I think it was a long step forward in my trading education when I realised at last that when old Mr Partridge kept on telling other customers, “Well, you know this is a bull market!” he really meant to tell them that the big money was not in the individual fluctuations but in the main movements-that is, not in reading the tape but in sizing up the entire market and its trend.-Jesse Livermore

The Phisix has been on a winning streak for 6 consecutive weeks.

Year-to-date, this week’s gains accrues to a year to date performance of a positive 2.82%.

In dollar terms, this should translate to returns of over 5%, as the Philippine Peso has risen by about 2.3% over the same period.

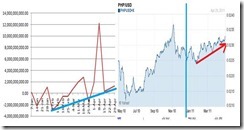

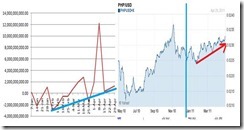

Net foreign trade (left window) in the Philippine Stock Exchange has steadily been advancing along with the ascendant Peso (right window; chart from yahoo[1]). Note: I am framing this presentation on a year-to-date basis, hence the blue vertical line on the Philippine Peso-US dollar chart.

As I have been pointing out[2], in today’s epoch of financial globalization, the Phisix and the Peso have strong correlations where the action of the local currency should be expected to harmonize with that of the Phisix.

And any interim divergences should be seen as a short term anomaly that would eventually be resolved—either the Phisix and the Peso conjointly rises or both will fall.

Again from this perspective we have been validated anew.

It’s not a dynamic limited to the Philippines.

ASEAN equity bourses and Asian currencies have shown similar patterns and near synchronous motions.

Chart from Bloomberg

The undulations of ASEAN equity benchmarks (lower window) and Asian currencies represented by the Bloomberg-JP Morgan Asian Dollar (upper window) appear to be contemporaneous. Despite some sporadic weaknesses, the general trend has been up!

With Thailand’s SET (SET-red line) successfully clearing of the hurdle or breaking above the November resistance level highs, and where the Phisix (PCOMP-yellow line) and Jakarta Composite (JCI-orange line) appears poised for their respective breakout points, I would suggest that momentum should favor a successful breach in the near future. I can’t say exactly when, perhaps anytime within 1 week to 1 months, but tailwinds seem to be headed in that direction.

The sharp rise of the Chinese yuan, which reached fresh milestone highs last Friday, signifies one of such forces[3].

Another is the fast foundering US dollar and surging prices of precious metals as gold and silver.

Chart from stockcharts.com

The growing sentiment against the US dollar appears to have prompted Emerging Market central bankers to seek safehaven in commodities[4].

The broad weighted Reuters CRB index (CCI) also reveals that surging prices have not been confined to a few commodities, but instead price surges have been broad based or signifying a ‘rising tide lifting all boats’ phenomenon.

As one would note, the US dollar index (USD) has broken down from its 2009 low.

Also Hong Kong’s currency board, the Hong Kong Monetary Authority [HKMA] has reportedly[5] shifted $300 billion of its US dollar holdings to “alternative investments, including real estate, private equity and emerging-market equity and fixed income.”

So there seems to be an implicit revolt against the US dollar standard which could be taking shape.

In addition, I earlier said[6] that the buoyancy of the Peso, despite the retrenchment or corrective phase in the Phisix, represented a rotational process instead of an exit.

I can see a paradox—a strong Peso and equity outflows—or a meaningful divergence...

These variables appear to imply that the negative foreign trade in the PSE had NOT been repatriated abroad, but possibly rotated into other local assets.

And this perhaps explains the continued strenght of the Peso despite a weak equity market environment. Again, a divergence that is likely to be resolved soon.

I guess I have been further validated.

Throughout the equity hiatus phase, foreign money which went out of equities only shifted to domestics bonds. That period, where the consensus mistakenly used the MENA Revolts-Japan triple whammy-high oil prices as pretext to call for further downturn of the equity markets, showed how bonds outperformed equities.

Incidentally, Philippine bonds in terms of returns snared the top spot in Asia (left window-Charts from IMF[7]) with Indonesia and Thailand, taking second and third place. Only India endured from NET outflows.

Also, the Weekly Net Flows to Asian equity and bonds (right window) during the first quarter of 2011 looks almost similar to the trend dynamics of the Net Foreign Trade chart in the PSE (see first chart left window).

I guess it is Asian equity’s turn to do a catch up with its bond counterpart.

Again, the rotational process among asset classes in Asia seems to resonate with actions within the Philippine Stock Exchange.

Sectoral rotation continues to take hold: over the past weeks we saw the focus shift from service to property to mining and holding, and now back to service.

Gains of major telecom issues such as PLDT (+4.02%) and Globe (+4.11%) has contributed substantially to the advances of the service sector index, as well as, in the Phisix.

This only goes to show that even if the Phisix may endure interim corrections, these are likely to be short term as the general uptrend appears to be reinforced by the abovestated dynamics.

To quote[8] the legendary trader Jesse Livermore through Edwin Lefevre in the classic book[9], Reminiscences of a Stock Operator (bold emphasis mine)

The public ought always to keep in mind the elementals of stock trading. When a stock is going up no elaborate explanation is needed as to why it is going up. It takes continuous buying to make a stock keep going up. As long as it does so, with only small and natural reactions from time to time, it is a pretty safe proposition to trail with it.

Bottom line:

Stock prices are relative. High prices can go higher. Inflationism is making sure that this bubble cycle is happening.

[1] Yahoo Finance, Philippine Peso

[2] See Phisix-Philippine Peso Back In Rhythm April 10, 2011

[3] See China’s Yuan Rises To Milestone High, April 30, 2011

[4] See The Implication of Emerging Market Central Banks’ Buying of Gold, April 30, 2011

[5] Asianinvestor.net HKMA enters alternative investments, April 28, 2011

[6] See Are The Current External Event Risks Signals or Noise? March 13, 2011

[7] IMF.org Managing the Next Phase of Growth, Regional Economic Outlook, April 2011

[8] The 3500, Quotes from Reminiscences of a Stock Operator (Jesse Livermore), February 1, 2007

[9] Wikipedia.org Reminiscences of a Stock Operator

![clip_image002[4] clip_image002[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgvR9_ZcIzD4cymOcLninjS02Qv1zyvW9m4zrnaRNhgnfLtCwUSQGZYHf50i2T8Vk87XvvUTCIv6WPaQZs600xXgGwe7dBaDoPzNy50ktMl3Pz_xADvhvG15QP4wSrfiADCPWig/?imgmax=800)