In defense of their interventionist bias, the conventional question framed by mainstream statists goes around this context, “given the FED’s printing of money, where is inflation?”

So I will be updating my earlier post questioning the reliability of US CPI Inflation as an accurate or dependable measure of inflation.

The magnificent charts below are from dshort.com, here, here and here

First, the breakdown of the CPI basket…

Next, the changes of inflation rate for each of the components from 2000 as shown by the line chart below…

The histogram perspective of the same rate of change over the same period….

What has weighed on the CPI inflation index has been the housing component which represents 42% of the basket. Apparel, recreation and communication which constitutes a 16.5% share has also had a downside influence on both indices (CPI and CORE CPI). Meanwhile inflation rates of energy, tuition fee and medical care have skyrocketed.

Yet energy’s impact on the basket appears to have been suppressed or muted.

Writes Doug Short

The BLS does not lump energy costs into an expenditure category, but it does include energy subcategories in Housing in addition to the fuel subcategory in Transportation. Also, energy costs are indirectly reflected in expenditure changes for goods and services across the CPI.

The BLS does track Energy as a separate aggregate index, which in recent years has been assigned a relative importance of 8.553 out of 100. In other words, Uncle Sam calculates inflation on the assumption that energy in one form or another constitutes about 8.55% of total expenditures, about half of which (4.53%) goes to transportation fuels — mostly gasoline.

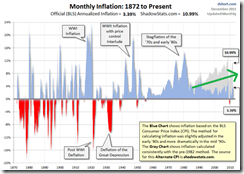

Finally, below is the long term inflation chart which includes

“the alternative look at inflation *without* the calculation modifications the 1980s and 1990s”

In short, the current methodological construct of the US CPI inflation vastly understates the genuine rate of inflation, which appears to be accelerating (green arrow)—even when measured without current CPI modifications.

And contrary to the mainstream arguments, deflation seems nowhere in sight. This only implies that those dismissing the presence of inflation seem to be engaged in sophism anchored on political bias rather from reality.

Statistics can be manipulated to suit one’s dogmatic perspective.

While much of the money created and parked at the FED will pose as an inflationary problem ahead, the dilemma would be in the timing or that when these will enter the market.

Besides the US Federal Reserve appears to be in an undeclared QE 3.0 mode, as the Fed’s balance sheet has began to swell anew, with notable increases in lending to financial institutions, growth in liquidity to key credit markets and purchases of the Fed agency debt mortgage-backed securities (chart from the Cleveland Federal Reserve).

Applying Austrian economics means to explain how future events will transpire rather than to make exact predictions.

In other words, we don’t know when the tipping point would occur, which would result to rapid escalation of inflation rates that will be increasingly visible to the public. Instead we do know that if the present trend of policymaking continues, the subsequent outcome would be a ramped up rate of inflation.

As the great Ludwig von Mises wrote,

Economics can only tell us that a boom engendered by credit expansion will not last. It cannot tell us after what amount of credit expansion the slump will start or when this event will occur. All that economists and other people say about these quantitative and calendar problems partakes of neither economics nor any other science. What they say in the attempt to anticipate future events makes use of specific "understanding," the same method which is practiced by everybody in all dealings with his fellow man.

In the fullness of time, surging inflation will explode on the nonsensical or absurd arguments peddled by statist-inflationists.

No comments:

Post a Comment