In the Philippine setting, record stocks equals PSE officials singing hallelujah! In Hong Kong, record stocks from panic buying means alarm bells for HKSE officials

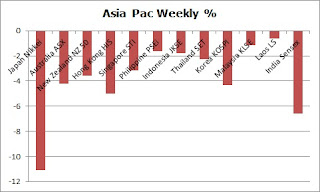

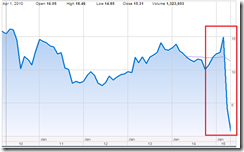

During the day the PSEi hit its milestone April 10 peak 2015, this period also coincided with the top in Hong Kong and Chinese stocks.

Back then, I noted on my Prudent Investor Blog how the PSE counterpart in Hong Kong, Mr. Charles Li, was a lot less political and a lot more concerned with the state of the markets which had been characterized by frenzied bidding.

Unlike the Philippine contemporary, whom would use every single opportunity to rationalize from price changes of record highs via the following publicity template—Today marks the Nth record highs, and x% gains for the year, from which represents investor confidence from corporate and economic growth…blah blah—thereby signifying total disregard of risks and blind adoration of the inflationary boom, given the latest milestone highs of Hong Kong stocks as a result of the spillover from the mania in Chinese stocks, Hong Kong Stock Exchange CEO Charles Li expresses concern over the current developments and writes to subtly warn of the developing mania in his article “A Little Advice to Investors”

A year after, Mr Li’s warning turned to be prescient.

Mr Li reveals of a character totally different from the Philippine counterpart

Some excerpts from Mr. Li’s article:

Shanghai and Hong Kong through the opening of the bridge is a long-term, it is for the next ten or twenty years built, there is no "after this village do not have this shop" issue. You can also be based on their actual situation and needs of arrangements ready before starting your journey from leisurely to invest. Do not have to hurry, not to join in the fun. You can always find valuable stock, but anxious often inviting risk. You know, as in the holiday get together, like travel, get together and can easily lead to congestion or bridge stampede, but also very personal experiences influence…In this new era, endless opportunities, but often at risk. Hong Kong investors, new investors in the mainland market has brought unprecedented vigor and trading opportunities. At the same time, differences between the two sides in the investment ideas and risk awareness for Hong Kong investors (particularly retail), bringing new challenges and risks. How to keep the excitement of the market conditions calm and cautious, every investor must consider.For many mainland retail investors, the Hong Kong and Shanghai through the first step of their investments overseas, naturally requires caution.Investment is like swimming as the water if you do not, you will never learn to swim, but the water is often the first time beginners are bound to choke a few saliva. Therefore, investors must do their homework, careful decision-making, should follow suit.As market operators and regulators, we know that the rising volume means more responsibility, we will continue efforts to ensure a stable and reliable system, we will always monitor the market closely and take appropriate risks when necessary management measures to maintain the orderly functioning of markets.Shanghai and Hong Kong through is designed to provide an opportunity for everyone is not made quick fortune, but to help the early realization of China's national wealth diversified international configuration, we provide long-term wealth preservation and appreciation of channels.

And we are made to believe how invincible the Philippines is!

Instead what this shows that is when politics invades the brain cells, they become addled.

.bmp)

.png)

.bmp)

.bmp)

.bmp)

.bmp)