If

you’re unhappy with what you’ve had over the last 50 years, you

have an unfortunate misappraisal of life. It’s as good as it gets,

and it’s very likely to get worse. It’s always wise to be

prepared for it getting worse. Favorable surprises are easy to

handle. It’s the unfavorable surprises that cause the trouble. In

terms of monetary authorities, you can count on the purchasing power

of money to go down over time. You can almost count on the fact that

you’ll have way more trouble in the next 50 years than we had in

the last. The technology is changing, so that a few nutcases could

make the World Trade Center look like a picnic. We should all be

prepared to adjust to a world that is harder.—Charles

Munger, Vice Chairman of Berkshire Hathaway

In

this issue

Phisix

7,250: More Proof of 2015’s EPS Fiasco: Crashes in JOLLIBEE and

MEGAWORLD’s EPS Growth! PSEi’s Record 8,127’s First Anniversary

-JFC’s

2015 Net Income Growth Crashed Big Time on Dwindling Topline!

-Megaworld’s

2015 EPS Growth Nose-Dived by 52% from Real Estate Sales Slump!

-Signs

of Strains Even in Government’s Income Statement? Fiscal Deficit

Rise in 2015!

-March

GIR: BSP’s Forex Inventory Skyrockets, Why?

-One

Year Anniversary of April Record PSE Record 8,127: A Coming

Successful Breakout of 7,400 or Déjà vu 2015?

Phisix

7,250: More Proof of 2015’s EPS Fiasco: Crashes in JOLLIBEE and

MEGAWORLD’s EPS Growth! PSEi’s Record 8,127’s First Anniversary

JFC’s

2015 Net Income Growth Crashed Big Time on Dwindling Topline!

I

have noted last week, that contra mainstream early predictions of

double digits growth, 2015 has signified to be an earnings

G-R-O-W-T-H FIASCO!

And

the earnings growth debacle has mainly been brought about by

pressures on corporate topline, or their respective NGDPs, which has

evolved to become a systemic problem

rather than just based on a few firms or industry.1

But

does it matter? Earnings or no earnings stocks can only go UP!!!

Current

divergence of record high stocks in the face of earnings degradation

can be seen not only in some of the record high biggest market cap

issues that has weightlifted the PSEi to its current level, like SM

Investments and AEV (stunningly -4.33%

2015 and -12.71% 2014) but also in another top 15 ranked firm,

specifically—the largest fast food chain in the Philippines,

Jollibee Foods Corporation (PSE: JFC).

As

a side note, JFC will most likely publish their annual report next

week.

However,

it has been interesting to see JFC exhibit at their February 9 press

release that eps growth for 2015 actually CONTRACTED! (see upper

window)

So

like SM which income growth collapsed to ZERO, JFC even trekked to

the NEGATIVE zone!

Well,

who says stocks represent the discounted value of the stream of

future cash flows or about income growth???

Like

SM, in the case of JFC, smaller income growth translates to near

record HIGH stock prices!!!!

JFC’s

share price has been up 5.3% year to date as of Friday. The latest

serial pumping entailed to a Price Earning Ratio (PER) of an eye

popping or NOSE BLEED 45.4 (as of April 7) as well as, a staggering

Price to Book (PBV) of 7.98!

And

JFC has just been off by 2.2% from a new record (as of Friday)

As

income growth materially decreases, stock prices skyrocket!

Absolutely stunning.

The

company’s headline bannered “JFC

Opens 303 Stores in 2015, Recurring Profit Up 21% in Q4” .

On

their broadcast, the company splurges on the G-R-O-W-T-H theme by

focusing on the ‘growth’ aspects while leaving the decaying

segment to a single paragraph.

Nonetheless,

the press release did mention and blamed “extra-ordinary expense”,

which totaled Php 903 million, for the decline in operating income of

31.8% for the quarter and 9% for the year. Basic eps growth actually

crashed by an astounding 11.3% in 2015! (see lower window in the

above chart)

Since

the annual report has yet to be published, here is my guess,

“extra-ordinary expense” has emerged from the firm’s massive

expansion program to resuscitate its falling topline hence the

dwindling eps.

JFC’s

profit pressures can be traced to its topline woes.

JFC’s

top line growth continues to ebb. In 2015, gross revenues grew by

11.15% which has been down from 12.94% and 12.98% in 2014 and 2013

respectively (see upper window of below chart). The peak in JFC’s

growth was in 2011 at 17.2%. JFCs’ gross revenues/NGDP has been in

gradual erosion for the past 4 years!

