``The danger from all forms of paper money controlled and regulated by governments or their appointed central banks is that they remain creatures of the political process, and dependent upon the knowledge and policy preferences of those who have the power over the monetary printing press. The history of paper monies is a sorry story of inflations, currency depreciations, and resulting social and economic disorder.”-Richard M. Ebeling, IMF Special Drawing Right "Paper Gold" vs. a Real Gold Standard

The recent weakness in gold prices has prompted some mainstream commentaries to suggest “fear” as the main driving force behind this.

The underlying premise is that since gold competes with every other asset class for the investor’s money, the recent surge in global stock markets may have revived “risk” taking appetite or the Keynesian “animal spirits”. And since gold has been seen as less attractive alternative, investors may have possibly sold gold and subsequently bought into the stock markets. Hence the recent selloff has had “fear” imputed on gold prices.

For me, this represents sloppy reasoning unbacked by evidence which has been “framed” in very short term horizon, the anchoring bias or the ``tendency to rely too heavily, or "anchor," on a past reference or on one trait or piece of information” in their analysis and an innate prejudice against the “barbaric metal”.

Such flawed analysis omits the following perspective:

1. Prices Are Relative.

As we discussed in Expect A Different Inflationary Environment, inflation moves in stages and would likely impact asset classes in a dissimilar mode.

From our perspective the stock markets and commodities have initially been the primary the absorber of government induced “reflationary” measures.

In other words, yes, a rotation will likely be the case, but this doesn’t imply “fear”. It simply means a pause in the trend because NO trend moves in a straight line. It is that elementary.

The same analogy can be ascribed to last year’s dreadful financial markets collapse, where many left leaning analysts have imputed “capitalism is dead”. The truism is that markets aren’t fated to move in one direction, because they always reflect on the fluid pricing dynamics by the different participants in response to perpetual changes in the flow of information as reflected by the changes in the environment.

But when markets are tweaked by governments to achieve a perennial boom, they attain the opposite outcome- a short-term euphoric boom and an equally devastating bust or the bubble cycle.

Mr. Bill Bonner in U.S. Banks Overrun by Dirty, Rotten Scoundrels eloquently describes this phenomenon, ``Capitalism is not a collection of nuts and bolts, gears and switches. Instead, it is a moral 'system.' 'Do unto others as you would have them do unto you,' is all you need to know about it. And like any moral 'system,' it rarely gives the capitalists what they hope for...or what they want. It gives them what they deserve. And right now, it's giving it to them good and hard.” (bold emphasis mine)

In short, losses are inherent features of the marketplace. Hence, they are reflected in trends or in cycles see figure 1.

Figure 1: stockcharts.com: Gold: Where’s The Fear?

Figure 1: stockcharts.com: Gold: Where’s The Fear?

Over the past three years we see some correlations among different markets, yet these correlations haven’t retained a fixed balance but instead have been continually evolving in a seemingly divergent fashion.

In 2006-2007 Gold (main window) soared along with the global stock markets (DJW), as the US Dollar index (USD) had been on a decline (see blue trend lines). So from this perspective alone, the premise that gold falls on higher stock markets simply DOESN’T HOLD. One could easily make the oversimplified case where the inflationary ramifications of a falling US dollar had fueled a frenzy over gold and global stock markets until this culminated.

But the past dynamics have been reconfigured.

Late last year, the spike in the VIX or the “Fear” index coincided with a surge in the US dollar as a majority of global stock markets went into a tailspin. Gold similarly melted. But in contrast to the stock markets, gold found an early bottom which corresponded with a peak in the US dollar and the VIX index. This apparently marked the end of an INVERSE or NEGATIVE correlation between gold and the US dollar.

In this landscape marked by FEAR, one can infer that the US dollar functioned as the sole “safehaven” from the banking meltdown triggered investor exodus in global stock markets and in gold. But apparently this dynamic appears to be a short term affair and may have signified as a ‘one-time’ event that marked the extraordinary market distress or dislocation-our Posttraumatic Stress Disorder PTSD.

In 2009, these dynamics have been rejiggered anew. From the start of the year, Gold strongly rallied but “peaked” alongside the US dollar index (see red arrows) concurrent to the decline in the fear index and a revival in global stock markets.

