The Philippine government plans to improve local equity standings through regional cooperation.

From Finance Asia

The Philippine Stock Exchange can boast a handful of companies that international investors are comfortable with — the biggest banks, telcos and conglomerates. But there are also a handful of companies in foods, pharmaceuticals and services that are well-run, growing businesses.

In an exclusive interview with FinanceAsia, Cesar Purisima, secretary of the Philippine department of finance, said that he hopes these dynamic firms will become future corporate champions through initiatives such as Asean Exchanges — a collaboration of seven exchanges from Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam.

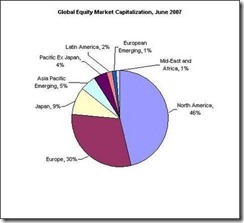

“We’ve been trying to encourage more of these start-ups and family-owned companies to come to the capital markets,” said Purisima. “It is important that Asean develops a deeper capital market that attracts investors from both within the region and outside. The problem for most of the exchanges right now is that it is simply not deep enough, not big enough. The Asean Exchanges will help us address that problem.”

A deeper pool of liquidity could make it more worthwhile for start-ups and other growing businesses to consider listing, but would also help bigger firms with international ambitions.

“We have companies that are starting to go beyond the boundaries of the Philippines,” said Purisima, “Getting funding from outside is crucial not just from a capital perspective, but also in terms of matching risk.”

The main reason that I am not sold to the notion of decoupling (yet), aside from globalization, has been because regionalization has already been happening, if not intensifying. So the political framework for deeper regional collaboration through equity markets are, in effect, responses to an ongoing phenomenon.

Yes, ASEAN has already embarked on a cross listing program via the Singapore Exchange and the Monetary Authority of Singapore (MAS) which began this month with Malaysia, Singapore and Thailand as pioneer participants. The Philippines, Indonesia and Vietnam has announced interests to join in the future.

While I am one with Mr. Purisima’s goal to deepen the domestic equity market partly through ‘collaboration’ with Asean exchanges and eventually through cross-listing, Mr. Purisima misses out the main reason for why many family owned businesses have been reluctant to list.

This basically boils down to economic opportunities: many economic opportunities has been politically derived, which also extrapolates to the lack of opportunities outside the political realm.

In a way, the Philippine political economy resembles Greece.

Robert Kaplan at the Stratfor describes the fundamental Greece political economy

Roughly three-quarters of Greek businesses are family-owned and rely on family labor, making meritocratic promotion difficult for those outside the family. Tax cheating is rampant. The economy suffers from a profound lack of competitiveness, even as Greece is mainly a service economy, relying on tourism, in which manufacturing constitutes a weak sector. Of course, these features have much to do with bad policies enacted over the years and decades, but they are also products of history and culture, which are, in turn, products of geography. Indeed, Greece lacks enough productive land to be an agricultural power.

Then there is political underdevelopment. Long into the 20th century, Greek political parties had a paternalistic, coffeehouse quality, centered on big personalities -- chieftains in all but name -- with little formal organizational support. George Papandreou, the grandfather of the recent prime minister of the same name, actually headed a party called the "George Papandreou Party." Political parties have been family businesses to a greater extent in Greece than in other Western democracies. The party in power not only dominated the highest echelons of the bureaucracy, as is normal and proper in a democracy, but the middle- and lower-echelons, too. State institutions from top to bottom were often overly politicized.

In other words, the structure of the economy reflects on the structure of politics.

As I pointed out before,

There about 250 political dynasties in the Philippines (New York Times 2007) and this number has been growing. The 14th Philippine congress has an estimated more than 75% of lawmakers from old political families (Wikipedia.org).

In short, the key problem has not been about ‘corporate governance’ or ‘corruption’ (which has been alluded to as obstacles by Mr. Purisma) both of which signifies as symptoms rather than the disease, but one of economic freedom.

Because greater economic freedom allows for MORE economic opportunities, economic freedom will likely reduce the incentives by families to keep a tight lock on their business holdings and allow more public ownership. Alternatively, family business owners are likely to be provided with more options to diversify or even to switch fields of investments, given the liberal business environment.

Lastly corporate governance has not been an issue of oversight from ‘virtuous’ regulators over scheming stockholders and managers, as the government has been guilty of the many sins endured by the economy and by unscrupulous corporate agents; particularly through taxes, manifold regulations (as licenses, disclosure rules, insider trading etc..) [ which diminishes profits, distorts profits and spurs corruption and transferring of resources to wasteful consumptive expenditures by governments], ownership restrictions, labor regulations (raises the cost of labor and thus unemployment) and more.

Corporate governance is largely the about the contractual relationship between the entrepreneurs, capitalists and managers.

As the great Ludwig von Mises explained,

The general direction of a corporation's conduct of business is exercised by the stockholders and their elected mandataries, the directors. The directors appoint and discharge the managers. In smaller companies and sometimes even in bigger ones the offices of the directors and the managers are often combined in the same persons. A successful corporation is ultimately never controlled by hired managers. The emergence of an omnipotent managerial class is not a phenomenon of the unhampered market economy. It was, on the contrary, an outgrowth of the interventionist policies consciously aiming at an elimination of the influence of the shareholders and at their virtual expropriation. In Germany, Italy, and Austria it was a preliminary step on the way toward the substitution of government control of business for free enterprise, as has been the case in Great Britain with regard to the Bank of England and the railroads. Similar tendencies are prevalent in the American public utilities. The marvelous achievements of corporate business were not a result of the activities of a salaried managerial oligarchy; they were accomplished by people who were connected with the corporation by means of the ownership of a considerable part or of the greater part of its stock and whom part of the public scorned as promoters and profiteers.

Politically based corporate governance can, thus, serve as a vehicle for government control of corporations and for cronyism.

![clip_image002[4] clip_image002[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhEl-ZHGXEwOoFzkugKJ1BaR6lwl_rZ6ls3ypjIAPKrhR6ArUndeswjPCQ0yTnWJYGaJ1s_OjymlVfObm8agwcNB1LBKXw23zspjKCVePB6OJrjkZG89WeFHjhRtFoW8YbX-Dxq/?imgmax=800)