Unpopular ideas can be silenced, and inconvenient facts kept dark, without the need for any official ban. Anyone who has lived long in a foreign country will know of instances of sensational items of news — things which on their own merits would get the big headlines-being kept right out of the British press, not because the Government intervened but because of a general tacit agreement that ‘it wouldn’t do’ to mention that particular fact. So far as the daily newspapers go, this is easy to understand. The British press is extremely centralised, and most of it is owned by wealthy men who have every motive to be dishonest on certain important topics. But the same kind of veiled censorship also operates in books and periodicals, as well as in plays, films and radio. At any given moment there is an orthodoxy, a body of ideas which it is assumed that all right-thinking people will accept without question. It is not exactly forbidden to say this, that or the other, but it is ‘not done’ to say it, just as in mid-Victorian times it was ‘not done’ to mention trousers in the presence of a lady. Anyone who challenges the prevailing orthodoxy finds himself silenced with surprising effectiveness. A genuinely unfashionable opinion is almost never given a fair hearing, either in the popular press or in the highbrow periodicals.-George Orwell

In this issue

Phisix 7,800: The Earnings Growth Mirage

-Introduction: PSE Facts

-The Interaction between EPS Growth and Interest Rates

-Phisix Returns Careens Away From Reality

-Sectoral EPS Growth Have ALL Been Declining!

-PSE 30 EPS Growth Rates Reveals that This Time Has NOT Been Different!

-DEBT EQUITY RATIO as Barrier to Earnings Growth

-The Four Horsemen to Earnings Growth

-The Fourth Horseman: Soaring US Dollar

Phisix 7,800: The Earnings Growth Mirage

Introduction: PSE Facts

The markets have been absurdly consumed by misperceptions.

As I wrote last January[1],

When stock market returns outpace earnings or book value growth, the result is price multiple expansions. This is why current levels of PE ratios are at 30, 40, 50 and PBVs are at 4,5,6,7. This is NOT about G-R-O-W-T-H but about high roller gambling which relies on the greater fool theory or of fools buying overpriced securities in the hope to pass on to an even greater fool at even higher prices—all in the name of G-R-O-W-T-H!

In the following outlook, I use PSE’s empirical findings to establish the facts and trends of the earnings growth.

The same data provides us plenteous insights that would not only would layout the growth blueprint of the future, but importantly either affirm or falsify popularly embraced wisdom such as current record highs has been about G-R-O-W-T-H as seen by media’s growth projections for 2014 and for 2015, and the perception that structural changes in the economy would tolerate current valuations to significantly depart from historical norms or “this time is different”.

I culled and assembled from the PSE’s monthly January reports the financial valuation numbers for the month of December from 2007-2014 as shown from the table above.

This would be the basis for my appraisal of the validity of popular perception.

The numbers have mostly been based on third quarter financial statements submitted by the listed firms to the PSE. The end of the year results will be out in the PSE’s April report. I include below the PERs of each members of the Phisix composite.

The table above consists of Price Earnings Ratio (PER) in yellow background, Book Value (BV), Debt Equity Ratio (DER) in green backdrop, annual returns of the benchmark in orange and the ratio of returns relative to earnings growth in blue.

From the numbers indicated, I derived the implied EPS and Book Value in order to generate their annual growth rates.

In this report we will not deal with the Book Value.

Some notes:

-While the starting point of the data set will be from the year end of 2007, annual changes will begin from 2008. In the occasion where I use compounded growth rates, since the above numbers are based from end of the year, the period used will be from the succeeding year until the last reference point. For instance, 2008-2014 will cover 6 years.

-The Phisix composite index has had marginal changes in the firms included in the basket over the stated period. Considering liquidity (market volume)—aside from free market float—as the two principal criteria for the inclusion of a firm to the elite basket, the composite indices of the major benchmark and of its subset, the different sectors, have represented the most popular issues. The PSE has announced changes in the composition of the sectoral indices to be implemented next week, March 16, 2015

Since 2008 serves as the nadir of the current cycle, the beginning reference point should magnify whatever numbers seen from the above. For instance, the Phisix posted a CAGR of 25.25% from yearend 2008 to yearend 2014. Over the same period, the equivalent EPS CAGR has been at 8.62%. This means that the market paid an astounding 193% premium on earnings growth each year! This explains how multiple expansions have been the key driver of the Phisix which is why the current levels of valuation.

Of course the numbers above shouldn’t be seen only from a single standpoint for the simple reason that annual changes and sectoral performances have been variable

So here I will adhere to the BSP chief’s gem of an advice to journalists as noted last week[2].

