Soaring property prices in the US has been prompting for a decline in homeownership.

From Bloomberg:

The U.S. homeownership rate, which soared to a record high 69.2 percent in 2004, is back where it was two decades ago, before the housing bubble inflated, busted and ripped more than 7 million Americans from their homes.

This serves evidence of the unintended consequences from noble-sounding social redistributionist policies of promoting homeownership through debt and inflationism.

This homeownership program has spanned the Clinton administration (June 5, 1995) “Today, all across the country, I say to millions of young working couples who are just starting out: By the time your children are ready to start the first grade, we want you to be able to own your own home”…

…and the Bush Administration’s Ownership society (October 15, 2002) “working together as a nation to encourage folks to own their own home”

So the push for more homes via redistribution has led to bubbles that eventually defeats the original intent; Americans have now LESS homes.

Differently said the housing bust has been greater than the boom.

The failed policy of promoting homeownership has began to put pressure on prices of rental properties.

On the demand side, from the same Bloomberg article: (bold mine)

The homeownership rate in the second quarter was unchanged from the prior three month period, according to Census Bureau data released today. It will hit bottom at about 64 percent in the next year as families leave the foreclosure pipeline and enter rental homes, according to a May analysis by London-based Capital Economics Inc. It’s currently the lowest in almost 18 years after averaging about 64 percent for 30 years through 1995.

The result of the switch to rental properties: soaring rental prices

From the Zero Hedge: (bold original, all chart excluding US Treasury yields theirs)

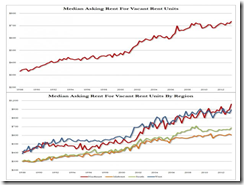

A record lot in fact: the median asking rent for US vacant housing units just hit an all time high of $735 per month.

The price rental increases has been nationwide. But the rate of increases differs by region where the Northeast has posted the biggest increase

Though there are more homeowners than renters, if the Fed fueled property boom persists and if income growth continues to stagnate (as shown by the above chart) then the shift to rentals could deepen, further undermining the homeownership levels

But what seems more important for now is the potential effect of higher rental prices to US CPI and to the financial markets.

If rental prices continue to soar, then given that housing rents comprises the biggest weighing in the CPI calculation, then record rental prices will mean higher CPI as I raised before (chart from dshort.com).

Rising inflation expectations will thereby add further pressures on the elevated yields of US treasuries

While 5 year yields are off the highs, 10 and 30 year yields are knocking at new highs.

At the end of the day property boom will be threatened by the supply side response to prices…

From Wall Street Journal: (bold mine)

The speed with which prices have risen over the past year has taken many economists by surprise. Gains have been fueled by record-low mortgage rates, a slowly improving economy that has released pent-up demand and strong appetites from investors converting homes into rentals.

…and from higher interest rates or combination of both.

Again clearly policy induced boom bust cycles at work

No comments:

Post a Comment