If politics continue to shackle central bankers, then the risks of a slowdown transitioning to a recession will get magnified.

The lucid example of political deadlock hounding the markets from the EU seems best captured by this Telegraph report[1]

The head of the European Central Bank hit out at the political paralysis gripping the region as he warned the eurozone's set-up was "unsustainable"

Mario Draghi said the central bank could not "fill the vacuum" left by member states' lack of action as it was claimed the zone is on the point of "disintegration".

Amid escalating talk of a potential bail-out for Spain, the president of the ECB said the central bank was powerless to stop the debt tornado. "It's not our duty, it's not in our mandate" to "fill the vacuum left by the lack of action by national governments on the fiscal front," he said.

Over at the worsening economic conditions in China, political debates over policy have once again been best illustrated by this comment from a former central banker turned representative for a think tank[2]

Americans and Europeans like it. Investors like it because they want to speculate on stocks. The whole world is hoping China will relax policy," Xia told Reuters.

"We will fall into a trap if we do. We will not be that stupid," Xia said, adding that the government should only stimulate economic growth in a "balanced and modest" way, while forging ahead with structural reforms to sustain growth over the longer term. China stimulus unnecessary, risks long-term damage

As a reminder, the current issue here has NOT been about a supposed “squeeze” on government spending and the supposed effects of low levels of capital from it.

The bank runs in the PIGS dismisses this false and self-contradictory logic, Spain experienced 100 billion capital flight during the first 3 months[3], as bank runs have been symptomatic of the fear of devaluations on the heightened prospects of a severance of EU ties.

The monumental capital flight has produced negative interest rates on the treasury yields of Switzerland[4] (see above) and also in Denmark.

Instead, the issue here has been the unwinding of MASSIVE malinvestments from EXCESSIVE government spending (welfare, bureaucracy, bailouts, and etc…) that has not only produced unsustainable loads of debt, but also resulted to the CROWDING out of the private sector investments. When government confiscates scarce private sector resources through taxation and spends it, the private sector losses ‘capital’ and opportunity from which to undertake productive activities. This is known as OPPORTUNITY costs; something which becomes a monumental blackhole to mainstream logic, whose ideas are premised on the laws of abundance.

Of course, add to this the misdirected resources from private the sector, particularly the real estate industry, whom had been induced by bubble ‘convergent interest rate’ policies.

The capital flight from crisis affected Euro nations has also been affecting the US where volatile money flows could exacerbate the current boom-bust dynamics. Add to this policy actions to address on such flows[5].

Yet the predicament of crisis afflicted EU nations has essentially been about vastly diminished competitiveness from asphyxiating bureaucracy and choking regulations, particularly in the labor markets[6].

Accounts of massive tax avoidance from current tax increases only debunk the supposed solution of increased government spending. Greeks have shown that they have not been amenable to paying NEWLY IMPOSED taxes[7].

If people truly believed that government spending is the solution then they would have volunteered payment for taxes. In reality, both the intensifying tax avoidance and capital flight defeats the silly statist illusory elixirs.

Even China today has been revealing signs of emergent bank runs[8] and such bank run seems to coincide with the recent depreciation of the yuan relative to the US dollar. This increases signs of uncertainty over China’s bubble economy.

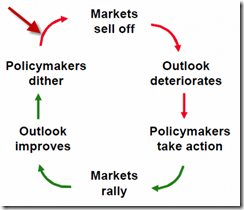

Yet in general, current uncertainty has been aggravated by the political paralysis which has led central bankers to dither from pursuing further inflationist policies.

This Reuters article entitled “Central Banks to hold fire... for now[9]” nails it.

The intensifying euro zone crisis and uncertain global growth outlook have raised hopes for a policy response from major central banks but, while it could be a close call, they are likely to resist pressure to act in the coming week.

When central banks and the banking system stops or withholds from further inflating, the ensuing market reaction from a PREVIOUS inflationary Boom would be a Bubble Bust.

As the great dean of Austrian school of economics explained[10]

For the banks, after all, are obligated to redeem their liabilities in cash, and their cash is flowing out rapidly as their liabilities pile up. Hence, the banks will eventually lose their nerve, stop their credit expansion, and in order to save themselves, contract their bank loans outstanding. Often, this retreat is precipitated by bankrupting runs on the banks touched off by the public, who had also been getting increasingly nervous about the ever more shaky condition of the nation's banks.

The bank contraction reverses the economic picture; contraction and bust follow boom. The banks pull in their horns, and businesses suffer as the pressure mounts for debt repayment and contraction…

This, then, is the meaning of the depression phase of the business cycle. Note that it is a phase that comes out of, and inevitably comes out of, the preceding expansionary boom. It is the preceding inflation that makes the depression phase necessary.

Pieces of the jigsaw puzzles have been falling right in place into the boom bust picture.

And another thing, if there should be a global recession it is not certain that this will be deflationary, as this will depend on how central bankers react. The term deflation has been adulterated by deliberate semantical misrepresentations.

Not all recessions imply a monetary deflationary environment as alleged by a popular analyst. The US S&P 500 fell into TWO bear markets 1968-70 and 1974-1975 even as consumer price inflation soared (blue trend line).

If in case the same phenomenon should occur where stagflation becomes the dominant economic landscape, then a bear market in stocks will likely coincide with a bull market in commodities.

Yet for now everything remains highly fluid with everything dependent on the prospective actions by policymakers

As of this writing, reports say that the EU has been preparing for the $620 ESM Rescue fund for July[11]. If this is true then perhaps, this means the ECB will begin her next phase of massive monetization of debt.

Let me reiterate my opening statement of last week[12]

Like it or not, UNLESS there will be monumental moves from central bankers of major economies in the coming days, the global financial markets including the local Phisix will LIKELY endure more period of intense volatility on both directions but with a downside bias.

I am NOT saying that we are on an inflection phase in transit towards a bear market. Evidences have yet to establish such conditions, although I am NOT DISCOUNTING such eventuality given the current flow of developments.

What I am simply saying is that for as long as UNCERTAINTIES OVER MONETARY POLICIES AND POLITICAL ENVIRONMENTS PREVAIL, global equity markets will be sensitive to dramatic volatilities from an increasingly short term “RISK ON-RISK OFF” environment.

And where the RISK ON environment has been structurally reliant on central banking STEROIDS, ambiguities in political and monetary policy directions tilts the balance towards a RISK OFF environment.

[1] Armistead Louise Eurozone is 'unsustainable' warns Mario Draghi, Telegraph.co.uk, May 31, 2012

[2] See HOT: China’s Manufacturing Activity Falls Sharply in May June 1, 2012

[3] CNBC.com Spain Reveals 100 Billion Euro Capital Flight, June 1, 2012

[4] Bloomberg.com Switzerland Govt Bonds 2 Year Note Generic Bid Yield

[5] See The Coming Colossal Bernanke Bubble Bust May 30, 2012

[6] See Germany’s Competitive Advantage over Spain: Freer Labor Markets, May 25, 2012

[7] See Is Greece Falling into a Failed State? May 28, 2012

[8] See Is China Suffering from Bank Runs too? June 2, 2012

[9] Reuters.com Central Banks to hold fire... for now, June 2, 2012

[10] Rothbard Murray N. Economic Depressions: Their Cause and Cure, Mises.org

[11] See HOT: EU Readies $620 ESM Rescue Fund for July, June 3, 2012

[12] See The RISK OFF Environment Has NOT Abated, May 27, 2012

No comments:

Post a Comment