Nations, like individuals, cannot become desperate gamblers with impunity. Punishment is sure to overtake them sooner or later.—Charles Mackay, The South Sea Bubble, Memoirs of Extraordinary Popular Delusions and the Madness of Crowds

In this issue:

Phisix Record 8,000: Market Confidence or Publicity Campaign to Project Confidence?

-Record Stocks as Symptoms of Monetary Abuse: The Venezuela and Argentina Model

-Record Stocks NOT EQUAL to G-R-O-W-T-H: Japan and China

-Record Stocks NOT EQUAL to G-R-O-W-T-H: US, Europe and ex-China and Japan Asia

-Phisix Record 8,000: Market Confidence or Publicity Campaign to Project Confidence?

-What the Philippine President’s Dream of Phisix 10,000 Means

-Dismal Rebound in February Philippine OFW Remittances

Phisix Record 8,000: Market Confidence or Publicity Campaign to Project Confidence?

I will open this outlook with this splendid quote from nineteenth century Scottish poet and author Charles Mackay from his epic book, Memoirs of Extraordinary Popular Delusions and the Madness of Crowds[1]

IN READING THE HISTORY OF NATIONS, we find that, like individuals, they have their whims and their peculiarities; their seasons of excitement and recklessness, when they care not what they do. We find that whole communities suddenly fix their minds upon one object, and go mad in its pursuit; that millions of people become simultaneously impressed with one delusion, and run after it, till their attention is caught by some new folly more captivating than the first…Some delusions, though notorious to all the world, have subsisted for ages, flourishing as widely among civilised and polished nations as among the early barbarians with whom they originated,—that of duelling, for instance, and the belief in omens and divination of the future, which seem to defy the progress of knowledge to eradicate them entirely from the popular mind. Money, again, has often been a cause of the delusion of multitudes. Sober nations have all at once become desperate gamblers, and risked almost their existence upon the turn of a piece of paper. To trace the history of the most prominent of these delusions is the object of the present pages. Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one.

Record Stocks as Symptoms of Monetary Abuse: The Venezuela and Argentina Model

Has stocks markets been about economic growth?

Let me frame this question under contemporary popular wisdom, has record stocks really been about booming economies?

The above equity benchmarks are from the Latin American nations of Venezuela and Argentina whose stocks have been racing to record highs since 2013.

Year to date as of Friday’s close, local currency returns for these indices have been at 39.45% and 38.94% respectively. In 2014, the same bourses returned a spectacular 41.01% and 59.14% while in 2013 returns have been at a shocking nosebleed 480.48% for the IBVC and a breathtaking but less stellar 88.87% for the Merval!!!

Yet a short glimpse of their respective statistical (annual) economic growth data suggests of mediocre performance for Venezuela and lethargic activities for Argentina.

But economic numbers don’t represent food on the table. The reality has been that basic supplies appear as being rationed in Venezuela. As aptly described by the New York Times last January: “the situation has grown so dire that the government has sent troops to patrol huge lines snaking for blocks. Some states have barred people from waiting outside stores overnight, and government officials are posted near entrances, ready to arrest shoppers who cheat the rationing system.”

In Venezuela, tourists have been even asked to bring their own toilet papers due to the near absence of supplies! It has been a little less desperate for the Argentine economy, but goods shortages exists nonetheless. And such scarcity of supply has been highlighted by the recent sensational shortages of tampons!

If the economies of both nations has been in dire straits, so why has their respective stocks been racing to record highs?

A concise answer has been that because of the lack of access to credit, the governments of both countries has been relying on the monetary printing press to finance political economic spending, the result of which has been massive devaluation of their currencies and HYPERINFLATION!

And given the rigorous clampdown on capital and currency flows by their governments, and since residents of both countries have sought safety of their savings from devaluation and from the severe loss of purchasing power, equities—which signify as titles to capital goods—have served as refuge from monetary abuse. Said differently, the store of value function of currencies of both countries has shifted to stocks!

Venezuela and Argentina represents the extreme episodes of stocks functioning as shock absorbers from monetary debasement.

But the buck doesn’t stop here.

Record Stocks NOT EQUAL to G-R-O-W-T-H: Japan and China

Venezuela and Argentina’s symptoms seem as being replicated everywhere but at a tempered basis that comes in different shades or form.