Note

that about a quarter of gross revenues are from overseas operations.

Perhaps

the decline

in the rate of store expansion, which has mirrored on the topline

performance, has prompted for JFC’s officials to commit to a more

ambitious expansion program.

Yet

intriguingly, 2015’s pronounced decline in JFC’s topline occurred

even when the company aggressively expanded (upper window). Total

supply via worldwide stores of the JFC group ballooned by 9.4% in

2015. This excludes stores from affiliates, for instance, newly

acquired Smashburger’s 352 outlets.

In

the other words, JFC

officials seem to think that the topline erosion has strictly been a

supply side issue, hence the supply side response.

The company stated that in 2016 capex budget would amount to Php 10.4

billion, with Php 7.5 billion allotted for new stores and the balance

for renovations. They seem to think that demand trend would remain

intact or static.

Yet

JFC officials hardly seem to realize that their predicament may have

been rooted from the law

of diminishing (marginal) returns.

And

JFC’s diminishing marginal returns may be a function of mostly

three major factors: demographics (JFC stores increasing faster than

population/market), demand (JFC stores expanding faster than

consumer’s income growth) and competition (aggregate supply growing

faster than aggregate demand, or in layman’s terms, more and more

fastfood stores competing for your peso).

Of

course, JFC has a diverse, and not homogenous, line of food

businesses. But still, the array of variegated retail food themes

focuses on consumers, whose spending depends on those three economic

factors.

So

in spite of the 9% surge in JFC’s retail outlets, topline revenues

continue to diminish.

Like

SM, this extrapolates to the

increasingly inefficient use of resources

(as measured by output per store), or worst, growing

signs of excess capacity.

And if it is the latter, then throwing good money on even more

wasteful activities will only lead to losses and eventually drain the

firms’ savings (retained earnings)

JFC’s

financial performance has manifested signs of misallocation of

resources. Symptoms

of malinvestments have become widespread and can now be seen from

company to company.

And

JFC’s 2015’s reduction of eps growth hasn’t been a deviance.

It’s been the second year for JFC’s eps growth rate to decline.

JFC’s

eps growth rate peaked in 2013 at 24.41%, but then sharply dropped in

2014 to 14.04%. Thus the

-11.3% collapse in 2015 eps growth signifies a continuation of the

2014 momentum. (see

lower window in the above chart)

Of

course, the firm’s expansion programs have not been costless or

cost free, which is likely the reason for “extra-ordinary expense”.

Yet

if I am right, where JFC officials have blatantly misread or

misdiagnosed on the economic prospects for the firm’s markets (both

domestic and overseas), then it wouldn’t be farfetched that these

adventurous expansions, or may I say JFC’s intrepid supply side

gambit, risks transforming reduced earnings growth into earnings

losses.

Moreover,

the

growing list of EPS growth casualties simply means that the cost to

the BSP’s “trickle down” policies—that urges the elites and

the “banked public” to borrow from the future to pump GDP—has

arrived; the consumer mirage story has begun to unravel. And if

consumer price inflation will be reignited, such will accelerate the

unmasking of a populist myth.

But

then again, Philippine stocks can only go up! Or so it seems…

Megaworld’s

2015 EPS Growth Nose-Dived by 52% from Real Estate Sales Slump!

Symptoms

of malinvestments have become widespread and can now be seen from

company to company. And the evidence just keeps pouring in.

Property

firm Megaworld reported a 52% collapse in eps growth in 2015, again

mainly from topline troubles.

Growth

rate in real estate sales, which accounted for 61% of the firm’s

NGDP or gross revenue sales, plunged to just 10.79% in 2015 from

15.79% in 2014 and 16.94% in 2013. In the context of % on the y-y

growth, real estate sales dived by an incredible 32% in 2015!

In

the management’s review of business performance for 2015, Megaworld

didn’t seem to specify which projects accounted for the new

inventories for this year (or I may have overlooked it if they have

been noted in the footnote section)

Yet

cascading real estate sales transfused into the bottomline: Sagging

growth revenues had been met by the acceleration in the company’s

business cost which ballooned 9.25% over the same year.

MEG’s

bottomline was providentially rescued by a surge in rental revenue

which blossomed by 23.46% in 2015 from 17.11% in 2014. Rental

revenues had mainly been boosted by “escalation of rental rates and

increase in demand for office space from BPO Companies”2

Rental revenues accounted for 19% of the firm’s gross sales.

