It’s has been a “Risk On” frenzy out there. And I’m not just talking about Philippine financial or risk assets, I’m alluding to global financial markets.

From the global stock market perspective, the bulls clearly have been in charge.

The Global Asset Rotation

Most of this week’s modest gains virtually compounds on the advances of the last three weeks.

Among the majors, the US S&P 500 and the Japan’s Nikkei appeared to have assumed the leadership on a year-to-date return basis, which looks like a rotational process at work too.

Last year’s developed market leader, the German DAX which generated a 2012 return of about 29% has now underperformed relative to the US S&P 500 (11.52% in 2012) and the last minute or mid-December spike by the Nikkei (22.94% in 2012). The huge push on the Nikkei has been in response to the Bank of Japan’s (BoJ) increasingly aggressive stance to ease credit by expanding her balance sheet.

The BoJ is set to target 2% inflation and may follow the US Federal Reserve and the ECB’s unlimited option or commitment on the coming week[1]

For the ASEAN majors, the Philippine Phisix has taken the helm with a 5.62% return over the same period. The milestone or records highs have been reached following three successive weeks of phenomenal gains.

Yet ASEAN’s peripheral economies, Vietnam and Laos, have eclipsed the remarkable performance of the Phisix, with 9.77% and 15.91% in nominal currency returns covering the same period. Incidentally, the Laos Securities skyrocketed by 11.61% this week contributing to the gist of her 2013 returns.

It is important to point out that rotational process which is a manifestation of the inflationary boom has not just been a domestic episode but a global one too.

First, my prediction that the domestic mining sector will lord over the Phisix in 2013 appears to have been reinforced this week. The mining sector has stretched its lead away from the pack, up by 13.65% in three weeks.

Last year’s other laggard, the service sector, also has taken the second spot.

So aside from some signs of rotation within the local stock market, there seems to be signs of an ongoing rotation dynamic operating among global equity markets.

This brings us to the next level

The rotational process across asset markets: Specifically, there has been a meaningful shift in money flows towards equities.

Since the start of 2013, during the second week of the year, money flows into global equities has reached historic highs[2] (left window).

The yield chasing dynamic has essentially reversed investor sentiment on the equity markets. Investors have mostly shunned the stock markets and have flocked into bonds. This has been particularly evident with the US stock markets[3] since 2007.

Nonetheless despite the still robust flows towards fixed income, initial manifestations of the so-called “great rotation” exhibited the outperformance of global equities relative to global bonds[4], two weeks into 2013 (right window).

Yet such phenomenon has not been a stranger to us. I predicted a potential rotation from the bond markets into the stock market in October of last year[5].

We can either expect a shift out of bonds and into the stock markets or that the bond markets could be the trigger to the coming crisis.

In my view, the former is likely to happen first perhaps before the latter. To also add that triggers to crisis could come from exogenous forces.

It is important to realize that financial markets are essentially intertwined. For instance, stock markets have been closely tied to bond markets since many companies have used the bond markets to finance stock buybacks[6], as well as, to finance the property sector which has prompted for today’s booming assets.

In other words, the RISK ON environment prompted by monetary policies have made the asset rotational process a global dynamic.

Rotation Pumped Up by Releveraging

We are seeing massive systemic “releveraging” which has been inciting a speculative mania that is being greased by a credit boom.

Proof?

In the US, Hedge funds have reportedly been upping the ante by the increasing use of leverage to increase stock market exposures. From Bloomberg[7] (chart from Zero Hedge[8] as of December 29th) [bold mine]

Hedge funds are borrowing more to buy equities just as loans by New York Stock Exchange brokers reach the highest in four years, signs of increasing confidence after professional investors trailed the market since 2008.

Leverage among managers who speculate on rising and falling shares climbed to the highest level to start any year since at least 2004, according to data compiled by Morgan Stanley. Margin debt at NYSE firms rose in November to the most since February 2008, data from NYSE Euronext show.

