High Volatility Continues

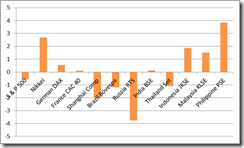

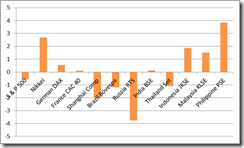

The Philippines Phisix had an ENORMOUS ‘RISK ON’ week with a raucous shindig over the outcome of the Greece elections.

The Phisix jumped by an eye popping 3.84% for the week to take the top spot in the region. This week’s gain practically obliterated the previous two weeks of losses.

ASEAN markets somewhat shared the carousal.

Unknown to most the Phisix-ASEAN blast came amidst highly volatile global market actions.

While most of the world shared the early excitement brought about by the pro-Euro Greece victory, gains eventually succumb to heavy losses. It’s only in Japan and in the major ASEAN markets where gains were maintained until the week’s close.

Even in the US, market breadth has been decisively either ON or OFF or a phenomenon driven by a rising or sinking tide.

Bespoke Invest writes[1],

We consider all or nothing days in the market to be days where the net daily A/D reading in the S&P 500 exceeds plus or minus 400. After a slow start to the year, the pace of all-or-nothing days has really picked up as nine of the year's sixteen occurrences have all come since the beginning of May. At the current rate, the S&P 500 is on pace to see 34 all-or-nothing days this year.

This demonstrates of the continued high volatility that has dominated the financial markets.

Another “Political” Intervention to Bolster the Phisix?

I suspect that interventions from non-market forces may be responsible anew for the resiliency of the Phisix.

The Phisix was bizarrely unruffled by the rout of the US markets last Thursday and even closed slightly positive on Friday.

Friday’s session opened with the Phisix sharply down driven by the developments in the US. But in no time, aggressive buyers constantly bid up the heavy market cap stocks, particularly by PLDT [PSE: TEL] and Bank of the Philippine Islands [PSE: BPI] significantly higher, thus driving the major domestic composite higher.

The 75 point pendulum swing from the troughs to the highs translated to another amazing 1.5% intraday move (intraday chart from technistock.com).

Such peculiar aggressive buying behaviors occurred when the region’s bourses suffered from losses.

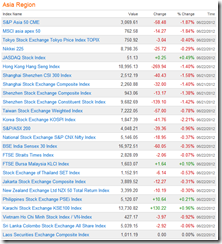

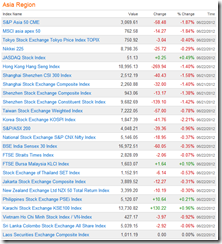

Friday’s closing scorecard for Asia from Bloomberg.

Why would any rational market agent aggressively buy up such index issues in the knowledge that they can take advantage of, and save a lot through bargain hunting or buying defensively, considering the prevailing dour market sentiment?

Are these forces really sooo exceedingly bullish such that they expect Philippine equities to immediately zoom even amidst all the surrounding risks? Are these forces price insensitive? Or are they assuming the role of market makers or of stock market operators?

Remember these entities are dealing with tens, if not hundreds of millions of pesos worth of equity positions. So they are unlikely to be gullible retail investors.

While it may be true that both issues posted heavy foreign buying on that day, statistics may not tell the true story. Foreign buying can come from offshore entities owned by local non-market entities or from foreign institutions allied to the local political class.

Besides, their actions appear to be inconsistent with actions of portfolio managers around the world as emerging market funds have registered net outflows.

From Reuters[2], (June 21st)

Funds that focus on emerging markets also saw outflows last month, eVestment found. For the ninth consecutive month investor withdrawals outpaced allocations to those managers, with $1.1 billion in redemeptions in May.

Even if foreign investors have distinct treatment on various emerging markets, I find these seemingly deliberate market defying actions as very suspicious.

As a side note, the Phisix has posted two consecutive weeks of net foreign buying.

Also Friday’s action seems to parallel the dynamics executed over the same environment three weeks back[3]. Yet such an attempt had been shot down by a single day loss[4].

Three weeks into a recovery, these operators have hardly been significantly up today.

The point is ‘interventions’ will eventually be smoothed out or neutralized by the underlying forces which drives the financial markets.

Will the Current Phisix Divergence Last?

This week’s dramatic upside showing by the Phisix nonetheless highlights another anomalous divergence within the region; particularly the winners Philippines (PCOMP orange)—Malaysia (FBMKLCI red) and the laggards as Thailand (SET yellow)—Indonesia (JCI green).

