The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Sunday, October 19, 2014

Wednesday, February 13, 2013

Video: F. A. Hayek Distinguishes Rule of Law and Arbitrary Laws

Any redistributive policy requires a discriminating treatment of different people. You cannot so long as you treat all the people according to the same formal rules—forcing them to act only to observe the same rules—bring about any distribution of incomes. Once you decide that government is entitled to take from some people in order to give it to others, this is automatically discrimination of a kind for which there can be no general rule. They are purely arbitrary.After long discussion in jurisprudence, it has come out that the essential point about general rule is you cannot predict who will profit from it and who will suffer from it. Any rule where you know beforehand who will be gainers and who will be the suffers is, in that sense, not a general ruleOnce you authorize government to act arbitrarily there is no limit to it.Not acting to a general rule is arbitrary. It is the only way in which you can define arbitrary.You distinguish between the people whom you want to have more and the people whom you want to have lessThe distinction is between (I can only say) a general rule which applies equally to all and a rule which distinguishes between different groups

Friday, December 28, 2012

Quote of the Day: Government Redistribution Tends to Bring Out the Worst in Us

the creation of wealth is edifying. When only voluntary transactions are permitted, the creation of wealth requires cooperation, and this brings out the best in us.Piles of wealth, however, tend to be corrupting. The fixed nature of a pile is all about apportionment, not cooperation, and this zero-sum game tends to bring out the worst in us.It follows directly that no matter how noble the ends, government redistribution (which is hardly voluntary) tends to bring out the worst in us. Rising government redistribution over the past 75 years has produced ample evidence of this point.We are in this mess because we have allowed our culture to be dominated by those who are bent on spreading the false and self-serving narrative that our economy is a giant zero-sum game.As such, we might as well have the government do the dividing.Small wonder why our politics have become increasingly about who you are for rather than what you are for.

Saturday, October 20, 2012

Quote of the Day: The Real Forgotten Man

The existence of government power sets man against man. It sets those who would achieve and create against those who would steal through elections and laws and taxes. In the end, the burden of government falls on that Forgotten Man, that real Forgotten Man. It is he who has worked and saved and done the right things to take care of himself and his family. Yet now he is told he must pay again for others who have not worked and saved as he.

Saturday, September 22, 2012

Quote of the Day: The Fallacy of Redistribution

Those who talk glibly about redistribution often act as if people are just inert objects that can be placed here and there, like pieces on a chess board, to carry out some grand design. But if human beings have their own responses to government policies, then we cannot blithely assume that government policies will have the effect intended.The history of the 20th century is full of examples of countries that set out to redistribute wealth and ended up redistributing poverty. The communist nations were a classic example, but by no means the only example.In theory, confiscating the wealth of the more successful people ought to make the rest of the society more prosperous. But when the Soviet Union confiscated the wealth of successful farmers, food became scarce. As many people died of starvation under Stalin in the 1930s as died in Hitler's Holocaust in the 1940s.How can that be? It is not complicated. You can only confiscate the wealth that exists at a given moment. You cannot confiscate future wealth -- and that future wealth is less likely to be produced when people see that it is going to be confiscated. Farmers in the Soviet Union cut back on how much time and effort they invested in growing their crops, when they realized that the government was going to take a big part of the harvest. They slaughtered and ate young farm animals that they would normally keep tending and feeding while raising them to maturity.People in industry are not inert objects either. Moreover, unlike farmers, industrialists are not tied to the land in a particular country.Russian aviation pioneer Igor Sikorsky could take his expertise to America and produce his planes and helicopters thousands of miles away from his native land. Financiers are even less tied down, especially today, when vast sums of money can be dispatched electronically to any part of the world.If confiscatory policies can produce counterproductive repercussions in a dictatorship, they are even harder to carry out in a democracy. A dictatorship can suddenly swoop down and grab whatever it wants. But a democracy must first have public discussions and debates. Those who are targeted for confiscation can see the handwriting on the wall, and act accordingly.Among the most valuable assets in any nation are the knowledge, skills and productive experience that economists call "human capital." When successful people with much human capital leave the country, either voluntarily or because of hostile governments or hostile mobs whipped up by demagogues exploiting envy, lasting damage can be done to the economy they leave behind.

Sunday, October 10, 2010

Political Spin On The Philippine Economy And An Overextended Phisix

``Now we see these qualities displayed by virtually all politicians in democracy: the constant need for status and recognition. The ends — compensating for an inferiority complex — justify whatever Machiavellian means. Because democracy is open to any and all who can get themselves elected, either through connections, personality, or personal wealth, it is a social system where leadership positions become a hotbed for sociopaths. Maslow's self-actualizing man won't have an interest in politics. But those stuck on the need for esteem are drawn to it like flies to cow pies.”- Doug French

The bullmarket has been relentless.

In the context of the Philippine Phisix, it has been a steamy 13.45% gains in 5 consecutive weeks that has produced a stupendous year-to-date return of 38.8%!

