The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2015 was 0.7 percent on May 13, down slightly from 0.8 percent on May 5. The nowcast for second-quarter real consumer spending growth ticked down 0.1 percentage point to 2.6 percent following this morning's retail sales report from the U.S. Census Bureau.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Thursday, May 14, 2015

Fed Atlanta's GDP Now Predicts 2Q US GDP at only .7%!

Monday, October 28, 2013

Phisix: The Implication of the US Boom Bust Cycle

Small-business owner optimism did not “crash “ in September, but it did fall, dropping 0.20 from August’s (corrected) reading of 94.1 and landing at 93.9. The largest contributing factor to the dip was the significant increase in pessimism about future business conditions, although this was somewhat offset by a notable increase in number of small-business owners expecting higher sales

In theory, a link between a CEO's compensation and a firm performance will promote better incentive alignment and higher firm values (Jensen & Meckling, 1976). However, executive compensation contract is an incentive where opportunistic earnings management behaviour is likely to be detected since CEOs are expected to have incentives to manipulate earnings if executive compensation is strongly linked to performance. A substantial literature has emerged to test the relationship between executive compensation and earnings management and has documented that compensation contracts create strong incentives for earnings management…When earnings management is driven by opportunistic management incentives, firms will ultimately pay a price and its negative impact on shareholders is economically significant.

Neiman Marcus, the upscale US department store chain, is no stranger to fashion trends. But in the autumn of 2005 the luxury retailer started a very different kind of fad – this time for an unusual new bond structure known as a “payment-in-kind toggle”.Pik-toggle notes, as they became known, gave Neiman Marcus the option to pay its lenders with more bonds instead of cash if the retailer ever ran into financial difficulty. For a company that was at the time being bought by private equity giants TPG and Warburg Pincus, in a leveraged buyout involving about $4.3bn worth of debt, that additional financial flexibility was considered a savvy move….The average amount of debt used to finance LBOs has jumped from a low of 3.69 times earnings in 2009 to an average 5.37 so far this year, according to data from S&P Capital IQ. At the height of the LBO boom, average leverage was 6.05.The $6bn sale of Neiman Marcus to Ares and a Canadian pension fund is expected to leave the retailer with a debt of about seven times earnings.At the same time, more than $200bn of “cov-lite” loans have been sold so far this year, eclipsing the $100bn issued in 2007. That means 56 per cent of new leveraged loans now come with fewer protections for lenders than normal loans.

Wall Street banks that package commercial mortgages into bonds are forgoing a ranking from Moody’s Investors Service on the riskier portions of the deals, a sign the credit grader isn’t willing to stamp the debt investment-grade amid deteriorating underwriting standards.Moody’s didn’t grade the lower-ranking debt in 9 of the 14 commercial-mortgage bond transactions it’s rated since mid-July, according to Jefferies Group LLC. Deutsche Bank AG (DBK), Cantor Fitzgerald LP and UBS AG (UBSN) are selling a $1 billion transaction this week that doesn’t carry a Moody’s designation for a $64.3 million portion that Fitch Ratings and Kroll Bond Rating Agency ranked the lowest level of investment grade, said two people with knowledge of the deal.Moody’s absence from the riskier securities in commercial-mortgage deals suggests the New York-based firm is taking a harsher view of the quality of some new loans as issuance surges in the $550 billion market, Jefferies analysts led by Lisa Pendergast said in a report last week. Credit Suisse Group AG’s forecast for $70 billion of offerings this year would be the most since issuance peaked at $232 billion in 2007.

A burst of investor “animal spirits” has boosted the value of mergers and acquisitions-related bonds to the highest raised since the financial crisis.Global acquisition-related bond issuance from non-investment grade, or high yield, companies has risen by 15 per cent to $62.9bn for the year to date compared with the same period in 2012.This is the highest amount since 2007, according to Dealogic, the data provider.The surge has been driven by purchases outside the US as non-US acquisition bond issuance nearly tripled to $14.1bn compared with last year, including deals such as Liberty Global ’s $2.7bn issue

According to data provider Dealogic, the $884.3 billion of highly rated corporate bonds sold in the U.S. this year through Wednesday has been the most of any year at that point since 1995, when it began keeping records.October’s rush of supply has helped put 2013 back on track to exceed the record $1.01 trillion issuance seen in 2012.

