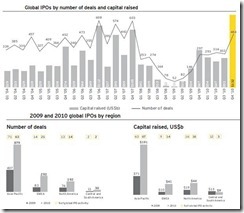

I generally do not subscribe to IPOs or secondary listings because I am not a fan of it. As I pointed out here (July 2007) and here, their successes mostly depend on the performances of the broader market where new share listings basically reflect on market sentiment.

Since new listings are sentiment based, they frequently signify faddishness, and in fact, serve as dependable indicators of the whereabouts of the phases of the bubble cycle.

On that note, the fund raising campaign by San Miguel via equity and the exchange bond seems to have raised a buzz. I sense a bandwagon type of enthusiasm especially from short term traders or punters.

Nevertheless here is Finance Asia’s splendid take (or may I say takedown) of the San Miguel Corporation [SMC] offering, (bold highlights mine)

San Miguel Corp, the Philippine conglomerate whose businesses range from beer and food to oil, power and infrastructure, is set to raise $880 million from a concurrent sale of shares and exchangeable bonds. The fundraising is slightly larger than the $850 million indicated by the company earlier this month and could increase to $970 million if the $20 million greenshoe on the international tranche of the equity portion, and the upsize option on the domestic tranche, are both exercised in full.

Even at the base size, this is the largest follow-on capital raising in the Philippines ever. It is also the first ever combined equity and equity-linked deal in this market.

However, in return for the larger size, the company and its controlling shareholder, Top Frontier, had to compromise on price, as most of the investors who came into the equity portion of the deal were highly price sensitive. Having initially set a price range of Ps140 to Ps160 before the international bookbuilding kicked off on April 14, the indicative price was lowered to Ps110 to Ps140 two days before the close and eventually fixed at Ps110. This translated into a 28.1% discount to the latest market price of Ps153.

The final deal also falls well short of vice-chairman Ramon Ang’s talk of a sale of 1 billion shares back in December. Based on the share price at the time, that suggested a deal size of about $3 billion.

The exchangeable bonds did price at the issuer-friendly end with a 2% coupon and yield and a 25% exchange premium, but because it used the same Ps110 as the reference price, it was viewed as generous relative to other recent equity-linked deals. Indeed, investors were much keener on the bonds, which attracted a final order book of $2.8 billion. By comparison, the demand for the equity portion reached only $500 million, which clearly shows that the deal would have failed had it not been for the concurrent EB. Or seen the other way, the bookrunners were able to turn a difficult situation into a successful capital-raising by using the EB to draw in investors.

The deal was marketed as a way to invest into the broader Philippine economy, but evidently investors were not that comfortable with San Miguel’s aggressive expansion into new industries such as power, mining, energy, infrastructure telecommunications and banking, during the past few years. For one, it makes the stock more difficult to value, and there may also be concerns that it is spreading itself too thin.

San Miguel’s precipitate corporate makeover occurred prior to the Philippine presidential elections, which for me, put to question the motives behind such actions by the controlling interests, as I pointed out earlier.

Then the timing of the Supreme Court’s validation of Danding Cojuangco’s ownership may also have some influence on this.

To get some clue...

Again from Finance Asia...

Some 75% of the equity portion consisted of existing shares that were sold by Top Frontier, which owned 67.2% of San Miguel before the transaction and controlled 88.4% of the votes. San Miguel also owns a 49% stake in Top Frontier, making this a classic cross-shareholding situation. The EB was sold by San Miguel itself.

Cross (interlocking) holdings like SMCs’ smacks of corporate legal maneuverings similar to Japan Inc which investopedia.com describes as a “high degree of collusion between Japan's corporate and political sectors led to corruption throughout the system and contributed to the downfall of the overvalued Nikkei.”

Whether applied to Korea’s Chaebol or Japan’s Kiretsu such ownership structure types have functioned as traditional havens for the aforementioned collusion.

So in my view, yes the marketing has purportedly been about returns from equity ownership (well like all politics everything is about everyone else’s benefit) but behind the scenes the incentives, for this offering, could be political more than financial.

I’d further say that the San Miguel’s business model turnabout from beverage and consumer goods to industries as energy, infrastructure and mining seems like a manifestation of the socio-standings and the philosophy of the company’s top honchos.

Beverage and consumer goods dealt with market based competition whereas the latter industries mostly represents political concessions. In short, political operators would intuitively elect for political business platforms; because these are not subject to competition but acquired through privileges from political alliances or networks.

Earlier, I negatively weighed on San Miguel’s shift in its business model (outside the political context).

More clues from Finance Asia,

Aside from raising funds that can be invested into the company’s emerging infrastructure business, a key purpose of the deal was to increase the free-float and put the San Miguel stock back on the radar screens of international institutions. According to the Philippine Stock Exchange, the free-float was only 8% before the offering, which meant the deal had to be marketed pretty much as an initial public offering with an extensive roadshow, pre-deal research and a discount to other Philippine conglomerates. Investors also looked at the equity on an absolute valuation basis, rather than as a discount versus the current market price.

To get the maximum effect on the free-float, San Miguel initially planned to sell only shares. However, this turned out to be too much of a challenge, and so the plan was revised to include the exchangeable bonds at attractive terms as well. To ensure the company would still achieve its free-float objective, the EB was designed to be equity-like and to maximise the possibility of conversion. Hence the favourable premium.

At the end of the day, much ado about San Miguel's offering, unknown to many, falls short of the owners’ expectations, which is another reason why I should not get one.

Besides, in looking at the SMC’s chart...

...it would seem easy to get enchanted on something that has already massively exploded. That’s reading past performance into the future (in behavioral finance-this is called as anchoring).

The above shows where the offering has been made (red horizontal line). Needless to say for chartist SMC chart would translate to a breakdown.

Nevertheless, the sellers (Top Frontier) obviously made quick buck here: buying at php 75 per share and selling at 110 per share or about 46% returns [gross maybe 40% net] (after a big push in SMC's price- their push?) on a holding period of 1 year and a quarter—Not bad for the “largest follow on capital raising” billion peso deal!

Of course, as I earlier stated, San Miguel’s price direction will flow with the overall market.

So SMC can sell you the meme about exposure to the Philippine economy, but at the end of the day SMC's price actions will reflect on the phases of bubble cycle than the company's so-called fundamentals.

And part of the typified trait of bubble cycles is political money hyping up stock prices...Japan Inc. and the US mortgage bubble should be great reminders.

That said, investing in stocks or in financial markets has the greater fool theory always in play.

[As a side note: I am not implying that SMC subscribers are the greater fool. The greater fool is the one usually left holding the empty bag -or the old maid-which means that this applies to all issues, IPO or not]

The point is it pays to be prudent.

.png)

.png)

.png)