Economic Takeoff Mumbo Jumbo

Again this has nothing to do with the Philippines allegedly in an economic takeoff[1] emanating from the so-called public’s belief in the effective deliverance of the incumbent political leadership.

This messianic thinking is no more than political spin anchored on current events used to grab credit for popularity ratings (votes on issues or endorsements) and for self-esteem purposes[2].

Governments cannot generate wealth by picking on Juan’s pocket in order to give to Pedro. Shifting resources away from productive activities to non-productive activities diminishes wealth creation. There is little or no value added from coercive (tax based) reallocation of resources. In a world of scarcity, prosperity cannot emerge from “something out of nothing”.

Wealth is generated by capital accumulation, or the act or process of increasing the supply of capital goods, whereby capital can only be accumulated by producing more wealth than is consumed, i.e. savings[3]. And this can only occur when more risk-taking, profit-and-loss and market price sensitive entrepreneurial activities are allowed to legitimately flourish.

Political redistribution of scarce resources only leads to inefficiency, wastage, corruption, inflation and capital decumulation. So claims of economic takeoffs can only take place by an intensive reduction of politicization of the economy and by liberalizing economic activities in favour of the entrepreneurs.

The other way to say this it is that—in a world of tradeoffs, political power has to pave way to economic power for capital accumulation to progress. We can’t have both.

Applied to politics, you either expand political power via socialism or enhance economic power via capitalism or the market economy. And the latter is something political leaders won’t intuitively succumb to, unless forced at hand by the natural laws of economics.

Proof?

The proposed P 1.645 trillion National Budget for 2011 supposedly would include a doubling of the Pork Barrel[4], a bonanza for lawmakers.

This simply means more government spending on political pet projects, which are unproductive and not demanded by the markets (think basketball courts[5]), and whose implied effects translate to higher taxes, higher cost of doing business, rising cost of goods and services, high unemployment, and importantly increasing incidence of corruption from arbitrary dispensation of resources and further restrictions to civil liberty.

The election mantra of a corruption free government is gradually being revealed as no less than a drivel, despite the public’s current blind faith over the prospects by the incumbent administration.

So with these added obstacles to entrepreneurship growth, how does one expect the domestic economy to takeoff?

What we are certain of is that the personal economies of politicians and their affiliates or cronies will indeed takeoff. P1.645 (estimated $37 billion) or 22% of the $161 billion (nominal dollars[6]) Philippine economy is certainly alot of money being channelled or transferred from the private (productive) sector to unproductive institutions and to political agents. And surely, these massive diversion of resources, will NOT serve to the wellbeing of the general public. Instead, more will suffer from the unforeseen and indirect effects of these redistributive actions.

Applied globally, political redistribution has its limits, as recent crisis has evinced.

And this grand experiment of the paper money (US dollar) standard seems to push redistribution to its near limits as global government debt has reached over $39 trillion[7] or about 63% of the $61 trillion GDP[8].

It’s a ticking time bomb that has been camouflaged by today’s concerted efforts by central banks to flood the world with liquidity. Eventually, the pressure valve will give way. It has been this way throughout history, which means that this is a cycle which we must pay heed to.

As George Santayana who once admonished, ``Those who do not learn from history are doomed to repeat it”. We certainly cannot stop history from repeating but we can take steps to protect ourselves.

Expect Normal Profit Taking From Overextended Markets

Of course, seen the political standpoint, but looking at the bigger picture, it’s not only us whom are on a takeoff.

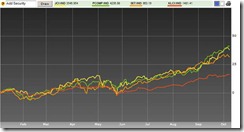

It’s the ASEAN or Asian emerging markets (see figure 1) aside from many emerging markets outside Asia that has been booming.

Figure 1: Bloomberg: ASEAN Bourses Takeoff

The Philippines (green line), Indonesia (yellow) and Thailand (orange) have been in a tight race for the top after successfully breaking past their most recent highs. Only Malaysia has lagged but remains on the positive.

On a year to date basis the gains of these bourses have been spectacular, with the three frontrunners posting over 30% returns.

Nevertheless, there appear to be signs of exhaustion strains from the recent breathtaking run.

And it would be ridiculous to expect the ongoing boom to streak endlessly as any overstretched gains are likely to result to the opposite action-a crash. We must remember that even in the financial markets Newton’s third law of motion[9] somewhat applies, where “To every action there is always an equal and opposite reaction”.

While I do not expect a major retrenchment in the global equity markets, a correction has long been overdue especially for the turbocharged emerging markets as ours.

And if there are any supposed signs of providence, last week’s market actions in Indonesia and Thailand could signify as pacesetters.

But any correction shouldn’t be construed as justification to raise cash balances. Rather, they should be used as entry point for those who have missed the ride or for those hoping to capitalize on the opportunities of the ASEAN-Phisix bullmarket.

What we can expect of is that any correction may unlikely be a broadmarket dynamic as last seen in the bearmarkets of 2007-2008. Instead, we should expect rotational of activities from outperformers to the laggards during the countercyclical phase.

