In the 2001 issue of the International Journal of Forecasting, an economist from the International Monetary Fund, Prakash Loungani, published a survey of the accuracy of economic forecasts throughout the 1990s. He reached two conclusions. The first was that forecasts are all much the same. There was little to choose between those produced by the IMF and the World Bank, and those from private sector forecasters. The second conclusion was that the predictive record of economists was terrible. Loungani wrote: “The record of failure to predict recessions is virtually unblemished.”Now Loungani, with a colleague, Hites Ahir, has returned to the topic in the wake of the economic crisis. The record of failure remains impressive. There were 77 countries under consideration, and 49 of them were in recession in 2009. Economists – as reflected in the averages published in a report called Consensus Forecasts – had not called a single one of these recessions by April 2008.This is extraordinary. Bear in mind that this is not the famous complaint from the Queen that nobody saw the financial crisis coming. The crisis was firmly established when these forecasts were made. The Financial Times had been writing exhaustively about the “credit crunch” since the previous summer. Northern Rock had been nationalised in the UK and Bear Stearns had collapsed in the US. It did not take a genius to see that trouble was on the way for the wider economy.More astonishing still, when Loungani extends the deadline for forecasting a recession to September 2008, the consensus remained that not a single economy would fall into recession in 2009. Making up for lost time and satisfying the premise of an old joke, by September of 2009, the year in which the recessions actually occurred, the consensus predicted 54 out of 49 of them – that is, five more than there were. And, as an encore, there were 15 recessions in 2012. None were foreseen in the spring of 2011 and only two were predicted by September 2011.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Saturday, June 07, 2014

Quote of the Day: The predictive record of economists was terrible

Wednesday, December 11, 2013

Why Nassim Taleb Disdains the Economic Profession

- An economist is a mixture of 1) a businessman without common sense, 2) a physicist without brain, and 3) a speculator without balls.

- A prostitute who sells her body (temporarily) is vastly more honorable than someone who sells his opinion for promotion or job tenure.

- The artificial gives us hangovers, the natural inverse-hangovers. The joys of post-exercise, breaking a fast, meeting a friend, helping someone in trouble, or humiliating an economist are examples of inverse hangovers. Antifragility = series of earned inverse hangovers. They don't come for free.

- Those with brains no balls become mathematicians, those with balls no brains join the mafia, those w no balls no brains become economists.

- To have a great day: 1) Smile at a stranger, 2) Surprise someone by saying something unexpectedly nice, 3) Give some genuine attention to an elderly, 4) Invite someone who doesn't have many friends for coffee, 5) Humiliate an economist, publicly, or create deep anxiety inside a Harvard professor.

- A trader listened to the firm's "chief" economist's predictions about gold, then lost a bundle. The trader was asked to leave the firm. He then angrily asked him boss who was firing him: "Why do you fire me alone not the economist? He is too responsible for the loss." The Boss: "You idiot, we are not firing you for losing money; we are firing you for listening to the economist."

- Discussing growth without concern for fragility: like studying construction without thinking of collapses. Think like engineer not economist.

- OPEN DISCUSSION: Back to skin in the game. It looks like skin in the game does not necessarily work because it makes people more careful, rather but because it allows the risk taker to exit the gene pool and stop transferring the risk to others. A bad driver exposed to harm would eventually die and stop killing people on the road; shielded from harm he would keep killing others ad infinitum, as if he were an economist a la JS or PK.

- Success in all endeavors is requires absence of specific qualities. 1) To succeed in crime requires absence of empathy, 2) To succeed in banking you need absence of shame at hiding risks, 3) To succeed in school requires absence of common sense, 4) To succeed in economics requires absence of understanding of probability, risk, or 2nd order effects and about anything, 5) To succeed in journalism requires inability to think about matters that have an infinitesimal small chance of being relevant next January, ...6) But to succeed in life requires a total inability to do anything that makes you uncomfortable when you look at yourself in the mirror.

- [On his greatest disappointment]: That I am unable to destroy the economics establishment, the press.

- Friends, I wonder if someone has computed how much would be saved if we shut down economics and political science departments in universities. Those who need to research these subjects can do so on their private time.

