``There are four ways in which you can spend money. You can spend your own money on yourself. When you do that, why then you really watch out what you’re doing, and you try to get the most for your money. Then you can spend your own money on somebody else. For example, I buy a birthday present for someone. Well, then I’m not so careful about the content of the present, but I’m very careful about the cost. Then, I can spend somebody else’s money on myself. And if I spend somebody else’s money on myself, then I’m sure going to have a good lunch! Finally, I can spend somebody else’s money on somebody else. And if I spend somebody else’s money on somebody else, I’m not concerned about how much it is, and I’m not concerned about what I get. And that’s government. And that’s close to 40% of our national income.” In memory of Milton Friedman July 31, 1912 to November 16, 2006

Suddenly there have been an avalanche of bullishness on the Philippines, an amazing turnabout from the past few years, here are some examples....

Eoin Tracey of Fullermoney.com quotes, UBS Investment Research, in their latest report, “Is the Philippines All Priced In”? (emphasis mine)...

``It's important to point out that domestic participation in the equity rally has been relatively minor to date; most of the action has come from foreign investors. From a stock market point of view, there are three potential catalysts next year: First, we expect a mild increase in real growth - and this is a significant achievement given the expected slowdown in the global economy, which should bring down growth numbers in other parts of Asia. Second, very benign inflation conditions, and finally, a cut in official short-term policy rates.

``Now, having real GDP growth accelerate from 5.2% to 5.8% is not really a barnstorming expansion by historical standards, but it does stand out in a regional context. More important, however, it's a potent signal to investors that the economy can hold water - and that domestic demand can take over the real cycle. Over the past two decades the Philippines suffered a decline in the investment to GDP ratio, from over 25% in the mid-1990s to 20% in 2000 to around 15% today. So the physical capital base has been eroded, and the government recognizes this and has been trying to open doors to investment in the infrastructure, mining and resources areas. Our view is that this is not going to reverse quickly; it's a slow process, there's a lot of bureaucratic grit in the wheels, and now there's an election coming next year.

``However, we have had a fundamental recognition of the problem, and have seen some underlying reforms last year in the resources part of the economy. Significantly, FDI has increased 60% to USD1.2bn this year to date - which is not very much in the Chinese context, perhaps, but a very big increase for the Philippines. We already noted that the government is likely to step up spending and investment a bit next year as well, and on top of that you have the new economic zones that give tax breaks to new services areas such as call centers, relocation of back office by major financial institutions, and these sectors are absolutely mushrooming. All in all, we are looking at a recovery in investment spending to around 9% y/y growth in 2007, and this is a major factor behind our favorable GDP call.

UBS likewise cited the Philippines’ outperformance (+38.2% year-to-date, local currency, based on Friday’s close) possibly due to “headline export/GDP ratio below 50%” or what they categorized as “big” countries [China (Shanghai +69.83% y-t-d, Shenzhen +62.62%), India (+42.89), Indonesia (+43.82%), Korea (+23.8%), Philippines) in the region that have been less reliant on exports.

Quoting anew UBS, ``this is likely a reflection of a rising large country "premium", as investors learn to differentiate between markets in the face of an expected US slowdown. But it's also true that large economies have grown somewhat faster than their smaller neighbors over the past five years - and more important still, large countries have a much higher domestic contribution to overall growth, more than twice the pace of the smaller group.”

In short, UBS thinks that the traits of economic independence and domestic demand strength have rewarded these markets compared to the “small” export dependent ones [Hong Kong (+28.95%), Malaysia (15.67%), Singapore (19.84%), Taiwan (10.86%) and Thailand (+2.08%)].

Figure 1: Bloomberg: Phisix treading on 9 year highs

This observation seems sensible considering how markets performed of late, see Figure 1, albeit, written obviously under the context of the recent past performance, or predicated upon the optimism etched from the current gains or the “rear-view mirror syndrome”.

Yet, it has been a long-time conviction of your analyst that as the region integrates economically and financially, to eventually decouple from its dependence on the US, such is where the meat of the advance of our economic and financial advance will be most pronounced.

This terse commentary from Gavekal Research, ``An upcoming large capital spending boom in the “third-tier” Asian countries (Thailand, Indonesia, Philippines, Vietnam…) fuelled by lower interest rates, higher currencies, cheaper machinery (often from China) and a clearer political situation.” Nothing new here, we’ve dealt with this since 2004, see November 29 to December 3, 2004 (Domestic Investment to Help Drive the Phisix?)

The Philippine investing theme has likewise hit mainstream media, Carl Delfeld, board representative of ADB and chief honcho of global investment advisory Chartwell Partners, writes about the Philippines and Indonesia in his “Two Surprising Markets” article in Forbes Magazine, excerpting Mr. Delfeld (emphasize mine)....

``Many would categorize Indonesia and the Philippines as relatively poor countries, but I beg to differ. Both countries have many assets and great promise. Indonesia is rich in natural resources, strategically positioned to benefit from Asian trade and economic growth, and it has a very young population, the fourth largest in the world. The Philippines' strength is its English-speaking population, giving it the potential to develop into a dynamic regional services hub....

``These markets can be volatile, so have in place some risk-management tools, such as a 10% trailing stop-loss order to lock in gains. Both Indonesia and the Philippines still have an upside, but the best time to score large gains is when investors are not showing the slightest interest in these markets.”

Sound advice from Mr. Delfeld. Nevertheless, he includes a buy recommendation on Manila Water Corporation [MWC].

Analyst Jim Jubak writing for thestreet.com, notes of the changing export patterns of the world plus growing domestic consumption ex-US, as primordial reasons for global portfolio diversification, and surprisingly in his 10 recommended blue chips stocks, he includes San Miguel Corporation [SMC]! The Philippine asset class appears to be hugging the today’s limelight!