In the case of Japan, milestone high stocks have been diverging from the statistical economy. Japan’s economy has been laboring to climb out of an economic rut or particularly intermittent recessions.

But the Japanese government thinks that they have found an elixir to her economic predicament. They believe that stock market boom and destruction of a currency translates to economic salvation.

So they have mandated the Bank of Japan to devalue her currency, the yen, by expanding the her balance sheets by buying enormous amounts of bonds and stocks since 2013. And the government has extended and expanded the same program in November 2014. Japan’s largest pension fund, the Government Pension Investment Fund (GPIF) has likewise been enlisted to the stock market buying program.

Unfortunately the result has been devastatingly opposite to what has been intended: stocks continue to diverge with the real economy as resident (individual and institutional) money continues to gush out of the nation.

Aside from the BoJ and GPIF, foreign money has largely been responsible for driving Japan’s stocks to record levels.

Chinese stocks have also frantically been skyrocketing as the statistical economy has been dramatically slowing.

Chinese property prices continue to fall in March but at a much subdued pace. However, China’s new built houses as of February crashed to its lowest level or by 6.1% year on year!

Broad indicators reveal that the Chinese economy’s downtrend appears to be accelerating. The continuing downshift includes fixed asset investments, retail sales and industrial production which has all contributed to the statistical economic growth of 7%, the slowest since 2009.

The Lombard Street Research (LRC) counters that real economic growth in China has CONTRACTED in 1Q 2015 Q-on-Q where the Chinese economy endured a ‘historic collapse’.

From Breibart (bold mine)[2]: Lombard Street Research (LSR) has reported that China’s “real” (after-inflation) GDP actually fell -0.2% for the quarter ending March 2015. Despite the official government claim of +1.3 percent growth for the quarter and +7 percent annualized growth. China’s quarterly performance was the worst showing since the Global Financial Crisis as, “real” domestic demand suffered a historic collapse. LSR’s Diana Choyleva has been the best Western economist at untangling China’s less-than-authentic economic statistics. She reveals that after peaking in 2014 at +2 percent on real domestic demand growth, China has collapsed by over 4 percent and to a -2.1 percent. Choyleva says this is the first negative performance observed since LSR began recasting China’s quarterly economic reports in 2004.

Trouble in the real economy has been more than a slowdown, as credit risks mounts.

Aside from the recent missed interest rate payment by Cloud Live Technology, another company, power-transformer maker Baoding Tianwei Group Co. expressed doubts whether it can make interest payments on April 21, signaling risks of another potential default.

Yet despite the economic fragilities, the Chinese government continues to force feed credit into system. The Chinese government appears to either be buying time from a bubble bust or hoping that blowing new bubbles may cure problems caused by previous bubbles.

Chinese loan growth beat expectations in March even as money supply growth continues to ebb. Those loans appear as being rechanneled into the frenzied bidding of stocks. Even funds from China’s shadow banks have reportedly been increasingly used for wanton stock market speculation.

Worst, despite recent imposition of regulatory controls, margin debt used to finance stock market speculation has reportedly more than doubled the US counterpart.

From Bloomberg[3]: Securities firms’ outstanding loans to investors for stock purchases were a record 1.64 trillion yuan ($264 billion) as of April 10, up 50 percent in less than three months, despite bans imposed by the CSRC in January and April on lending to new clients by four Chinese brokerages…China’s margin finance now stands at about double the amount outstanding on the New York Stock Exchange, after adjusting for the relative size of the two markets.

The serial record breaking Chinese stock market benchmark has already surpassed the Japan contemporary in terms of market capitalization.

At the close of Friday’s trading session for Chinese stocks, Chinese regulators once again say that they will tighten margin trade as exchanges announced expanding shorting facilities.

