By destroying the basis of reckoning values—the possibility of calculating with a general denominator of prices which, for short periods at least, does not fluctuate too wildly—inflation shakes the system of calculations in terms of money, the most important aid to economic action which thought has evolved. As long as it is kept within certain limits, inflation is an excellent psychological support of an economic policy which lives on the consumption of capital. In the usual, and indeed the only possible, kind of capitalist book-keeping, inflation creates an illusion of profit where in reality there are only losses. As people start off from the nominal sum of the erstwhile cost price, they allow too little for depreciation on fixed capital, and since they take into account the apparent increases in the value of circulating capital as if these increases were real increases of value, they show profits where accounts in a stable currency would reveal losses. This is certainly not a means of abolishing the effects of an evil etatistic policy, of war and revolution; it merely hides them from the eye of the multitude. People talk of profits, they think they are living in a period of economic progress, and finally they even applaud the wise policy which apparently makes everyone richer.But the moment inflation passes a certain point the picture changes. It begins to promote destructionism, not merely indirectly by disguising the effects of destructionist policy; it becomes in itself one of the most important tools of destructionism. It leads everyone to consume his fortune; it discourages saving, and thereby prevents the formation of fresh capital. It encourages the confiscatory policy of taxation. The depreciation of money raises the monetary expression of commodity values and this, reacting on the book values of changes in capital—which the tax administration regards as increases in income and capital—becomes a new legal justification for confiscation of part of the owners' fortune. References to the apparently high profits which entrepreneurs can be shown to be making, on a calculation assuming that the value of money remains stable, offers an excellent means of stimulating popular frenzy. In this way, one can easily represent all entrepreneurial activity as profiteering, swindling, and parasitism. And the chaos which follows, the money system collapsing under the avalanche of continuous issues of additional notes, gives a favourable opportunity for completing the work of destruction.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Wednesday, February 20, 2013

Does Unemployment Cause Deflation?

Tuesday, February 19, 2013

The Political Pretense called Currency War

if the quantity of money is increased, the purchasing power of the monetary unit decreases, and the quantity of goods that can be obtained for one unit of this money decreases also.

Global finance chiefs signaled Japan has scope to keep stimulating its stagnant economy as long as policy makers cease publicly advocating a sliding yen.The message was delivered at weekend talks of finance ministers and central bankers from the Group of 20 in Moscow. While they pledged not “to target our exchange rates for competitive purposes,” Japan wasn’t singled out for allowing the yen to drop and won backing for its push to beat deflation.

Tuesday, October 09, 2012

Sri Lanka Joins Global Money Printing Contest

Sri Lanka's central bank has sterilized a foreign exchange sale injecting 8.0 billion rupees in one-month money into the banking system, ending several weeks of monetary policy that has been favourable of a stronger exchange rate.On Friday the central bank printed 8.0 billion rupees for one month at 9.81 percent, slightly above the 9.75 percent reverse repo rate at which overnight liquidity is injected into the banking system for 31 days.Until Thursday the monetary authority was injecting cash overnight in to the banking system, following a large liquidity shortage that occurred in late September. In a pegged exchange rate system, a large liquidity shortage occurs through an unsterilized foreign exchange sale.While overnight rupee injections also generate demand in the economy, it can be less damaging than longer term cash injections, since bank managers will not try to grow the loan book while funding the balance sheet with overnight liquidity.Instead they will try to cover the positions by curbing loan growth or raising more deposits or both.But central bank liquidity injections through term Treasury bill purchases allow banks to focus on loans again, preventing the adjustment of the economy to the outflow of money through the central bank foreign exchange sales and triggering balance of payments trouble.

Monday, October 01, 2012

Currency Manipulation and the Politics of Neo-Mercantilism

The dollar maintains its reserve currency status because it is the least worst of the major four currencies – the US dollar, the British pound, the Japanese yen, and the euro. All four of these currencies are now suffering the effects of a stimulative, expansive, and QE-oriented monetary policy.We must now add the Swiss franc as a major currency, since Switzerland and its central bank are embarked on a policy course of fixing the exchange rate between the franc and the euro at 1.2 to 1. Hence the Swiss National Bank becomes an extension of the European Central Bank, and therefore its monetary policy is necessarily linked to that of the eurozone…When you add up these currencies and the others that are linked to them, you conclude that about 80% of the world’s capital markets are tied to one of them. All of the major four are in QE of one sort or another. All four are maintaining a shorter-term interest rate near zero, which explains the reduction of volatility in the shorter-term rate structure. If all currencies yield about the same and are likely to continue doing so for a while, it becomes hard to distinguish a relative value among them; hence, volatility falls.The other currencies of the world may have value-adding characteristics. We see that in places like Canada, Sweden, and New Zealand. But the capital-market size of those currencies, or even of a basket of them, is not sufficient to replace the dollar as the major reserve currency. Thus the dollar wins as the least worst of the big guys.Fear of dollar debasement is, however, well-founded. The United States continues to run federal budget deficits at high percentages of GDP. The US central bank has a policy of QE and has committed itself to an extension of the period during which it will preserve this expansive policy. That timeframe is now estimated to be at least three years. The central bank has specifically said it wants more inflation. The real interest rates in US-dollar-denominated Treasury debt are negative. This is a recipe for a weaker dollar. The only reason that the dollar is not much weaker is that the other major central banks are engaged in similar policies.