Economic numbers rarely tell the complete story when taken at face value. Therefore, a responsible journalist who seeks to offer readers a fuller appreciation of the information will examine the figures within a broader context or against an array of other relevant indicators.

The Interaction between EPS Growth and Interest Rates

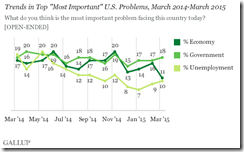

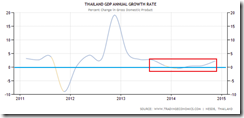

Despite headline hallelujahs, the chart of the reported nominal EPS growth can easily be seen as refuting the vaunted G-R-O-W-T-H story. Since 2010, EPS growth rates have steadily been in a decline!

Here is a terse chronicle or historical narrative of the EPS’s history.

The Great Financial Recession took the sails out of the Phisix. While EPS growth remained positive its growth rate fell by 20.9% in 2008.

Then, the Philippine economy had a relatively clean balance sheet with debts at vastly lower levels than today. I’m not referring to Debt Equity Ratio but to aggregate debt.

Yet let me interject a short history on Philippine interest rates

Remember that the BSP embarked on a target to radically alter the structure of the Philippine economy through the monetary tool of ‘boosting aggregate domestic demand’ by easing through a series of rate cuts. The BSP slashed interest rates from 6% to 4% in 2009.

In 2Q 2011, the BSP partly reversed course to raise rates by 50 basis points. So from 4% official rates went by 50 bps to 4.5%

However the BSP had an immediate change of mind and engaged into another succession rate slashing activities from yearend 2011 until the 3Q of 2012. In total, the BSP trimmed 100 basis points to from 4.5% to 3.5%.

The BSP maintained rates from 2012 until rampaging food prices and financial assets forced them to raise official policy rates twice during the third quarter of last year from 3.5% to 4%.

Now the link between interest rates and earnings growth

The frantic reduction of interest rates in 2009 apparently juiced up the Phisix earnings growth for two years. The rate of earnings growth registered a spectacular 26% and 28% in 2009 and 2010 respectively.

Apparently, the overheating of earning growth rates was unsustainable, so this came under pressure. The reversion to the mean flexed its muscle and evidently forced the downside adjustments.

So coming from two successive years of earnings growth juggernaut, earnings growth rate recoiled and stumbled by 20.24% at almost at the same scale with 2008. This coincided with the BSP’s rate increases in 2011.

So earnings growth backpedaled when the BSP slightly tightened.

However, the sharp downturn EPS growth had been reversed in conjunction with the BSP’s second wave of rate cuts from late 2011 to 3Q 2012.

In 2012, earnings growth jumped by another splendid 16.46%. But this has been far less than the pace of 2009 and 2010.

This shows that when the BSP eased earnings growth temporarily revived.

But from then, things turned downhill, EPS grew by less than half of 2012 levels or at 7.94% in 2013 and worst, in 2014 EPS growth eked out only 1.63%!

So despite the sustained easing mode by the BSP, the EPS growth momentum subsided. The downshift has been exacerbated by the BSP’s minor tightening in 2014.

In effect, the positive impact from interest rate manipulations has been subject to the law of diminishing returns. The tightening only compounded on this dynamic.

As a side note, again full year EPS will be revealed in the April report.

Yet to see a rebound in line with popular expectations means 4Q earnings will need to explode.

For instance media says that 2014 earnings will come at 6%. Given the 1.63% EPS growth for three quarters, for this to happen, 4Q earnings will have to explode by 19%!!!

This only demonstrates how EPS growth projections have been immensely overrated.

Phisix Returns Careens Away From Reality

Now that we have dealt with earnings and interest rates, we look at returns.

With the exception of 2014, in the past, and in general, Phisix returns largely tracked the earnings performance (see left window). In short, markets behaved relatively rationally.

The Phisix zoomed for two years, 63% in 2009 and 38% in 2010, in response to the fabulous rebound of earnings coming off the 2008 meltdown based on the relatively sound fundamentals and the BSP easing as noted above.

When earnings growth retrenched in 2011 in conjunction with the BSP hikes, the Phisix posted only a meager 4% return for the year. So the market’s priced in the EPS growth downturn.

Ironically, while the 2011 earnings growth performance was almost equal to 2008, with both scoring a significant retrenchment in growth rates, returns revealed immense disparity; the Phisix lost 48% in 2008 as against a positive 4% for 2011.