From the Wall Street Journal[4] (bold mine): The CSRC warned small investors, who have been big drivers of the rally, not to borrow money or sell property to buy stocks, ratcheting up its rhetoric about the market. Mainland investors opened stock-trading accounts at the fastest pace ever in the week ended April 10, and margin account balances reached a record 1.16 trillion yuan ($187 billion) as of Thursday, according to the Shanghai Stock Exchange. The regulator banned a type of financing called umbrella trusts that provided cash for margin trading, the practice of borrowing against the value of common shares held at a brokerage, and placed limits on margin trading for highly risky small stocks that trade over the counter, rather than on exchanges. The regulator said customer accounts needed to be better classified, potentially a warning that limits will be placed on the type of trading permitted for small investors. The exchanges issued rules that would make it easier for investors to short, or bet against, stocks. To short a stock, an investor borrows shares and sells them, hoping the price will fall and so let them repay with cheaper shares. It has been difficult to short stocks in China even as valuations soared because it has been virtually impossible to borrow shares. The exchanges said they would push for an increase in the supply of shares available for lending and increase the number of stocks whose shares can be borrowed.

This seems like another superficial or political staged attempt to curb or control the stock market bubble that has been going berserk.

The Shanghai index pole-vaulted 6.27% last week.

With Chinese stock market futures as indicated by China A50 futures suffering a 5.97% loss Friday, Chinese stocks may be headed for a sharp selloff in Monday’s opening.

And it has not just been about stocks, Chinese junk bonds have been enjoying a record run.

From Bloomberg[5] (bold mine): Investors in Chinese junk bonds are taking the biggest gamble in at least a decade. Leverage for speculative-grade Chinese companies is at its highest since at least 2004, whether measured by earnings relative to interest expense or total debt to a measure of cash-flow, according to data compiled by Bloomberg using a Bank of America Merrill Lynch index. Borrowers have also piled on the most debt relative to their assets since 2007. The deterioration in credit quality coincides with the slowest annual growth since 1990 for Asia’s biggest economy, and helps explain why Fitch Ratings Ltd. predicts defaults will climb. That’s bad timing for bond investors who swallowed a record $209.2 billion of Chinese-company notes denominated in either dollars, euros or yen last year, Bloomberg data show.

As one can see for Japan and China, record stocks have been a function of monetary abuse.

Record Stocks NOT EQUAL to G-R-O-W-T-H: US, Europe and ex-China and Japan Asia

You think it is different for the US or for Europe? Well think again.

Record US stocks has been about growth? Hardly

The US Federal Reserve of Atlanta, one of the twelve regional Federal Reserve banks, has a NOWcasting or real time forecasts of the US statistical economy.

Here is what they see for the 1Q 2015 as of this writing: The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2015 was 0.1 percent on April 16, down from 0.2 percent on April 14. The decline came after Wednesday morning's industrial production release from the Federal Reserve Board

Record stocks on a .1% G-R-O-W-T-H??!!

Additionally, whatever growth that had been posted in the recent past has been below the 3.24% average. Yet again record stocks.

More.

Factset, a company that provides financial information, recently noted that for 1Q 2014 negative earning guidance has dominated earnings announcements. Importantly, they note that stock markets have been rewarding companies posting negative earnings announcement more than those with positive earnings[6]!

Even more. Record US stocks comes as bankruptcies climb to its fastest level since 2010.

From Reuters[7] (bold mine): The number of bankruptcies among publicly traded U.S. companies has climbed to the highest first-quarter level for five years, according to a Reuters analysis of data from research firm bankruptcompanynews.com. Plunging prices of crude oil and other commodities is one of the major reasons for the increased filings, and bankruptcy experts said a more aggressive stance by lenders may also be hurting some companies. While U.S. stocks have climbed to near record levels and the jobless rate has fallen to a six-year low, 26 publicly traded U.S. corporations filed for bankruptcy in the first three months of 2015. The number doubled from 11 in the first quarter of last year and was the highest since 27 in the first quarter of 2010, which was in the immediate aftermath of the financial crisis. In addition, many of the bankruptcies were large. Six companies had reported at least a billion dollars in assets when they filed in the first quarter of this year, the most in the first quarter of any year since 2009. The $34 billion in assets held by the 26 companies is the second highest for a first quarter in the past decade. The highest was the $102 billion held by the public companies that filed in the first quarter of 2009 when the crisis was at its worst.

Yet it has been pretty bizarre for Fed officials and Wall Street to quibble over a measly proposed quarter of a percent (.25%) rate hike, which goes to show how hooked on credit the entire economy and financial markets has been founded on.

As for Europe, this earnings chart indicates why Europe’s turbocharged stocks have hardly been about growth!