I am not a seer who can give you the exactitudes of the potential retrenchment. Anyone who claims to do so would be a pretender. But anywhere from 5-15% from the recent highs should be reckoned as normal.

Yet, one cannot discount the potentials of a swift recovery following the corrective process. This is why trying to “market timing”, in this “growing conviction” phase of the bullmarket, could be a costly mistake.

From our standpoint, profit taking should be expected over the interim, but the main drivers of the current rally seem well entrenched enough to seemingly ensure that our markets (and those of our neighbours) are eventually headed higher in spite of the illusory political attribution and rhetoric.

[1] Philstar.net Noy: RP ready for takeoff, October 8, 2010

[2] See The Corrupting Influence of Political Power, October 9, 2010

[3] Greaves, Percy Jr. Mises Made Easier, Mises.org

[4] Inquirer.net, ‘Pork’ in budget doubled, October 9, 2010

[5] See Philippine Sports: The Craze For Basketball And The Lack Of Interest In The World Cup, June 12, 2010

[6] Wikipedia.org Economy of the Philippines

[7] See Global Debt Time Bomb, October 8, 2010

[8] Google Public Data, World GDP

[9] Wikipedia.org Newton's laws of motion

Monday, April 26, 2010

Mainstream’s Three “Wise” Monkey Solution To Social Problems

Say what you want

Say what you will

'Cos I find you think what makes it easier

And lies spread on lies

We don't care

Belief is our relief

We don't care

-Roland Orzabal, Tears For Fears, Ideas As Opiates

For the mainstream, our social problems can be simplified into three “wise monkey” solutions:

First, speak no evil-throw money at every problem.

Everyone desires a free lunch. Almost everybody believes that they deserve a special place in this world. Since society’s interests are divergent, such sense of entitlement should come at the expense of someone else. It’s usually dignified and justified with the word “right”. One man’s effort is another man’s privilege.

For them, scarcity of resources can only solved by forcible redistribution. It doesn’t really matter if there are limitations to the scale of taxation. It also doesn’t matter if redistribution reduces the incentives to produce and trade. It doesn’t matter if “picking winners” takes away resources meant for productive activities which have been meant to enhance livelihood. The only thing significant is to be at the receiving end. And it’s hardly ever been asked “when is enough, enough”?

Heck, it would even be politically incorrect to argue for prudence. ‘Moral’ justifications demand for immediate gratification. It’s almost always about NOW. Forget the future.

That’s why the intellectual classes long came up with varied theories in support of these political demands.

Importantly that’s why the political classes are enamoured with these concepts. Redistribution enhances only their power, esteem and control over the others. And that’s why “inflation” has long been a part of human nature, since the introduction of government.

For as long as the system is tolerant of such nebulous tradeoff, trouble can be kept at bay, ergo speak no evil.

The other way to see it is that while everyone wants to rule the world, in reality this isn’t feasible. It’s a mass delusion. The universal law of scarcity always prevails. By force of nature, artificially induced imbalances are resolved eventually.

Second, see no evil-elect or put in place a virtuous leader.

The popular redress to most social problems has been premised mostly on hope, cosmetically embellished by “specific” ennobling goals.

In times of frustrations, the next alternative has been to look for a saviour.

Yet hope is mostly anchored on symbolism. And these are what elections are mostly all about. Even if one’s vote doesn’t truly count, everybody believes they do. Elections are reduced to the polemic of self-import.

Hardly has the directions of policies been the context of any meaningful discussion. People’s arguments will always be simplified to what seems “moral” in the popular sense. Yet, a vote on a person to office is a carte blanche vote on the ensuing policies. But it’s hardly about stakes involved and the prospective costs, but mostly about emotions and the feeling of being in the winning camp.

And since the world has been condensed into strictly a “moral” sphere, political leaders are most frequently deemed to have been transformed into demigods.

Once in power, people mistakenly believe that these entities have transcended the laws of scarcity. People have assumed that they possess the superlative knowledge that is needed to effect the exigent balance on a complex and continuously evolving society. These leaders are presumed to know of our needs, our values, our priorities and our preferences, which lay as basis of our actions in response to ever changing conditions.

Not of only of knowledge, but people also expect leaders and officials to dispense justice and equity according to our sense of definition. Many see these leaders as reflecting on their values. And that’s why many fall for the dichotomous trappings of the well meaning “motivations”. Yet, motivations barely distinguish the role of “means” and “ends”.

Essentially genuflecting on hope to see one’s moral desires as represented by politics can be construed as refusing to see evil for what it is.

And it’s only when the rubber meets the road, from which people come to realize that their expectations have misaligned with reality-and usually through deepening frustrations or in the aftermath of some horrifying outcome.

Hardly has it been comprehended that politics and bureaucratic activities are merely HUMAN activities.

That leaders and officials are subject to the very same foibles as anyone else. That these people see things and act according to the incentives brought about by their interpretation of events, their existing limited and ‘biased’ knowledge and are swayed by influences brought about by cognitive biases, networks, familiarity, assessment of prevailing conditions, information relayed by the underlings, varying degree of stakes of involved and et. al.