In the past, ASEAN price trends have largely moved in consonance, inflection points have almost been synchronized (blue vertical lines)

So either divergence become a lasting (decoupling) feature, or that eventually a recoupling will happen—where the laggards catches up or the winners will fall in line with the laggards.

My bet is on the latter—recoupling. There have hardly been any durable signs of divergences. And a decoupling within the region must also mean a decoupling with the world. That would be unlikely.

As previously discussed[5] the Philippines IS sensitive to developments abroad particularly through the merchandise trade channel (which accounts for about 50% of GDP) and through the OFW-remittance channel (which is about nearly 12% of GDP)

I believe that the possibility of a decoupling may happen in the event of a currency crisis. However current setting which has been about unwieldy debt and boom bust cycles doesn’t seem conducive for such scenario. Of course I could be wrong.

Even in terms of conventional methodology, sustained divergences may seem implausible.

If economic growth should prove to be an indicator of future profits or earnings, then current manufacturing surveys of major economies does not seem to be supportive of further earnings or profit growth.

Europe’s largest economies Germany and France seem headed towards or if not have already been in a recession. The US manufacturing index has likewise slumped, while China’s manufacturing index has steadily been on a decline as shown by the charts from Danske Bank[6].

Of course this ultimately depends on the persistence of such trends.

The same applies to earnings growth.

The consensus view of earnings of global publicly listed companies according to the UBS appears to be rolling over[7].

So if stocks continue to rise even as economic growth begins to stagnate, which subsequently suggests of increasing risks of a downturn in profits, then deductive logic tells us that rising stocks won’t be sustainable.

Sustained rise in stocks means that valuations will eventually become ‘pricey’ and thus subject markets to the risks of the regression to the mean[8]—or outlier events that statistically reverts towards the mean.

In short, markets will decline either orderly or in disorderly fashion depending if markets will adjust today or sometime in the future to reflect on the evolving realities.

So there hardly have been fundamentals (even in the conventional perspective) in support of a sustained upswing EXCEPT for interventions by central banks that supports the financial markets.

And here lies the essence of today’s volatile markets.

Diminishing Returns and the Withdrawal Syndrome

As I pointed out last week, expectations of central bank rescues have functioned as the focal point of the market’s directions.

I wrote[9],

Global financial markets have relied heavily on the “buy the rumor” from central banking rescues.

These are likely to have two short to medium term outcomes.

One, if central bankers FAIL to deliver in accordance to market’s expectations, then we will likely see another huge bout of downside volatility in global equity markets…

On the other hand, if markets may be temporarily satisfied with REAL actions of central banks (e.g. $1 trillion bailout) then we should see a minor or a slight “sell on news”. But this should be seen as opportunities to RE-ENTER the markets incrementally.

Like the bailout of Spain, the Greece elections have had a short term effect on most of the world markets.

[As a side note, to call the Philippine (Phisix) and Malaysia’s (KLSE) one week deviation as sustainable trends would be based on HOPE.]

The attention of global financial markets eventually shifted to the US Federal Reserve to deliver the promise of stimulus.

The Ben Bernanke led Federal Open Market Committee (FOMC) DID deliver, but did so reluctantly.

The FOMC extended Operation Twist until the yearend by only about three-fifths ($267 billion) of the original size ($400 billion)[10]. But along with it comes more assurance of “additional asset purchases would be among the things that we would certainly consider”

Unknown to most is that the current bailouts have been subjected to the laws of diminishing returns.

For instance, the positive impact to the marketplace from bailouts in Eurozone has been shortening or experiencing diminishing returns as measured and documented by a recent study[11].

The same diminishing returns can be seen from US Federal Reserve actions (QE 1, QE 2, and Operation Twist or Maturity Extension Program MEP) as shown by the yields from different debt instruments[12].

The point is that central bankers will need to step up or INTENSIFY the scale of balance sheets expansions. Otherwise similar or lesser degree of actions would mean vastly reduced positive impact to the marketplace which alternatively accentuates the risks from downside volatilities.

So the Fed’s announcement belatedly incited a huge slump on the S&P 500, Thursday.

Again, the slump can be construed as ventilation of the frustrated expectations or as consequence to “sell on news” or as manifestations of diminishing returns or a combo of the three.

