That's according to globalpropertyguide.com, (all bold highlights mine)

``In early 2009, luxury condominium prices, and sales, both fell in Manila. Compared to the previous quarter, the average price of luxury three-bedroom condominiums in the Makati Central Business District dropped by 0.7%, according to Colliers International (a fall of 0.6% in real terms).

``During the year to Q1 2009 the average price has appeared to increase by 4.6%, to PHP101,000 per sq.m. But this increase is illusory, because when adjusted for inflation, the average price has in fact fallen by 2.2%.

``Two of the biggest real estate developers in the country, Ayala Land and Megaworld, experienced declining real estate sales in Q1 2009. Sales of residential projects of Ayala Land declined by 10%. Megaworld reported that a decline in its real estate sales was offset by rental income growth, and posted flat net earnings growth from the same period last year.

``Housing demand from US-based overseas Filipinos weakened significantly, due to the economic recession. This was slightly offset by demand from Overseas Filipinos Workers (OFWs) in the Middle East and Asia. But this may not last long, since most of these countries are in or near recession.

Nonetheless the study appears to rely heavily on remittances as the main driver for the domestic property market.

Nonetheless the study appears to rely heavily on remittances as the main driver for the domestic property market.Again from Globalpropertyguide, ``There are approximately 9 million Overseas Filipinos (OF) worldwide, or around 10% of the Philippine population. Of all OFs, 42.3% are permanent.

``Among permanent OFs, 68.2% reside in the US, followed by Canada (11.1%), Europe (7.7%), Australia (6%), and Japan (3.6%). The economies of these countries are in deep recession.

``Saudi Arabia has the most OFWs, at 25.3% of the total, and followed by UAE (11.9%). Housing demand from OFWs in the Middle East is expected to weaken, because the economies of the major OFW employers, Saudi Arabia, UAE, and Kuwait, have weakened.

``Remittances from OFs are major drivers of consumption and investment in the Philippines. Remittances reached US$16.4 billion in 2008, around 9.7% of GDP. A significant portion of remittances is spent on housing.

``Although remittances grew 2.7% y-o-y to Q1 2009, total remittances in 2009 are expected only to match 2008 levels, in sharp contrast to double-digit growth rates in the past. In 2008, remittances rose 13.7%, following 13.2% growth in 2007, 19.4% in 2006 and 25% in 2005.

``Even if remittances continue growing in 2009, purchases of residential property may be delayed, until the economy recovers."

Nonetheless, the study also reveals the other obstacles in the Philippine property market development.

Again from globalpropertyguide.com

``In the Philippines, most buyers pay in cash, or buy during the pre-sale period. With remittance-fed demand weakening, local demand is hampered by an underdeveloped mortgage system.

``The ratio of housing loans to GDP remains small, at less than 2%. Outstanding real estate loans for acquisition of residential property grew by an average of 14% annually from 2001 to 2007, to PHP112.2 (US$2.4) billion. Data for 2008 is still unavailable but growth is expected to exceed 10%, because the BSP relaxed rules on real estate lending in December 2007 to support the property industry.

``Despite this growth, several factors still hamper local mortgage market expansion. Banks impose restrictive lending conditions, and approval of loan applications takes a long time. Few major banks offer housing loans, and loans have similar terms and conditions. Land titling and registration problems are prevalent, as are delays in the foreclosure process.

``Housing loan rates charged by major commercial banks remain high, at around 9.5% for loans fixed for one year, and at least 11% for mortgages with rates fixed for five years or more. In-house financing offered by developers involves even higher rates of between 15% and 22%.

``The government-owned Pag-ibig Fund (Home Development Mutual Fund) offers lower interest rates of between 6% to 11.5%, depending on the amount borrowed and loan conditions. Compared to bank loans, the amount that can be borrowed is lower, but the payment periods are longer and loan-to-value ratios are higher. Membership requirements have to be fulfilled to get a loan.

But, the study suggest that yields from investment remain attractive

``In October 2008, the average rental yield for condominiums in CBDs in Metro Manila was around 9.4%, according to Global Property Guide research. The highest returns were achieved on condominiums measuring between 70 and 120 sq. m., with yields typically exceeding 10%. Rental yields are expected to remain high, as property prices are expected to fall faster than rents."

Here are my additional comments:

1. While I don't have the details of the entire property market, the stereotyped generalization of remittances driving consumption and investment (of the economy) and property prices seems vastly exaggerated.

As to how 10% of an economy is greater than the composite 90% of the economy is certainly beyond me. Up to now, I have yet to see figures (even estimates) from the so-called multiplier effects from remittances as a share of consumption or investments.

Also how much of property pricing dynamics are from remittances?

2. Property prices aren't the same. OFW's are likely to be buyers of low and middle cost housing than the luxury condo market. In short, different products for different markets.

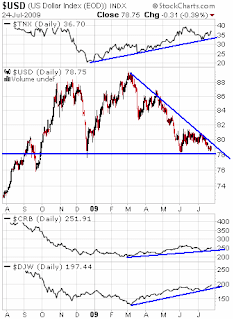

3. There seems to be a much ignored factor-an inflationary environment that is symptomatic of the falling US dollar worldwide.

This suggests that for condominiums, aside from local residents or OFW remittance money, foreign money could pose as prospective buyers especially considering the attractive relative yield as mentioned above.

4. Ultra loose monetary policies here and abroad are likely to stimulate an asset chasing phenomenon. Aside from stocks, this should include the property sector.

Hence, buying from local residents, considering the immense liquidity in the domestic financial system, could boost property prices.

5. I don't share the view that property prices depends on economic recovery as to clear oversupply and push prices up. Inflationary monetary policies in a low leveraged environment could do the trick of inducing speculative money flows into property.

Here, economic recovery will lag property prices but will be subjected to the local boom bust cycle.

6. Lastly, some reasons why the development in the Philippine property sector has lagged the world has been addressed above: underdeveloped mortgage or capital market (which has led to few suppliers with tight standards and high rates) and stifling red tape.