The falling US dollar and declining gold prices have reversed the NEGATIVE correlation to a POSITIVE correlation where both have moved in the same direction. The implication is that the US dollar, the VIX “fear” index and Gold encapsulated the investor’s negative sentiment, all of which have recently declined. And subsequently, the stock market rally has been “fueled” by the revival of the animal spirits, according to the fear believers.

Hence, the swift “rationalization” that investor’s negative sentiment has reversed course and has passed on the “fear factor” burden to “gold”.

Yet, this ignores the fact that both the US dollar index and gold are still on an UPTREND from the basis of the simultaneous lows last October. To reiterate, from their lows both had been positively correlated.

Stretching the picture, gold remains entrenched in a bullmarket since 2001, while the US dollar’s newfound virility could signify as either a cyclical rally within long term bear market or as a fledging bull.

But since gold represents as the nemesis of the paper money system (as seen by Keynesians-ergo “barbaric” metal) epitomized by the US dollar hence price action should reveal an inverse correlation. But this hasn’t been the case today, or as it had similarly been in 2005, where both the US and gold rose even amidst a milieu of rising stock markets.

Yet such positive correlation between gold and the US dollar may account for many variable reasons for the aberration. Since the US dollar index is significantly weighted towards the Euro this could mean a frailer European economy than the US, investor’s perception of Europe’s banking system as relatively more vulnerable, the deleveraging process continues to manifests of sporadic US dollar shortages in the global financial system, and etc.., but this seems likely to be temporary.

Nonetheless given that gold has been in a longer and a more solid trend of 8 years, combined with the fundamentals of the growing risks of unintended consequences by the collective money printing financed spending spree by governments, our money is on gold.

2. Governments Have Been Distorting Every Market Including Gold.

It’s quite naïve for anyone to docilely believe that the gold markets have been efficiently reflective of the genuine market based fundamentals, when almost every financial markets have seen massive scale of interventions from global governments.

To consider, the gold markets despite its relative smaller breadth (estimated at $4 trillion of above gold stocks and $150 billion gold mining stocks measured in market capitalization) has been a benchmark closely monitored by Central Bankers. For example the speech of Federal Reserve Chairman Ben Bernanke entitled as Money Gold and the Great Depression reinforces this view.

It is because gold has functioned as money for most of the years since humanity existed. So it isn’t just your ordinary or contemporary commodity.

In fact, this has been the 38th year where our monetary system has operated outside the anchors of gold or other commodities. Alternatively, this represents as the boldest and grandest experiment of all time [see our earlier article Government Guarantees And the US Dollar Standard]. Remember, all experimentations of paper money system that has ever existed perished due to “inflationary” abuses by governments.

In other words, government distortions may cloud interim activities in the gold market, but this doesn’t suggest of a reversal of its long term trend. Thus, this isn’t fear.

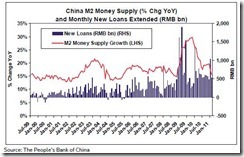

The unstated overall goal of collective governments today is to revive the status quo ante environment predicated on the paradigm of borrow-spend-speculate policies. Thus an all out effort is being waged.

That’s why global central banks have geared policy interest rates towards ZERO-in the name of providing liquidity. That’s why global central banks have resorted to the printing press or in technical terms “quantitative easing” and absorbed various junks from the banking system-in the name of “normalizing” the credit process. And that’s why governments have thrown or indiscriminately spent enormous sums of money into the global financial and economic system-in the name of sustaining aggregate demand.

In essence, they want everybody to stop saving and indulge in a binge of borrowing, spending or speculating in order to drum up the “animal spirits”.

For those with common sense, we understand that these policies are simply unsustainable. And unsustainable policies eventually will unravel.

Yet why are these being practiced? Because of sundry political reasons-primarily to expand the presence of government in the system.

When gold defied the “deflationary outlook” which infected almost all asset classes, we argued that governments could have wanted a higher gold prices as signs of reviving inflation [see Do Governments View Rising Gold Prices As An Ally Against Deflation?]. With the present developments, this has changed.

Since the overall goal of governments is to revive the “animal spirits”, then rising stock markets serves as a vital instrument to project these reinvigorated investor sentiment. Now that stock markets have been sensing signs of emergent inflation, gold markets are being targeted as the traditional adversary.

Proof?

Take the publicized plan by the G-20 to sell part of IMF’s gold stash of 403 tons out of the 3,200 tons it holds which is the third largest after the US and Germany.