So while most publicly listed US companies have yet to immerse themselves into Ponzi financing, sustained easy money policies have been motivating them towards such direction.

We really can't forecast all that well. We pretend that we can but we can't. And markets do really weird things sometimes because they react to the way people behave, and sometimes people are a little screwy.

Economics provides us with true laws, of the type if A, then B, then C, etc. Some of these laws are true all the time, i.e., A always holds (the law of diminishing marginal utility, time preference, etc.). Others require A to be established as true before the consequents can be affirmed in practice. The person who identifies economic laws in practice and uses them to explain complex economic fact is, then, acting as an economic historian rather than as an economic theorist. He is an historian when he seeks the casual explanation of past facts; he is a forecaster when he attempts to predict future facts. In either case, he uses absolutely true laws, but must determine when any particular law applies to a given situation. Furthermore, the laws are necessarily qualitative rather than quantitative, and hence, when the forecaster attempts to make quantitative predictions, he is going beyond the knowledge provided by economic science

Friday, October 18, 2013

Video: Peter Schiff on The Myth Surrounding Janet Yellen's Forecasting Record

Using Ms. Yellen's speeches and public pronouncements as basis, financial analyst Peter Schiff, in the following video, debunks such claims as inaccurate and an exaggeration.

This is important because the consensus seems to have massively build their hopes and optimism around Ms. Yellen's leadership. In reality, what the mainstream has been cheering about has been the prospects of bigger inflationist policies, which signify as subsidies to Wall Street and politicians at the expense of main street. This also means that the mainstream expects Ms. Yellen to accommodate bigger and bigger systemic debt.

Worst, should Ms. Yellen's administration oblige to Wall Street's desires, then we should expect a bubble bust under her watch.

Again as pointed out in the past, outgoing Fed chief Ben Bernanke must have been cunning enough to have bailed out and passed the burden of bubbles to his successor.

(hat tip Zero Hedge)

Thursday, September 05, 2013

Economic Forecasting: The Mainstream’s Horrible Track Record

Last month, Singapore’s government announced the economy grew 3.8% on-year in the second quarter. But as late as June, economists polled by the city-state’s central bank were predicting growth of just 1.5%.Economists got it wrong on exports too: They predicted a nearly flat print in the second quarter, when exports actually fell 5.0%.The difference was even starker in the first quarter: Economists in March predicted exports would fall 0.5%, but in fact they shrank a whopping 12.5%.The Monetary Authority of Singapore polls economists at banks and research firms every quarter on key local data such as gross domestic product, exports, currency, inflation and employment. The results are released at the start of every quarter, with the third-quarter survey landing Wednesday.It turns out that the 20 or so economists who respond to the survey get it quite wrong, quite often.Economic predictions are never easy. But they become even more complex in tiny Singapore, where trade is more than three times the size of GDP.

The experience with which the sciences of human action have to deal is always an experience of complex phenomena. No laboratory experiments can be performed with regard to human action. We are never in a position to observe the change in one element only, all other conditions of the event remaining unchanged. Historical experience as an experience of complex phenomena does not provide us with facts in the sense in which the natural sciences employ this term to signify isolated events tested in experiments. The information conveyed by historical experience cannot be used as building material for the construction of theories and the prediction of future events. Every historical experience is open to various interpretations, and is in fact interpreted in different ways

Saturday, February 23, 2013

US Fed Ben Bernanke: No Asset Bubbles

Federal Reserve Chairman Ben S. Bernanke minimized concerns that the central bank’s easy monetary policy has spawned economically-risky asset bubbles in comments at a meeting with dealers and investors this month, according to three people with knowledge of the discussions.The people, who asked not to be identified because the talks were private, said Bernanke made the remarks at a meeting in early February with the Treasury Borrowing Advisory Committee. Fed spokeswoman Michelle Smith declined to comment.The Fed chairman brushed off the risks of asset bubbles in response to a presentation on the subject from the group, one person said. Among the concerns raised, according to this person, were rising farmland prices and the growth of mortgage real estate investment trusts. Falling yields on speculative- grade bonds also were mentioned as a potential concern, two people said…Speculation about scaled-back asset purchases by the Fed was fanned by the Feb. 20 release of minutes of the central bank’s last policy making meeting in January.