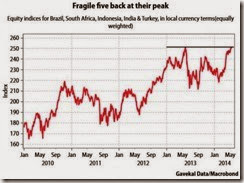

Record or near record stocks has become a dominant feature even in ex-Japan and China Asia. Yet if one looks at their respective economic G-R-O-W-T-H trends since 2011, they have MOSTLY been on a decline: Australia, South Korea, Taiwan, Singapore, Hong Kong, Indonesia and Thailand. Only India, Vietnam and New Zealand appear to beat the region’s dominant trend.

On the other hand, what the establishment has mostly ignored has been the relationship of debt with record stocks…that is with the exception of a few…

For instance, German Finance Minister Wolfgang Schaeuble expressed concerns last week that that “high debt levels remain a source of concern for the global economy”, where the Chinese economy has been "built on debt".

Moreover, research company MSCI recently warned against global property bubbles (bold mine): “Fears of a renewed global property bubble are rising as prices and yields hit records last seen before the financial crisis” as “the pricing of real estate around the world had become ‘increasingly aggressive’….The main factor behind the pricing is “exceptionally low” bond yields, which made property much more appealing to investors in relative terms, Mr Hobbs said, citing “frenzied buying”.

In sum, record stocks (as well as record property prices and bonds) have mostly been about unbridled and rampaging speculative activities financed by credit that has been pillared on zero (or negative) bound rates, QEs and other monetary easing tools than they have been about G-R-O-W-T-H.

Reasoning from price changes will be detrimental for one’s portfolio.

Phisix Record 8,000: Market Confidence or Publicity Campaign to Project Confidence?

This bring us to the Philippines where popular wisdom has been to tie record stocks with to confidence from economic G-R-O-W-T-H

The following represents the hazards of rationalizing from price changes, or the recency bias or serial position bias or ticker tape mentality.

The Philippine president graced the opening ceremony at the PSE last Tuesday where officials of the Philippine Stock Exchange cajoled to the honored guest[8]. (bold mine)

In his welcome remarks during the event, PSE Chairman Jose T. Pardo said, "At the 8,000 point level, the index is giving returns just this year of already more than 10 percent. It is interesting to note that the unprecedented ascent to 8,000 comes with other remarkable market indicators."Mr. Pardo cited the brisk trading activity in the first quarter of 2015 which soared by 40 percent from the same period a year ago. He also mentioned that in the first three months of the year, total market capitalization of listed firms rose by 18 percent to P14.98 trillion from the same period in 2014 and that foreign funds registered a net buying of P48.87 billion in the January to March period, a 182 percent increase year-on-year. There was also an increase in local investor participation as they accounted for 53 percent of trading activity in the first quarter of the year."This can only mean one thing, confidence in the economy under your leadership, Mr. President", Mr. Pardo stated.

Last week’s 2.2% correction came with a net foreign trade of NEGATIVE Php 5.71 billion, the largest since October 2014.

If record Phisix 8,000 has allegedly been about ‘confidence’ partly predicated on foreign trade, then the above indicates an OOPS moment!!!

With the above and this week’s correction, has confidence on G-R-O-W-T-H been reversed? Or will this be explained or justified away by sidestepping the selling activities as mere profit taking? So rising stocks equals G-R-O-W-T-H but falling stocks equals denial?

The problem with rationalization has always been the inconsistency of the logic presented.

And here is what the PSE officials forgot to say…

…that record stocks has been engineered by index managers.

Massaging or manipulating the index via “marking the close”, which represents a violation of the SEC Securities Regulation Code, has been used with blatant regularity and has apparently been condoned by the authorities.

And to add to last week’s discussion[9] of the growing concentration of trade activities, here are more facts about record Phisix 8,000.

On market cap distribution

As of the close of April 17, the market cap weighting of the top 15 issues of the Phisix constitutes a staggering 79.57% of the domestic bellwether!

Meanwhile, the 10 best performers as measured by year to date gains (as of last week) has an accrued market cap share of an astounding 55.23%!

So movements of the 10 best performers or the top 15 biggest market caps determine the direction of the Phisix!

On Peso volume distribution

Peso volume trades of the 30 members of the Phisix basket relative to total volume (Phisix issues+ non-Phisix issues+ special block sales + odd lot) on a daily basis have been climbing since February. They have now ranged from over 60% to 80% of total volume.

