India stepped up efforts to help the rupee after its plunge to a record low, raising two interest rates in a move that escalates a tightening in liquidity across most of the biggest emerging markets.The central bank announced the decision late yesterday after Governor Duvvuri Subbarao earlier in the day canceled a speech to meet the finance minister. The RBI raised two money-market rates by 2 percentage points and plans to drain 120 billion rupees ($2 billion) through bond purchases.Indian rupee forwards jumped the most in 10 months, and the RBI’s move yesterday left Russia as the only BRIC economy to not have reined in funds in its financial system. Brazil has raised its benchmark rates three times this year and a cash squeeze in China sent interbank borrowing costs soaring to records last month.

The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Tuesday, July 16, 2013

More Signs of the End of Easy Money: Following Brazil, the Indian Government Raises Interest Rates

Thursday, July 11, 2013

Brazil's Central Bank Sharply Increases Interest Rates

Brazil raised its benchmark interest rate to 8.50 percent from 8 percent on Wednesday, maintaining the pace of monetary tightening to battle above-target inflation in Latin America's largest economy.The central bank's monetary policy committee voted unanimously to hike its Selic rate by 50 basis points, a move widely expected by markets.Under the leadership of Alexandre Tombini the central bank has hiked rates three consecutive times this year in a bid to regain its credibility as an inflation fighter and curb prices, which in June rose at their fastest pace in 20 months."The Committee understands that this decision will contribute to lowering inflation and ensuring that the trend continues next year," the central bank said in a statement, repeating the same language used in the previous decision.A sharp depreciation of the real, which increases the value of imports, poses a serious challenge for the central bank, which has pledged to bring inflation below the 5.84 percent mark recorded last year.

Thursday, May 30, 2013

More Signs of the End of Easy Money? Brazil Raises Rates amidst Stagflation

Brazil’s central bank on Wednesday confronted an increasingly acute policy dilemma with firm hand and clear voice, seeming to throw its customary caution to the wind.In its fourth monetary policy meeting of 2013, the central bank voted unanimously to raise its Selic base interest rate by a half point to 8%. In a brief statement, the central bank said the change was “continuing with” an adjustment in interest rates that would help put inflation on a downward path.Most analysts had expected a more modest quarter-point increase in the face of soft economic growth.“They finally woke up,” said Paulo Faria-Tavares, managing partner of Sao Paulo’s PTX Lending consultants. “But they need to stay awake or it won’t work.”The central bank’s policy dilemma became unexpectedly acute earlier Wednesday, when the government’s IBGE statistics bureau released first quarter economic growth figures. The data showed disappointing first quarter growth of only 0.6%. Most analysts had predicted 0.9% growth.But slower growth is coming at the same time as rising inflation. Brazil’s 12-month inflation rate is currently running at 6.46%, up from 5.84% at the end of 2012. The current rate is skating dangerously close to the 6.5% ceiling of Brazil’s inflation targeting range, which is 2.5%-to-6.5%.Under Brazil’s 1999 inflation-targeting law, the central bank is obliged to take action whenever inflation bursts through the top of the range. That could happen at any time

When it comes to rising housing prices, no country in the world beats Brazil.According to Knight Frank’s Global Real Estate Index, released this month, Brazil ranks No. 3 in the world and No. 1 in the Americas for rising home prices. Only ridiculously expensive Hong Kong and Dubai, which are not countries, have seen prices rise more. So in fact, no single country has seen its housing prices rise as much as Brazil.Brazil housing prices rose 13.7% from the fourth quarter of 2011 to Dec. 31, 2012. By comparison, U.S. housing prices rose 7.3% in the same period, putting it at No. 12 in a list of 55 countries ranked by Knight Frank.The only other country in the hemisphere to make it into the top 20 was Colombia, with real estate prices rising 8.3% in 2012.Brazil stands out. And one reason is the low cost of financing. Or at least low by Brazilian standards. Mortgage rates are at least 1.3% a month, and loan payments are generally for just 15 years. It used to be that Brazilians bought homes in cash, but not anymore. They are financing purchases with down payments. Since 2009, when Brazilians starting buying homes on debt, mortgage lending has risen five fold, by 550% between then and 2012.According to Brazil’s Institute for Economic Research, or FIPE, housing prices rolled into the end of 2012 in seven capital cities on a high note. Prices in all seven cities — from São Paulo to Rio de Janeiro — rose well above the inflation rate of 5%. At the start of the fourth quarter last year, at the end of September, Brazilian housing prices had already risen by 15% while inflation was not even half that.Looking back at September, FIPE said São Paulo real estate rose 1.5%, three times higher than the national inflation average for the month.