Table1: ADB Bond Monitor: iBoxx ABF Family Returns Index

In addition, Table 1 from ADB shows that the Philippines have likewise outperformed the region’s bond markets in both the local currency and the US Denominated instruments category since 2005, with double digit returns. So it is not a surprise for investor sentiment to shift and be more vocal on their confidence on the Philippine assets as present gains have buttressed such outlook.

I recall a local analyst argue lately that domestic “fiscal reforms” have been the mainly responsible to the present wellbeing of the Philippine asset class and cited neighbors as Indonesia as an example.

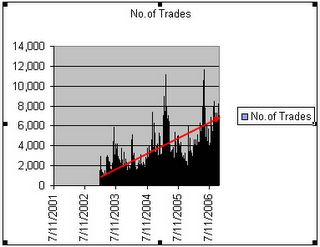

While I do not dispute the fact, that reforms have been made enough to makeover our asset class or even Indonesia’s as more palatable for investors, I would dissent on this frame of argument such that with reference to the Phisix, please refer back to figure 1, our equity market have risen since mid-2003, even when reforms were yet on the drawing boards. In other words, reforms have not been the key drivers to our markets, in my view, excess liquidity has.

Figure 2: Bloomberg: Indonesia’s JKSE have risen in tandem with the Phisix

And the same goes with Indonesia, as shown in Figure 2. Even prior to any change of administration or purported reforms, Indonesia's JKSE has been an equal recipient of global diversification emanating from the chase for yields phenomenon and has risen almost in tandem with our Phisix over a similar timeframe.

Yes today’s market makes everyone inexorably a genius. Every “rationalization” or justification, especially one that’s been in congruence with the current affairs, no matter how specious, meets a round of applause especially by mainstream media.

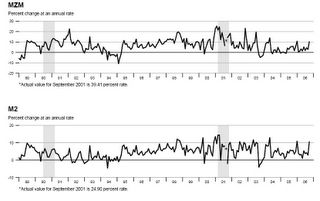

However, I would accentuate that the present euphoric mode of global markets are a result from a significantly lesser degree to domestic developments, but on a larger premise from that of massive credit and money creation and intermediation on an international scale.

You have to look no further than the recent explosion of derivatives. Let me cite the recent press release from Bank for International Settlements (emphasis mine), ``The volumes outstanding of over-the-counter derivatives expanded at a brisk pace in the first half of 2006. Notional amounts of all types of OTC contracts stood at $370 trillion at the end of June, 24% higher than six months before. Growth was particularly strong in the credit segment, where the notional amounts of outstanding credit default swaps (CDS) increased by 46%. Rapid growth was also recorded in other market segments. Open positions in interest rate derivatives rose by 24%, while those in FX contracts expanded by 22%. Equity and commodity contracts grew at 17% and 18%, respectively. Gross market values, which measure the cost of replacing all existing contracts and thus represent a better measure of market risk at a given point in time than notional amounts, increased by 3% to $10 trillion at the end of June 2006.”

$370 trillion! That’s about 7.22 times the global GDP and about 2.14 times the estimated aggregate world financial stock components, i.e. sovereign and private debt, equity securities and bank deposits! And to consider, derivatives are supposedly instruments which derive their underlying value from a security, group of securities or an index, which to extrapolate, means that derivative contracts are disproportionately larger than the underlying values of the securities they represent. This simply implies that the world’s financial system keeps getting increasingly levered to the hilt. Until when the global financial system can accommodate these dynamics is one thing to behold, otherwise it poses no other than intensifying systemic risk!

The world central banks has tightened interest rates alright, but this has not been manifested in the rather buoyant financial markets as we have repeatedly asserted, according to Wall Street Journal’s Cynthia Koons and Michael Aneiro (emphasis mine), ``Global issuance of risky ‘high yield,’ or junk bonds -- which Wednesday surpassed the previous record for a single year -- surged further into uncharted territory following yesterday’s blockbuster sale of $5.7 billion in new debt by hospital operator HCA Inc.…Global high-yield issuance surged past the $210.8 billion mark set in 2004 to a record, according to Dealogic. By yesterday…total global junk issuance stood at $217.4 billion, with a month and a half to go until year end. October set a single-month record with $30.5 billion in new issuance… And a report issued this week by J.P. Morgan forecasts that this month could see as much as $25 billion in new issuance, which would be a record for November… Despite the surge in issuance, junk-bond yields have dropped to a 5½-month low of 8.15%...” To which we ask what tightening? And where?

This bring us to the logical explanation by Mr. Raghuram G. Rajan, Economic Counselor and Director of Research of IMF, ``The mismatch between unabated global desired savings and lower realized investment, between the amounts available for finance and the flow of hard assets to absorb it, has led to a liquidity glut which has pushed long term real interest rates the world over lower. This has spilt over into markets for existing real and financial assets — real estate, high-risk credit, private equity, art, commodities, etc — pushing prices higher. Indeed, casual empiricism suggests that the most illiquid markets, where typically there are few transactions, and small infusions of liquidity can have substantial effect, have been pushed the highest.”

Which brings us back to the year-to-date performances of Asia as cited above; the most illiquid markets has apparently performed the best, namely the stellar gains of the Philippines, Indonesia, India and China or the UBS’ rubric of “Big” countries, which appears to also reinforce Mr. Rajan’s viewpoint.

Now given the three varying perspectives, to wit, the local analyst’s “domestic reforms”, UBS’ “economic independence/domestic demand theme” or IMF’s Rajan “liquidity glut”, which fits today’s dynamics better? Go figure.