Monday, December 31, 2012

Quote of the Day: The Illusions of Pundits

People who spend their time, earn their living, studying a particular topic produce poorer predictions than dart-throwing monkeys who would have distributed their choices evenly over the options. Even in the region they knew best, experts were not significantly better than non-specialists.Those who know more forecast very slightly better than those who know less. But those with the most knowledge are often less reliable. The reason is that the person who acquires more knowledge develops an enhanced illusion of her skill and becomes unrealistically overconfident. “We reach the point of diminishing marginal predictive returns for knowledge disconcertingly quick,” Tetlock writes. (Philip E. Tetlock, University of Pennsylvania in 2005 book Expert Political Judgment: How Good is It? How Can We Know?—Prudent Investor) “In this age of academic hyperspecialization, there is no reason for supposing that contributors to top journals—distinguished political scientists, area study specialists, economists, and so on—are better than journalists or attentive readers of the The New York Times in ‘reading’ emerging situations”. The more famous of the forecaster, Tetlock discovered, the more flamboyant the forecasts. “Experts in demand,” he writes, “were more confident than their colleagues who eked out existences far from the limelight.”

For many, thus, expertise signify more as social signaling (posturing or seeking social acceptance) and or “telling people what they want to hear” but predicated on certain technically based paradigms which produces an aura of supposed superiority rather than representative of the true domain knowledge.

Saturday, December 17, 2011

US CPI Inflation’s Smoke and Mirror Statistics, Part 2

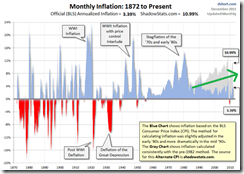

In defense of their interventionist bias, the conventional question framed by mainstream statists goes around this context, “given the FED’s printing of money, where is inflation?”

So I will be updating my earlier post questioning the reliability of US CPI Inflation as an accurate or dependable measure of inflation.

The magnificent charts below are from dshort.com, here, here and here

First, the breakdown of the CPI basket…

Next, the changes of inflation rate for each of the components from 2000 as shown by the line chart below…

The histogram perspective of the same rate of change over the same period….

What has weighed on the CPI inflation index has been the housing component which represents 42% of the basket. Apparel, recreation and communication which constitutes a 16.5% share has also had a downside influence on both indices (CPI and CORE CPI). Meanwhile inflation rates of energy, tuition fee and medical care have skyrocketed.

Yet energy’s impact on the basket appears to have been suppressed or muted.

Writes Doug Short

The BLS does not lump energy costs into an expenditure category, but it does include energy subcategories in Housing in addition to the fuel subcategory in Transportation. Also, energy costs are indirectly reflected in expenditure changes for goods and services across the CPI.

The BLS does track Energy as a separate aggregate index, which in recent years has been assigned a relative importance of 8.553 out of 100. In other words, Uncle Sam calculates inflation on the assumption that energy in one form or another constitutes about 8.55% of total expenditures, about half of which (4.53%) goes to transportation fuels — mostly gasoline.

Finally, below is the long term inflation chart which includes

“the alternative look at inflation *without* the calculation modifications the 1980s and 1990s”

In short, the current methodological construct of the US CPI inflation vastly understates the genuine rate of inflation, which appears to be accelerating (green arrow)—even when measured without current CPI modifications.

And contrary to the mainstream arguments, deflation seems nowhere in sight. This only implies that those dismissing the presence of inflation seem to be engaged in sophism anchored on political bias rather from reality.

Statistics can be manipulated to suit one’s dogmatic perspective.

While much of the money created and parked at the FED will pose as an inflationary problem ahead, the dilemma would be in the timing or that when these will enter the market.

Besides the US Federal Reserve appears to be in an undeclared QE 3.0 mode, as the Fed’s balance sheet has began to swell anew, with notable increases in lending to financial institutions, growth in liquidity to key credit markets and purchases of the Fed agency debt mortgage-backed securities (chart from the Cleveland Federal Reserve).

Applying Austrian economics means to explain how future events will transpire rather than to make exact predictions.