But the boom cannot continue indefinitely. There are two alternatives. Either the banks continue the credit expansion without restriction and thus cause constantly mounting price increases and an ever-growing orgy of speculation, which, as in all other cases of unlimited inflation, ends in a “crack-up boom” and in a collapse of the money and credit system. Or the banks stop before this point is reached, voluntarily renounce further credit expansion and thus bring about the crisis. The depression follows in both instances

Tuesday, May 07, 2013

Cyprus Model of Deposit Haircuts Spread to Brazil

The Brazilian government, concerned about systemic risk in the rapid growth of banking assets, will propose legislation to make shareholders, bondholders and depositors pay for rescuing troubled banks and shield taxpayers from the cost of bailouts.Central Bank President Alexandre Tombini told a banking seminar on Monday that the legislation aims to mitigate "moral hazard" by forcing banks to assume full responsibility for their losses in what is known as a "bail-in." It was applied in Cyprus to stop a run on the banks and Canada is also considering rules to deal with potential bank failures.In the case of Brazil, the proposed bill underscores mounting unease among regulators with the rapid pace of growth of banking assets in Latin America's largest economy in recent years. Some banks might be "too big too fail" in Brazil, and the need to discourage irresponsible behavior could be higher now than before as state-run lenders expand their balance sheets three times the pace of their private-sector peers.

Monday, January 21, 2013

Global Financial Markets Party on the Palm of Central Bankers

We can either expect a shift out of bonds and into the stock markets or that the bond markets could be the trigger to the coming crisis.In my view, the former is likely to happen first perhaps before the latter. To also add that triggers to crisis could come from exogenous forces.

Hedge funds are borrowing more to buy equities just as loans by New York Stock Exchange brokers reach the highest in four years, signs of increasing confidence after professional investors trailed the market since 2008.Leverage among managers who speculate on rising and falling shares climbed to the highest level to start any year since at least 2004, according to data compiled by Morgan Stanley. Margin debt at NYSE firms rose in November to the most since February 2008, data from NYSE Euronext show.

What’s old is new again on Wall Street as banks tap into soaring demand for commercial real estate debt by selling collateralized debt obligations, securities not seen since the last boom.Sales of CDOs linked to everything from hotels to offices and shopping malls are poised to climb to as much as $10 billion this year, about 10 times the level of 2012, according to Royal Bank of Scotland Group Plc. (RBS) Lenders including Redwood Trust Inc. are offering the deals for the first time since transactions ground to a halt when skyrocketing residential loan defaults triggered a seizure across credit markets in 2008.The rebirth of commercial property CDOs comes as investors wager on a real estate recovery and as the Federal Reserve pushes down borrowing costs, encouraging bond buyers to seek higher-yielding debt. The securities package loans such as those for buildings with high vacancy rates that are considered riskier than those found in traditional commercial-mortgage backed securities, where surging investor demand has driven spreads to the narrowest in more than five years.

Investors are pouring the most money since 2009 into U.S. municipal debt, putting the $3.7 trillion market on a pace for its longest rally versus Treasuries in three years.Demand from individuals, who own about 70 percent of U.S. local debt, rose last week after Congress’s Jan. 1 deal to avert more than $600 billion in federal tax increases and spending cuts spared munis’ tax-exempt status. Investors added $1.6 billion to muni mutual funds in the week ended Jan. 9, the most since October 2009 and the first gain in four weeks, Lipper US Fund Flows data show.

The market for corporate borrowing through commercial paper expanded for a 12th week as non- financial short-term IOUs rose to the highest level in four years.The seasonally adjusted amount of U.S. commercial paper advanced $27.8 billion to $1.133 trillion outstanding in the week ended yesterday, the Federal Reserve said today on its website. That’s the longest stretch of increases since the period ended July 25, 2007, and the most since the market touched $1.147 trillion on Aug. 17, 2011.

Bonds issued by local-government-controlled financing vehicles totaled 636.8 billion yuan ($102 billion) in 2012, surging 148% from 2011, the central bank-backed China Central Depository & Clearing Co. said in a report published earlier this month.