Importantly like everyone else, their actions skewed based on personal values. So when a political or bureaucratic leader forces upon their sense of moral vision to a constituency and which has not well received, the result in some cases has been political upheavals.

Yet in spite of the repeated errors, people never learn from George Santayana’s admonition that those who ignore the past are condemned to repeat it.

The third intuitive recourse to any social problems is to hear no evil by enacting new rules/laws.

Like any “throw the money” and “virtuous leader” syndromes, rules are little seen for its costs but nevertheless oftenly envisaged as preferred nostrums to existing problems as identified from the biased viewpoint of the observer/s.

Causal factors are hardly considered in the appraisal of the existing problems. What seems more important is to automatically blame market forces and unduly impose proscriptions. Never mind if the past ills have been caused by the same underlying dynamic-previous interventionism.

The act of simply “doing something” is meant to be perceptibly seen by the voting public for political purposes (extension of career by vote or by appointment). Thus the “hear no evil” therapy, which is merely adding rules for extant fallibilities, are simply props for more of the same malaise.

Many rules, regulations, edicts or laws are imposed upon the “populist demand of the moment”, without the realization that rules, which tend to realign people’s behaviour, can cause huge unintended consequences and likewise entails costs of enforcement. Hence when new rules create distortions in the political economic order, the instinctive response is to have more of rules or regulations.

Importantly, popular clamor for new rules/laws hardly differentiates “rule of laws” against “rule of men”.

Rule of Law are in effect, the guiding principles or the laws that had been a legacy from our forefathers, as the great Friedrich August von Hayek wrote, ``Political wisdom, dearly bought by the bitter experience of generations, is often lost through the gradual change in the meaning of the words which express its maxims[1]”. (underscore mine)

This means because these laws have been constant, are anticipated by all and easily observed or practiced, they become part of our heritage. Again we quote the Mr. Hayek, ``Stripped of all technicalities, this means that government in all its actions is bound by rules fixed and announced beforehand.[2]”

In stateless Somalia, customary laws serve as default laws after her government had been eviscerated,

Benjamin Powell writes[3], ``Somali law is based on custom interpreted and enforced by decentralized clan networks. The Somali customary law, Xeer, has existed since pre-colonial times and continued to operate under colonial rule. The Somali nation-state tried to replace the Xeer with government legislation and enforcement. However, in rural areas and border regions where the Somali government lacked firm control, people continued to apply the common law. When the Somali state collapsed, much of the population returned to their traditional legal system... But Somalia does demonstrate that a reasonable level of law and order can be provided by nonstate customary legal systems and that such systems are capable of providing some basis for economic development. This is particularly true when the alternative is not a limited government but instead a particularly brutal and repressive government such as Somalia had and is likely to have again if a government is reestablished.” [bold highlights mine]

That’s simply proof that “rule of laws” exists even outside of the realm of governments, which also goes to show that society can exist stateless. None of this is meant to say that we should be stateless, but the point is rule of law is what organizes society.

Importantly, “rules of law” have been passed through the ages as a means to protect the citizens from the abuses of the authority, again Mr. Hayek[4],

``The main point is that, in the use of its coercive powers, the discretion of the authorities should be so strictly bound by laws laid down beforehand that the individual can foresee with fair certainty how these powers will be used in particular instances; and that the laws themselves are truly general and create no privileges for class or person because they are made in view of their long-run effects and therefore in necessary ignorance of who will be the particular individuals who will be benefited or harmed by them. That the law should be an instrument to be used by the individuals for their ends and not an instrument used upon the people by the legislators is the ultimate meaning of the Rule of Law.” (emphasis added)

In short, the fundamental characteristics of respected and effective laws are those that to limited, steady or constant, designed for the benefit of everyone and importantly a law that is clearly enforceable.

Of course this doesn’t overrule the occasional use of arbitrary laws, but nevertheless arbitrary rules should compliment and NOT displace the essence of the “rule of law”.

Mr. Hayek quotes David Hume[5], ``No government, at that time, appeared in the world, nor is perhaps found in the records of any history, which subsisted without a mixture of some arbitrary authority, committed to some magistrate; and it might reasonably, beforehand, appear doubtful whether human society could ever arrive at that state of perfection, as to support itself with no other control, than the general and rigid maxims of law and equity.”

In essence, in contrast to mainstream thinking, the rule of law and not simply arbitrary regulations, serves as the central element to well functioning societies.

Former President Ronald Reagan nicely captures part of our “Three Wise Monkey” solution as seen by the mainstream, “The government’s view of the economy could be summed up in a few short phrases: If it moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidize it”, from which I would add, “if subsidies are not enough, elect one who makes sure it would”.

