From the Bloomberg,

The European Central Bank’s balance sheet surged to a record 3.02 trillion euros ($3.96 trillion) last week, 31 percent bigger than the German economy, after a second tranche of three-year loans.

Lending to euro-area banks jumped 310.7 billion euros to 1.13 trillion euros in the week ended March 2, the Frankfurt- based ECB said in a statement today. The balance sheet gained 330.6 billion euros in the week. It is now more than a third bigger than the U.S. Federal Reserve’s $2.9 trillion and eclipses the 2.3 trillion-euro gross domestic product of Germany (EUANDE), the world’s fourth largest economy.

The ECB last week awarded banks 529.5 billion euros for three years in the biggest single refinancing operation in its history, adding to the 489 billion euros it lent in December. The flood of money, which aims to combat Europe’s sovereign debt crisis by unlocking credit for companies and households, has increased the risk exposure of the 17 euro-area central banks that together with the ECB comprise the Eurosystem.

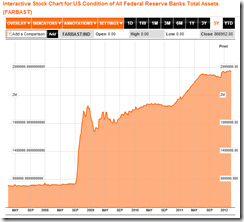

Here are the accompanying charts also from Bloomberg

ECB’s € 3.0 (US $ 3.96) Trillion

US $2.9 Trillion

In seeing the above, we understand that underneath today’s veneer of tranquility, there has been a lingering disorder that has yet to be manifested on the marketplace and on the real economy. These can be analogized to rapidly spreading cancer cells at the earlier stages.

Yet the above does not include the balance sheets of the Bank of England, Bank of Japan and the Swiss National Bank whom have all been undertaking similar actions.

Despite occasional publicized opposition, these policy palliatives will be sustained by political authorities in the hope of rehabilitation and the preservation of the incorrigibly degenerate political system.

Policymakers of developed economies will likely push this or exploit the use of central banks to the limits until a blowback in the economy and the monetary system becomes apparent.

Because the public is hardly aware of the operations of central banks, central bankers have assumed the role of hatch men for politicians and their privileged cronies the banking class.

Yet to desist from the current actions will translate to a collapse of too big to fail banking institutions that should drag along the welfare-warfare state, a development which current political agents have fervently been trying to defer, thus the unprecedented experiment.

There is no way for any person who understands the fundamentals of money to be bearish on prices of precious metals given the prospective extension of these policies.

The recent surge in global stock markets has been symptomatic or signifies as the initial outcome of the the second wave of central banking money therapy that is being applied. I expect that equity markets particularly those from emerging markets to mainly benefit from these remedial measures for the time being. This will hardly be an issue of earnings or valuations, but of the evolving state of money.

Lastly with the Euro balance sheet surpassing that of the US Federal Reserve, it’s time to be temporarily bearish the Euro. I say temporary because I expect the US Federal Reserve to eventually ramp up on their balance sheet through another QE (or a variant of it) for many earlier stated reasons.

However, I wouldn’t short the Euro though, the political management of fiat currencies have already been evincing of their innate tendencies of returning to their intrinsic value—zero. I’d buy precious metals instead

We have to be reminded that the relative valuations of currencies is determined by the relative demand and supply of currency units.

As the great Ludwig von Mises wrote,

These observers do not understand that the valuation of a monetary unit depends not on the wealth of a country, but rather on the relationship between the quantity of, and demand for, money. Thus, even the richest country can have a bad currency and the poorest country a good one.

No comments:

Post a Comment