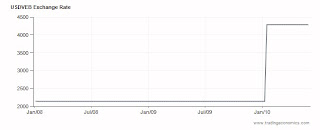

My prime candidate for the next episode of hyperinflation (

which I mentioned here) has long been Venezuela.

That's because accelerating socialism, espoused by the dictatorship regime translates to profligate spending which generates intractable financial claims and economic inefficiencies (which impedes the capacity to pay the incurred liabilities) that has resulted to ballooning deficits.

And this translates to massive printing of money in order to fill or cover such shortfalls for the preservation of power by the incumbent political leader. In short, using the printing press as political tool.

So while hyperinflation is technically about sustained excessive money printing, the underlying incentives that beckons it is political.

The end result: the demonetization of money.

According to Professor Ludwig von Mises from his Stabilization of the Monetary Unit? From the Viewpoint of Theory,

According to Professor Ludwig von Mises from his Stabilization of the Monetary Unit? From the Viewpoint of Theory,

``If people are buying unnecessary commodities, or at least commodities not needed at the moment, because they do not want to hold on to their paper notes, then the process which forces the notes out of use as a generally acceptable medium of exchange has already begun. This is the beginning of the “demonetization” of the notes. The panicky quality inherent in the operation must speed up the process. It may be possible to calm the excited masses once, twice, perhaps even three or four times. However, matters must finally come to an end. Then there is no going back. Once the depreciation makes such rapid strides that sellers are fearful of suffering heavy losses, even if they buy again with the greatest possible speed, there is no longer any chance of rescuing the currency. In every country in which inflation has proceeded at a rapid pace, it has been discovered that the depreciation of the money has eventually proceeded faster than the increase in its quantity.” [all bold emphasis mine]

Seen in the context of Venezuela, which massively devalued its currency last week, this from

Wall Street Journal account, (hat tip

Douglas French and Mises Blog) [bold highlights mine]

``President Hugo Chávez's decision to devalue Venezuela's bolivar and impose a complicated new currency regime may paper over some growing cracks in the economy, but it is also setting the stage for bigger problems down the road for the country's oil-rich nation and its populist leader.

``Over the weekend, there were signs that Mr. Chávez's slashing of the "strong bolivar" currency could create as many problems as it solves in Venezuela's economy, provoking a wave of anxiety that sent Venezuelans scurrying to spend cash they feared could soon be worthless.

``At Caracas's middle-class Sambil shopping mall, lines at cashiers reached 50-deep. Carmen Blanco, a 28-year-old accountant, waited to buy a 42-inch flat-screen television she doesn't need because she already has one at home.

``"It doesn't make any sense to keep my savings," Ms. Blanco said Saturday. "I'd love to see how things work in a normal country."

``On Sunday, Mr. Chávez vowed to fight speculation and price increases that could result from the devaluation, which raises the price of imports.

``Harried by recession and sliding popularity, Mr. Chávez on Friday weakened the bolivar to 4.3 per dollar from 2.15 in a bid to shore up government finances, which have been hit by weaker oil prices, and to stimulate economic growth ahead of key elections."

And where does Mr. Chavez gets his ideas? Unfortunately from the stereotyped self-righteous protectionist mindset.

Again from the same

WSJ article, (all bold highlights mine; comments added)

``In Mr. Chávez's favor, a weaker currency helps narrow a growing budget shortfall by instantly giving his oil-rich government more local currency to spend per barrel of oil exported by the state petroleum company, PDVSA. That is a key consideration with congressional elections looming in September.

[yes inflationism shifts spending power to the government and his allies at the cost of less spending power for the people-Benson]

``Mr. Chávez has watched his popularity slide amid corruption scandals, a shrinking economy, rising crime and shortages of food and electricity. Increased spending could boost Mr. Chávez's popularity.

[note: Venezuela is a major oil exporter-Benson]

``Mr. Chávez also predicted a weaker currency would breathe life into a domestic economy that depends on imports for everything from beef and milk to cars.

[this is an example of the currency magic wand mindset at work-Benson]

``The measure may buttress the banking system, which has been rocked by the closure of several institutions amid an embezzling scandal. Many Venezuelan banks head into the devaluation holding large stocks of dollars.

[governments almost always favors the banking system because it can help in the financing of its political goals-Benson]

``Holders of dollar-denominated bonds issued by Venezuela and PDVSA will be encouraged by the move. Devaluation narrows Venezuela's financing gap to around 3% of economic output from around 7%, said Boris Segura, a Royal Bank of Scotland economist."

``However, the devaluation does little to assuage the deeper problems plaguing the Venezuelan economy, economists say. Devaluation isn't enough to revive the domestic manufacturing base. Few investors are willing to brave Venezuela's maze of price caps, currency controls and the ever-present fear of nationalization."

[Here's the rub: the rubber finally meets the road, this is a vivid example where fallacious theories don't square with reality. The currency magic wand can't offset domestic policy distortions-Benson]

``Higher inflation from the move will also keep chipping away at the value of the bolivar, even at its new peg."

``What is more, by keeping a subsidized dollar rate for importing food, medicine and essential items, Mr. Chávez removes any incentive for Venezuelans to produce what they need most."

From Murray Rothbard in Mystery of Banking, ``But if government follows its own inherent inclination to counterfeit and appeases the clamor by printing more money so as to allow the public’s cash balances to “catch up” to prices, then the country is off to the races. Money and prices will follow each other upward in an ever-accelerating spiral, until finally prices “run away,” doing something like tripling every hour. Chaos ensues, for now the psychology of the public is not merely inflationary, but hyperinflationary, and Phase III’s runaway psychology is as follows: “The value of money is disappearing even as I sit here and contemplate it. I must get rid of money right away, and buy anything, it matters not what, so long as it isn’t money.”We seem to be witnessing unfolding chaos from the demonetization process.

Another observation: It's been a common fallacious notion that stock markets respond negatively to intensified inflation.

In Venezuela, this hasn't been the case.

Perhaps this could be true depending on the degree of inflation.

But in cases where the state of money swiftly deteriorates, where its store of value comes into question or comes under severe strain, stock markets become haven from the demonetization process.

Why?

Again from

Professor von Mises, ``If the future prospects for a money are considered poor, its value in speculations, which anticipate its future purchasing power, will be lower than the actual demand and supply situation at the moment would indicate. Prices will be asked and paid which more nearly correspond to anticipated future conditions than to the present demand for, and quantity of, money in circulation. The frenzied purchases of customers who push and shove in the shops to get something, anything, race on ahead of this development; and

so does the course of the panic on the Bourse where stock prices, which do not represent claims in fixed sums of money, and foreign exchange quotations are forced fitfully upward."

And this has been the case of Weimar Germany and just recently Zimbabwe.

If present political trends won't reverse, then Venezuela would be another real time example of paper money based system that will evaporate soon.