[1] Hayek, Friedrich August von, Decline of the Rule of Law, Part 1, The Freeman April 20, 1953

[2] Hayek, Friedrich August von, Decline of the Rule of Law, Part 1, The Freeman April 20, 1953

[3] Powell, Benjamin; Somalia: Failed State, Economic Success? The Freeman

[4] Hayek, Friedrich August von, The Road To Serfdom

[5] Hume, David; The history of England, from the invasion of Julius Caesar to the revolution, we earlier quoted this see Graphic: Origin of The Rule of Law

Monday, April 12, 2010

How Moralism Impacts The Markets

``Man, on the other hand, does not now possess a like set of instinctual do-nots: built-in prohibitions. Instead, he must enjoy or suffer the consequences of his own free will, his own power to choose between what's right and what's wrong. In a word, man is more or less at the mercy of his own imperfect understanding and conscious decisions.” -Leonard E. Read Find the Wrong, and There's the Right

WHENEVER someone quotes passages from the Holy Scriptures, in social media or in articles, in order to preach their version of morality, I would almost cringe out of cynicism. Quoting the Bible per se isn’t what I am averse at, but it is the excerpts meant to pontificate on one’s perceived sense of virtues.

Fundamentally, that’s because morality or our sense or perception of right or wrong has massive political implications. And being no stranger to the Bible, which is a daily fare for me, it is my understanding that “sacred words” can be construed or interpreted differently.

Moralism As False Reality

One of the worst things we see from self-designated moralists is reductionism, i.e. the oversimplification of reality as solely operating based on morally redeeming actions.

This view myopically ignores the role of scarcity (resources, time and spatial constraints), prices, individual scale of values, distinctive perception and interpretations of information depending on the sources or the accounts of events, cost of decisions (opportunity costs), cognitive biases, the impact of social mores, rules and regulation and authority, peer influences and the role of human action in adapting to a constantly changing environment.

It would always seem plausible to argue from a generalized standpoint on abstractions as honesty, fairness, equality and etc., but from a case to case basis such applications can exposed as being muddled or twisted or vastly misunderstood. For instance, people can all be honest in their actions, but conflicting opinions, based on interpretation of events or respective interests on how to distribute resources, can lead to conflicts[1].

The fact that conflicts are frequent occurrences even among family members, among friends, associates, or in other diverse types of social interactions reveals of human frailty which is not necessarily about the lack of virtues. Yet self-designated moralists ignore this reality.

As Gene Callahan writes[2], ``Abstraction can be an entertaining and useful activity. But every abstraction falsifies reality simply because it is an abstraction – it is a one-sided emphasis on certain aspects of the real at the expense of neglecting or even denying others. That is not necessarily harmful as long as we remember what we have done. But the abstraction, being simpler and more manageable than the real world, is a seductive fantasy, and the temptation to ignore messy reality and attempt to replace it with a clean and neat dreamworld.” (bold emphasis mine)

In other words, morality as a form of escapism will simply not work.

True, moralization is always melodious to hear. That’s why moralism is the primary staple of politics. Yet, a caveat is that one should vet if the incentives guiding such moralizers matches with their actions.

That’s because morality can be used as instrument for different goals, such as to ingratiate oneself to acquire group acceptance or to promote political agenda-outside of faith alone.

Murray N. Rothbard[3] explains how these are achieved, through the lens of the founder of modern political science Niccolò Machiavelli, (all bold emphasis mine)

`` Following straightaway from power as the overriding goal, and from his realism about power and standard morality being often in conflict, is Machiavelli's famous defense of deception and mendacity on the part of the prince. For then the prince is advised always to appear to be moral and virtuous in the Christian manner, since that enhances his popularity — but to practice the opposite if necessary to maintain power. Thus Machiavelli stressed the value of appearances, of what Christians and other moralists call "hypocrisy."

More from Rothbard on the major work of “Old Nick”,

``Niccolò Machiavelli is the same preacher of evil in the Discourses as he had been in The Prince. One of the first atheist writers, Machiavelli's attitude toward religion in the Discourses is typically cynical and manipulative. Religion is helpful, he opined, in keeping subjects united and obedient to the state, and thus "those princes and those Republics which desire to remain free from corruption should above all else maintain incorrupt the ceremonies of their religion."

It’s no different when applied to many ASEAN tycoons. Author Joe Studwell argues that one of the chinks of vulnerability of the economic elite group has been insecurity. And this has led to an “obsession with status” of which religion is part of assimilative “IN” character ASEAN tycoons has toiled to attain.

``What no godfather believer suggests, but what may also be true, is that evangelical Christianity allows them to have a strongly held belief where their daily lives are all about expressing no beliefs at all unless given a cue by a political power. It is also possible to believe in religion without upsetting Asian politicians, whereas to have independent political or social views is disastrous[4].” (bold highlights mine)

In short, the need to be seen as “moral” is understandably just part of peoples’ prestige seeking intuition or can be a source of fulfilment of social esteem needs.

At worst, moralism can be used as manipulative tools to acquire and or maintain political power or privileges.

And it is the latter aspect which our revulsion is directed to.

Yet, for all its alleged angelic purity, moralizers fail to account for institutional lapses of the Church which had engaged in a nearly 200 year war known as the Crusades (This involved 9 major “Crusades” expeditions plus minor Crusades against Tatars, Balkans, Aragonese Alexandrian and Hussite[5]), the French Religious Wars[6] and even today’s controversial supposed cover up by the Pope of a priest engaged in child molestations[7] and other sex based scandals.