And

like the quintessential domestic property firms, what has been

reported or recognized as “profits” have actually been largely

uncollected installment sales from either NO or low downpayment

financing schemes. This has been manifested by the continuing upsurge

in receivables (left window) in MEG’s balance sheets.

Total

current and non current receivables rose by 14.11% but this has

slumped from 2014’s skyhigh 22.4%. Receivables have essentially

tracked real estate sales performance.

On

the supply side, real estate inventory growth exploded by 29.39% in

2015 but this has plunged from the crest of 2014’s growth rate at

43.35% and 2013’s 50%.

Slowing

sales in the face of soaring inventory translates to EXCESS capacity.

Because

property firms have largely been cash deficient in spite of reported

“profits”, they increasingly rely on leverage to finance their

business model: vendor

financing

scheme (sales or demand), business costs (operations) and inventory

buildup (supply).

So

Megaworld’s steepening leverage can be seen via the ballooning or

56.85% surge in total liabilities (right window). The firm appears

to be shifting the mix of its loan bond portfolio tilted towards

loans, or away from bonds. Bonds have accounted for 40% share of the

firm’s total liabilities.

So

firms like Megaworld are not only faced with the risk of losses from

excess capacity from a deeper decline in the topline, but from

increased credit risk or even from a systemic liquidity shortfall

(whether incited here or from abroad)

Signs

of Strains Even in Government’s Income Statement? Fiscal Deficit

Rise in 2015!

If

I am not mistaken many of the listed firm’s financial travails as

revealed by their income statements may have already started to

percolate into the government’s income statement.

Sure,

from the annualized basis, 2015’s tax revenue growth rate of 11%

(see top) was flat compared to the same number in 2014. With 2011 and

2012 serving as twin peaks after posting 13% growth rates a piece,

however, tax revenue growth appears to have plateaued (blue trend

line).

Meanwhile,

government expenditures grew faster in 2015 than tax collections for

the first time since 2012.

Yet

seen from a monthly basis, tax revenues have been volatile in the 1H

of 2015. The tax revenue surge in March (+32.33%) and May (+40.81%)

has virtually buoyed and kept annual growth rates flat in 2015

relative to last year3.

But

aside from such spikes, tax revenues had been in a sharp decline

during the second half of the year. Tax collections even shrank by

5.5% year on year last December. December’s negative output

represented the second negative growth or contraction (after April’s

-6.84%) for the year.

Amidst

falling revenues, the growth rate of government expenditures appears

to have moderated in the 2H of 2015. But still, given that the growth

rate of government expenditures had been higher than tax collections,

the consequence was a bigger deficit.

As an old saw goes, there

are many ways to skin a cat. And there are many ways to see view

data. What’s even more interesting has been that seen from a

quarterly basis, the six month decline in tax collections appears to

have ‘smoothed out’ on the two monthly spikes during the 1H 2015.

Furthermore,

I may be accused as looking for patterns here, but quarterly growth

rates appear to be shaping a downtrend. If so, then the declining

quarterly trend may eventually corroborate or confirm the plateauing

momentum seen in the annualized tax revenues

It’s

not difficult to discern that decelerating profits, a slowdown in

consumption and economic activities will eventually ventilate its

presence on taxes.

I

plotted the Philippine NGDP to see if there was any pattern.

Apparently the relationship hasn’t been airtight to make any

comment.

But

as noted above, falling

tax collections in the face of greater demand for government

services, such as infrastructure spending means bigger deficits.

The

BSP’s implicit subsidies to the government and to the firms owned

by the elites, through “trickle down” negative real rates has

impelled for the temporary closing of the budget gap from 2009 to

2014.

Of

course, BSP’s subsidies have been transmitted through a credit boom

that embellished GDP. The credit fueled GDP boom consequently

translated into a tax collection boom which allowed government to

offload her debt burdens.

But

again, underneath the credit fueled GDP boom has been an orgy in the

private sector’s uptake of credit, which essentially took the

credit yoke from the government.

In

short, the

BSP’s implicit subsidies extrapolated to an embedded transfer

of debt load from the government to the private sector.

The

fall in the government’s deficits and debt levels through a massive

credit subsidy to the few “banked” entities, or mostly elite

owned non-financial enterprises created an aura and imagery of

exemplary standards of management by the government.

Moreover,

the BSP’s implicit subsidies through artificially lowered interest

means that the government has been paying less interest liabilities

on its debt than it would when zero bound policies have not been in

place.