- Being nice to the wicked (or economist) is equivalent to being nasty with the virtuous.

The problem is that academics really think that nonacademics find them more intelligent than themselves.

Tuesday, June 04, 2013

How Financial Experts Bamboozle the Public

Americans would like an apology from Wall Street for the financial crisis.They probably aren't going to get it.But how about giving the number crunchers and investment managers a "time out" to reflect a little on the era of financial alchemy and greed that did so much damage?That's what was happening in Chicago this week, where about 2,000 of the financial industry's quantitative minds and investment professionals gathered for their annual CFA Institute conference. They got some verbal punishment from some of the industry's stalwarts, who were admonishing their chartered financial analyst peers to think rather than allow mindless financial models and dreams of success to drive them to endorse the kinds of aggressive investment decisions that can create riches for themselves -- and destroy wealth for others."If you are attracted to a job in finance because the pay is so generous, don't do it," said Charles Ellis, one of the elder statesmen of the profession. "That's a form of prostitution."Rather, Ellis said, his profession needs to return to the days he knew in the 1960s, when the emphasis was on counseling investment clients and not on churning out esoteric products and pushing people to buy them blindly.Today the emphasis too often is on "complexity rather than common sense," said James Montier, asset allocation strategist for investment manager GMO. "In finance, we love to complicate. We rely on complexity to bamboozle and confuse."

Too many in his profession, Montier said, are trying inappropriately to apply physics to investing, where it doesn't belong, and they are ignoring inconvenient truths. Complex mathematics is valued but not necessarily used honestly, he said."A physicist won't believe that a feather and brick will hit the ground at the same time, and they won't use models to game the system. But that's what finance does with models," Montier said. "They take them as though they are reality."Montier, speaking to financial professionals who design, evaluate and sell investment products to individuals and institutions, warned that all professionals in finance need to be thinking more, rather than following the herd."Who could have argued that CDOs were less risky than Treasurys with a straight face?" he said. But that's what happened. "Part of the brain was switched off, and people took expert advice at face value.

Indeed, the very concept of "variable" used so frequently in econometrics is illegitimate, for physics is able to arrive at laws only by discovering constants. The concept of "variable," only makes sense if there are some things that are not variable, but constant. Yet in human action, free will precludes any quantitative constants (including constant units of measurement). All attempts to discover such constants (such as the strict quantity theory of money or the Keynesian "consumption function") were inherently doomed to failure.

Government regulators and the Federal Reserve are guilty, too, of blindly putting their confidence in flawed models, he said. And if his profession and the regulators continue to ignore the dangers of financial concoctions involving massive leverage and illiquid assets, financial companies again will create an explosive brew that will result in calls for another government bailout.

You never want a serious crisis to go to waste..This crisis provides the opportunity for us to do things that you could not do before.

Wednesday, August 03, 2011

Mainstream Economists Lack Ethics

Speaking of occupational hazards, lawyers are known as liars while economists are known for their lack of ethics.

Al Lewis at the marketwatch.com writes (via Mises Blog Mark Thornton) [bold emphasis mine]

Economist Martha Starr thinks there’s something you should know about economists: They have no code of ethics.

Starr has worked for the Federal Reserve, the World Bank and the U.S. Agency for International Development. Today, she’s an economics professor at the American University and the editor of a new book of essays, “Consequences of Economic Downturn: Beyond the Usual Economics.”

“Economists have absolutely no guidelines regulating their conduct,” Starr said. “Accountants, financial professionals...sociologists, anthropologists, historians, mathematicians and physicists all have standards, but not economists.”

This includes the economists who were wrong about the Internet bubble, the housing bubble and whether the Fed’s multitrillion-dollar liquidity injections would revive the economy. It also includes the economists who are now offering us differing views on what happens if America loses its Triple-A credit rating or defaults on its debt.

Economists don’t have to disclose relationships that leave them fatally conflicted. They too often work for banks, real estate groups, trade associations, corporations, political organizations and other aggressive players with a vested interest in a nation of suckers thinking that things they buy will always go up.

