In February of last year, I proposed that the volatility incited by the Bernanke "Taper Talk" would have a feedback loop transmission mechanism to developed economies: (bold original)

if the adverse impact of emerging markets to the US and developed economies won’t be offset by growth (exports, bank assets and corporate profits) in developed nations or in frontier nations, then there will be a drag on the growth of developed economies, which would hardly be inconsequential. Why? Because the feedback loop from the sizeable developed economies will magnify on the downside trajectory of emerging market growth which again will ricochet back to developed economies and so forth. Such feedback mechanism is the essence of periphery-to-core dynamics which shows how economic and financial pathologies, like biological contemporaries, operate at the margins or by stages.

Let us see how this may have been applied anent earnings growth.

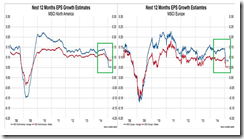

First 12 forward EPS growth estimates for MSCI Emerging markets and Pacific…

EPS growth has declined in 2013, rallied in the 1Q of 2014 (green trend line) and has cascaded through the yearend. There seems to be innate signs of recovery. But recoveries look as if it has been driven by seasonal yearend forces (green boxes)

Nonetheless the general trend looks headed south interspersed with gains.

Now here is the more interesting part.

The same EPS estimates for MSCI North America and Europe has collapsed.

Notes the prolific Gavekal Team (charts theirs too)

Without delving into the multitude of reasons for the drop, we just point out that EPS estimates for next twelve months are falling like a stone in North America and Europe and for these two regions the bottom line estimates point to the lowest growth rate since late 2009. It doesn't matter whether we look at average EPS growth estimates or median, as the fall in both series is becoming concerning.Thankfully, the estimated EPS growth rate for developed Asia and EMs has remained stable.

Will the feedback loop from the developed economies magnify on the downside trajectory of emerging market growth which again will ricochet back to developed economies and so forth?

Also record stocks in the face of collapsing EPS!

Very interesting.

No comments:

Post a Comment