Yet it would be misguided to view the FED’s actions as simply providing what the market wanted as proposed by the populist analyst John Mauldin[13],

So why did the Fed continue Operation Twist? Because the market (that amorphous, omnivorous blob) expected something from the Fed. This summer's version of Twist and Whisper was about the least they could do.

The FED has been CONDITIONING the markets of the coming FED actions that has artificially propped up the markets[14].

So the market expectations simply adjusted to pledges made by officials. Besides market participants have been brainwashed like Pavlov’s dogs with the Bernanke “inflation” Put.

And that’s why bad news became good news—or markets rose amidst a spate of bad news—for the simple reason that major central bank authorities continually whetted on the appetite of the marketplace with guarantees of support.

The genuine reason for the extension of Operation Twist is that the FED continues to finance the US treasury or bails out the US government.

While Operation Twist has been designed to nudge market’s appetite to take on more risk “by taking long-term bonds off the market”, notes the Wall Street Journal[15], what has been happening, instead, is that the US Treasury has been taking advantage of low interest rates to ramp up on the issuance of long term securities.

This means that the Fed has actually been accommodating the shift in the debt maturity profile by the US Treasury, whose moves may have been possibly intended to reduce rollover risks[16] or the risk from refinancing debt that could be triggered by an upward move of interest rates.

A surge in interest rate would balloon interest payments and deficits and most likely trigger a debt crisis ala the Eurozone (see chart above[17]). A US debt crisis would likely elicit a currency crisis if the FED insists on resorting to the printing press to solve her problem of debt.

But of course, the Fed’s accommodation has also been about the growing debt of the US which now stands at $15.809 trillion according to USdebtclock.org

US politicians have become so addicted to debt based spending such that House Minority Leader Nancy Pelosi, D-Calif., writes the Washington Examiner[18], thinks that President Obama should unilaterally eliminate the debt ceiling. Politicians really believe that they are above the laws of economics.

And perhaps the Fed’s parsimonious actions may have been due to the reduced number of short term instruments available for the twist (US Treasury securities held by the FED for 1-5 years maturity has been collapsing).

Or perhaps, Mr. Bernanke would like to avoid a political backlash similar to that of the last quarter of 2011, which may have prompted him to jilt the markets expecting for QE 3.0[19].

Bottom line, the current uncertainty dynamic comes with the growing gap between actualized policies and market expectations mainly premised on the pledges of backstops from central bank authorities.

The failure to meet such expectations is likely to provoke turbulent episodes symptomatic of a withdrawal syndrome.

Uncertainty leads to volatility.

As the past 3 weeks has shown, the Phisix has not been immune to volatility in both directions.

China’s Languid Economic Conditions Aggravates Political Uncertainty

Developments in China has been adding to the landscape of uncertainty.

Reports of a worsening decline in the manufacturing index[20] have not only led to a technical breakdown of China’s Shanghai markets but also to a breakdown of commodity prices.

The SSEC will soon test the immediate support level (green horizontal line)

China’s economy seems to be in a slomo burn rate.

And the epicienter of China’s weakness (bursting bubble?) emanates from the property sector (see chart above[21]) which continues to reel from a slomo decline, and which has spread to the manufacturing sector.

An even grimmer news is that reports say that China has been artificially been propping up economic statistics for political reasons[22], particularly for the coming national elections, as local officials pad up statistical output in order to get promotions. The implication is that China’s economic performance has been weaker than what has been published

So far, the Chinese national government has repeatedly shown reluctance to aggressively intervene. Most of interventions has been marginal, done on a stealth State level[23], on the monetary aspects (lowering of interest rates)[24] and on the cosmetic inflation of economic statistics.

So the deterioration in China’s economy has been aggravated by political deadlock.

Low Oil Prices Jeopardizes the Oil Welfare State and Enhances Risks of War

The ongoing economic slowdown in multiple fronts (most especially in China) has hurt commodity prices and has led the US Oil (WTIC) benchmark to break below the $80 level.

And with oil prices slightly below the $80 threshold, this should begin to affect the fiscal balances of many welfare states of oil producing economies, whose critical welfare threshold is at the $80 level and above (see chart[25]).

As I previously wrote[26],

The welfare states of many of the major producers, particularly OPEC economies or even non-OPEC such as Russia greatly depends lofty oil prices, perhaps about $85 and above. Even President Obama’s green energy projects have been anchored on high oil prices.

This means that if oil prices breaks below their welfare threshold for a prolonged period, then this would incite popular uprising and the eventual collapse of the current political order.

