Speaking of central banks determining market actions, it would seem that the mainstream (media, investors, academe, institutional analysts and other market participants) has been all over calling for the next wave of interventions.

From the Newsmax

Consensus is building fast that the Federal Reserve will roll out a third round of quantitative easing, possibly as high as $1 trillion and likely by the end of January, economists say.

The Fed has already carried out two rounds of quantitative easing, in which it buys assets from banks with freshly printed money with the aim of steering the economy away from deflation and contraction.

The Federal Open Market Committee, which sets monetary policy, meets next Tuesday and Wednesday and a decision could come then.

While improving economic indicators had many believing a third round, known as QE3 wouldn't be necessary, a slumping housing sector and the onset of recession in Europe may prove otherwise.

I know, there has been a lot of talk of QE3.0 since the last semester of 2010, but an official QE 3.0 has yet to be announced.

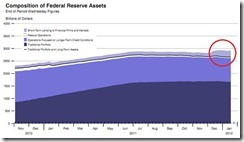

Yet as I keep pointing out, QE 3.0 has already been happening, as the Federal Reserve’s balance sheet began expanding at the start of last December. Perhaps this could be part of the backdoor bailout of the Eurozone being conducted via foreign exchange swaps between the ECB and the US Federal Reserve.

The resonant call for more interventionism has been the same in the Eurozone.

From Bloomberg,

European banks, shunned by investors and each other, may borrow as much next month from the European Central Bank as they did in a record offering in December as they seek refuge from frozen funding markets.

The ECB last month lent banks an unprecedented 489 billion euros ($637 billion) for three years. Analysts said they expect demand to be just as high at a second auction on Feb. 29 because the stigma associated with using the facility is dissipating and the list of what assets can be used as collateral in exchange for the loans will be extended. ECB President Mario Draghi said last week he expects demand for loans next month to be “still very high,” though “probably lower than in December.”

“February’s second three-year Long Term Refinancing Operation looks set to be extremely large,” Credit Suisse Group AG analysts led by William Porter wrote in a report to clients. “The last LTRO has removed any stigma, making managements who do not exploit the value on offer arguably careless at best.”

The ECB is flooding the banking system with cheap money in a bid to avert a credit crunch after the market for unsecured bank debt seized up and funding from U.S. money markets dries up. Politicians, including French President Nicolas Sarkozy, are pushing the banks to use the loans, which carry an interest rate of 1 percent, to buy higher-yielding southern European sovereign debt, thereby forcing down borrowing costs in the region.

The actions of central bank have consequences. Money printed from thin air will find their way into the markets and the economy on a distinct level and timing of impact. And making comparisons with any recent historical accounts are unjustified for the simple reason that the current wave of central bank interventions has been unprecedented.

As the great Ludwig von Mises explained in Theory of Money and Credit, (bold emphasis mine)

A government always finds itself obliged to resort to inflationary measures when it cannot negotiate loans and dare not levy taxes, because it has reason to fear that it will forfeit approval of the policy it is following if it reveals too soon the financial and general economic consequences of that policy. Thus inflation becomes the most important psychological resource of any economic policy whose consequences have to be concealed; and so in this sense it can be called an instrument of unpopular, i.e., of antidemocratic, policy, since by misleading public opinion it makes possible the continued existence of a system of government that would have no hope of the consent of the people if the circumstances were clearly laid before them. That is the political function of inflation. It explains why inflation has always been an important resource of policies of war and revolution and why we also find it in the service of socialism. When governments do not think it necessary to accommodate their expenditure to their revenue and arrogate to themselves the right of making up the deficit by issuing notes, their ideology is merely a disguised absolutism.

And part of the communications tool used by central banks to manage inflation expectations is called signaling channel. Hence we are currently being conditioned to accept inflationism as the only viable recourse to the present dilemma.

No comments:

Post a Comment