``People still want to believe in magic. Newsletters are the equivalent of magic. They are like prayer wheels for Tibetan monks. "Just write down a few prayers, paste them on a spinning wheel, and put the wheel in a breezy location. Then forget about it." They expect the wheel to bring blessings...People say, "I want specific advice." Most people really don't. Instead, they want pages of specific advice, so they can say in two years, "There was just too much advice, so I did nothing."...Why else do they read investment newsletters? For the same reason that men read "Car and Driver." It's low- risk fantasy...”-Prof. Gary North

With the Phisix successfully carving out a new landmark high, I know, many of you are now close to celebrating a festive Christmas season, especially those with well-cut diversified portfolios. However, expectations and realizations of such goals are two distinct animals. The Christmas Bonus question is, will the Phisix continue with its serendipitous roll?

First of all, to broaden our visual spectrum, it is not only the Phisix that have been on a streak, Philippine assets as a whole as signified by the Peso, sovereign bonds and to even credit default swaps have either hit new landmark territories or are close to establishing milestone records.

The local currency, the Philippine Peso broke its psychological threshold level of Php 50 to a US dollar, was up .57% for the week at Php 49.82, marking its highest close since May 23, 2002, according to Bloomberg. Yet, but before anyone gets too agog to cite the wonders of “stabilizing” domestic politics or progressing microeconomics as the marvel behind this unfolding phenomenon, one must not forget that the Asian Currency universe has been mostly treading on new heights even prior to our Peso’s renascence. For instance, this week, coincidental to the rising Peso, the politically scourged Thai Baht likewise etched record levels, according to Bloomberg, ``Thailand's baht climbed to the highest since January 2000 (emphasis-mine), as foreign investors bought equities on optimism growth will accelerate.” Ergo, we are not alone.

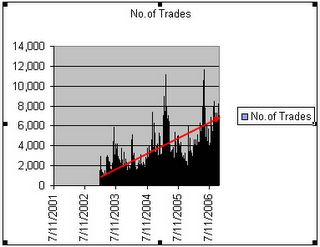

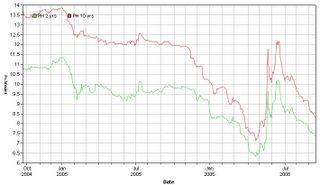

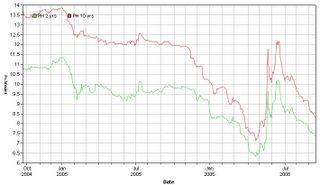

Figure 1: Asianbondsonline.com: Fierce Rally in Philippine Sovereign Bonds

While it took a rather lengthy period for Philippine bonds to rally (since 2004), following the May’s ‘risk aversion’ scare, our sovereign instruments took off dramatically over the past quarter, as shown in Figure 1 (Falling bonds yields are inversely related to Bond prices). According to the Philippine Daily Inquirer, ``Philippine 2016 bonds were traded at 111.50 and its 2031 bonds were at 109, a record high.”

Not limited to bonds, even derivative contracts as Credit Default Swaps have been gaining new record levels, again from the same Inquirer report, ``Five-year Philippine credit default swaps -- insurance-like contracts that offer protection against debt default or restructuring -- came in to a record low of 135/138 basis points.” With investors pricing our default swaps at a record low, this suggests that the Philippines would be less likely to emulate the Argentine paradigm.

Even the Philippine government’s Napocor which had in previous outings encountered difficulties raising funds, recently reaped a whirlwind of demand for its securities from the international credit markets to raise $500 million in a breeze; its offering was reportedly oversubscribed by 5 times!

No, I think that Philippine assets have not been rising primarily out of country-specific developments, as some others suggest, but rather surfing on a wave of a backstop of exploding liquidity in the global financial realm.