Economists don’t have to disclose the big, fat speakers fees they might receive from a Wall Street investment firm. They don’t have to mention their roles as corporate board directors, consultants and paid expert witnesses in corporate litigation. Or even the investments they’ve made personally that could benefit from some good, old-fashioned economic cheerleading.

Mainstream economists, along with politicos, are one of the main practitioners of the principal-agent conflict of interest (agency problems). Many of them are shills and operate on a revolving door relationship with government agencies as the US Federal Reserve

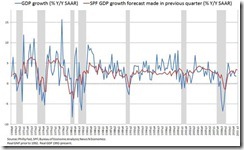

Worst, they have a string of very poor track record in forecasting markets

Chart from NewsNEconomics

Yet here is the kicker (from the same article):

Economists are not responsible for the consequences of their forecasts. They don’t even stand to be embarrassed for failing to disclose conflicts or living up to any sort of code.

Al Lewis is right, even sewer workers have standards!

Thursday, April 21, 2011

Gold at $1,500 Settles the Jim Rogers-Nouriel Roubini Debate

Celebrity guru Nouriel Roubini has been dead wrong. Prolific investor Jim Rogers has been spot on. They had an impassioned debate in November of 2009.

Professor Roubini earlier said of gold prices,

Maybe it will reach $1,100 or so but $1,500 or $2,000 is nonsense,” Roubini said.

Professor Roubini represents the mainstream econometric model based analysis whom has constantly failed to predict the markets accurately.

As Professor Robert Higgs points out, mainstream (academia) thinking has [bold highlights mine]

little interest in the search for truth, however one might understand or pursue it. To them, their research and publication amounted to a game in which the winning players receive the greatest rewards in salary, research funding, and professional acclaim. They understood that because of cloistered academic inbreeding, economists at the most prestigious universities consider the “smartest guys” to be those who employ the most advanced, complex, and incomprehensible mathematics in their “modeling” and “empirical testing.

Gold’s record price surge has been nominal based.

Economist John Williams, who uses the old methodology (1990 CPI) to compute for inflation, says that gold is still far away from reaching its inflation adjusted high in 1980s.

The USAWatchdog quotes economist John Williams (bold highlights original)

In a recent report, economist John Williams of Shadowstats.com contends a declining U.S. currency is reflected in spiking gas prices. Williams’ said, “. . . the primary problem behind higher oil and gasoline prices is the Fed’s efforts at dollar debasement, but few in the media are willing to blame the Fed . . . Also hitting the dollar, though, are increasing instabilities in and ineffectiveness of political Washington, D.C., as viewed by the rest of the world.”

Williams says gold and silver are nowhere near their former inflation adjusted highs of 1980. Back then, gold hit $850 per ounce and silver $49.45 per ounce. To truly equal that price in today’s inflated money, gold would have to be “$8,331 per troy ounce” and silver would have to be priced at “$485 per troy ounce,” according to Williams’ recent calculations.

Yet Gold’s record price surge isn’t only a US dollar dynamic but against global currencies.

The following charts from gold.org shows of gold trends in different currencies since 1998

Euro

Yen

Pound

South African Rand

Australian Dollar

Canadian Dollar

Indian Rupee

G-5 basket

In my view, surging gold in all currencies seem to be validating Voltaire’s observation—Paper money eventually returns to its intrinsic value ---- zero.

The blunt way to say this is that zero extrapolates to hyperinflation.

Again, all these mainly depend on the prospective actions of global governments, most especially the US Federal Reserve.

Saturday, February 12, 2011

Inflation Expectations: The Widening Chasm Between Households And Experts

Despite mainstream experts blabbering about deflation, we’ve been defiantly predicting for a long long long long time that inflation would be coming and would pose as the next real risk (everywhere).

That’s because it has been the instinctive/intuitive approach by central bankers to use their printing presses as antidote to perceived economic predicaments. (Despite years of experience people never learn and always find ways to perpetuate policies anchored upon acquiring “something from nothing”-which I would call “political greed”)

And reemergent “consumer price” inflation represents as the “unintended consequence” and “symptoms” from such persistent policies.

This report from the Wall Street Journal’s Blog, (bold emphasis original)

Consumers see more inflation ahead. That views puts them at odds with Federal Reserve officials and private sector economists.