Traditional instruments of leverage haven’t been enough. Wall Street has essentially resurrected financing via securitization or the innovative pooled debt instruments called Collateralized Debt Obligations or CDOs, which played a pivotal role in the provision of finance to the previous housing bubble which resulted to a crisis.

From Bloomberg article[9], [bold mine]

What’s old is new again on Wall Street as banks tap into soaring demand for commercial real estate debt by selling collateralized debt obligations, securities not seen since the last boom.

Sales of CDOs linked to everything from hotels to offices and shopping malls are poised to climb to as much as $10 billion this year, about 10 times the level of 2012, according to Royal Bank of Scotland Group Plc. (RBS) Lenders including Redwood Trust Inc. are offering the deals for the first time since transactions ground to a halt when skyrocketing residential loan defaults triggered a seizure across credit markets in 2008.

The rebirth of commercial property CDOs comes as investors wager on a real estate recovery and as the Federal Reserve pushes down borrowing costs, encouraging bond buyers to seek higher-yielding debt. The securities package loans such as those for buildings with high vacancy rates that are considered riskier than those found in traditional commercial-mortgage backed securities, where surging investor demand has driven spreads to the narrowest in more than five years.

The search for yield extrapolates to a search of alternative assets to speculate on. This is why investors have also been piling into state and municipal fixed income bonds. From Bloomberg[10]

Investors are pouring the most money since 2009 into U.S. municipal debt, putting the $3.7 trillion market on a pace for its longest rally versus Treasuries in three years.

Demand from individuals, who own about 70 percent of U.S. local debt, rose last week after Congress’s Jan. 1 deal to avert more than $600 billion in federal tax increases and spending cuts spared munis’ tax-exempt status. Investors added $1.6 billion to muni mutual funds in the week ended Jan. 9, the most since October 2009 and the first gain in four weeks, Lipper US Fund Flows data show.

Companies have once again commenced to tap unsecured short term fixed income security commercial markets usually meant to finance payroll and rent.

The market for corporate borrowing through commercial paper expanded for a 12th week as non- financial short-term IOUs rose to the highest level in four years.

The seasonally adjusted amount of U.S. commercial paper advanced $27.8 billion to $1.133 trillion outstanding in the week ended yesterday, the Federal Reserve said today on its website. That’s the longest stretch of increases since the period ended July 25, 2007, and the most since the market touched $1.147 trillion on Aug. 17, 2011.

This hasn’t just been a US dynamic, but a global one.

For instance, China has been exhibiting the same credit driven pathology too, as local governments go into a borrowing binge.

From the Wall Street Journal[12]

Bonds issued by local-government-controlled financing vehicles totaled 636.8 billion yuan ($102 billion) in 2012, surging 148% from 2011, the central bank-backed China Central Depository & Clearing Co. said in a report published earlier this month.

Moreover, lending from China’s non-banking institutions Trust companies, which is said to be the backbone of the ($2 trillion) Shadow Banking system—via loans to higher risks entities as property developers and local government investment vehicles—have likewise zoomed.

A seven-fold jump in last month’s lending by China’s trust companies is setting off alarm bells for regulators to guard against the risk of default.

So-called trust loans rose 679 percent to 264 billion yuan ($42 billion) from a year earlier, central bank data showed on Jan. 15. That accounted for 16 percent of aggregate financing, which includes bond and stock sales. The amount of loans in China due to mature within 12 months doubled in four years to 24.8 trillion yuan, equivalent to more than half of gross domestic product in 2011, and the People’s Bank of China has set itself a new goal of limiting risks in the financial system.

Reports of the credit boom appears to have jolted China’s Shanghai index to soar by 3.3% this week. This brings China’s benchmark into the positive territory up 2.7% year-to-date. In 2012, the Chinese benchmark eked out only 3.17%, most of the recovery came from December which erased the yearlong losses.