Aside from liquidity issues, the difference reflects on the prevailing sentiment where the former had been bogged down from an overseas contagion while the latter manifested a residual carryover of optimism from the previous 2009-2010 run. But still returns then somewhat reflected on earning activities.

The BSP easing in 2012 which again had been accompanied by an EPS growth rebound had the Phisix posting a magnificent 33% return.

The bullish sentiment spilled over to the first semester of 2013 but was truncated by the 2013 taper tantrum selloff.

Yet that 2H selloff brought Phisix valuations closer to earth. Valuations was high but not at outlandish levels.

In 2014, the wheels just came off.

The suppressed bullish sentiment from 2012 to 1H 2013 came back with fury.

In 2014, while EPS grew by a speck (1.63%), returns simply went off tangent and blasted away.

In the past, the return-EPS growth ratio, which reflected on market’s assessment on earnings or the premium or discount paid relative to earnings, hardly went beyond 100%.

That all changed in 2014 where the market paid an astronomical 13x earnings growth (left window)!!!

This is the reason why the Phisix PER in 2014 soared by 20% to 21.84 from 18.08 in 2013.

Yet the current departure between returns and valuation levels has been representative of this massive and still ballooning divergence!

Sectoral EPS Growth Have ALL Been Declining!

It would not do justice for us to look at the Phisix without examining the sectoral performance in the lens of earnings growth.

As of Friday’s close, the holding sector dominates the share of the Phisix with a 35.41% weighting. This is followed by Industrial 17.09%, property 16.04%, services 15.28% financial 14.88% and mining 1.3%.

So given that the holding and industrial sector plays the lead role as the major influencers of the Phisix, I show them first.

Yet for both sectors, EPS growth apparently has moved in tandem with that of the major benchmark. They have all underperformed expectations.

The highly popular property sector, which has been sizzling hot today and outperforming the rest and responsible for much of the lifting of the Phisix to current record highs produced a surprisingly negative (-7.4%) growth in 2014!

The finance sector departed from the majors, posting two hefty EPS growth in 2012 and 2013, but this seem to have faded as the sector’s growth rate shrank to a paltry .8% in 2014.

On the other hand, the service sector, which has underperformed in 2010-2012, rebounded strongly in 2013 but gains appear to have been short-lived as EPS growth posted only 6.33% last year.

Yet the service sector had been the best performer in 2014 in terms of EPS growth compared to the rest including the most popular and most influential peers.

Unfortunately the service sector had been the industry laggard in terms of returns, posting only 13.94% in 2014 when the Phisix celebrated a 22.76% buoyed mostly by the biggest three sectors. So the present state of the domestic markets have been rewarding hype and at the same time punishing the real performer.

In essence, December 2014 underperformance had been broad based as it reflected on ALL the aforementioned major industries.

What media sells as G-R-O-W-T-H has really been a deviation from reality.

PSE 30 EPS Growth Rates Reveals that This Time Has NOT Been Different!

The above represents the Phisix composite members and their respective EPS from 2007 to 2014.

Given the facts that PSE’s EPS growth has been declining for the last three years, and where the decline has been a phenomenon that has been shared by three major sectors and lastly that in 2014 all sectors had performed dismally, my focus will be on the EPS growth performance during this period 2012-2014.

From the above table we get the following insights:

-There have been only SIX issues which has consistently delivered positive growth (blue font), specifically ALI, URC, JFC, ICT, RLC and MER. (blue font)

-There have been only FIVE issues, namely ALI, URC, JFC, ICT, and MER, which delivered an average growth of above 10% over the past 3 years!

-Last year, 10 issues, only one-third of the basket, posted growth of 10% see above yellow background.

-Last year, 13 issues posted NEGATIVE growth (red font).

-Most earnings of the individual firms has been very volatile.

So there had been more negative growth than positive growth with over 10%.

All these converge to demonstrate why the PSE’s EPS grew by only 1.63% in 2014.

Which is the exception and which is the rule, outperformance or mediocre earnings activities?

So has there been a structural change in earnings growth to warrant an alleged “new normal” of high valuations?

Based on the above, the answer is a clear NO.

Understanding Media’s Bubble Promotion; IIF’s Warning on Buyside Institutions

The above only reveals what media and their quoted experts/industry leaders see as “new normal” has actually been about survivorship bias—the error of focusing on the winners or the visible—in combination with fallacy of composition—what is true in some parts is interpreted as true for the whole.

Yet we have to understand where such sentiment has been coming from.

When buyside institutions declare “new normal” of high valuations they are most likely speaking to reflect on how they manage their balance sheets. I previously noted that this signifies a yellow flag. Remember[3]?

