Doubt isn't the opposite of faith; it is an element of faith—Paul Tillich, German theologian and historian

Growing Imbalances at the Philippine Stock Exchange: Coincidences or Patterns? Will the Philippines Be Immune from an Escalation of the Middle East War?

Stock market trading opened the second decade of the twenty-first century with a peculiar twist, both the headline index and broader market were in the red!

On January 2nd, when the PSYEi 30 tumbled below the 2% threshold, similar to December 20, the international business media outfit, the Bloomberg immediately released a tweet of an article that highlighted the market’s dilemma.

Perhaps because of the abbreviated trading week due to the holidays, which many used to extend their vacation, attempts to push the index higher post-lunch break lacked vigor unlike December 20, and therefore, lost ground.

The fizzling of the intraday day pump didn’t deter the rescue of the index, though. Similar to December 20th, a massive mark-the-close pump cut the index’s losses by almost half!

But unlike the historic December 20 pump*, the low volume activities limited the scale of the rescue.

*Plunge Protection Team Rescues Index with December 20’s HISTORIC Magical Pumping! BSP’s Consumer Survey versus the CPI December 22, 2019

Was the media’s article about the struggling PhiSYX a coincidence or a pattern? Was it a beacon signal for a rescue?

Was the gigantic (+2.7%) pump on January 2nd led by SM Prime a coincidence or a pattern?

After soaring by close to 2%, the second day of 2020 saw the index jump by only 1.26.

And have the strength of the index in the first two days of the last two years, backed by mark-the-close pumps, been a coincidence or a pattern?

But why the inferior performance of 2020? Because of the want of vim expressed by the low volume? 2020’s two-day return was significantly below the over 2% in 2018 and 2019.

Despite understanding that in interpreting statistical probabilities, the difference between case probability and the class probability matters, will 2020’s significant inaugural underperformance weigh on the month’s returns? Except for 2016, the two-day trading week led the headline index to return a paltry .31%, the lowest since 2011.

Historically, less than 1% return on the first week have led to negative January returns. The headline index posted negative returns in the first week only in 2016 and 2008 in the last 13-years.

As a reminder, the index composition and weight distribution have differed over the years.

Even as several index issues, like Ayala Corp, Megaworld, PLDT, Jollibee, Metro Pacific, LT Group, DM Consunji, and Semirara Mining have touched multi-year lows in the last month or two, shares of only the Sy Group of companies have carved either a milestone or have been within the ambit of fresh highs!

While BDO and SM closed the week 6.06% and 7.81% off their respective January 2018 zeniths, SMPH has vertically ascended to repeatedly carve fresh highs in December 2019 extending to the first week of 2020. SM Prime’s September 2019 climb should be the steepest in history! And the headline index is at the 7,800 level only!

SMPH’s % share weight of the index jumped 65.2% from 6.12% in the first week of 2016 to a stunning 10.11% share in 2020!

Has the disproportionate accumulation of the share weight of the free-float index of Sy Group been a coincidence or pattern?

Is the mounting divergence between the Sy Group and most of the PSYEi issues a coincidence or a pattern? How sustainable is such an imbalance?

Has it been a coincidence or a pattern that 2019’s 4.68% returns had almost entirely accrued from the advances of the top 5 issues? And that such gains, which has magnified the lopsidedness of the index, came at the expense of the rest! The first quintile’s percentage share jumped by 14.9% in 2019 to 48.98% from 42.64% in 2018. Since Bloomberry replaced Petron Corporation in February 2019, the last quintile group has been excluded.

To what extent would such fundamental discrepancies from either coincidence or patterns persist?

Or should we just deny facts and economic precepts to blindly embrace with unquestioning faith what we have been programmed to believe?

Finally, have we not been repeatedly told that the Philippines would be immune from external events**?

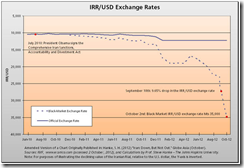

Then why the sudden backpedaling of establishment experts with the likely escalation of the US-Iran conflict, following the assassination of Iran’s military commander Qassem Soleimani in Iraq by US President Trump, which may have likely been done under the implicit bidding of the US military-industrial complex, Israel's Netanyahu and Saudi Arabia?

And since Syria and Iran have a mutual defense cooperation deal, would the theater of war expand should Syria lend a helping hand to Iran?

And would this not drag members of the China-led Shanghai Cooperation Organization (SCO) to an open conflict with the US-led NATO? Iran is an observer state of the SCO.

As Richard Haas, President of the politically connected Council on Foreign Relations (CFR) recently tweeted, “Make no mistake: any war with Iran will not look like the 1990 Gulf war or the 2003 Iraq wars. It will be fought throughout the region w a wide range of tools vs a wide range of civilian, economic, & military targets. The region (and possibly the world) will be the battlefield.”

And should the Middle East tinderbox be ignited, would the Philippines decouple from World War III????

For those who believe in this, good luck!

![[image%255B11%255D.png]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhGXldVYiudP7Z2-AuW7IaznC4reAq16oxzudSf9hTORnQge4Q_-tk5iIkg9Us45BU0l6CAuMUwa5T4ot4zPaM9riqFDY8w1Ipe-qMX8L7Fp6Pi1SJZDGTPj4b1KA2b8HKrA8kU/s1600/image%25255B11%25255D.png)