And one of the stated reasons of the Crusades was due to “an outlet for an intense religious piety which rose up in the late 11th century among the lay public” which ironically implies self-righteous intolerance (“us against them” concept). [Whatever happened to the doctrine of forgiveness?]

If World War II was about extremist nationalism, the earlier religion based wars accounted for fatalistic zealotry, both of which vainly fought for idealistic but demented causes aimed at the realization of the universality of morals based on the interpretations and perceptions of their leaders.

And this has been no different for the failed grandest experiment of the 20th century: communism, whose death toll took a horrendous (estimated) 94 million lives[8], in a futile attempt at establishing a communist Utopia!

As Tibor Machan rightly avers[9] (bold highlight mine), ``Does morality need to be reconceived? If one considers what horrible deeds have been perpetrated in the name of serving others, there is little doubt that morality needs a serious reexamination. All the major tyrannies have been carried out in the name of making us serve others instead of ourselves. The very call to submit to czars and tyrants goes hand in hand with the idea that everyone needs to serve something bigger than himself in his life! That would be God or society or humanity. The individual certainly comes off as deserving little love from himself. From commencement speeches to sermons and political oratory galore, one's self doesn't much matter, only other people do. As the poet W. H. Auden quipped, "We were put here on earth to serve other people, what the other people were put here for I don't know."

Moralistic Policies of Redistribution and Inflation Nostrums

What has this got to do with markets? Everything.

Markets are simply mechanisms or platforms of social interactions, via property rights, contractual obligations and voluntary exchanges, meant to fulfil the needs and wants of individuals, which comprise a society, based on the principle of scarcity.

Where the moralists tends to fixate on certain angles, for instance in the flows of money from which exposes some or certain moral shortcoming, the desire to attain a moralist “utopia” or agenda means a call to action for political authorities to close on such gaps. Yet the political act of doing so translates to the curtailment of someone’s property rights or liberty in order to achieve a benefit for another. In short, someone’s benefit is another man’s burden or simply, redistribution.

The booming markets of today are manifestations of such redistribution.

The forcibly lowering of interest rates by global central banks punishes savers, depositors and lenders/creditors and rewards borrowers and speculators. It’s bizarre and dichotomous situation.

For the current crop of moralists, who mostly wears the hat of the regulators and their academic followers, a fixation on short term patches guided by economic theories based on government dicta of money printing and spending, essentially conditions the public’s mindset to engage in wanton immoral acts (of greed and speculation) from which they rail against. It’s like handing a child a bunch of porno magazines while telling him/her that nudity or reading sex magazines is immoral. Yet the mainstream hardly upbraids the skewed incentives provided for by today’s policymakers.

Yet since there is no free lunch, the effective price control coursed through interest rates, like the previous experience, should lead to a massive production and resource allocation distortions in the global economy, which should also be manifested on market pricing. And an eventual capital consumption would occur, following the transition of the boom-bust cycle, once the manipulations of the laws of economics becomes overstretched and snaps backs.

The central bank of Indonesia, which has determined that her markets are presently in a state of a bubble or “Whatever methodology we use” shows an excess valuation”, should be a clear example.

From Bloomberg[10], (bold highlights mine)

``Bank Indonesia board members last year discussed the risks posed by an influx of foreign funds, and the bank did a study on the feasibility of imposing capital controls, Warjiyo said. For now, the bank is “confident” Indonesia can cope.

There is “no need to put capital controls” in place now, Warjiyo said. “The existing framework of monetary policy through setting the benchmark interest rate, foreign-exchange intervention and managing expectations is able to manage monetary and financial stability.”

``At the same time, “if the market behaves irrationally, the study has some reference of measures that can be used to put sand in the wheel on capital flows on a temporary” basis, he said. Mulya said in his e-mail that the bank “reaffirms that there is no plan for capital control.” He also said the bank has a “cautious stance towards large capital inflow of late.”

While Indonesia’s central bank acknowledges that one of its primary or key policy tools is the benchmark interest rates, there will hardly be attributions that interest rates shape the public’s expectations and that the bubble cycles are manifestations of the artificially suppressed interest rates.

As you can see, policymakers are always portrayed as beyond reproach, always need to be seen in control and panders to the public’s impression that they can successfully shape or nurture the laws of economics to their whims....until the basic laws of economics unravels such pretentions.

Yet forcing savers to speculate out of the economic doctrine to spend is simply to rob the public of money, through inflation and eventual capital losses, via the said misplaced policies.

Will officials reverse the policies to curb from apparent “bubbles”? From their tones, they seem to be dithering. Hence the answer is no.

Moreover, with elevated asset prices reflecting economic “recovery”, short term triumphalism is likely to be the path dependency for the prospective actions policymakers: what worked in the recent past should work again (past performance equals future outcome)!

As you can see authorities are merely human beings subject to the same cognitive biases as everyone else.

