In discussing the convergence trade, here is what I wrote two weeks back (bold original)

The surge in banking loans was equally reflected on domestic liquidity or M3 which grew by 31% year on year.So the BSP will achieve a $32k per capita income by continually inflating of bubbles via a massive build-up of debt or by borrowing tomorrow’s spending today.This also means that statistical economic growth for the third quarter will likely remain at 7% or above.

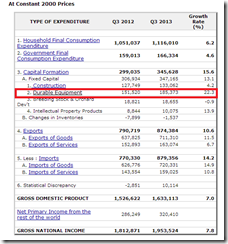

Let us see where the latest (3rd Quarter) statistical growth has been attributed to… [note I will not depend on the NSCB's narration but rather on the data they presented.]

From the NSCB’s breakdown of the statistical economy based on expenditure type (at constant prices), durable goods powered growth…

In the durable equipment sector, transportation equipment has been instrumental in the attainment of this quarter’s 'strong' statistical economic growth.

The Transportation sector accounts for 57.8% of the gross capital formation category based on 3rd quarter output. Air Transports reported a stunning 23.9x (times) growth. Meanwhile railway transports posted a 25.2% growth rate and road vehicles grew by a modest 12.9%. Although the above numbers appear to be different here and here

Since the NSCB’s sources of data for transportation and communications are from National Statistics Office (NSO), Land Transportation Office (LTO), Philippine National Railways (PNR), Light Rail Transit Authority (LRTA), Philippine Postal Office (PPO), Philippine Air Lines (PAL), Philippine Ports Authority (PPA) and Department of Transportation and Communication (DOTC), my guess is that airline companies may have added new planes or that the government has acquired non-military planes that has contributed to gist of the growth in the “fixed capital formation”.

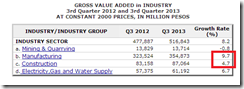

On growth based on industry type, the services sector has again delivered the substance of this quarter’s statistical growth.

The services sector has largely been fueled by Financial Intermediation and Real Estate Renting & Business Activities

Remember this chart where we saw a vibrant revival of banking loans to the same industries during August-September?

Meanwhile the agricultural sector has taken the second spot mainly led by fishing.

But what of the industry sector which trailed services and agriculture? (note all of the above are based on constant 2000 prices)

The growth in the construction sector eased while manufacturing took leadership.

Now go back to the chart above from the BSP. One would note of a two month spike in manufacturing loans while construction loans 'dived' over the same period. Trends in the loan growth dynamic have been manifested on statistical growth.

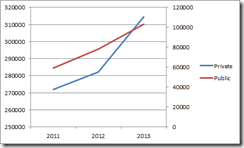

I’d also like to point out that despite the so-called moderation in the growth rate of construction activities in the 3rd quarter, based on 1st up to 3rd quarter for the past 3 years, slope of growth in the construction activities has been ascending in a near vertical fashion.

The table above which represents the NSCB’s breakdown on the quarter on quarter growth in construction sector reveals the numbers.

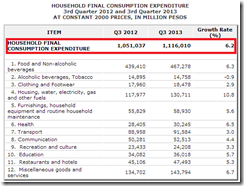

How about household consumption? Well again, household consumption (via the HFCE), which represents the final demand, has grown less than the overall statistical growth.

In other words, supply-side growth continues significantly outpace demand. The continuing dynamic essentially leads to a widening of the chasm between supply side and demand side growth which extrapolates to an accumulation of more imbalances, brought about by a credit boom from zero bound rates.

No bubble?

The Phisix (chart from technistock) appears to be celebrating what seems much of an expected outcome.

As I said last weekend:

Well the oversold markets will surely experience bounce. Mr Pacquiao’s victory or the coming announcement on Philippine GDP which I expect to be in line with the mainstream’s expectations given the late spurt of credit growth will have little do with it.

No comments:

Post a Comment