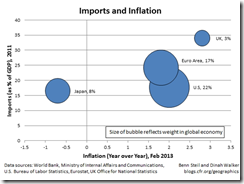

Currency depreciation is likely to have a much more adverse effect on inflation in the UK than in the United States, the eurozone, or Japan, owing to much higher imports relative to GDP. UK consumer price inflation is already running at a relatively high 2.8%, and the Bank of England’s own analysis suggests that a 20% sterling depreciation risks pushing the price level up 6 percentage points higher than it would otherwise be.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Tuesday, April 02, 2013

Chart of the Day: Unintended Effects of Currency Devaluation

Friday, February 22, 2013

Quote of the Day: Deficit Without Tears

For its part, the United States finds congenial a world in which a dollar sent to China for cheap goods comes back overnight in the form of a near-zero interest loan, which can then be recycled through the U.S. financial system to create yet more cheap credit.Neither partner in this monetary marriage is, therefore, likely to file for divorce any time soon.

Saturday, November 03, 2012

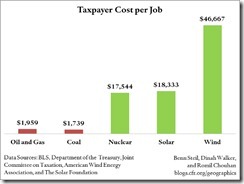

CFR: US President Obama’s Renewable Energy Jobs Comes at High Cost to Taxpayers

The Joint Committee on Taxation estimates that energy-related tax preferences will cost Americans $5.4 billion this year. Half of this, $2.7 billion, will benefit green sectors: $1 billion in nuclear subsidies, $1.3 billion in wind-energy credits for electricity production, and $400 million in solar-energy property credits.So-called “section 1603” renewable energy grants, part of the 2009 fiscal stimulus package, will cost taxpayers a further $5.8 billion. If we assume that the grants are awarded across sectors in the last five months of this year as they were in the first seven, then the nuclear, solar, and wind energy sectors will receive $4 billion of this, boosting total green-sector subsidies to $6.7 billion this year.Taxpayers will also provide $700 million in energy-efficient property credits. The credits apply mainly to solar, though we don’t know the precise allocation – so we leave it out of the figure, which therefore understates the cost of solar-backed jobs.Dividing the total wind, solar, and nuclear subsidies by the number of Americans employed in these sectors (252,000), they are currently generating jobs at an average annual cost to taxpayers of over $29,000. Wind jobs cost taxpayers nearly $47,000 per job per year.By way of comparison, the coal, oil, and gas sectors receive $2.7 billion in subsidies annually, and employ about 1.4 million Americans. The taxpayer-cost per job in these sectors is therefore just over $1,900.The bottom line is that green-energy jobs cost taxpayers, on average, 15 times more than oil, gas, and coal jobs. Wind-backed jobs cost 25 times more.

Wednesday, January 25, 2012

Iran to Trade Oil for Gold to Bypass Sanctions

Iran reportedly plans to skirt US and Euro sanctions by trading her oil for gold with India and China

From Debka.com (hat tip lewrockwell)

India is the first buyer of Iranian oil to agree to pay for its purchases in gold instead of the US dollar, DEBKAfile's intelligence and Iranian sources report exclusively. Those sources expect China to follow suit. India and China take about one million barrels per day, or 40 percent of Iran's total exports of 2.5 million bpd. Both are superpowers in terms of gold assets.

By trading in gold, New Delhi and Beijing enable Tehran to bypass the upcoming freeze on its central bank's assets and the oil embargo which the European Union's foreign ministers agreed to impose Monday, Jan. 23. The EU currently buys around 20 percent of Iran's oil exports.

The vast sums involved in these transactions are expected, furthermore, to boost the price of gold and depress the value of the dollar on world markets.

Iran's second largest customer after China, India purchases around $12 billion a year's worth of Iranian crude, or about 12 percent of its consumption. Delhi is to execute its transactions, according to our sources, through two state-owned banks: the Calcutta-based UCO Bank, whose board of directors is made up of Indian government and Reserve Bank of India representatives; and Halk Bankasi (Peoples Bank), Turkey's seventh largest bank which is owned by the government.

If the major reason the US pushed for the invasion of Iraq and the overthrow of the Saddam Hussein regime was because latter had pushed for Iraq’s oil to be paid in Euros is true, then Iran’s oil for gold trade will likely presage a shared fate with her neighbor.

The other aspect here is the potential use of gold as money for transactions outside the incumbent banking-financial and political system or in the informal economy.

But of course, governments have already been restricting international gold flows. For instance South Korean authorities recently arrested men who tried to smuggle out gold by hiding it in their rectums.

Interesting signs of times.

Update: A source suggests that the DEBKA files or the source of the quoted news is run by Council of Foreign Relations (CFR), believed to a conspiracy group whose aim has supposedly been to uphold the interests of some well connected elites via control of governments, and some other network of war hawks. CFR has called for a war on Iran.

The implication is that I am not sure whether the news cited above represents a propaganda or a reported fact.