Yet if adjusted for major special block sales to include Friday’s Php 26 billion Meralco special block sales, the volume from Phisix trade expands to the range of 65% to 95%. The above doesn’t even include minor special block sales. Firms from the Phisix basket constitute a large majority of special block sales even from the perspective of minor block sales

So this translates to a massive gravitation of trading activities towards Phisix companies.

And it has been more than just the entire Phisix.

Aside from valuations, gains and market cap weightings, like a centripetal force, trading activities has been converging into the top 15 biggest firms.

The same top 15 issues have increasingly been taking the bulk of the daily peso trade volume based on gross basis (left) especially if adjusted for major block sales (right).

Additionally, with the top 15 garnering the market’s attention and or signifying the index managers’ maneuvering, the 10 outperformers from the 15 biggest market caps have also been absorbing an increasingly significant share of the daily peso volume trades (left). This has been magnified by the special block sales (right)!

So since record Phisix 8,000 has been a function of an increasing concentration in terms of trading, price setting, valuations and performance activities towards the biggest market cap issues, in particular, the 10 best performers, it can be construed that record Phisix 8,000 has hardly accounted for as a genuine product of market confidence, but rather about stealth publicity measures to “project” market confidence that has been engineered from rampant market manipulations.

What the Philippine President’s Dream of Phisix 10,000 Means

Yet the Philippine president hopes to see 10,000 Phisix at the end of his term.

Given the appalling or revolting degree of current overvaluations even at 8,000, what the president proposes will be a transmogrification of the Philippine stock exchange into a destructive hub of casino speculators.

What he seems to also be suggesting is for stock market’s basic function as channel to intermediate savings into investments, enabled and facilitated by price discovery predicated on the discounting dynamics of finance, to be totally obliterated or dismantled!

He appears to also implicitly promulgate that—since soaring stocks will extrapolate to a redistribution of resources in favor of the beneficiaries, particularly the elites, many of whom has already been basking in glory to be included in the roster of the world’s richest, all coming at the expense of the average citizens—inequality must be promoted!

Of course, Phisix 10,000 can be achieved. All he has to do is to mimic the monetary policy aspects of Japan’s Abenomics. He can instruct the Bangko Sentral ng Pilipinas and public pension funds to emerge from the shadows and to openly buy stocks.

Yet this will crash the peso and send price inflation to the skies, while at the same time inflating the already inflated balance sheets of the many companies particularly the publicly listed ones.

So instead of positively contributing to the economy, Phisix 10,000 will lead to a total collapse of the real economy!

Of course, the other way to do it is for market manipulators to stay their course. But where will the index managers get their funding to sustain present activities?

I am reminded of the fateful BW bubble that turned into a scandal. BW’s preposterous 52x run climaxed with the visit of Macau’s casino mogul Stanley Ho to the PSE. This eventually was followed by the stock’s monumental collapse back to its origins!

Dismal Rebound in February Philippine OFW Remittances

Low or zero growth even in the government’s own statistical accounts has now been reckoned as taboo and has even been subject to implied censorship!

In the perspective of remittance statistics, in the past where rate of growth falls in line with government projections, the BSP headlines will ostensibly indicate of the N% of the increase, or be accompanied by acclaims such as “Sustain Robust Growth” or “Continue to Rise”.

But with recent accounts of low growth, the BSP headlines will just denote of, or frame remittance data as having “reach” X levels. This seems designed to sanitize the unpopular event or to put a positive spin on the below expectation numbers.

Yet, framing aside, the reality has been February’s remittance growth rates continue to disappoint.

The BSP on personal remittances[10]: Personal remittances from overseas Filipinos (OFs) amounted to US$2.1 billion in February 2015, an increase of 4.0 percent compared to the same period in 2014. As a result, remittance inflows for the first two months of the year reached US$4.1 billion, posting a year-on-year growth of 2.1 percent, Bangko Sentral ng Pilipinas Officer-in-Charge Nestor A. Espenilla, Jr. announced today. For the period January-February 2015, personal remittances from land-based workers with work contracts of one year or more, and migrants’ transfers totaled US$3.1 billion. Meanwhile those from sea-based and land-based workers with work contracts of less than one year aggregated US$1.0 billion.