You’d be wondering why the efforts by the G-20 to broadcast sales, considering the substantial size, would have a negative short term impact on gold prices even prior to the actual sales.

A normal seller in the marketplace would have the incentive to get the best possible price in exchange for the goods or services being sold. Hence if the IMF aims to achieve optimum prices from its sales it should conduct its program discreetly. But this isn’t so. Obviously the announcement of proposed gold sales would result to depressed prices even prior to the action itself. Therefore, this wouldn’t account for an “economically rational” seller but one shrouded by political motivations.

Factually, this is just one of the psychological tools employed by central bankers when manipulating the currency market. They call this the “signaling channel”.

According to IMF’s Division Chief of the Research Department, in his article Turning Currencies Around, ``Through the signaling channel, the central bank communicates to the markets its policy intentions or private information it may have concerning the future supply of or demand for the currency (or, equivalently, the path of interest rates). A virtuous expectational cycle can emerge: for instance, if the central bank credibly communicates its belief that the exchange rate is too strong—and would be willing to change policy interest rates if necessary—then market expectations will lead to sales of the currency, weakening it as intended.” (bold underscore mine)

In short, G 20 policymakers have been using conventional currency manipulation tactics to put a kibosh on the gold market.

Moreover, the same article on the G 20 gold sales from CBS Marketwatch reports that the European Central bank had “completed the sale of 35.5 tons of gold” late March.

Another, there have been discussions in cyberspace on the unverified interventions by the European Central Bank to save Deutsche Bank from its short positions.

The point is you can’t ascribe fear when knowingly such markets are being cooked up for some political purposes, although the superficial nature of market manipulations ensures that the impact will be felt on a short term basis.

But even as the G-20 has been attempting to maneuver the gold markets, actions by one party appear to be offset by the actions of another.

Apparently China has been doing the opposite of the G-20. Instead of publicly airing its intent to increase gold reserves, it has tacitly been amassing gold from its domestic producers and from the domestic market (mineweb.com) to see a 75% surge in gold reserve holdings to 1,054 tonnes in 2008 from the 600 tonnes in 2003. (AFP)

While other analysts downplay the significance of this reported gold hoarding citing that China has been buying up almost everything from US treasuries, US equities to other commodities, we believe that China seems to be positioning its currency, the yuan, as a candidate to replace the US dollar as the world’s reserve currency as discussed in Phisix: The Case For A Bull Run or possibly working to provide an insurance cover on its currency against the growing risks of hyperinflation, which would translate to massive losses in its US dollar holdings on its portfolio [see Has China Begun Preparing For The Crack-Up Boom?].

In presaging for times of trouble, commodities essentially could function as the yuan’s potential “anchor”.

It makes no fundamental sense to excessively store up on gold, other metals, oil and other commodities unless severe shortages have been perceived as a potential problem.

As a political institution, China won’t be much concerned with the “convenience yield” or “the benefit or premium associated with holding an underlying product or physical good, rather than the contract or derivative product” (answers.com), even as commodities don’t generate interest income which is offered by financial assets.

Besides what’s the point of disclosing the sharp increase in gold reserves by China after 5 years of covert accumulation operations?

Thus, China’s actions can be construed as essentially more politically motivated (timed with its bleating over the increased risks of the US dollar) with economic and financial ramifications.

The other point is NOT to look at China’s holdings of US dollar assets on an absolute level but from a relative standpoint: where has China’s concentration of US assets been-in long term or short term securities? Remember although China may continue to buy US securities in order to hold its currency down, if it does so by accumulating assets in mostly short term duration, then this may be extrapolated as an attempt too reduce its currency risks exposure.

Finally, despite the ongoing official manipulations gold market isn’t just an issue for central banks as private institutions have been feverishly accumulating on gold holdings as seen in Figure 2.

Figure 2: Casey Research: Gold ETFs are rapidly catching up with top Central Banks

Figure 2: Casey Research: Gold ETFs are rapidly catching up with top Central Banks

According to Casey Research, ``SPDR Gold Shares (GLD), an exchange-traded fund, first hit the market in November 2004 with 260,000 ounces of gold. Today, GLD is the world’s 6th largest holder of physical gold with over 35 million troy ounces in the vault. In fact, since the general market meltdown last fall, the ETF has added over 16 million ounces and ended 2008 with a 5% gain – not many investments can make that claim. Investors worldwide are sending a clear message: Gold is the safest asset in which to store wealth, not the product of the printing press.”