Back to the Philippine Stock Exchange; our Phisix indeed had a rather awesome week topping Asia’s key benchmarks with a sizzling 3.25% advance. Including the previous week’s advance, the Phisix has had a cumulative gain of about 145 points or an eye-popping 5.67%! And to consider, since the week that ended on August 25th, the local bellwether has been up in 8 out of 9 weeks to post a whopping 18.8% gains!

While on a year-to-date basis, the accrued gains of the Philippine benchmark has reached 28.93% as of Friday’s close. To consider, based on seasonality factors, the last quarter of the year has, statistically speaking, been the strongest or the most favorable environment for equities!

| Year End |

|

|

|

| Phisix | Y-o-Y variance |

| 27-Dec-96 | 3,170.56 |

|

| 29-Dec-97 | 1,869.23 | -41.04 |

| 29-Dec-98 | 1,968.78 | 5.33 |

| 29-Dec-99 | 2,142.97 | 8.85 |

| 29-Dec-00 | 1,494.50 | -30.26 |

| 28-Dec-01 | 1,168.08 | -21.84 |

| 27-Dec-02 | 1,018.41 | -12.81 |

| 30-Dec-03 | 1,442.37 | 41.63 |

| 29-Dec-04 | 1,822.83 | 26.38 |

| 29-Dec-05 | 2,096.04 | 14.99 |

Table1: Phisix Year on Year Changes since 1998

Defined in the following table (see table 1) is the year-on-year changes by the Phisix in the course of the past ten years. It must be remembered that during this span of time, the Phisix appears to have segued into two phases; first the declining phase of 1997-2002, then the recovery phase, 2003 until the present.

At the present circumstance, the Phisix looks poised to match or even possibly supplant the gains erected in 2004 (+26.83%), if it manages to hold current levels by the end of this year. Moreover, if the present momentum persists, the baptismal surge to hallmark the Phisix’s pivotal reversal could likely be an achievable target.

Now to offset my ‘framed’ optimism on you, I wish to also point out that despite the declining phase of 1997 to 2002, there had been two years where the Phisix actually registered advances. This means that it is natural to expect a cyclical rally within a secular bear market phase and conversely, a cyclical decline within a secular bull market.

Now if the Phisix would for instance, continues to prove its ‘Midas Touch’ to possibly end this year for its fourth successive yearly gain, especially with continued clip of outsized returns, then the law of averages or the market’s mean reverting tendencies could translate to a larger-than-average probability that the Phisix could suffer a pullback by next year. Put bluntly, you should expect negative annual returns in the future even if such cycle remains on the upside. One must be reminded that NO trend goes in a straight line!

Figure 2: Stockcharts.com: Phisix’s Peaks and Troughs

It is said that one of the key defining advantage of mankind over its antecedents is our ability for pattern recognition. This method of supervised learning enables us to manage our lives for the better with constant invention and utilization of various tools or instruments to measure, control or manage risk. Applied to the markets, such variegated templates of patterns can usually be seen through the price behavior of securities, which incidentally signifies the collective investor’s outlook as determined by actual transactions (not polls/surveys).

|

|

|

| Approx Period |

|

|

| Approx |

|

|

|

| Peak-to-Peak |

|

|

| Peak-to-Trough |

| Date | Peak | Gains | in Months | Date | Trough | Declines | in Months |

| 22-Jan-04 | 1,572.21 |

|

|

|

|

|

|

| 28-Apr-04 | 1,620.37 | 3.06 | 3 | 29-Mar-04 | 1,385.16 | -11.90 | 2.00 |

| 05-Oct-04 | 1,865.64 | 15.14 | 6 | 19-May-04 | 1,465.36 | -9.57 | 0.50 |

| 08-Mar-05 | 2,172.76 | 16.46 | 5 | 12-Nov-04 | 1,734.10 | -7.05 | 1.00 |

| 08-May-06 | 2,602.46 | 19.78 | 14 | 4-Jul-05 | 1,805.49 | -16.90 | 4.00 |

|

|

|

|

| 21-Jun-06 | 2,034.49 | -21.82 | 2.00 |

Table 2: Phisix Peak-to-Peak and Peak-to-Trough Patterns

Since the Phisix has broken past its critical threshold level of 2,602 with much OOMPH, as shown in Figure 2, maybe history could help us identify where this should lead us, in the assumption that external developments remain favorable to equities.