The BSP on cash remittances (bold added): Cash remittances from OFs coursed through banks summed up to US$1.9 billion in February 2015, higher by 4.2 percent than the level posted a year ago. This brought cash remittances for the first two months of 2015 to US$3.7 billion, representing a 2.4 percent increase relative to the year-ago level. In particular, cash remittances from land-based and sea-based workers rose to US$2.8 billion and US$0.9 billion, respectively. The bulk of cash remittances came from the United States, Saudi Arabia, the United Arab Emirates, the United Kingdom, Singapore, Japan, Hong Kong, and Canada. The slowdown in growth in recent months could be due to base effect as remittances last year were relatively high given higher transfers from overseas Filipinos that were intended for the rehabilitation and rebuilding efforts in Eastern Visayas due to the damage caused by Typhoon Yolanda.

This month’s numbers marks the third in four months of dismal or below expectations growth figures.

February 2015 remittance growth rates have sunk below 2009 levels, or have been worse than 2009, or accounts for as the lowest growth rate since 2002!

Key questions:

One, should ‘base effects’ of low growth in February data—allegedly due to the previous ‘high growth’ in response to Typhoon Yolanda according to the BSP—occur immediately or a year after the event?

Typhoon Yolanda occurred in first week of November 2013. November and December remittances soared, but since, remittance trend has been on a steady decline. However the recent downshift appears to have sharply intensified. These are base effects?

Has the BSP been reasoning from price changes?

Two, has the decline in remittances been instead a function of diminishing returns (see chart above lower pane)?

Three: If the much touted OFW remittances growth rate remains muted or subdued, then where will demand come from?

Yet how will high expectations of consumer based statistical economic G-R-O-W-T-H be met? More importantly, how will this be financed? Will income (wages, dividends, earnings, profits, rents and interests) from BPOs, construction, shopping malls, hotel and casinos offset the decline in remittance growth rates? Or will credit growth recover and zoom?

[As a side note, following a landmark spike in 1 month Philippine treasury bills last Thursday, index managers—who may be reading me—came back to contain recent bouts of volatility in the short term spectrum, Friday. We’ll see how this goes.]

What will be the effect of diminishing growth of remittances to the supply side? The supply side has been in a frantic race to build shopping malls, housing, condos, hotels and allied industries, so where will these industries get their customers? What happens if expectations won’t be met?

Unlike establishment analysis, where demand seems to just pop out of statistics, demand will only emanate from income or savings or borrowing. OFW remittances mostly account for as wages earned from employment. And OFW employers depend on economic activities of their respective locality.

Since remittances and BPOs depend on global political economic developments, which represent most of their sources of income, how then will a sustained downshift in global economic conditions (or even a prospective crisis) impact these economic agents? Or have these agents acquired superhuman or divine powers to become ‘immune’ to external economic developments? The consensus seem to assume such conclusion for them to project fantastically high economic growth rates.

Expectations that will eventually crash into reality like share prices of the infamous Enron—previously billed as the “seventh largest company in the world”.

[1] Charles Mackay Preface to the First Edition, Memoirs of Extraordinary Popular Delusions and the Madness of Crowds, Library of Economics and Liberty

[2] Breibart.com REPORT: ‘REAL’ CHINA GDP SHRINKS AS DEMAND COLLAPSES April 16, 2015

[3] Bloomberg.com China Walks $264 Billion Tightrope as Margin Debt Powers Stocks April 13, 2015

[4] Wall Street Journal China Raises Red Flag on Its Stock Markets April 17, 2015

[5] Bloomberg.com China Junk Bonds Pose Most Risk Since ’04 on Credit-Quality Dips April 14, 2015

[6] See US Stock Market Bubble: In 1Q 2015, Firms with Bad Earnings Have Been Rewarded More than those with Good Earnings April 2, 2015

[7] Reuters.com U.S. public companies seek bankruptcy at fastest first-quarter rate since 2010 April 14, 2015

[8] PSE.com PSE cites President Aquino's leadership for market’s ascent to 8,000 April 14, 2015

[9] See Phisix 8,100: A Story of 10 of the 15 Biggest Market Cap Heavyweights and the Combustion of the Global Risk ON Moment April 12, 2015

[10] Bangko Sentral ng Pilipinas, January-February 2015 Personal Remittances Reach US$4.1 Billion April 15,2015

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)