Do policymakers really set the tone for interest rates?

We think and argue not (see figure 1)

Using the US as example, for every bottom phase (black arrow) of the interest rates cycle, the 10 year constant maturity (red) leads the Fed Fund Rate (blue) higher. The same holds true for the inflection points of an interest rate peak, except during 1981.

In other words, authorities only respond to the rate increases as seen in the markets; they are reactive and not proactive agents. They hardly determine interest rates policy.

Why should government policies lag and not lead the markets?

The answer should be quite obvious, governments through central banks always find low interest rates as an attractive way to finance their spending through borrowing instead of taxation, thereby favor (or would be biased for) extended period of low interest rates.

As Dr. Max More wrote[11], ``The state expands its power largely through taking more of the wealth of productive individuals. Taxation provides a means for funding new agencies, programs, and powers. Raising taxes generates little enthusiasm, so governments often turn to another means of finance: Borrowing and expanding the money supply. Only a legally-enforced monopoly on currency has allowed governments to cover deficits by issuing money. Taxation and deficits are related: If tax rate categories are not adjusted for inflation, inflation pushes people into higher tax brackets: their nominal but not real income rises, giving the government a way of increasing tax revenues seemingly without raising tax rates. Unexpected inflation also reduces the real value of the government's debt.” (bold highlights mine)

In the most recent bubble cycle, the boom was financed by quasi government institutions GSEs, as Fannie Mae and Freddie Mac, which massively underwrote mortgage underwriting activities out of artificially depressed interest rates.

According to Dr. Richard Ebeling[12],

``The monetary expansion and the artificially low interest rates generated wide imbalances between investment and housing borrowing on the one hand and low levels of real savings in the economy on the other. It was inevitable that the reality of scarcity would finally catch up with all these mismatches between market supplies and demands. This was, of course, exacerbated by the Federal government’s housing market creations, Fannie Mae and Freddie Mac. They opened their financial spigots through buying up or guaranteeing ever more home mortgages that were issued to a growing number of uncredit worthy borrowers. But the financial institutions that issued and then marketed those dubious mortgages were, themselves, only responding to the perverse incentives that had been created by the Federal Reserve and by Fannie Mae and Freddie Mac.”

Lessons From The Moralists

So what have we learned from the moralists?

One, it is a misguided belief for anyone to oversimplistically think that central banks will wilfully tighten because it isn’t their interest to do so. If there is a possibility that low rates can stay forever, officials will attempt to do so, because this should be the most politically palatable among other options.

From the mainstream gospel of John Maynard Keynes[13],

``Thus, the remedy for the boom is not a higher rate of interest but a lower rate of interest! For that may enable the boom to last. The right remedy for the trade cycle is not to be found in abolishing booms and thus leaving us in a semi-slump; but in abolishing slumps and thus keeping us permanently in a quasi-boom.”

Unfortunately, at the end of the day, the universal laws of economics always prevail.

Second, the tightening of interest rates will come as reactions to the markets which has been experiencing heightened competition for resources via higher prices.

The so called “inflation expectations” are simply nonsense peddled by authorities to hoodwink the public: if the exchange value of one apple is 2 oranges, and if the number of oranges has been doubled then the new exchange ratio of one apple is 4 oranges. Just replace oranges with pesos or dollars you get the same math. The difference is that is the use of money, which functions as a medium of exchange, but does not contain the supernatural powers of Harry Potter.

Athough the moralists imagine that the “expectations” works, in reality they are only defying basic economic laws. Thus, prices will adjust accordingly overtime against their expectations.

Three, rising interest rates doesn’t necessarily or automatically mean a market collapse. Interest rates function as key integral component of business cycles. The peak and troughs of the business cycles largely depends interest rate fluctuations largely manipulated by governments for political reasons.

In a boom phase of the business cycle, markets are thus, sensitive to the rate of increase and the level of increase of the interest rates.

Since rising interest rates reflect on market forces than from government policies, the rate of increases exhibits the degree of competition for resources used on misdirected projects and by the consumers. This should reflect on the moralists’ perverse intention to create a state of permanent but unsustainable boom from unimpeded monetary expansion.

Whereas, the level of rate increases eventually exposes unviable projects to losses, which emerged into existence out of artificially suppressed rates. This will not be uniform though. The tipping point is when interest rate increases would have reached the levels where malinvestments or business errors have massively been clustered.

Fourth it’s not just interest rates. Higher commodity prices from credit or monetary inflation could also impact on the expected returns of unviable projects. Economist James Hamilton argues that an oil shock had also been a major factor in the recent crisis.

We quote Mr. Hamilton[14], ``It is also interesting that the observed dynamics over 2007:Q4-2008:Q4 are similar to those associated with earlier oil shocks and recessions. The biggest drops in GDP come significantly after the oil price shock itself. What we saw in earlier episodes was that the drops in spending caused by the oil price increases resulted in lost incomes and jobs in affected sectors, with those losses then magnifying other stresses on the economy and producing a multiplier dynamic that gathered force over subsequent quarters.” (bold highlights mine)

Today both the interest rates markets and commodities are reflecting the boom phase of what we deem as a new bubble cycle (see figure 2).