Such

invisible resource transfers through social policies are called

financial

repression

And

vested interest groups which benefited from such invisible transfers

vociferously lauded and promoted such scheme which they sold as

‘G-R-O-W-T-H’! And because most people think with their eyes,

they bought into this simulacra

and simulation hook, line and sinker.

And

such populist mirage of fiscal discipline may have likely reached its

turning or inflection point in 2015.

And

if I am right, the sixth major costs from the BSP’s invisible

transfers may be transitioning to reality. As I wrote two years ago4:

(bold original)

A

sixth major cost is that once

the bubble implodes, government revenues will dramatically fall while

government spending will soar as the government applies the so-called

“automatic stabilizers” (euphemism for bailouts). This would also

extrapolate to a phenomenal surge in debt levels. All

these will unmask today’s Potemkin’s village seen in the fiscal

and debt space.

Like

government deficit, total debt (domestic plus foreign) had been on a

downswing from 2009-2014.

Reduction

in total debt may have climaxed in 2014 where the rate of growth of

total debt inched up by only .95% during the said year. And for the

first time since 2009, total debt was higher (in terms of %) in 2015

from the previous year. Total debt increased by 3.82%, which was

mainly driven by foreign debt expansion at 8.12%.

Since

the USD rose against the peso by 5.2% in 2015, then part the increase

in the nation’s foreign debt levels stemmed from the weaker peso.

The rest of the additions to debt must have accounted for the

financing of the revival of deficits.

Should

the momentum of faltering profits continue, then expect tax

collections to stagnate as government expenditures remain ascendant.

This means a widening of fiscal deficit. And the ramifications from

such would be bigger government debt, greater inflation pressures and

a weaker peso.

The

incoming political leaders from the current national elections will

be inheriting a terrible mess created and nurtured by the BSP that

has benefited two previous administrations. Unfortunately, the coming

administration will bear the brunt of the political backlash from the

BSP engineered boom bust cycle.

March

GIR: BSP’s Forex Inventory Skyrockets, Why?

Last

week, the Bangko Sentral ng Pilipinas reported that March Gross

International Reserves rose to $82.6 billion.

The

bizarre part of March rise was that it featured a second monthly

spike in the forex inventory of the BSP’s GIR.

March

forex reserves eclipsed the December 2013 highs by 44%. And the $2.2

billion may signify a fresh record in the BSP’s forex holdings.

The

BSP explained: This

level was higher by US$0.72 billion than the end-February 2016 GIR of

US$81.88 billion due mainly to net foreign currency deposits by the

National Government (NG) (which include proceeds from its issuance of

ROP Global Bonds amounting to US$495 million and from program loans

extended by the Asian Development Bank), as well as the BSP’s

income from investments abroad, and revaluation adjustments on the

BSP’s foreign currency-denominated reserves.5

The

National Government raised

$2 billion in February

of this year from the international markets. They also raised $2

billion in January of 2015,

$1.5 billion in January

2014

and January

2012.

In contrast to 2016, the BSP didn’t seem to incorporate deposits by

the national government from the previous three international bond

issuances. What seems to be the difference this time?

The

March spike in forex inventory has accounted for a follow thru from a

February spike (to $1.44 billion) which almost reached the December

2013 levels at $1.51 billion.

I

suspected then that the BSP has resorted to derivatives in

particular, forex swaps and forwards, similar to China, to window

dress the GIR reserves6

Considering

the USD Php February zenith of Php 47.64, has the BSP aggressively

intervened in the USD Php market by selling its USD hoard or

reserves? Perhaps such has been the reason for the substantial

liquidations in foreign investments? And in order to offset the USD

inventory loss and maintain or preserve on the GIR accounting

position, has the BSP been borrowing foreign exchange through the

swap markets and simultaneously hedged such borrowings with currency

forwards?

Could

it be that derivative forward cover contracts could soon be expiring

that would lead to a hefty decline in GIRs for the BSP to have

borrowed from the national government in order to cushion on the

coming drop?

Interesting

developments.

One

Year Anniversary of April Record PSE Record 8,127: A Coming

Successful Breakout of 7,400 or Déjà vu 2015?

April

10 marks the first anniversary of the landmark 8,127.48 high for the

headline index the PSEi.

Yet

in spite of the recent near vertical rally from end January lows,

Friday’s close at 7,247.2 remains still a substantial 10.8% off

last year’s feat.

Remarkably

even at current levels, four issues—all of which have been holding

firms, specifically, SM, JGS, AEV and GTCAP—carved fresh record

highs last March and continues to drift at, or near such levels. And

two of the record breakers belong to the top 3 biggest market cap

while the other two have been part of the top 12.