First, they serve as lenders of last resort, which in practice means bailouts for the big financial firms. Second, they coordinate the inflation of the money supply by establishing a uniform rate at which the banks inflate, thereby making the fractional-reserve banking system less unstable and more consistently profitable than it would be without a central bank (which, by the way, is why the banks themselves always clamor for a central bank). Finally, they allow governments, via inflation, to finance their operations far more cheaply and surreptitiously than they otherwise could.

Protectionism, often refuted and seemingly abandoned, has returned, and with a vengeance. The Japanese, who bounced back from grievous losses in World War II to astound the world by producing innovative, high-quality products at low prices, are serving as the convenient butt of protectionist propaganda. Memories of wartime myths prove a heady brew, as protectionists warn about this new "Japanese imperialism," even "worse than Pearl Harbor." This "imperialism" turns out to consist of selling Americans wonderful TV sets, autos, microchips, etc., at prices more than competitive with American firms.Is this "flood" of Japanese products really a menace, to be combated by the U.S. government? Or is the new Japan a godsend to American consumers? In taking our stand on this issue, we should recognize that all government action means coercion, so that calling upon the U.S. government to intervene means urging it to use force and violence to restrain peaceful trade. One trusts that the protectionists are not willing to pursue their logic of force to the ultimate in the form of another Hiroshima and Nagasaki.

People favor discrimination and privileges because they do not realize that they themselves are consumers and as such must foot the bill. In the case of protectionism, for example, they believe that only the foreigners against whom the import duties discriminate are hurt. It is true the foreigners are hurt, but not they alone: the consumers who must pay higher prices suffer with them.

While the size of the credit expansion that private banks and bankers are able to engineer on an unhampered market is strictly limited, the governments aim at the greatest possible amount of credit expansion. Credit expansion is the governments' foremost tool in their struggle against the market economy. In their hands it is the magic wand designed to conjure away the scarcity of capital goods, to lower the rate of interest or to abolish it altogether, to finance lavish government spending, to expropriate the capitalists, to contrive everlasting booms, and to make everybody prosperous.

Tuesday, June 12, 2012

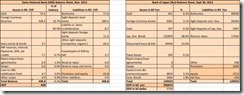

Aftermath of Boom Bust Policies: US Family Net Worth Fell Nearly 40% Between 2007-2010

From the Wall Street Journal Blog (bold emphasis mine)

Families’ median net worth fell almost 40% between 2007 and 2010, down to levels last seen in 1992, the Federal Reserve said in a report Monday.

As the U.S. economy roiled for three tumultuous years, families saw corresponding drops in their income and net wealth, according to the Fed’s Survey of Consumer Finances, a detailed snapshot of household finances conducted every three years.

Median net worth of families fell to $77,300 in 2010 from $126,400 in 2007, a drop of 38.8%–the largest drop since the current survey began in 1989, Fed economists said Monday. Net worth represents the difference between a family’s gross assets and its liabilities. Average net worth fell 14.7% during the same three-year period.

Much of that drop was driven by the housing market’s collapse. Families whose assets were tied up more in housing saw their net worth decline by more. Among families that owned homes, their median home equity declined to $75,000 in 2010, down from $110,000 three years earlier.

Between 2007 and 2010, incomes also dropped sharply. In 2010, median family income fell to $45,800 from $49,600 in 2007, a drop of 7.7%. Average income fell 11.1% to $78,500, down from $88,300. That was a departure from earlier in the decade. During the preceding three years, median income had been constant, while the mean had climbed 8.5%.

Family incomes also dropped the most in regions of the country hardest hit by the housing market tumble. Median family income in the West and South decreased substantially, while those in the Northeast and Midwest saw little change.

This serves as evidence of how interest rate policies (zero bound rates) which attempts to induce a “permanent quasi boom” essentially impoverishes a society.

The market’s fierce backlash from Keynesian snake oil policies, serves as another validation or the realization of admonitions from the great Ludwig von Mises.

He who wants to "abolish" interest will have to induce people to value an apple available in a hundred years no less than a present apple. What can be abolished by laws and decrees is merely the right of the capitalists to receive interest. But such decrees would bring about capital consumption and would very soon throw mankind back into the original state of natural poverty.

Capital consumption indeed.

Postscript:

Policymakers instead has been shifting the blame on China than accepting their mistakes and has further pursued similar set of policies. This means we should expect the same results overtime. Yet part of the imbalances caused by the boom phase of bubble cycles has been to overvalue a currency.

As a side note, politicians and mercantilists have long blamed China for alleged currency manipulation. The US Treasury recently avoided a direct confrontation by refusing to label China as one. That's because the US Treasury has become beholden to China, as evidenced by the privilege of direct access. This represents the another case where the mythical pot calls the kettle black.