According to Friday’s consumer sentiment survey released by Reuters/University of Michigan, inflation expectations have been rising since late summer. Back in September, U.S. consumers expected the inflation rate one year out to hit 2.2%. In early-February, the one-year expected inflation rate is up to 3.4%.

Contrast that rate with the tamer forecasts at the Fed and among private economists.

On Wednesday, Fed chairman Ben Bernanke told the House Budget Committee that “inflation is expected to persist below the levels that Federal Reserve policymakers have judged to be consistent over the longer term with our statutory mandate to foster maximum employment and price stability.”

In the US, it’s hardly true that mainstream private sector experts have been on the “inflation risk” camp, many, if not most, have sided with officials to claim inflation hasn’t been a threat mostly because of “output gap", “capacity utilization”, “unemployment” conditions and etc...an example of this outlook can be read here

Yet the “man on the street” sees things differently.

More from the same article, (bold highlights mine)

How can households be more hawkish about inflation than the Fed?

Much of the dichotomy reflects which prices are in focus. The Fed and economists tend to pay attention to core inflation, which ignores food and energy and which better reflects underlying economic conditions. Households pay more attention to the items most frequently bought, in particular gasoline and groceries.

See the difference?

The expert-official camp fundamentally relies on statistical data which isolates real world variables.

Meanwhile, households feel the pressure from relative price changes that affects their overall purchasing power based budgets.

The end result: A massive detachment between expert-official opinions and real events which shapes household’s expectation.

The use of statistical data can be manipulated to the extent that it will be (has been repeatedly) used to justify the imposition of ideologically based policies (mostly predicated on mathematical models).

Again to quote Mark Twain,

There are three kinds of lies: lies, damned lies and statistics

Eventually statistical chicanery backfires, as the above developments shows.

Friday, August 06, 2010

Why Mainstream Economists Are Mostly Wrong

How could economists/experts get it (forecasting, policy prescriptions) so wrong?

This from Janus Lim of the World Bank (hat tip: Prof Antony Mueller) [bold emphasis mine, italics his]

It would seem that the current crop of modern macro models are not only ill-suited for prime-time policymaking in the developed world, they are also inadequate for the developing-country context. At some level, this is ironic. Developed economies are typically far more complex, with larger and more sophisticated product, financial, and labor markets. If anything, the relatively simple structure of DSGE models should be attractive to developing countries, since they are more likely to be successful in capturing the primary features of these economies.

Of course, it may well be the case that developing country policymakers are not quite ready for such sophisticated, state-of-the-art macro modeling tools. Perhaps so, but this seems to me to be a red herring. While ease of use is certainly relevant for capacity-constrained LDCs, the more important question to ask is whether such models can answer the questions foremost on the minds of developing country policymakers. If they can't, it matters much less that the developing world is not ready for them. It would be more that these models are not ready for the developing world.

For simplicity sake, the answer is because they substitute models for human action.

Prof Richard Ebeling writes,

The inability of the economics profession to grasp the mainsprings of human action has resulted from the adoption of economic models totally outside of reality. In the models put forth as explanations of market phenomena, equilibrium — that point at which all market activities come to rest and all market participants possess perfect knowledge with unchanging tastes and preferences — has become the cornerstone of most economic theory.

Saturday, May 29, 2010

Hugh Hendry: 'I would recommend you panic'

The fascinating part is the engagement between Mr. Hendry, supposedly a fan of Austrian economist Jesus Huerta de Soto, and the mainstream camp whose views seem to be represented by academist Mr. Sachs. (hat tip Mises Blog, Jeffrey Tucker)

Some important comments by Mr. Hendry (courtesy of the comments posted at the Mises Blog)

~2:30 “When you bring on a professor and when you bring on a politician, they are unaccountable. If Jeffery’s wrong, he will survive in tenure. If I’m wrong, I go bankrupt. Who do you want to bet with?”

And,

~4:50 “I don’t know, was Jeffrey skiing two months ago? Because I was working and Julian was working. So we can tell you about the real world, because it doesn’t look like two months ago.” To which Sachs responded “please watch your language.”

Again more reasons not to trust presumptuous mainstream (ivory tower) views.