So even when official institutions have been attempting to control the gold markets, the interest from private investors have been strongly accelerating to possibly offset any substantial sales by top gold holders.

As Professor Gary North notes, ``Eventually, governments will run out of gold to sell, and so will the IMF. They will run out of gold to lease. While I do not think the politicians will ever catch on to the fact that their nations' gold is gone, leaving only IOUs for gold written by bullion banks that are on the verge of bankruptcy anyway, I do think that at some point the central banks will stop leasing gold.”

In short, once a substantial segment of gold from official institutions has been transferred to the investing public, governments will lose their power to manipulate gold prices.

Moreover, the relative variances in the holdings of the gold reserves among central banks underpins a possible realignment of gold distribution from crisis affected US and European nations with present heavy gold holdings to the savings and foreign currency reserve rich emerging economies.

So the potential shift likewise favors rising gold prices.

3. Ignores Seasonality Effects of Gold

Those bewailing fear have likewise been guilty of the omission of the seasonality patterns of gold see figure 3.

Figure 3: US Global Investors: Seasonal Patterns

The chart from US Global Investors manifests of the 15 and 30 year pattern of gold.

Basically, the annual trend can be identified starting with Gold’s summit during the first quarter which effectively goes downhill until the early third quarter where it bottoms, strengthens and ascends.

Even if we were to compare the movements over the last 3 years in Figure 1, the seasonality effects almost seem like clockwork but not in exactitude.

So if I were a gold trader, I’d start accumulating the benchmark precious metal during the lowest seasonal risk months of July to September and be a seller at the start of the year. Although in the interim, I should expect gold to firm up going into May where I should expect a summit and weaken into July or August.

Of course the seasonality factors have divergent depth or heights in terms of losses and gains mostly depending on the underlying long term trend. However in the present bullmarket, instead of correcting during the seasonal low months gold could simply consolidate (similar to 2007).

The point is if we understand and become cognizant of gold’s seasonality patterns, we won’t be lulled to the oversimplified anchoring of ascribing “fear” on gold prices.

Although as a caveat, considering that in the past 15-30 years gold’s annual cycle has been predicated on the demand configuration centered on mainly Jewelry (as I have shown in a chart last February), the accelerating interests on identifiable investments could diminish the seasonality effect variable.

4. Neglects the Risks of Accelerated Inflation Due To Flawed Economic Principles

Most believers of the “Fear” in gold see the risks of deflation more than the risks of inflation. That’s because they live in a simple world of known variables such as “liquidity traps”, “aggregate demands”, “animal spirits”, “current account imbalances” and “overcapacity”. On the same plane, they believe in the “neutrality” of money.

Let me remind you that the fundamental reason global governments are inflating have been due to the perceived risks of deflation, or said differently, for as long as the perceived risks of deflation is in the horizon, governments will continue to inflate, as they have been practicing what can be described as their ideology or textbook orientation-where policymaking or the decisions of a few is reckoned as better than the decisions of the billions of people operating in the marketplace.

As you can see, the irony here is that governments essentially FEAR falling prices in everything. Where falling prices are good for the individual (as it translates to more purchasing power), they are deemed bad for the society, so it is held.

And the same applies to savings; “savings” defeat consumption, so it is held, as reduced consumption equates to diminished “demand” which is equally bad for the society. Hence, to counter falling prices, means that governments and their coterie of mainstream supporters exalt on the furtherance of borrowing, spending and speculative inducing policies, the very policies that brought us this crisis.

Unfortunately the US and European banking system remains fragile as governments have kept alive institutions that needs to expire. The losses have now escalated to a sink hole-some $4.1 trillion of toxic assets, according to the revised estimates of the IMF. This means more redistributive processes is in the offing given this ideological framework, where more money especially from crisis affected nations will be used to prop up zombie institutions. The US has pledged or guaranteed a stupendous $12.8 trillion and growing (as of March 31), while UK’s support for its financial industry has already surged to a remarkable $2 trillion and counting.

Apart, every nation have been urged to do their role of printing money, borrowing and spending from which global policymakers have gladly obliged. The local crocs have been jumping with glee as Philippine stimulus spending of Php 330 billion or ($7 billion) translates to a surge in “S.O.P” (Standard Operating Procedure or other term for kickbacks).