Biggest

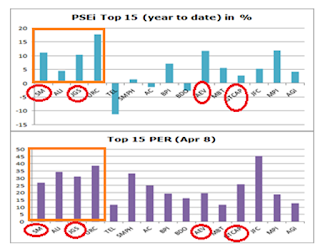

year to date gains have accrued to the top 4 issues. (upper window)

This reveals why PSEi 7,250 has been mainly emerged out of the

phenomenal performance of a few elite or biggest market cap issues.

Or seen from a different angle, PSEi 7,250 was partly a product of a

manipulated “marking the close” pump which mainly focused on the

four biggest issues.

As

testament to the concentration of pumping activities, PERs of the top

4 have accounted for the most expensive (lower window).

Oddly,

the current cavalcade of aerial acrobatics by these firms occurred

even as earnings growth by most PSEi issues has significantly

underperformed.

An

example which I noted last week, SM’s ZERO earnings growth in 2015

has signified the THIRD year of earnings growth downtrend. 2015’s

dismal performance was not an anomaly for the largest listed firm, it

manifested a trend.

And

SM’s ZERO income growth in 2015 was mostly attributable to the

firm’s diminishing top line which was highlighted by her real

estate’s negative growth performance. However in the current

context, ZERO growth has translated to RECORD HIGH stocks!

This

means that current actions at the PSE have brazenly accounted for

price

multiple expansions

or ‘greater fools’ hoping to unload their inventories to yet

bigger ‘greater fools’!

The

deepening detachment between price chasing actions and fundamentals

undergirds on the one directional expectations outlook, which implies

of excessive optimism anchored on hope, and its corollary, the denial

of strains from current accounts of underperformance.

Most

importantly, price chasing actions reveals of the impassioned

speculation (fear of missing out) predicated from such one

directional expectations perspective

Such

one directional expectation stance can clearly be seen from the

PSEi’s parabolic move which occurred from the late January lows

through the end of March. At no time during the last three years (or

even from the last 7 years) has the PSEi behaved with such tenacity.

Yet

the January to March sprint appears to have hit a wall—the May 2013

record high at 7,392 or the 7,400 psychological level—which appears

to be a major resistance level. Of course, there is no such thing as

resistance level for index managers or manipulators, who think that

they, and not the markets, shape the charts.

Aside

from the near vertical liftoff of the Phisix, in contrast to last

year, a speculative rampage has engulfed activities at the broader

market.

The

two month ripfest has reached records of sorts in terms of the

average number of daily trades (left upper window) and the average

number of daily traded issues (left lower window).

Coupled

with the overwhelming dominance by the advancing issues over

declining issues over the said period (upper right window), the near

record number of daily trades can be deduced to the frantic episodes

of trade churning which involved a record high number of issues! Yet

the near term supremacy of advancing issues over declining issues

appear to be corroding.

And

foreign trade seemed barely a factor. (lower right window)

While

foreign trade reported a net buying Php 6.52 billion over the past 11

weeks, foreign buying accounted for a paltry 8% of total peso volume

(Php 77.7 billion) over the same period. This means that the

parabolic move by the PSEi and the wild broad market pump has largely

been accounted for by domestic punters.

Moreover,

while the PSEi zoomed in a near vertical fashion in the face of

intensifying broad market manic speculation, the average daily volume

remained substantially lackluster in relative context.

Differently

put, in five occasions where 7,400 had been reached and tested (with

one successful breach), from 2H 2014 through today, peso volume from

current attempt has signified the LOWEST. This suggests that the

frenetic pumping lacks substance.

So

in perspective of the first anniversary of 8,127.48, will the fifth

attempt to breach 7,400—characterized by the most ferocious pump

backed by the lowest volume—be successful?

Or

will the first year anniversary of record high serve as a déjà

vu—another time resonant waterfall similar to its record

antecedent?

_____

1

See

Phisix

7,250: SM Investments Posted NEGATIVE Growth in Real Estate Sales in

2015! Peso-Asian Currencies Fly on Yellen Dovishness April 3,

2016

2

Edge.com.ph

MEG

17 A with AFS and ACGR April 5, 2016

4

See

Phisix:

In 2009, the BSP Engineered a Crucial Pivot to a Bubble Economy

April 14, 2014

5

Bangko

Sentral ng Pilipinas End-March

2016 GIR Level Reaches US$82.60 Billion April 7, 2016

No comments:

Post a Comment