If your emotional abilities aren't in hand, if you don't have self-awareness, if you are not able to manage your distressing emotions, if you can't have empathy and have effective relationships, then no matter how smart you are, you are not going to get very far.-Daniel Goleman, Emotional Intelligence

Markets thrive on information. Information is processed as knowledge. Thus knowledge which coordinates people’s actions through prices, determines the risk-reward tradeoff.

Amgydala’s Fight or Flight Response[1]

When uncertainties or the prospect of peril emerges, our brain’s amygdala responds by impelling us either to fight or to take flight. That’s because our brain has been hardwired from our ancestor’s desire for survival—they didn’t want to be the next meal for predators in the wild.

Applied to the present state of the markets, the legacy of our ancestor’s base instincts still remains with us.

Yet in face of market turmoil, some would say “when in doubt get out”. But that’s an absurd statement to begin with.

First, there is hardly any market that operates without a doubt. Markets exist exactly with the aim to reduce such uncertainties, risk and or doubts.

As the great Ludwig von Mises pointed there is nothing certain, and everything is subject to speculation[2]

Future needs and valuations, the reaction of men to changes in conditions, future scientific and technological knowledge, future ideologies and policies can never be foretold with more than a greater or smaller degree of probability. Every action refers to an unknown future. It is in this sense always a risky speculation.

Two, the sheer prospects of black swan event (low probability, high magnitude impact) like Japan’s nuclear crisis always lurks somewhere.

Again, our understanding is always based on incomplete knowledge.

In contrast to the act of taking flight, doubts are where profits reside.

It’s basically a battle between the emotional and the rational. This is magnificently encapsulated by the Wall Street axiom “Bears and Bulls make money Pigs get slaughtered”.

Pigs get slaughtered because they depend on the amygdala to direct their actions. In short, when emotions hijack our rationality then we react senselessly and increase our risks.

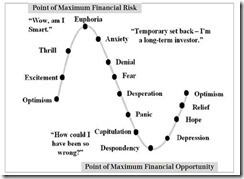

Emotional Phases of Investing

The chart above illustrates how overconfidence or extreme depressions mark the inflection points of major market trends. In other words, when the consensus reveals certainty about a specific trend, that’s the time to take the classic contrarian stance—stay on the opposite side of the trade!

As author and economist the late Peter Bernstein wrote[3], (bold highlights mine)

In their calmer moments, investors recognize their inability to know what the future holds. In moments of extreme panic or enthusiasm, however, they become remarkably bold in their predictions; they act as though uncertainty has vanished and the outcome is beyond doubt. Reality is abruptly transformed into that hypothetical future where the outcome is known. These are rare occasions, but they are also unforgettable: major tops and bottoms in markets are defined by this switch from doubt to certainty.

Three, when dealing with the financial markets, it is the Emotional Intelligence (EI)—or the argued ability, capacity, skill or, in the case of the trait EI model, a self-perceived ability to identify, assess, and control the emotions of oneself, of others, and of groups[4]--that is essential.

The management of the emotions is critical to weighing risk-reward tradeoff.

Psychologist and author Daniel Goleman offers 4 main ways to manage Emotional Intelligence:

-Self-awareness – the ability to read one's emotions and recognize their impact while using gut feelings to guide decisions.

-Self-management – involves controlling one's emotions and impulses and adapting to changing circumstances.

-Social awareness – the ability to sense, understand, and react to others' emotions while comprehending social networks.

-Relationship management – the ability to inspire, influence, and develop others while managing conflict.

Thus when the stream of information suggests that the ensuing problems, like Japan’s nuclear crisis, are becoming less uncertain, what then we have is a transformation of uncertainty (immeasurable risk) to a quantified risk environment (measurable losses). Thus, the market starts to discount the ‘negative’ information.

And that’s why the effect of calamities on the financial markets has usually had limited impact[5].

Let me add that the problems that beset Japan today has been one of technical (how to control the risk of contamination from the affected nuclear power and the disaster rehabilitation or rebuilding) more than about sociology (social relations).

This makes the ongoing interventions in the Middle East by the Saudi Arabia-led GCC forces on Bahrain[6] and UN sanctioned military strikes in Libya[7] as having the probability of more lasting adverse impact than Japan because the MENA events represents social problems.

What would pose as the uncertainty factor would be the consequences or the possible unforeseen events from these interventions, e.g. how will Iran (Shiite) respond to Saudi’s (Sunni) aggressive actions given the sphere of influence conflict between Islam sect Shia-Sunni? Will Iran’s response be benign or will it provoke or parlay into a regional armed conflict which should drag the entire world with it?

The point here is to distinguish the source of uncertainty and ascertain how will it be resolved or dealt with. The events in itself do not constitute as market risks, it is the chain of 'stimulus-response' and 'action-reaction' based on the interpretations of the consequences of these events that constitutes as uncertainties or risks.

I close this with a quote from the great Professor Ludwig von Mises[8], (bold highlights mine)

In the real world acting man is faced with the fact that there are fellow men acting on their own behalf as he himself acts. The necessity to adjust his actions to other people's actions makes him a speculator for whom success and failure depend on his greater or lesser ability to understand the future. Every action is speculation. There is in the course of human events no stability and consequently no safety

[1] Royal Air Force, On Field Discipline 2004

[2] Mises, Ludwig von VI. UNCERTAINTY: Uncertainty and Acting Chapter 6 Section 1, Human Action

[3] Bernstein Peter, quoted from A Study Of Market History And Valuation Through Graham And Buffett And Others By John Chew, istockanalyst.com

[4] Wikipedia.org Emotional intelligence

[5] See Will Japan’s Earthquake-Tsunami Be Market Bearish Or Bullish? March 13, 2011

[6] See Saudi Arabia Led GCC Intervention In Bahrain March 15, 2011

[7] See Fearing A Slap On The Face, UN Sanctions A No-Fly Zone, March 18, 2011

[8] Mises, Ludwig von VI. UNCERTAINTY: Case Probability; Chapter 6 Section 4 Human Action