When, then, does plunder stop? It stops when it becomes more painful and more dangerous than labor. It is evident, then, that the proper purpose of law is to use the power of its collective force to stop this fatal tendency to plunder instead of to work. All the measures of the law should protect property and punish plunder.- Frédéric Bastiat

In a few hours the Philippine President, Benigno Aquino Jr. will be making his second state of the nation’s address (SONA).

Yet like most speeches, much of what we will likely hear will be founded on emotive platonic rhetoric, mostly founded on logical fallacies and empty promises whose solution would require expanded political redistribution and more control over the economy and the sacrifice of civil liberties.

And most likely, the important real factors will be glossed over.

Nevertheless, the following charts shows where the Philippines have gotten policies so wrenchingly astray.

The heart of any market economy is the small businesses.

In the US, small businesses have functioned as an indispensable force.

According to the US Small Business Association[1]

-Represent 99.7 percent of all employer firms.

-Employ just over half of all private sector employees.

-Pay 44 percent of total U.S. private payroll.

-Have generated 64 percent of net new jobs over the past 15 years.

-Create more than half of the nonfarm private gross domestic product (GDP).

-Hire 40 percent of high tech workers (such as scientists, engineers, and computer programmers).

-Are 52 percent home-based and 2 percent franchises.

-Made up 97.3 percent of all identified exporters and produced 30.2 percent of the known export value in FY 2007.

-Produce 13 times more patents per employee than large patenting firms; these patents are twice as likely as large firm patents to be among the one percent most cited.

China’s majestic renaissance also shares the same dynamics

Ms. Lydia So of Matthews Asia writes[2], (bold emphasis mine)

With the diminishing dominance of state-owned enterprises (SOEs), China’s private sector is increasingly becoming an important driving force for economic growth. Over the past few decades, these private businesses have been a large contributor to providing consumer-oriented goods and services, generating employment, and leading to innovation as well as increased productivity in China. These changes didn’t occur overnight. A favorable business environment is essential in fostering entrepreneurship in any country. While entrepreneurs in China got a relatively "late" start compared to their global counterparts, its achievements and contributions in driving the private economy have been impressive. To date, small and medium enterprises (SMEs) have become the dominant growth driver and a critical source of China’s expanding and evolving economy. In 2007, SMEs accounted for 55% of GDP, 60% of China’s industrial output, 65% of patent registrations and 70% of employment in urban areas.

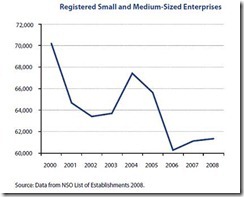

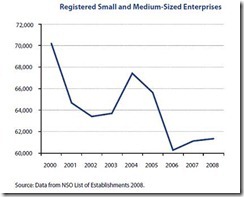

Now, in contrast, the Philippines have shown a tremendous decline in registered small and medium sized business over the past decade.

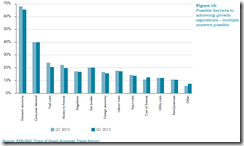

Such dismal outcome have been in place despite the so-called manifold government assistance via (chart above and quote from ADB[3])

extension of financial support, enhancement of managerial and technological capabilities, tapping domestic and international markets, streamlining systems and institutions, and providing infrastructure and incentives

We understand that small businesses have not entirely vanished but have mostly gone underground or have operated beyond formal government.

This we know or call the informal economy.

The chart above from the ADB[4] shows that 43.4% of the Philippine economy has been operating underground or informally.

The other way to say this is that 2/5 of the Philippine economy exists outside of the ambit of government.

The multifarious reasons for the existence of an informal economy as I earlier pointed out are[5]

-high taxes,

-high welfare payments (social security)

-restrictions, mandates in the official labor market

-minimum wages

-a smothering web of government regulations (license requirements, labor market regulations and trade barriers)

-compliance and other regulatory related costs

In other words, an overdose of government regulations and tax and welfare burdens has pushed small businesses out to operate in the informal economy which has surmounted any trivial incentives by the government to promote them. What the left hand giveth, the right hand taketh away!

The simple reason is that operating in the formal economy has been so politically and economically exacting whose cost benefit rewards informal operations. Talk about the Philippine government sowing the seeds of self destruction!

The ADB chart shows almost the same concerns.

Corruption, as expressed by the surveys, is seen as the fundamental problem.

Yet the public has been virtually deluded to think that the roots of corruption have been about all about personal virtuousness.

Little realize that corruption, inefficient government bureaucracy, inadequate supply of infrastructure, policy instability, tax regulations, crime and theft and tax rates or at least 84% of the aforementioned obstacles for doing business have all been intertwined. You can even count in coups, labor regulations, inflation and foreign currency regulations as part of this.

Many people (vendors) pay bribe money just to be able to operate the informal economy which makes corruption an informal way of governance too. Except that bribe money goes directly into the pockets of the enforcers than the coffers of the government.

Yet people hardly realize that all these obstacles are consequences of predatory laws, as governments have been all about the power to plunder others and not about moral uprightness[6].

I reprise my previous quotation of the legendary investor Doug Casey on corruption[7] (bold emphasis mine)

As Tacitus said in the second century A.D., "The more corrupt the state, the more numerous the laws." It's absolutely predictable that as all these governments around the world – and I mean all of them – respond to the ongoing crisis with an ever-accelerating onslaught of new laws, there will be more and more corruption – and frustration with that corruption.

Tacitus was right. But he could just as accurately have said, "The more numerous the laws, the more corrupt the state," because lots of laws engender lots of corruption. In other words, corruption isn't the problem. The state and its laws are the problem, to which corruption is an unsavory and unaesthetic – but necessary – solution. Laws create corruption, and corruption engenders laws.

Anyone can operate on utopian illusions and fantasies, yet economic reality eventually prevails and slaps us in the face.

Don’t we ever realize why self appointed messiahs in uniforms always pop out somewhere with their reformist rhetoric[8] but whose goal is to only seize power?

Personality based politics which operates on the principle of plunder represents a vicious cycle that deals with the superficial or the symptom and won’t solve whatever ills we have.

The only way to improve the Filipinos’ standard of living is to adapt and promote economic freedom through the repeal of these byzantine arbitrary anti-competitive laws and regulations, by vastly reducing bureaucracy and government spending, by having an economic system based on sound money, by pruning political stranglehold over the economic distribution of resources, by promoting property rights and the upholding the sanctity of contract through the rule of law.

[1] SBA.gov How important are small businesses to the U.S. economy?

[2] So Lydia, China's New Generation of Entrepreneurs, Matthews International Capital Management July 1, 2011

[3] Paderanga, Jr. Cayetano W. Private Sector Assessment Philippines 2011 ADB.org

[4] Martinez-Vazquez Jorge, Taxation in Asia 2011 ADB.org

[5] See Does The Government Deserve Credit Over Philippine Economic Growth?, May 31, 2011

[6] See Video: The Myth of Good Government, July 23, 2011

[7] See Doug Casey On Corruption: Laws Create Corruption And Corruption Engenders Laws, February 10, 2011

[8] Inquirer.net Marine colonel calls for Aquino’s ouster, July 16, 2011