Finally I’d be very concern about buyside institutions selling products heavily based on expectations of beyond historical average returns. Those rose colored glasses may be a function of endowment effect—people value things highly because they own them. If the portfolio of buyside institutions have been largely weighted on such expectations, and if such expectations fail to take hold, a big mismatch in the asset—liability could result to a lot of pain for the clients.

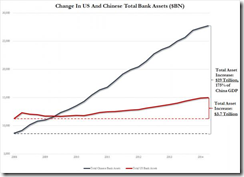

The Institute of International Finance a consortium or a global association or trade group of financial institutions with nearly 500 members in 70 countries last week warned about the imbalances being accumulated on the asset-liability matching process by the buyside (pensions and insurance) industry due to the low interest rate regime.

Given that low interest rates have effectively increased present value of liabilities of such institutions, low interest rates effectively spurred the widening of the gap between assets and liabilities. Add to these, regulatory obstacles have created “shortages” of assets that these institutions are allowed to hold on their balance sheets.

So with the gulf between liabilities and assets, buyside institutions have resorted to incredibly perilous risk taking of using “various investment strategies” intended to “produce equity-like returns”.

On a global scale, such institutions aside from boosting holdings of corporate and foreign bonds to record levels, have vastly increased exposure on ETFs, high dividend yield stocks, unhedged usually options based directional trading and carry trades. Worst, in order to produce equity like returns, buyside have used enormous amounts of leverage to finance such transactions.

Addressing buyside institutions, here is the IIF’s latest warning[4]: (bold mine)

The longer lower rates and net negative supply of high-quality government bonds persists, the more pressure is put on long-term investors to take on extra risk to generate income. These risk exposures would accumulate and render the financial system more fragile as long players become more exposed to a severe market downturn. Moreover, the phenomenon of “savings glut” chasing bonds could become endogenous, keeping bond yields low and requiring additional savings—thus prolonging the low-rate environment and supporting the buildup of even more risks.

The IIF essentially validates my yellow flag warning.

So when representatives of domestic buyside institutions declare that “this time is different”, they are symptomatic of the dynamic of “more pressure is put on long-term investors to take on extra risk to generate income”. It’s also sign of endowment bias—ascribing more value to things merely because they own them. In particular, they are expressive of their investment strategies employed for balance sheet matching.

In short, those “pressures” to match asset and liabilities have now been conveyed as rationalizing high valuations with “this time is different”.

Yellow flag it is for many financial institutions.

Of course the incentives of the buyside and the sellside industries are different.

Yet it would be really off the mark for anyone to say that media’s sentiment represents the consensus.

Take the stock market. There are only about 600,000+ invested directly at stocks or .6% of the population. If we add those indirect investors via mutual fund, UITFs and others this would be about 2-3% of the population. Even if we give the benefit of the doubt that there have been 5% directly or indirectly exposed to the market this means 95% have not been invested.

95% is THE consensus. But you don’t hear them. They are the silent majority. That’s because they are not organized. Also they don’t pay media advertising revenues.

Except for me, hardly anyone speaks in behalf of them. So for instance, when I get reprimanded by an industry leader for not towing the line, where the “consensus” (appeal to majority) has been used as a pretext to justify current mania, what has been talked about have really been about the sentiment of the consensus of the industry—again organized interest groups benefiting from the mania.

The organized interest groups are in control of communications in media. Media expresses on their sentiments and not of the silent majority. Even if many in the public shares media’s sentiment, for as long as they are not participants in the marketplace they remain uncommitted to such interest groups. Action speaks louder than words—demonstrated preference.

But again this would be an issue for another day.

DEBT EQUITY RATIO as Barrier to Earnings Growth

This leads to next ingredient to the stew of interest rates, earnings and growth; the role of debt as expressed in the PSE report as Debt Equity Ratio (DER).

From 2008 to 2014, the suppression of DER growth boosted EPS growth. On the other hand, a surge in DER growth has impeded EPS growth (see left window).

Correlation is not causation but there is a link. Debt is a liability. It is included in a company’s operating cost. If a company acquires debt and if such increase in costs will not be negated by an increase in revenues or in margins, then debt servicing will gnaw at the company’s earnings.

So the inverse fluctuations from DER and EPS seem like a manifestation of such dynamic.

The huge debt buildup has also been broad based in terms sectoral performance and a largely a 2013 origin dynamic.

DERs of all the major sectors have spiked in 2013. In 2014, DERs continued to rise in the holding industry, finance and service. The growth rates have declined in the industrials and the property sector.

