on drillings costs.

In short, as the oil market price takes its next leg down into the $50s/bbl. bracket, much of the fracking patch will become a losing proposition. Moreover, given the faltering state of the global economy and the huge overhang of excess supply, it is likely that the current crude oil crash will be more like 1986, which was long-lasting, than 2008-09, which was artificially resuscitated by the raging money printers at the world’s central banks.

So why is there a shale patch depression in store? Because there is literally a no more toxic combination than the high fixed costs of fracked oil wells, which produce 90% of their lifetime output in less than two years, and the massive range of short-run uncertainty that applies to the selling price of the world’s most important commodity.

Surely, it doesn’t need restating, but here is the price path for crude oil over the past 100 months. That is to say, it went from $40 per barrel to $150, back to $40, up to $115 and now back to barely $60 in what is an exceedingly short time horizon.

Obviously, what we have here is another massive deformation of capital markets and the related flow of economic activity. The so-called “shale miracle” was not made in Houston with some technology help from Silicon Valley. The technology of horizontal drilling and well fracking with chemicals has been around for decades. What changed were the economics, and those were made in the Eccles Building with some help from Wall Street.

As to the latter, was it not made clear by Wall Street’s mortgage CDO meth labs last time that when the central bank engages in deep and sustained financial repression that it produces a stampede for “yield” which is not warranted by any sensible relationship between risk and return? It should not have been even possible to sell a shale junk bond or CLO that was based on assets with an effective two year life, a revenue stream subject to wild commodity price swings and one thing even more unaccountable. Namely, that the enterprise viability of virtually every shale junk issuer has always been dependent upon an endless rise in the junk bond issuance cycle.

Stated differently, oil and gas shale E&P operators are drastic capital consumption machines. Due to the lightening fast decline rates of shale wells, firms must access more and more capital just to run in place. If they don’t flush money down the well bore, they die along with all the “sunk” capital that was previously put in place.

In the case of shale oil, for example, it is estimated that were drilling to stop for just one month, production in the Eagle Ford, Bakken and one or two other major provinces would drop by 250,000 barrels per day. After four months, the drop would be 1 million bbl./day and after a one-year, nearly half the current four million barrels of shale oil production would disappear.

That’s why all of a sudden there is so much strum and drang about “breakeven” pricing. Obviously, new drilling is not going to go to zero under any imaginable price scenario, but for all practical purposes the shale revolution could shut down just as fast as did the housing boom in 2006-2007. In effect, the shale financing boom presumed that both the junk bond cycle and the oil price cycle had been eliminated.

Needless to say, they have not. So the impending “correction” may well be as swift and violent as was the housing bust.

The coming shale oil bust…

Indeed, in the short-run the shale crash could be worse. The fantastic, debt-fueled drilling spree of the past 5-years is now sunk and will produce rising levels of production for a few quarters until rig activity is sharply curtailed and some of the better capitalized operators stop drilling in order to avoid lease expiration writeoffs.

So as the WTI market price is driven toward $50/ barrel, recall that the netback to the producer is significantly less. In the case of the biggest shale oil province, the Bakken, the netback to the well-head is upwards of $11 below WTI. Accordingly, cash flow will plunge and that source of drilling funds will evaporate with it.

But the big down-leg is coming in the junk market. This time around, Wall Street has been even more reckless in its underwriting than it was with toxic securitized mortgages. Barely six months ago it sold $900 million of junk bonds for CCC rated Rice Energy. The latter operates in the Marcellus gas shale trend but that makes the story even more preposterous.

These bonds were sold at barely 400 bp over the 10-years treasury, and the issue was 4X oversubscribed. That is, there was upwards of $4 billion of demand for the bottom of the barrel securities of a shale speculator that had generated the following results during its 15 quarters as a public filer with the SEC. To wit, it had produced $100 million of cumulative operating cash flow versus $1.2 billion of CapEx. In short, if the junk bond market dies, Rice Energy is a goner soon thereafter.

The transmission mechanism: From debt to the economy…

As the global boom cools, oil demand withers, the junk market craters, and the shale patch tumbles into depression, someone might actually note the chart below.

Its been another central bank parlor trick. The job count in the 45 non-shale states last Friday was 400,000 lower than it was at the end of 2007. That’s right, not one new job—even part-time or in the HES complex—- for the last seven years.

All the new jobs have been in the 5 shale states. That is, they were manufactured by the Fed’s tidal wave of cheap capital and the central bank fueled global recovery which created the illusion that $100 oil was here to stay.

But it isn’t and neither is the shale boom, the shale jobs or the shale investment spike, which counts for a good share of overall CapEx growth since the crisis.

Yes, indeed. The monetary politburo did it again.