Table 2 in support of the chart, shows that since the Phisix reversed from its descending phase in 2003, the previous 5 watermark highs, as manifested by blue circles, over the present cycle reveals that gains based on a peak-to-peak basis have been ratcheting upwards. While the said sample is insignificant to draw a valid qualitative forecast, my four-leaf clover guess is that if the present momentum holds, then a 15% gain (it took 5 months to overtake the previous high, so I took the least % of returns over a similar period) from its previous peak of 2,602 may imply a 2,992 or a 3,000 target for the Phisix. Essentially, on a year-to-date basis, this translates to more or less 42% gain which fundamentally surpasses that of 2003!

In the same context, one should note that higher gains have likewise meant greater volatility. The same table shows that on a Peak-to-trough basis (troughs represented by red circles), the arithmetic mean for the 5 episodes of retracement is roughly 13%. Put differently, once the Phisix concludes a new high and goes into a “major” correction mode, the likely target for a retracement bottom would be 13% off from the Phisix’s new high.

So, at this instance you are equipped with a guidepost or an estimate of the possible price behavior of the Phisix. Yet, how I wish markets could be as simple as this, but they are not. They are hardly an exact science. But we can definitely work on playing the odds.

Now, given such approximations, would it be feasible to inject new money into the Phisix in light of the present circumstances?

If our target for the Phisix (30-company index) is 3,000 as explained above, then from Friday’s close of 2,702.37 suggests of a yearend % potential gain of 11%. On the other hand, based on my computed arithmetic mean, the possible downside is 13% from an upcoming peak which has yet to be identified.

Let us assume that if the Phisix does hit the 3,000 target by yearend and a possible 13% decline ensues, this should translate to a Phisix at 2,610 which is essentially lower than Friday’s close, and therefore implies that positioning at current levels would be a losing proposition, unless of course we can get to be lucky enough to accurately time the markets or if the Phisix manages to run past 3,000 by a significant margin.

In a different perspective, given the context of my assumptions, with an 11% prospective gain slightly eclipsed by a potential 13% prospective loss, the risks factors have evidently grown larger than potential gains, while simultaneously the present climate tells me too that our cost of capital have risen significantly relative to the potential returns on our invested capital and most importantly, considering today’s “euphoric” sentiment, there appears to be more “greater fools” found in the market today rather than “money” to be made. In short, before one reckons on investing on Phisix issues, one must be made to understand that the GIST of the present gains APPEARS TO HAVE ALREADY been made!

Therefore, in consideration of the persistence of today’s buoyant sentiment, I would reckon to either invest on issues with potentials to deliver over 15%, possibly on second or third tier issues which should benefit from the ongoing market’s rotational activities, or stay on the sidelines and await better times. Remember, should you decide to take upon today’s risks, then managing risks means knowing how much stake to put at risk.

Another not so bright scenario working against today’s high octane markets is that based on the charts, the Phisix has been quite overextended in terms of being overbought and is due bound for either a short-term pause or a natural corrective phase within its present momentum. I say present momentum with reference to the continuity of its interim uptrend, in contrast to a “major” corrective mode (potential 13% decline). Yet it is important to note that in bullmarkets, overbought conditions could go into the extremes, and vice versa for bearmarkets, which makes trading anticipation rather complex, if not abstruse. As mentioned above, patterns in markets are not something definite as to repeat exactly, but as Mark Twain puts it, it may “rhyme”. Prudent investing means measuring your potential gains against your potential losses and naturally, take on the appropriate action.