The commodity markets are not only influenced by expansion of credit and massive government spending but likewise influenced by government restrictions to access more supplies. With oil, 88% of global reserves are held by state and state owned companies[15].

So the missives promoted by moralizers that greed or speculation drives oil or commodity prices has hardly any merit; government owns the printing press that fosters extraordinary demand, while supply is equally constrained by government restrictions basically monopolized by governments. 1+1=2.

While there are other factors involved such as government subsidies, the export land model, strategic petroleum reserves, Hubbert Peak curve for conventional oil, lack of investments for over 2 decades (especially for gasoline refineries in the US), technology and etc.., the cocktail mix of these two forces alone are enough to send towering high energy prices.

Lastly, markets do not react mechanically. They represent human response to ever changing conditions. Today’s market has been more responsive to financial innovation given the more liberal or freer and deeper markets underpinned by rapid technology enhancements and the integration of global markets.

In the chase for the profits, today’s business cycle probably means an attendant credit cycle which would undergird interest rates.

Essentially this means a reflexive self-reinforcing feedback loop between borrowing appetite and state of collateral values-where higher prices raises the collateral value from which encourages more borrowing and vice versa.

Moreover, financial innovation is likely to compel a transition of the credit cycle to what we see as Mr. Hyman Minsky’s model of hedge, speculative and ‘ponzi’ economy.

We quote Mr. Minsky[16], (all bold highlights mine)

“Three financial postures for firms, households, and government units can be differentiated by the relation between the contractual payment commitments due to their liabilities and their primary cash flows. These financial postures are hedge, speculative, and ‘Ponzi.’ The stability of an economy’s financial structure depends upon the mix of financial postures. For any given regime of financial institutions and government interventions the greater the weight of hedge financing in the economy the greater the stability of the economy whereas an increasing weight of speculative and Ponzi financing indicates an increasing susceptibility of the economy to financial instability.”

Bubble policies are likely to encourage a transition from risk averse, to bigger risk taking appetite to outright gambling.

This means that investors at the start of the cycle will engage in hedging (borrow to expand from which the income is used to pay for outstanding interest and principal), will turn to speculators (borrow and use the income to pay only interest rates) and ultimately peak with the transformation to Ponzi phase (borrow to chase rising prices).

And guess what? As in the previous boom, this will be encouraged by the moral hazard provided by big governments.

Back to Mr. Minsky[17] (all bold emphasis mine)

``It should be noted that this stabilizing effect of big government has destabilizing implications in that once borrowers and lenders recognize that the downside instability of profits has decreased there will be an increase in the willingness and ability of business and bankers to debt-finance. If the cash flows to validate debt are virtually guaranteed by the profit implications of big government then debt-financing of positions in capital assets is encouraged. An inflationary consequence follows from the way the downside variability of aggregate profits is constrained by deficits.”

In short, all the recent government backstops would only stimulate a greater and far larger bubble, despite all the “regulatory reforms” being mulled today.

While it isn’t clearly evident where all the money has been flowing to yet or where the next concentration of misdirected investments would be, everything as we have discussed above simply points to a formative bubble.

This means that yes, markets and the global economy will likely be headed for a positive surprise for 2010. And yes, moralizers will probably achieve what they had hoped over the short to medium term. But no, this isn’t a sustainable economic growth, but a continuation or a sequel of the spectacle of serial bubbles.

[1] See Is Honesty Enough For A Society To Succeed?

[2] Callahan, Gene; The Abstract and the Concrete, ThinkMarkets

[3] Rothbard, Murray N.; Who Was Niccolò Machiavelli? Mises.org

[4] Studwell, Joe; Asian Godfathers: Money and Power in Hong Kong and Southeast Asia, p.51. Grove Press.

[6] Wikipedia.org, French Religious Wars

[7] New York Times, Vatican Priest Likens Criticism Over Abuse to Anti-Semitism

[8] Courtois, Stéphane et. al., The Black Book of Communism, Harvard Press Wikipedia.org

[9] Machan, Tibor, Lessons in Freedom: A Bit of Nietzsche Will Help; weblogbahamas.com

[10] Bloomberg, Indonesia Stocks in Bubble, Central Bank Study Shows

[11] More, Max; Denationalisation of Money, Friedrich Hayek's seminal work on Competing Private Currencies, Maxmore.com

[12] Ebeling Richard M. Market Interest Rates Need to Tell the Truth, or Why Federal Reserve Policy Tells Lies, Northwood University

[13] Keynes, John Maynard, The General Theory of Employment, Interest and Money (p.20-21)

[14] Hamilton, James D., Oil prices and the economic recession of 2007-08; voxeu.org

[15] See Peak Oil: Where Art Thou?

[16] Minsky, Hyman; Finance and Profits: The Changing Nature of American Business Cycles, 1980

[17] Minsky, Hyman; "Inflation, Recession and Economic Policy", 1982 (page 43)