I would guess that those numbers have been underrepresented. That’s because BSP’s bank loans to the general economy especially to the property sector have risen through 3Q 2014.

Also I believe that there has been a lot of off balance sheet loan transactions aside from the existence of the domestic shadow banking system as previously reported by the World Bank.

In addition I believe that balance sheets have been bloated from monetary inflation to possibly overstate equity values.

So add to the DER story the BSP interest rate history we get an idea how the Phisix EPS growth story has been shaped.

Those interest rate cuts of 2009 which ignited the magnificent EPS growth effectively reduced DERs. But again we see the law of diminishing at work. The succeeding rate cuts in 2012, not only reduced EPS growth trends, but likewise combusted the PSE’s DERs past 2008 highs since 2013!

So debt must have likely been a key factor in depressing EPS growth in the past and so will they affect EPS growth in the future.

Debt accounts for as just ONE of major barriers on why those high growth expectations from industry consensus will likely miss overstated targets by a galaxy.

The Four Horsemen to Earnings Growth

Yet I will add FOUR more obstacles that have not been included in the PSE report.

Three are domestic, which I have previously discussed, has been part of the Philippine government’s puffed up 6.9% 4Q GDP.

The fourth is exogenous.

Despite the panoply of media cheerleading on selective statistics, embedded in the government’s economic growth statistics has been substantial ongoing challenges in investments, household spending activities and even retail and wholesale trade as noted here.

If investments won’t pick up where will real economic growth come from that should filter into earnings? Why have households been pulling back? Why has growth in the retail industry plummeted in 4Q 2014?

If household spending remains lackluster where will malls, condos, casinos and hotels or the PSE’s top line come from and how will earnings growth be generated? How about the surge inventory from wholesale activities?

And how about those debt that has financed all these activities?

Also why does the BSP chief insist in his deflation spiel to even lecture journalists on how to see events in the framework of deflation?

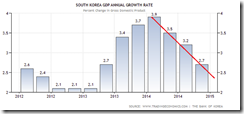

The Fourth Horseman: Soaring US Dollar

Now the fourth factor: the USD-peso

Last week, Asian currencies had practically been hammered.

Against the USD, the South Korean won collapsed by about 2.7%, the Indonesian rupiah was smoked anew by about 1.7%, and the Singapore dollar got smashed 1.1%.

The most recent currency star of Asia, the Indian rupee was not invincible after all. The rupee was battered by 1.2%. This has reduced the rupee’s year-to-date gains which still remain positive. The rupees’ smashed up have likely been due to her ‘surprise’ interest rate cut along with South Korea.

As a side note, it’s a surprise to media but not a surprise for me as I expect Asian currencies, including the BSP to jump into the interest rate cutting bandwagon.

The Thai baht lost 1.07%, the Malaysian ringgit fell .97%, the Taiwan dollar slipped .59% while the Philippine peso lost only .47%. The Chinese currency the yuan was the best performer to date to rise by .07%.

And speaking of central bank panics, add to this week’s rate cutting has been Russia and Serbia.

Year to date except again for the rupee, Taiwan dollar and the Philippine peso Asian currency has been substantially weaker. For now, the Philippine peso now takes on the leadership but for how long?

There are two major transmission mechanisms for currency weakness, one is through imports, and the other is through foreign denominated debt.

On a global scale, with the US dollar index hitting 100, a multiyear high, this bring into the light the $9 trillion US Dollar based credit to non banks OUTSIDE the US (see left), and the potential harbinger for a colossal event risk (right) which in the past has been “associated with major market events such as 1981 Volker shock, 1992 ERM crisis, Lehman in 2008 and so on” according to Bank of America Merrill Lynch/Business Insider.

Question now is what happens when one of these Asian nations suffer from a credit event? Will this be isolated or will history repeat?

It appears that the industry would like to anchor on the former, while the latter is the likely outcome.

A lot of people think in terms of satisfying present convenience. As Bill Bonner of Agora Publishing writes[5]:

People come to think what they must think when they must think it.

This time will NOT be different. The obverse side of every mania is a crash.

[1] See Phisix at Record 7,400: Be Fearful When Others Are Greedy January 12, 2015

[2] See Phisix 7,800: Record Phisix as the BSP Continues with Deflation Spiel! March 9, 2015

[3] See Phisix 7,800: Record Stocks, Incredible Misperceptions February 23, 2015

[4] Institute of International Finance, Capital Markets Monitor: A Fundamental “Asset-Liability Mismatch:” Investing in a Low-Rate Environment March 4, 2015

[5] Bill Bonner How This Great Race to Disaster Finally Ends January 9, 2015

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)