Last week, I wrote (bold original)

debts are NOT just about statistics. Since every debt incurred postulates to money allotment in the economic stream—whether this has been in properties, stocks, bonds, grandiose political projects, welfare or warfare state or a combination of—such extrapolates to the commitment of resources in the direction of money allocation.

A fantastic example have been China’s ghost projects

Add to this list a mimic of New York’s Manhattan

From the Bloomberg:

China’s project to build a replica Manhattan is taking shape against a backdrop of vacant office towers and unfinished hotels, underscoring the risks to a slowing economy from the nation’s unprecedented investment boom.The skyscraper-filled skyline of the Conch Bay district in the northern port city of Tianjin has none of a metropolis’s bustle up close, with dirt-covered glass doors and construction on some edifices halted. The area’s failure to attract tenants since the first building was finished in 2010 bodes ill across the Hai River for the separate Yujiapu development, which is modeled on New York’s Manhattan and remains in progress

This is a wonderful example of the distinction between statistical and real economic growth.

Central bank and government policies aimed at attaining artificial (statistical) economic growth for political purposes or goals via debt

financed spending boom not only creates excess supply, they knock off

real growth overtime as resources have been sunk into non profitable

projects while simultaneously transforming existing liabilities into credit risks

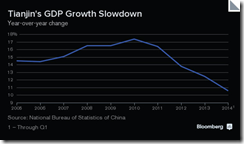

Tianjin, a city of 14.7 million people whose center is about 125 kilometers (78 miles) southeast of Beijing’s, saw its economic growth cool to 10.6 percent in the first quarter of 2014 from a year earlier, from 17.4 percent in full-year 2010, compared with a moderation in national expansion over the same period to 7.4 percent from 10.4 percent. An annual pace of 10.6 percent would be the weakest for Tianjin since 1999.The government financing vehicle, Tianjin Binhai New Area Construction & Investment Group Co., reported revenue fell to 5.9 billion yuan ($950 million) in 2013, and profit dropped about 37 percent to 246.6 million yuan, according to its annual report.The company has 20.7 billion yuan of debt due in 2014, including loans, corporate bonds and commercial paper, almost triple 2013’s amount. Another 13.9 billion yuan is due next year. It sold 2.5 billion yuan of seven-year notes in May at a 6.5 percent coupon to repay bank loans and interest, according to a prospectus.

All these means that such imbalances will require market clearing or massive re-pricing that would entail capital losses.

The conclusion from my introductory quote.

And the imbalances accrued from misdirected resources in response to interventionist policies fertilize the roots of depression.

China's political economy is headed in the aforementioned direction

1 comment:

Metro Manila alone have an out of control condo buildings being built left and right with exorbitantly high prices per unit and condo fees. Yes they may be sold out to "flippers" and after that who will be the "new" buyers? Is the mania still ongoing or are there unit/home owners defaulting on payments?

Post a Comment