In other words, we don’t know when the tipping point would occur, which would result to rapid escalation of inflation rates that will be increasingly visible to the public. Instead we do know that if the present trend of policymaking continues, the subsequent outcome would be a ramped up rate of inflation.

As the great Ludwig von Mises wrote,

Economics can only tell us that a boom engendered by credit expansion will not last. It cannot tell us after what amount of credit expansion the slump will start or when this event will occur. All that economists and other people say about these quantitative and calendar problems partakes of neither economics nor any other science. What they say in the attempt to anticipate future events makes use of specific "understanding," the same method which is practiced by everybody in all dealings with his fellow man.

In the fullness of time, surging inflation will explode on the nonsensical or absurd arguments peddled by statist-inflationists.

Thursday, February 17, 2011

Explaining Popularity In Terms of Predictions: Dr. Nouriel Roubini’s Case

This seems like good news to me. My favourite mainstream Keynesian bear, Nouriel Roubini, appears to have ‘capitulated’. Mr. Roubini, a popular and very well connected economist, has almost always been on the wrong side of the prediction fence, and this seems to be just another of chapter of his string of failed forecasts and eventual turnaround.

Mr. Roubini has turned bullish on the US markets, reports the Bloomberg,

Nouriel Roubini, the economist who predicted the financial crisis, said U.S. stocks may gain in the next few months as company earnings remain resilient.

Adds Thomas Brown of bankstocks.com

What the heck happened to the L-shaped recovery? Roubini’s view is now squarely within the mainstream expectation. Good for him. The facts changed, and so he changed his opinion. Keynes would be pleased.

For me, Mr Roubini exemplifies as one of the bizarre ironies of the marketplace where despite his persistent wrong predictions, Mr. Roubini has remained quite popular with media.

If his strategy has been patterned to a tournament bridge game called “playing for a swing” as Professor Arnold Kling suggests, where “It would appear that Roubini's strategy is to make forecasts that differentiate himself from the consensus forecast. This allows him to be spectacularly right sometimes and spectacularly wrong sometimes. As long as he succeeds in getting everyone to remember the right forecasts more clearly than the wrong ones, he becomes a prophet”, then his success reflects on the public’s poor memory (or survivorship bias).

Google search trends for Mr. Roubini vis-a-vis Dr. Marc Faber

While there may be some truth to this, I am not convinced.

The public seems jaded to the forecasting accuracy by experts.

In relative performance, another (less) popular grizzly bear (but Austrian school leaning bear), Dr Marc Faber, who appears to have consistently been accurate even in predicting short to medium term trends—even the latest divergence between EM and developed economies stocks—has almost trailed Dr. Roubini’s in terms of popularity. (note the difference in search volume index—X axis).

So the explanation of “spectacularly” right or wrong doesn’t seem to suffice.

Instead, I think, Mr. Roubini signifies what the public wants to hear more than the validity of his theories. He personifies the confirmation of many entrenched but flawed beliefs.

Search volume for Austrian versus Keynesian Economics

One would note of an almost similar performance between Dr. Faber and Dr. Roubini’s popularity variance levels—Austrian economics has largely been subordinate in popularity to Keynesian economics during the past years (although this could be changing).

Finally there could be another factor: pessimism bias sells.

In the question and answer portion of this splendid talk on innovation, economist Deirdre McCloskey points out that Paul Ralph Elrich remains quite popular in spite of his ‘spectacularly’ wrong prediction.

Mr. Elrich is known for having lost the famous Simon-Elrich wager- wager that based on the price of 5 metals anchored upon the overblown risks of overpopulation.

Perhaps many are simply more attracted to a pessimistic outlook, whether valid or not, out of the penchant to see or resist a change in the status quo, or based on social signalling (to conform with the consensus outlook or to show intellectual prowess or promote an ideology, e.g. using fear to expand government control)

As Professor Bryan Caplan writes,

David Hume—economist, philosopher, and Adam Smith’s best friend—blamed popular pessimism on our psychology. “The humour of blaming the present, and admiring the past, is strongly rooted in human nature,” he wrote, “and has an influence even on persons endued with the profoundest judgment and most extensive learning.”

Bottom line: The popularity of economic or market forecasters appear grounded mostly on the confirmation bias or giving the public what they want or desire to hear more than the validity of theories or the batting average or the accuracy of predictions.

.bmp)