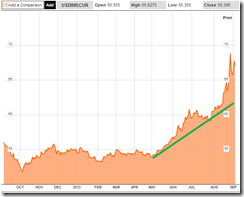

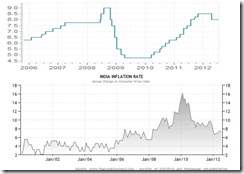

In India, soaring loan growth by the banking system, (chart from tradingeconomics.com[14]) now at almost 80% of the economy, has prompted the IMF to raise the alarm flag citing risks of “a deterioration in bank assets and a lack of capital as the economy slowed”[15].

India’s major stock market index, the BSE 30, seems on the verge of a record breakout. Also, India purportedly has a property bubble[16].

The Brazilian government’s directives to improve on credit accessibility have likewise led to a surge in lending.

From Bloomberg/groupomachina.com[17]

President Dilma Rousseff's insistence that Banco do Brasil SA boost lending is helping the state-controlled bank almost double its bond underwriting, giving the government a record share of the market.

International debt sales managed by the bank surged to 10 percent of offerings last year from 5.6 percent in 2011, the biggest jump in the country. With Brazilian issuers leading emerging markets by selling a record $51.1 billion in bonds, Banco do Brasil advanced six positions to become the third- largest underwriter, overtaking Bank of America Corp., Banco Santander SA and Itau Unibanco Holding SA, data compiled by Bloomberg show.

Banco do Brasil, Latin America's largest bank by assets, is profiting from the government's push to expand credit as policy makers cut interest rates to revive an economy that had its slowest two-year stretch of growth in a decade. The bank's total lending, which includes loans, bonds on its books and other guarantees to companies, surged 21 percent in the year through Sept. 30 to 523 billion reais ($257 billion) as it piggybacked off existing relationships and bolstered a team of bankers dedicated to pitching borrowers on debt sales.

Following last year’s 7.4% gain, the Bovespa has been up by a modest 1.65%. Like almost everywhere, there have been concerns over the growing risk of a bubble bust[18] in Brazil.

The point is that all these synchronized and cumulative push to create “demand” via massive credit expansion has been driving leverage money into a speculative splurge that has elevated asset markets relatively via the rotational process.

Asset Bubbles and the Mania Phase

The impact of asset inflation has been different in terms of time and scale but nonetheless most assets generally rise overtime. Of course, such will need to be supported by greater inflationism which central banks have obliged.

Eventually all these will spillover to the real economy either via higher input prices or via higher consumer prices that will entail higher rates that may reverse current environment.

Even FED officials have raised concerns anew that “record-low interest rates are overheating markets for assets from farmland to junk bonds, which could heighten risks when they reverse their unprecedented bond purchases.”[19]

Of course, the problem is HOW to reverse without materially affecting prices of financial assets deeply DEPENDENT on the US Federal Reserves and or global central bank easing policies.

The likelihood is that each time market pressures or downside volatility resurfaces, policymakers will resort to even more easing. Threats to withdraw such policies have merely been symbolical.

And a further point is that while overextended runs usually tend to usher in a natural correction or profit taking phase, a blowoff phase may yield little correction. Instead, any transition to a manic phase of a bubble cycle will generally mean strong continuity of the upside.

We have seen this happen in 1993 when the Phisix posted an astounding 154% yearly return.

Moreover, the 1986-2003 era basically epitomized the full bubble cycle in motion as shown by the bubble cycle diagram (left) and the Phisix chart (right).

I am not saying that this manic phase is imminent, but rather a possibility considering the current behavior of global and the domestic financial markets.

And I would like to reiterate, I believe that the returns of the Phisix will depend on the expected direction of, and actual actions by policymakers on, interest rates.

If the current boom will not yet impel for a higher rates soon, then such inflationary boom may continue. The Phisix I believe will remains strong, at least until the first quarter of this year.

All these goes to show that financial markets essentially have been dancing on the palm of the central bankers.