Wednesday, January 27, 2010

US Stock Market Turbulence Hardly About Fundamentals

While the (bull-bear) arguments may focus on ex-post events as against ex-ante scenarios, still there seems little clues that any of the recent activities could be attributable to "economic" metrics, unless one argues that a surprise or a sudden largely unseen "collapse" is in the offing.

That would be, of course, based on a preconceived bias and not based on current evidence.

Tuesday, October 20, 2009

Desperately Looking For Normal

In cases where markets misbehaves or veers from the norm, then all one has to do is to extend the premise of the argument, regardless of its validity, until perhaps it occurs…one day (even for the wrong reasons).

The following is a chart of the day from Bloomberg takes a perspective from seasonality patterns.

According to Bloomberg,

``Predictions that U.S. stocks would decline in September and October weren’t wrong, just early, says Mary Ann Bartels, an analyst at Bank of America Corp.

``The CHART OF THE DAY shows how the Standard & Poor’s 500 Index’s surge from its 12-year low on March 9 compares with rebounds from troughs in March 1938 and October 1974. Bartels cited those two periods as precedents in a report today.

``Using the earlier rallies as a guide suggests the “seasonal weakness” that stocks often suffer in September and October will occur in November, December and January instead, she wrote.

``The 1930s advance appears in the chart’s top panel and the 1970s surge is in the bottom panel. In both cases, the S&P 500 fell more than 10 percent from its peak after the rally ended, surpassing a commonly used threshold for a stock correction.

``Bartels, who relies on chart patterns to determine the market’s prospects, wrote that a correction after the current recovery would lay the groundwork for further gains next year. She sees the S&P 500 climbing as high as 1,325, a gain of 22 percent from the benchmark’s close of 1,087.68 last week.

``September has been the worst month for U.S. stocks on average since 1950, according to the Stock Trader’s Almanac. October 1987 and last October produced the biggest-ever losses for the benchmark Russell 1000 and Russell 2000 indexes, dating back 30 years, the almanac said.

We sympathize with such view knowing that markets don’t move in a straight line. This means that eventually markets will correct but the timing is the ultimate question. It could happen tomorrow, in a week, in a month, or so on.

As a saying goes even a broken clock is right twice a day.

Nevertheless, for us, as long as policymakers persist with its manipulative mode, markets may continue to "surprise" on the upside.

Perhaps, until money or liquidity in the system may not be sufficient to sustain present levels or until policymakers reverse present actions...and that's where "normal will probably look normal".

![clip_image003[4] clip_image003[4]](http://lh6.ggpht.com/_H262-zY4QpU/Ta_cMbMV-eI/AAAAAAAAGXE/7CF96teBaA8/clip_image003%5B4%5D%5B2%5D.gif?imgmax=800)

![clip_image004[4] clip_image004[4]](http://lh6.ggpht.com/_H262-zY4QpU/Ta_cMvaoAfI/AAAAAAAAGXI/6R4ytOA9ZT4/clip_image004%5B4%5D%5B2%5D.gif?imgmax=800)

![clip_image005[4] clip_image005[4]](http://lh4.ggpht.com/_H262-zY4QpU/Ta_cNIp4fpI/AAAAAAAAGXM/S8_s_XlQJSM/clip_image005%5B4%5D%5B2%5D.gif?imgmax=800)

![clip_image006[4] clip_image006[4]](http://lh4.ggpht.com/_H262-zY4QpU/Ta_cN4c1d5I/AAAAAAAAGXQ/tEvZA1ytLn0/clip_image006%5B4%5D%5B2%5D.gif?imgmax=800)

![clip_image007[4] clip_image007[4]](http://lh6.ggpht.com/_H262-zY4QpU/Ta_cOQRp_RI/AAAAAAAAGXU/Ye1IWz1kZRA/clip_image007%5B4%5D%5B2%5D.gif?imgmax=800)

![clip_image008[4] clip_image008[4]](http://lh3.ggpht.com/_H262-zY4QpU/Ta_cO-HIfmI/AAAAAAAAGXY/ErQiWhXvNSM/clip_image008%5B4%5D%5B2%5D.gif?imgmax=800)