More Chinese tycoons appear to be jumping ship or has been expressing reservations on the Chinese economy.

Earlier I pointed to Li Ka Shing, who sold his entire holdings in China, and to Soho China Ltd. Pan Shiyi who equated the current economic slowdown in the face of mounting debt as the “Titanic moment”.

Another tycoon, Song Weiping has been reported to be in the process of selling his holdings while blaming the government for his troubles

From Marketwatch.com (bold mine) [hat tip Zero Hedge]

A prominent property tycoon in China on Friday lashed out at government real estate policies, took a verbal swipe at a former premier and said authorities shouldn't be squeezing small- and medium-size developers out of business.Song Weiping, who is selling most of his stake in luxury-property developer Greentown China Holdings and is stepping down as chairman amid a worsening market downturn, told a news briefing that local and central governments were to blame for the industry's problems, having interfered too much in the market.China's property developers face increasing pressure from falling sales and stringent government limits on home purchases. Since 2010, Beijing has rolled out tight measures such as curbs on second or subsequent homes and price ceilings to rein in market speculation and high housing prices.Property developers have complained that such measures distort the market, and the recent downturn in the country's housing market has brought more of such comments to surface. Mr. Song said he is tired of operating in an environment in which the market isn't free.So far this year, housing sales have been hit by excessive supply and bouts of price slashing, with expectations of more discounting to come.

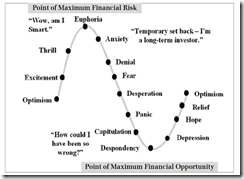

Every credit inspired boom is a distortion. The attendant bust has been the market’s response to the uncovering of the imbalances brought about by the phony boom. Government regulations certainly add more to the such distortions. But the point is that during the bust cycle, there will be lots of finger pointing. It’s part of the denial stage.

Yet this serves as more evidence of resident elites or "smart money" anticipating a black swan in China.

And if these monies move out of China, they will continue to pressure on the currency the renminbi

While not as dreary another bigwig from the industry has called for the end of China’s golden era for the property market

From Bloomberg: (bold mine)

China Vanke Co. (3333), the nation’s biggest developer, is focused on developing homes for owner occupiers rather than investors because the country’s property industry has passed its “golden era,” President Yu Liang said.“The period in which everybody makes money out of property is gone,” Yu told reporters May 26 in Dongguan, a southern city in Guangdong province. “Vanke will take a cautiously optimistic approach to face the slowdown and target those buyers who need homes for self-use.”Yu joins Vanke Chairman Wang Shi in flagging a slowdown in China’s property market and follows Moody’s Investors Service’s revision of its credit outlook for Chinese developers to negative from stable last week. Home sales slumped 10 percent in the first four months of this year amid tight credit and slower economic growth, reversing last year’s 27 percent jump and prompting developers including Vanke to cut prices.

It’s quite odd to declare the passing of the golden era while taking on a cautiously “optimistic” approach. The implication is that not all of China’s property sector have been fated for a bust. But doesn't look like the case.

The most probable reason why the Vanke hasn’t been as bearish is because they are looking into investing in the Chinese government's privatization of state owned firmed that had been hit from the recent slowdown. According to a Reuters report “As part of the government's reform plans, Beijing has promised to allow more private participation in state-owned enterprises. Many of those state-owned enterprises have expanded into property development in recent years, drawn by big profits.”

So perhaps the Vanke group will be doing some special crony deals with the government in the so-called reforms. Most likely, political deals redounds to cautiously "optimistic" approach.

In the meantime Chinese government reported a surge in Non Performing loans. From Bloomberg:

China’s biggest banks are poised to report the highest proportion of bad debts since 2009 after late payments on loans surged to a five-year high, indicating borrowers are struggling amid an economic slowdown.The nation’s 10 largest lenders reported overdue loans reached 588 billion yuan ($94 billion) at the end of 2013, a 21 percent increase from a year earlier to the highest level since at least 2009. The rise in late payments portends more losses on soured loans for banks in coming months as China’s slowing economy crimps companies’ earnings, while a government crackdown on nonbank funding makes it tougher for borrowers to get new credit or finance older debt.“Overdue loans are a leading indicator of asset-quality deterioration and show the rising liquidity constraints among borrowers,” said Liao Qiang, a Beijing-based director at Standard & Poor’s. “While we believe Chinese banks’ credit woes will unfold gradually, the disturbing thing is that the end is nowhere in sight.”Overdue loans, those late by at least a day, were 31 percent greater for the banks as of Dec. 31 than nonperforming ones, which are debts they don’t expect to recoup in full. That’s the biggest gap in at least five years, signaling lenders may be resisting acknowledging the deterioration to avoid setting aside funds to cover potential losses.

More signs of big trouble in big China. But for the "be happy" crowd, stocks has been destined to always go up.

1 comment:

I read somewhere that the Real State Market in China was cooling off. Market Cooling off? Based on everything I have read, I think the China's Real Estate Market has fallen off a cliff. I think the smart money has sold their properties or are in the process of selling. Asia's richest man has sold all of his Properties in China. And no, it's not different in China. It's the same where ever you may live. When homes cost too much, eventually, people will wake up to the fact that things are out of control. And I think it's happened. In the past, only people buying in China were the one's who could afford to buy. And the average person in China does not make enough money in China to buy an apartment. I believe we're in the midst of a housing crash in China. People need to wake up to this fact. People in the West, especially in the US, don't pay attention to what is happening in China and they should. Because if China's Real Estate Market is crashing, then their economy will follow. And this will have severe consequences for the United States as well. Right now the price of insuring against this type of risk is not yet priced into the market. Once people realize what's going on in China, the markets will crash. All market. Just my opinion. I could be wrong. Wouldn't be the first time. But Look around. Type in China Real Estate in Google for the last month and see for yourselves.

Post a Comment