A seven-fold jump in last month’s lending by China’s trust companies is setting off alarm bells for regulators to guard against the risk of default.So-called trust loans rose 679 percent to 264 billion yuan ($42 billion) from a year earlier, central bank data showed on Jan. 15. That accounted for 16 percent of aggregate financing, which includes bond and stock sales. The amount of loans in China due to mature within 12 months doubled in four years to 24.8 trillion yuan, equivalent to more than half of gross domestic product in 2011, and the People’s Bank of China has set itself a new goal of limiting risks in the financial system.

President Dilma Rousseff's insistence that Banco do Brasil SA boost lending is helping the state-controlled bank almost double its bond underwriting, giving the government a record share of the market.International debt sales managed by the bank surged to 10 percent of offerings last year from 5.6 percent in 2011, the biggest jump in the country. With Brazilian issuers leading emerging markets by selling a record $51.1 billion in bonds, Banco do Brasil advanced six positions to become the third- largest underwriter, overtaking Bank of America Corp., Banco Santander SA and Itau Unibanco Holding SA, data compiled by Bloomberg show.Banco do Brasil, Latin America's largest bank by assets, is profiting from the government's push to expand credit as policy makers cut interest rates to revive an economy that had its slowest two-year stretch of growth in a decade. The bank's total lending, which includes loans, bonds on its books and other guarantees to companies, surged 21 percent in the year through Sept. 30 to 523 billion reais ($257 billion) as it piggybacked off existing relationships and bolstered a team of bankers dedicated to pitching borrowers on debt sales.

Thursday, August 16, 2012

Brazil’s Government Unveils $66 Billion Stimulus

Brazil, one of the key emerging markets, has finally taken official action. Brazil’s government has launched a $66 billion economic stimulus.

From Globe and Mail,

Brazil is getting back in the stimulus business, underscoring the limits of emerging markets to drive growth in the global economy.

Facing a deteriorating economy, President Dilma Rousseff Wednesday announced an infrastructure investment strategy valued at about $66-billion (U.S.), the first of several programs that local media reports say could be coming in the weeks ahead.

The massive program, which includes private construction of toll roads and investment in rail lines, comes amid slowing growth in other emerging powerhouse economies such as India and China, which along, with Brazil and Russia form the BRIC group of nations.

Not so long ago, Brazil was an economic high flyer, turning its back on a history of financial crises and emerging as one of the world’s most dynamic economies.

But more recently, the country has been grounded, dashing hopes that Latin America’s largest economy would help offset weak recoveries in the United States and Europe…

Ms. Rousseff’s plan should accelerate construction. Loosening the government’s grip on public goods, she pledged to sell concessions that will clear the way for private contractors to build 7,500 kilometres of roads, and then collect the tolls.

The government also will hire private companies to build 10,000 kilometres of railroads and allow them to share in the profits.

Brazil’s state-run development bank will finance all the projects at subsidized rates.

In today’s world of fiat money based central banking system, boom bust cycles have become the main feature. Brazil has been no different.

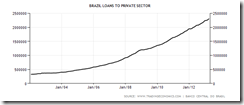

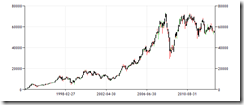

Charts from tradingeconomics.com

Brazil’s interest rates fell in 2009 as her economy plunged into a recession having been contaminated by the US property-mortgage bust in 2008.

However Brazil’s version of (zero bound rates) or negative real rates fueled the recovery of Brazil’s stock market.

The ensuing stock market boom has also been reflected on the economy, as well as, in the inflation rates.

Signs of credit powered “overheating” prompted for a series of interest rate increases which drained liquidity from the system. This has prompted for the recent economic slowdown which has also been ventilated on a sluggish stock market.

So in order to avoid from having to endure the required market adjustments from previous malinvestments, Brazil’s government today resorted to policy maneuverings that focuses on a short term fix.

Of course, the major beneficiaries here would be the cronies of Brazil’s incumbent government who will likely be assigned contractors for such state directed spending binge.

Nonetheless short term fixes will accrue to even more misdirected investments that would mean the amplification of Brazil’s homegrown bubble cycles.

Yet it would be interesting to see if Brazil’s stimulus program would be enough to shield her economy from increasing evidences of a deepening downturn in the global economy.