And this is why oil producing governments have been limiting private sector’s access to oil reserves. Yet the capacity by these governments to bring oil to the surface has been constrained by government budget, which has been mostly spent on welfare (yes to buy off their political privileges from their constituents), and the lack of technology.

The implication of the above is that these governments will probably try to restrict production, seek the war option (e.g. urge the US to militarily take on Iran), inflate their economies to pay for their welfare system or influence major central banks and politicians of major economies to resort to more inflationism.

And it is why the brinkmanship politics in the Middle East has scaled up the drumbeats of war not just on Iran, but also on Syria.

Foreign policy interventions have been about promoting the interests of the welfare states allied to the West and the interests of the neoconservative political class who represents the interests of the military industrial complex.

As Ron Paul rightly points out[27],

And once again, we are about to engage in military action against Syria and at the same time irresponsibly reactivating the Cold War with Russia. We're now engaged in a game of "chicken" with Russia which presents a much greater threat to our security than does Syria…

Controlling Iranian oil, just as we have done in Saudi Arabia and are attempting to do in Iraq, is the real goal of the neo-conservatives who have been in charge of our foreign policy for the past couple of decades.

So politicians are looking for political scapegoats from which to divert people’s attentions, as well as, to create justifications for more inflationism.

Bottom line: Either from demand-supply perspective or from monetary inflation, falling commodity prices can hardly be seen as positive for stock markets for the moment.

Falling commodity prices are manifestations of an ongoing liquidation process from malinvestments and from the political uncertainty over ambiguous policies.

We would need to wait for declared actions from political authorities. Otherwise, should markets awaken to the reality of false promises, downside volatility will likely be amplified.

[1] Bespoke Investment Group Another All or Nothing Day!, June 21, 2012

[2] Reuters.com Investors fled Europe-linked hedge funds in May-report, June 21, 2012

[3] See Phisix: Very Impressive Day or Month End Close for May 2012, May 31, 2012

[4] See Phisix: Last Week’s Big Surge Wiped Out in a Single Day! June 4, 2012

[5] See Will the Phisix Divergence Last? June 4, 2012

[6] Danske Research Time for another important EU summit, June 22, 2012

[7] Zero Hedge Three Charts Your Stockbroker Won't Want You To See, June 18, 2012

[8] Chegg.com Definition of Regression to the Mean Regression to the mean, or regression threat, refers to the statistical phenomenon of outlier data moving toward the mean in subsequent non-randomly selected tests. Statisticians need to take regression to the mean into account when designing experiments.

[9] See Dealing with Today’s Uncertainty: Patience is the Better Part of Valor June 17, 2012

[10] See US Federal Reserve Extends Operation Twist, Commodities Drop June 21, 2012

[11] See The Diminishing Returns from Euro Bailouts Becoming Evident June 20, 2012

[12] Zero Hedge The Diminishing Returns Of Central Planning, And Why More Printing Would Have No Impact June 15, 2012

[13] Mauldin John, Daddy's Home Goldseek.com June 24, 2012

[14] See Bad News Is Good News: Global Markets Rise on MORE Stimulus Expectations June 20, 2012

[15] Wall Street Journal Economics Blog Bernanke Acknowledges Treasury Strategy at Odds With Fed Policy, June 22, 2012

[16] Investopedia.com Rollover Risk

[17] Zero Hedge Presenting Dave Rosenberg's Complete Chartporn, June 1, 2012

[18] Washington Examiner Pelosi: Obama should unilaterally eliminate the debt ceiling, June 22, 2012

[19] See Bernanke Jilts Markets on Steroids, Suffers Violent Withdrawal Symptoms, September 22, 2012

[20] See China’s Manufacturing Troubles Hasn’t Gone Away June 21, 2012

[21] Businessinsider.com SocGen: China's Housing Market Correction Is 'Sending Shock Waves Through Its Economy', June 18, 2012

[22] See China’s Economy has been Artificially Embellished for Politics June 24, 2012

[23] See China’s New Loans Unexpectedly Surged in May June 12, 2012

[24] See HOT: China Cuts Lending Rates and Deposit Rates June 7, 2012

[25] King Byron What’s the Deal With Oil Prices? June 13, 2012 Daily Reckoning.

[26] See Phisix: The Correction Phase Cometh, May 14, 2012

[27] Paul Ron When Will We Attack Syria?, June 20, 2012, lewrockwell.com