“A continual rise of stock prices cannot be explained by improved conditions of production or by increased voluntary savings, but only by an inflationary credit supply.” -Fritz Machlup, The Stock Market, Credit And Capital Formation

If you think that the bullmarket in the Philippine Phisix is an isolated ‘special’ affair and has been exhibiting signs of economic or corporate (micro fundamental) improvements or political endorsements, then you would be wrong (see Figure 3).

The same applies to the mainstream permabears who can’t seem to get their focus away from the debt problem angle or the supposed “lack of aggregate demand” in major economies.

The US Dollar Story

Figure 3 Bloomberg: Exploding MSCI Emerging Market and Asian Currencies

As one would note, emerging markets stocks, as represented by the MSCI Emerging Market index (upper window), have been exploding of late. But still has some distance from reaching the 2008 highs.

And this has not just been a dynamic in the Emerging market stock markets, but also in the currencies of Emerging markets and their Asian contemporaries.

This is best represented by the Asian currency index, the Bloomberg-JPMorgan Asia Dollar Index (ADXY) which have similarly spiked (lower window)!

With Asian currencies surging, I would assume that in spite of the recent appreciation of the Philippine Peso, the relative performance of the Peso has been lagging, considering that foreign money flows have been quite active. Nevertheless, despite my suspicion of the repeated intervention by the local central bank, the Bangko Sentral ng Pilipinas (BSP), the Peso should follow her neighbours and appreciate going into the yearend.

So domestic assets are evidently being juiced up by foreign and local money flows.

And as further proof that past performance can’t serve as reliable indicator of the future, even the ongoing troubles in Ireland hasn’t prevented the Euro from appreciating against the US dollar.

And more on more mainstream analysts appear to be getting it.

This from the BCA Research[1], (bold emphasis mine)

``Four currencies – dollar, euro, sterling and yen – currently account for the vast majority of reserve holdings. All of these four major reserve currencies have their own fundamental weaknesses. At the margin, this will force reserve managers to look for alternatives. Indeed, according to the IMF, there is already a sharp spike in holdings of “other” currencies, to 3.6% of total reserves...

``Bottom line: Reserve diversification away from the U.S. dollar remains an ongoing structural theme in the foreign exchange market and commodity currencies will be a main beneficiary.”

It has been an open theme for us here that the so-called policy divergences between the major economies led by the US and emerging market economies, which can be likewise as the called the US dollar carry trade, has underpinned the actions in today’s financial markets.

And the telegraphed actions by the US Federal Reserve in support of a weaker dollar have been causing a flood of liquidity flowing into emerging markets, gold and other commodities.

The Holy Grail Is The Rising Tide

However in the domestic front, I sense alot of psychological changes as some people seem to get aggressive over their expectations of stock market returns.

Some seem to think that the role of the analysts is to provide them optimal returns by capturing the trajectory of price actions via market timing of every issue.

They desire to be in every security that are rapidly going up and expect analysts to be able to identify and predict them.

Yet they read momentum as a way to generate outsized returns and seek all sorts of information (earnings, economic growth and etc...) to confirm on such biases in order to justify their participation. They seem to be seeking the elusive Holy Grail of investing. Unfortunately, either they are being misled or are being overwhelmed by emotions.

Let me reiterate, this isn’t about special events surrounding particular issues. This is about the rising tide lifting all, if not most boats. (see figure 4)

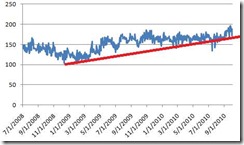

Figure 4: PSE: Number of Traded Issues (Daily)

It’s been happening across emerging markets, where many EM bourses appear to be reacting “positively” to the “leash effects” of the falling dollar-policy divergence trade.

And the same phenomenon seems underway in the local stock exchange where the massive liquidity spillover has been generating a broader interest on publicly listed issues.

The underlying bullmarket has drawn market participants to trade on more issues, where an increasing number of formerly illiquid issues have now become “liquid”. The search for yield has been expanding and lifting prices across the most issues.

This only goes to show how an inflation driven bullmarket has relative effects on prices of securities even when the general level is likewise being lifted overtime.

The other way to say it is that rotational price actions of publicly listed issues is a general feature of a blossoming boom-bust cycle. As for which issues becomes tomorrow’s darling is a phenomenon that can be divined by Lady Luck and not any mortal analysts. Yet to narrow one’s timeframe is to unnecessarily increase risk tolerance and very dicey gambit.

So those who pin their analysis on a variety of non-essentials will certainly get the surprise of their lives when such dynamics reverses. For the meantime, as price levels go up, everyone’s a genius.

Interest Rates As Key

And it is equally important to remember that should there be any pin that may pop this liquidity driven activities (bubble) in the marketplace, it would be due to rising interest rates.

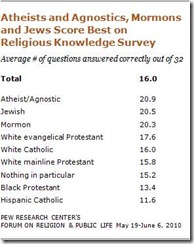

Figure 5: Casey Research[2]: Inflation Is The Biggest Driver of Interest Rate

And the benign levels of interest rates, which have been mainly due to manipulations by the governments will eventually succumb to one of the following factors:

-greater demand for credit or

-deterioration in the expectations of governments’ ability to settle existing liabilities, or

-most importantly, rising consumer price inflation which in the past have been the most pivotal factor in the determining interest rate levels (see figure 5).

As a final note, let me add to Warren Buffett’s advise, “The dumbest reason in the world to buy a stock is because it's going up”, and use all sorts of justifications to do so.

[1] BCA Research, Prospects For FX Diversification September 28, 2010

[2] CaseyResearch.com Debtflation, September 13, 2010