The unfortunate part is that not every country or region has been affected by an impaired banking system. Emerging markets have primarily been affected by the transmission mechanism of the US epicenter crisis via external linkages of trade (falling exports), labor (reduced remittances) and investments. Hence, the deflationary pressures seen in nations which presently endure from busted credit bubbles and emerging markets suffering from sharp external adjustments or two distinct diseases have been administered with similar medication but in varying dosages.

Apparently, since money, for us, has relative impact on prices, these concerted government sponsored programs has begun to ‘leak out’ to the marketplace-through stock markets first then commodities next, as expected.

The recently published World Economic Outlook from the IMF gave me an eye popping jolt over the very compelling fundamentals of food!

Thus, we’d deviate from gold and discuss about food. See figure 4.

Figure 4: IMF’s WEO: Supply side dynamics for select Food

Figure 4: IMF’s WEO: Supply side dynamics for select Food

According to the WEO (p.55) , ``In the face of weaker demand from emerging economies, reduced biofuel production with declining gasoline demand, falling energy prices, and insufficient financing amid tightened credit conditions, farmers across the globe have reportedly reduced acreage and fertilizer use. For example, the U.S. Department of Agriculture projects that the combined area planted for the country’s eight major crops will decline by 2.8 percent (year over year) during the 2009–10 crop year. At the same time, stocks of key food staples, including wheat, are still at relatively low levels. These supply factors should partly offset downward pressure from weak demand during the downturn.” (bold underscore mine)

Did you see spot the fun part in the chart? Notice that the inventory cover for the world’s major Food crops (middle) has been nearly at the lowest levels since 1989!

Despite the surge in Food prices in early 2007 these hasn’t translated to a boom in the production side. Now that the crisis has been the underlying theme which has also impacted the food industry, production has further been impeded by “tightened credit conditions” which has “reduced acreage and fertilizer use”. Whereas consumption demand is expected by the WEO to be maintained at present levels (yellow line middle chart).

Remember the shelf life for food is short. Hence, surpluses are likely to be minimal.

Moreover, we have a looming structural long term demand-supply imbalance.

According to Earth Policy, ``Demand side trends include the addition of more than 70 million people to the global population each year, 4 billion people moving up the food chain--consuming more grain-intensive meat, milk, and eggs--and the massive diversion of U.S. grain to fuel ethanol distilleries. On the supply side, the trends include falling water tables, eroding soils, and rising temperatures. Higher temperatures lower grain yields. They also melt the glaciers in the Himalayas and on the Tibetan plateau whose ice melt sustains the major rivers and irrigation systems of China and India during the dry seasons.”

What is this implies is that this episode of intensive money printing on a global scale will have a tremendous impact on food prices!!! If the boom in financial markets in emerging markets does extrapolate to “reflation” then there will be a tidal wave of demand to be met by insufficient supplies!! The next crisis may even be a food crisis!

In addition, the inelasticity or poor or lagged response from the price action, possibly due to overregulation, subsidies, import tariffs, etc… , suggests of a prolonged supply side response; as I earlier noted -the boom in food prices in 2007 didn’t translate to a meaningful supply side adjustment.

So those obsessing over the “deflation” bogeyman will most likely be surprised by a sudden surge of Consumer Price Index especially when food prices hit the ceiling.

This is equally bullish for gold.

Moreover, for governments and those fearing deflation who are in support of policies operated by the printing press, it seems to be a case of “be careful of what you wish for!”

![clip_image002[1] clip_image002[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhvdqAElBZns0qCTZizg46guGUElAdxX1DKsFpdGppwtSwbU0MYshYolzqkJcy7ThWHD25CXfyVD05Wt1yqO4Yi99xIZUuAluGZlhgo3x6vJ8s_bP4EX1I7FwLLd98JN_p_VFK7/?imgmax=800)

![clip_image004[1] clip_image004[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEg0K1WXGSGwJxypbmZ57Y3OBs1ZGUdnwdc_lWtay1UTu-GHwaHSLjqovvRl9F4jfFjSc0gL3C4rr1Momx2_r7kDNqbO2EjG7zwXp0ScQwmnMYauCCTuYfKhj0sdxvk7HNusSrxk/?imgmax=800)